(chart-driven macro insights for investors)

The 2020 stimmy unleashed a wave of speculation that has only grown and intensified since.

There is an air of desperation.

People feeling like they’re behind and trying to catch-up by taking big risks, people chasing those stories of overnight wealth, and even folk trying to g

The 2020 stimmy unleashed a wave of speculation that has only grown and intensified since.

There is an air of desperation.

People feeling like they’re behind and trying to catch-up by taking big risks, people chasing those stories of overnight wealth, and even folk trying to g

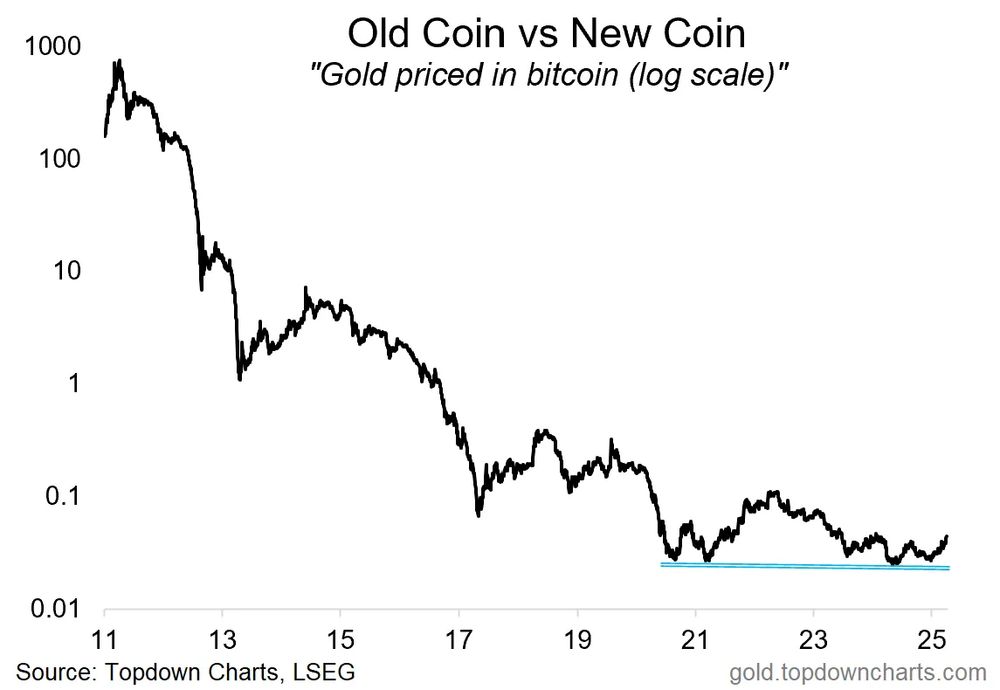

I previously highlighted when this chart was at its peak that this is either going to be a tipping point or tripping point for Bitcoin, and now it sure looks like a tripping point... 👀

From: www.chartstorm.info/p/weekly-s-a...

I previously highlighted when this chart was at its peak that this is either going to be a tipping point or tripping point for Bitcoin, and now it sure looks like a tripping point... 👀

From: www.chartstorm.info/p/weekly-s-a...

This week: global market update (risk-off!), commodity technicals, global bank surveys, credit spreads (and private credit), stocks vs bonds, global ex-US equities, GSV vs ULG...

This week: global market update (risk-off!), commodity technicals, global bank surveys, credit spreads (and private credit), stocks vs bonds, global ex-US equities, GSV vs ULG...

This could well be the start of a major breakout by gold vs bitcoin. So it’s something to keep an eye on as the macro-risk backdrop shifts.

This could well be the start of a major breakout by gold vs bitcoin. So it’s something to keep an eye on as the macro-risk backdrop shifts.

