Single B spreads failed to even re-test the lows this summer, and have since been leaking wider.

Single B spreads failed to even re-test the lows this summer, and have since been leaking wider.

Zak Polanski on Newsnight last night was trying to argue that immigration isn't a problem. I don't think that position washes with the public.

Zak Polanski on Newsnight last night was trying to argue that immigration isn't a problem. I don't think that position washes with the public.

With access to many new sources, this is an excellent updated history even for those who have read "The Great Crash" by JK Galbraith. A real page-turner.

Many parallels to today too!

With access to many new sources, this is an excellent updated history even for those who have read "The Great Crash" by JK Galbraith. A real page-turner.

Many parallels to today too!

A biography of Sir Thomas Gresham, who acted as banker to Edward V, Mary, and Elizabeth I.

Quite a story. He kept screwing-up, and screwing-over counterparties and even his own family members. Died with an estate in bankruptcy.

A biography of Sir Thomas Gresham, who acted as banker to Edward V, Mary, and Elizabeth I.

Quite a story. He kept screwing-up, and screwing-over counterparties and even his own family members. Died with an estate in bankruptcy.

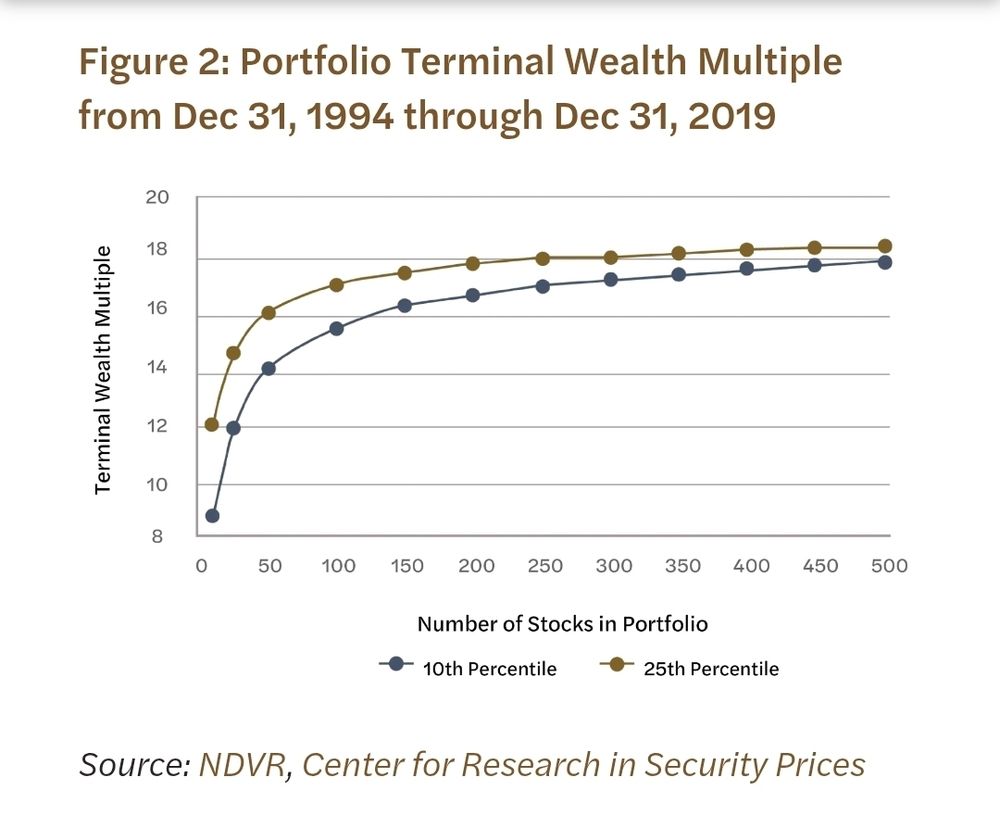

Diversification isn’t just about reducing idiosyncratic risk, it's also about giving yourself more chance of holding the big winners.

Diversification isn’t just about reducing idiosyncratic risk, it's also about giving yourself more chance of holding the big winners.

(I own it).

(I own it).

A left-of-centre critique of where our country has gone wrong and how we can fix it.

A left-of-centre critique of where our country has gone wrong and how we can fix it.

* Note: I suspect he has a lot of other assets too.

* Note: I suspect he has a lot of other assets too.

A good introduction to Warren Buffett if you want to read about him for the first time. But it won't provide anything new if you've read his letters or "The Snowball" by Alice Scroeder.

A good introduction to Warren Buffett if you want to read about him for the first time. But it won't provide anything new if you've read his letters or "The Snowball" by Alice Scroeder.