The AI industry spent 2025 convinced that pre-training scaling laws had hit a wall. Models weren’t improving just from adding more compute during training.

The AI industry spent 2025 convinced that pre-training scaling laws had hit a wall. Models weren’t improving just from adding more compute during training.

The answer is yes, or at least yes in our case. Here’s our current effort :

The answer is yes, or at least yes in our case. Here’s our current effort :

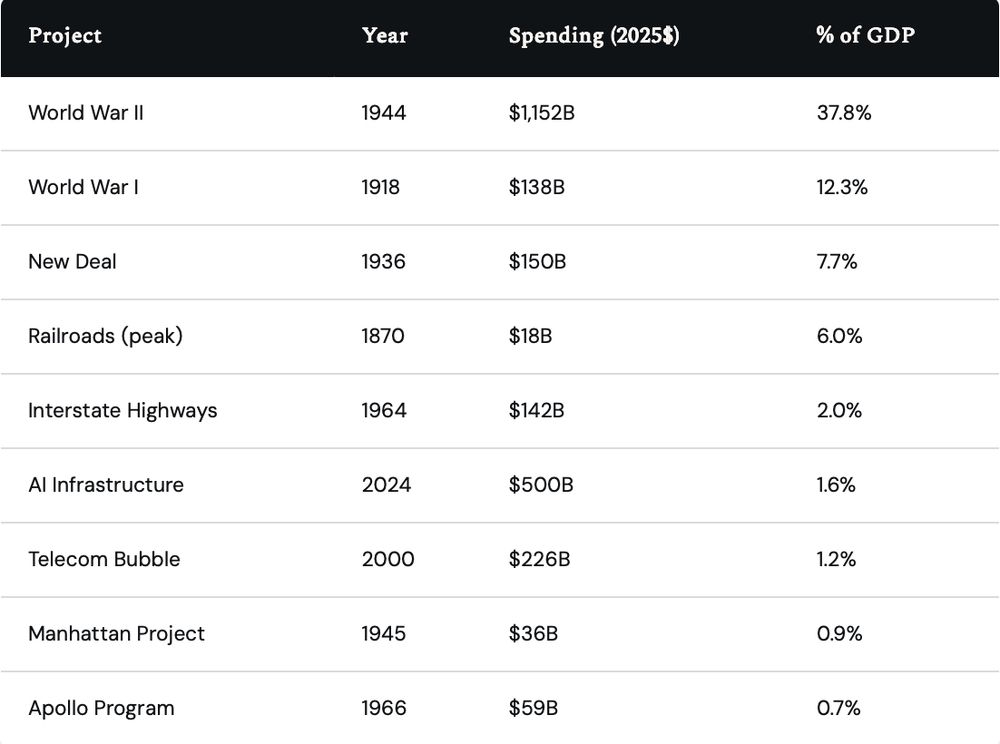

If we assume OpenAI represents 30% of the market, total AI infrastructure spending would reach $983B annually by 2030, or 2.8% of GDP.

If we assume OpenAI represents 30% of the market, total AI infrastructure spending would reach $983B annually by 2030, or 2.8% of GDP.

AI infrastructure today sits at 1.6%, just above the telecom bubble’s 1.2% & well below the major historical mobilizations.

AI infrastructure today sits at 1.6%, just above the telecom bubble’s 1.2% & well below the major historical mobilizations.

As the amount of data expands & I process more technology podcasts every day, I’m sure I’ll need a data lake. At that point, I can migrate to DuckLake.

Small data becomes big data faster than you know it.

As the amount of data expands & I process more technology podcasts every day, I’m sure I’ll need a data lake. At that point, I can migrate to DuckLake.

Small data becomes big data faster than you know it.

Aside from ease of use, there are real price-performance advantages. MotherDuck systems are two to four times faster than a Snowflake 3XL & from a tenth to a hundredth of the price.

Aside from ease of use, there are real price-performance advantages. MotherDuck systems are two to four times faster than a Snowflake 3XL & from a tenth to a hundredth of the price.

As I collect more & more podcast information, my data has grown. I’m using a larger instance of MotherDuck.

As I collect more & more podcast information, my data has grown. I’m using a larger instance of MotherDuck.

Both companies are spending at or above their cash positions on AI infrastructure. Microsoft is committing 137% of its cash reserves to annualized capex, while Google’s capex represents 93% of its cash position.

Both companies are spending at or above their cash positions on AI infrastructure. Microsoft is committing 137% of its cash reserves to annualized capex, while Google’s capex represents 93% of its cash position.

The answer is not much! All the fun is in the private markets.

Multiples haven’t moved outside of a narrow band since the post-Covid crash in 2022.

The answer is not much! All the fun is in the private markets.

Multiples haven’t moved outside of a narrow band since the post-Covid crash in 2022.

Will we see an AutoRL? Not for a while. The techniques for RL are still up for debate. Andrej Karpathy highlighted the debate in a recent podcast.

Will we see an AutoRL? Not for a while. The techniques for RL are still up for debate. Andrej Karpathy highlighted the debate in a recent podcast.