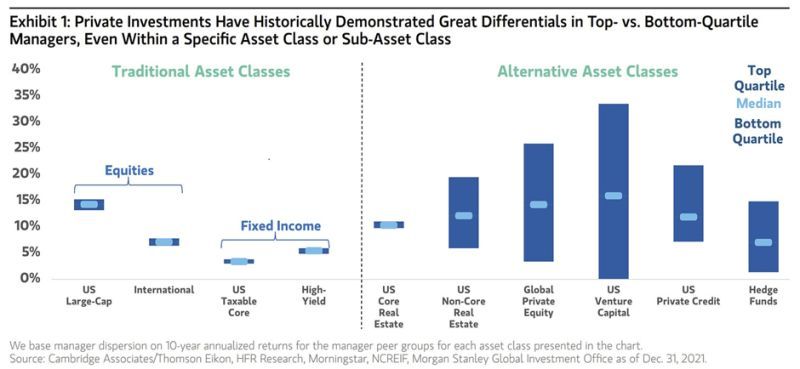

Private Markets = pick the manager 🧐

Mileage varies greatly across (but not so much within) asset classes for Public assets -- while mileage varies enormously *within* asset classes for the very opaque, illiquid, and idiosyncratic Private markets...

From:

Private Markets = pick the manager 🧐

Mileage varies greatly across (but not so much within) asset classes for Public assets -- while mileage varies enormously *within* asset classes for the very opaque, illiquid, and idiosyncratic Private markets...

From:

If you buy an index fund on the MSCI World index (Developed markets), only about 25% of that fund will be invested in the ""world""

The ACWI is a little better, with US "only" ~65% but that still leaves RoW at a miniscule and hardly diversifying 35%

...is it time to rethink globa

If you buy an index fund on the MSCI World index (Developed markets), only about 25% of that fund will be invested in the ""world""

The ACWI is a little better, with US "only" ~65% but that still leaves RoW at a miniscule and hardly diversifying 35%

...is it time to rethink globa

This week: bitcoin harbingers, private market problems, valuations and market cycle perspectives, upside opportunities, biotech and healthcare, practical issues...

This week: bitcoin harbingers, private market problems, valuations and market cycle perspectives, upside opportunities, biotech and healthcare, practical issues...

In the meantime be sure to check out last week’s edition (+ subscribe for this week): www.chartstorm.info/p/weekly-s-a...

In the meantime be sure to check out last week’s edition (+ subscribe for this week): www.chartstorm.info/p/weekly-s-a...

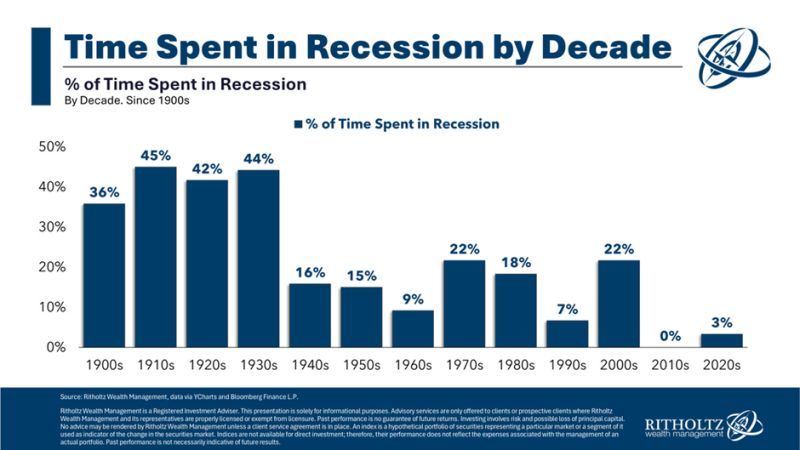

Don't say it...

(...don't jinx it!)

chart featured here: www.chartstorm.info/p/weekly-s-a...

Don't say it...

(...don't jinx it!)

chart featured here: www.chartstorm.info/p/weekly-s-a...

But so is gold...

How does this impact on how things might unfold for the stock/bond ratio?

Some perspectives: gold.topdowncharts.com/p/goldnugget...

But so is gold...

How does this impact on how things might unfold for the stock/bond ratio?

Some perspectives: gold.topdowncharts.com/p/goldnugget...

-Global loan demand

-Credit spreads (and private credit)

-Stocks vs Bonds

-Global ex-US Equities

-GSV vs ULG

Download the report here: www.topdowncharts.pro/p/weekly-mac...

-Global loan demand

-Credit spreads (and private credit)

-Stocks vs Bonds

-Global ex-US Equities

-GSV vs ULG

Download the report here: www.topdowncharts.pro/p/weekly-mac...

