1. Persistent health inequalities

2. COVID-19 pandemic disruption

3. Vaccine misinformation and hesitancy (biggest NEW factor)

Researchers warn 2030 global immunization targets won't be met without urgent action.

#ThreeCulprits #2030Targets

1. Persistent health inequalities

2. COVID-19 pandemic disruption

3. Vaccine misinformation and hesitancy (biggest NEW factor)

Researchers warn 2030 global immunization targets won't be met without urgent action.

#ThreeCulprits #2030Targets

#NbS #ClimateAdaptation #UrbanResilience #NatureForPeople #2030Targets #GESI

#NbS #ClimateAdaptation #UrbanResilience #NatureForPeople #2030Targets #GESI

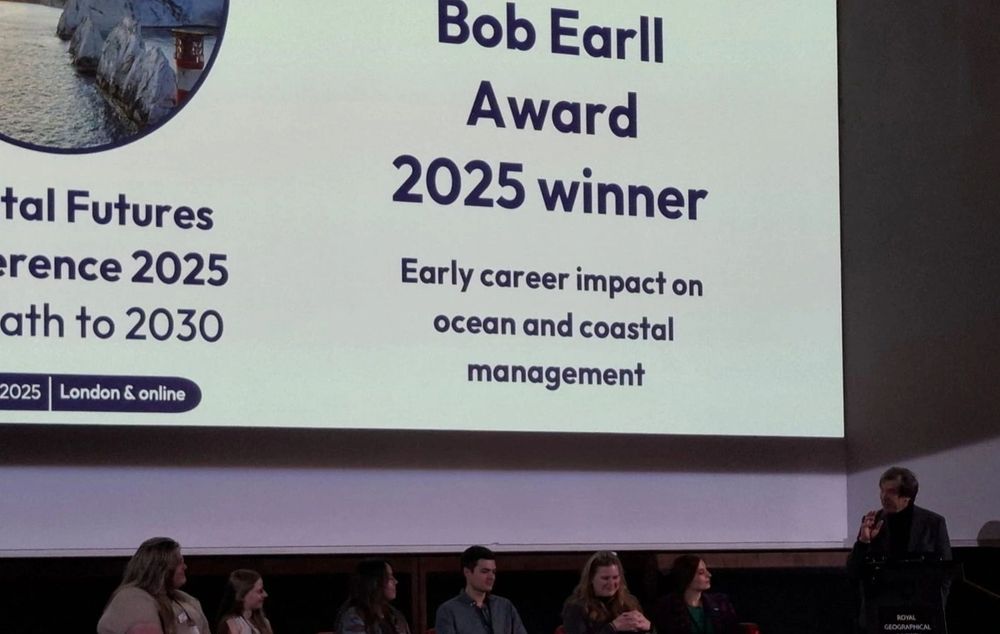

#coastalfutures2025 #marine #science #2030targets #networking

#coastalfutures2025 #marine #science #2030targets #networking