...the higher the valuation, the lower future returns are likely to be?

And we see this playout in both *absolute* and *relative* returns

Detail: entrylevel.topdowncharts.com/p/important-...

...the higher the valuation, the lower future returns are likely to be?

And we see this playout in both *absolute* and *relative* returns

Detail: entrylevel.topdowncharts.com/p/important-...

"I keep coming back to this chart as barometer of speculative risk appetite and liquidity (+potential early-warning indicator). To that end, with bitcoin rolling over and tech topping out, it’s not a good sign."

From: www.chartstorm.info/p/weekly-s-a...

"I keep coming back to this chart as barometer of speculative risk appetite and liquidity (+potential early-warning indicator). To that end, with bitcoin rolling over and tech topping out, it’s not a good sign."

From: www.chartstorm.info/p/weekly-s-a...

Next up?

Gold breaking out vs stocks. 👀

Next up?

Gold breaking out vs stocks. 👀

Yep.

But sometimes they not only don't go up, but actually get f----d up.

Here's some horrific examples.

As featured in the Weekly ChartStorm www.chartstorm.info/p/weekly-s-a...

Yep.

But sometimes they not only don't go up, but actually get f----d up.

Here's some horrific examples.

As featured in the Weekly ChartStorm www.chartstorm.info/p/weekly-s-a...

Bulls: this is fine, this is the new normal, it's backed by earnings, it's high for good reason.

Bears: this is dot-com 2.0, earnings are unsustainable, AI bubble.

The Truth?

Probably somewhere in between: www.chartstorm.info/p/weekly-s-a...

Bulls: this is fine, this is the new normal, it's backed by earnings, it's high for good reason.

Bears: this is dot-com 2.0, earnings are unsustainable, AI bubble.

The Truth?

Probably somewhere in between: www.chartstorm.info/p/weekly-s-a...

It's entirely normal for big gold bull markets to have long pauses, and if anything the entire up-move in gold almost only happens over a few key weeks and days...

Further thoughts: gold.topdowncharts.com/p/goldnugget...

It's entirely normal for big gold bull markets to have long pauses, and if anything the entire up-move in gold almost only happens over a few key weeks and days...

Further thoughts: gold.topdowncharts.com/p/goldnugget...

...something for those focused on the next 3-5 years and beyond (vs the next 3-5 days or hours for that matter!)

Explained: entrylevel.topdowncharts.com/p/chart-of-t...

...something for those focused on the next 3-5 years and beyond (vs the next 3-5 days or hours for that matter!)

Explained: entrylevel.topdowncharts.com/p/chart-of-t...

(but no one believes it)

Conventional wisdom says Japan is demographically doomed, but the conventional wisdom is based on an incomplete understanding that has missed several major developments...

Here's the big picture: entrylevel.topdowncharts.com/p/chart-of-t...

(but no one believes it)

Conventional wisdom says Japan is demographically doomed, but the conventional wisdom is based on an incomplete understanding that has missed several major developments...

Here's the big picture: entrylevel.topdowncharts.com/p/chart-of-t...

Wall Street, Investors, Consumers -- all agree on one thing: www.chartstorm.info/p/weekly-s-a...

Wall Street, Investors, Consumers -- all agree on one thing: www.chartstorm.info/p/weekly-s-a...

-big picture perspectives

-big moves underway already

-big ideas and things to watch for

Wednesday 2pm EST -- Register: us06web.zoom.us/webinar/regi...

-big picture perspectives

-big moves underway already

-big ideas and things to watch for

Wednesday 2pm EST -- Register: us06web.zoom.us/webinar/regi...

Thoughts: gold.topdowncharts.com/p/goldnugget...

Thoughts: gold.topdowncharts.com/p/goldnugget...

Thanks to scars of the financial crisis spurring folk to be more prudent with debt and of course — more-to-the-point: the dream run in stocks and property on the asset side...

US household leverage (as measured by debt as a % of assets) has dropped to multi-decade lows.

W

Thanks to scars of the financial crisis spurring folk to be more prudent with debt and of course — more-to-the-point: the dream run in stocks and property on the asset side...

US household leverage (as measured by debt as a % of assets) has dropped to multi-decade lows.

W