That’s why decision criteria - the first D in MEDDIC - matters more than most reps think.

Watch the full breakdown - https://youtu.be/75RDEn92GSo

#MEDDIC #SaaS #DecisionCriteria

That’s why decision criteria - the first D in MEDDIC - matters more than most reps think.

Watch the full breakdown - https://youtu.be/75RDEn92GSo

#MEDDIC #SaaS #DecisionCriteria

Full data in our Q2 State of SaaS Report - https://www.send.co/a/draft-state-of-saas-report-q2-2025-FQjWkvqP

#SaaS

Full data in our Q2 State of SaaS Report - https://www.send.co/a/draft-state-of-saas-report-q2-2025-FQjWkvqP

#SaaS

If you’re not aligned with the economic buyer, you’re selling from the sidelines.

They’re not a box to check - they’re the one who gets your deal signed.

#MEDDIC #EconomicBuyer #SaaS #SalesTips

If you’re not aligned with the economic buyer, you’re selling from the sidelines.

They’re not a box to check - they’re the one who gets your deal signed.

#MEDDIC #EconomicBuyer #SaaS #SalesTips

What does it mean for growth, cash flow, and the next earnings season?

We break it down in the full State of SaaS Q2 episode → https://youtu.be/Y4Jd6o-AGPQ

#SalesandMarketing #SaaS #Metrics

What does it mean for growth, cash flow, and the next earnings season?

We break it down in the full State of SaaS Q2 episode → https://youtu.be/Y4Jd6o-AGPQ

#SalesandMarketing #SaaS #Metrics

Ask these 5 questions 👇

Watch the full breakdown on Youtube - https://youtu.be/bJEtWMT9h1E

#MEDDIC #SaaS #EconomicBuyer

Ask these 5 questions 👇

Watch the full breakdown on Youtube - https://youtu.be/bJEtWMT9h1E

#MEDDIC #SaaS #EconomicBuyer

The economic buyer decides what gets funded - not your champion.

Watch → https://youtu.be/bJEtWMT9h1E

#EconomicBuyer #MEDDIC

The economic buyer decides what gets funded - not your champion.

Watch → https://youtu.be/bJEtWMT9h1E

#EconomicBuyer #MEDDIC

#EconomicBuyer #MEDDIC #SaaS

#EconomicBuyer #MEDDIC #SaaS

Few understand the E.

This week’s breakdown: the Economic Buyer - who they are, why they matter, and how to stop wasting time on deals that won’t close.

Watch → https://youtu.be/bJEtWMT9h1E

#MEDDIC #EconomicBuyer #SaaS

Few understand the E.

This week’s breakdown: the Economic Buyer - who they are, why they matter, and how to stop wasting time on deals that won’t close.

Watch → https://youtu.be/bJEtWMT9h1E

#MEDDIC #EconomicBuyer #SaaS

Median CAC payback → 29mo (Q2 ‘23) → 35mo (Q2 ‘25)

Applovin + Palantir are outliers, but most SaaS names are spending more and growing slower.

Full breakdown here - https://youtu.be/Y4Jd6o-AGPQ

#CACpayback #SaaS #Applovin

Median CAC payback → 29mo (Q2 ‘23) → 35mo (Q2 ‘25)

Applovin + Palantir are outliers, but most SaaS names are spending more and growing slower.

Full breakdown here - https://youtu.be/Y4Jd6o-AGPQ

#CACpayback #SaaS #Applovin

Free cash flow margins are up 57% YoY (14% → 22%), with names like Figma, Box & Appian swinging from negative to positive.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#FreeCashFlow #SaaS

Free cash flow margins are up 57% YoY (14% → 22%), with names like Figma, Box & Appian swinging from negative to positive.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#FreeCashFlow #SaaS

Median CAC payback hit 35 months in Q2 2025 - up from 29 two years ago (+21%).

Applovin (4) & Palantir (11) are leading; Zoom (100) & Asana (78) dragging the median higher.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#CACpayback

Median CAC payback hit 35 months in Q2 2025 - up from 29 two years ago (+21%).

Applovin (4) & Palantir (11) are leading; Zoom (100) & Asana (78) dragging the median higher.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#CACpayback

Only 2 companies still negative (SentinelOne, Semrush).

Big turnarounds:

Box -1 → 15%

Figma -7 → 24%

Appian -12 → 26%

Full breakdown here - https://youtu.be/Y4Jd6o-AGPQ

#FreeCashFlow #SaaS #Tech #Finance

Only 2 companies still negative (SentinelOne, Semrush).

Big turnarounds:

Box -1 → 15%

Figma -7 → 24%

Appian -12 → 26%

Full breakdown here - https://youtu.be/Y4Jd6o-AGPQ

#FreeCashFlow #SaaS #Tech #Finance

Rubrik - 78% → 59%

Confluent - 68 → 54

GitLab - 66 → 46

Okta - 47 → 34

Efficiency > growth in 2025.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#SaaS #Tech #Finance

Rubrik - 78% → 59%

Confluent - 68 → 54

GitLab - 66 → 46

Okta - 47 → 34

Efficiency > growth in 2025.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#SaaS #Tech #Finance

Sales & marketing spend as % of revenue is down 17% over two years.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#Salesandmarketing #SaaS #Tech #Finance

Sales & marketing spend as % of revenue is down 17% over two years.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#Salesandmarketing #SaaS #Tech #Finance

Sprout Social - 30 → 57 months

Procore - 30 → 55

SentinelOne - 30 → 47

CrowdStrike - 20 → 34

Go-to-market efficiency is fading fast.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#SaaS #Tech #Finance #Startups

Sprout Social - 30 → 57 months

Procore - 30 → 55

SentinelOne - 30 → 47

CrowdStrike - 20 → 34

Go-to-market efficiency is fading fast.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#SaaS #Tech #Finance #Startups

Median CAC payback has blown out from 29 → 35 months in two years - up 21%.

Even top performers like CrowdStrike are slipping.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#SaaS #Tech #Finance

Median CAC payback has blown out from 29 → 35 months in two years - up 21%.

Even top performers like CrowdStrike are slipping.

Full breakdown in The SaaS Report Ep. 30 → https://youtu.be/Y4Jd6o-AGPQ

#SaaS #Tech #Finance

It’s all in our State of SaaS Report, breaking down the real trends in public SaaS - https://www.send.co/a/draft-state-of-saas-report-q2-2025-FQjWkvqP

#TheSaaSReport

It’s all in our State of SaaS Report, breaking down the real trends in public SaaS - https://www.send.co/a/draft-state-of-saas-report-q2-2025-FQjWkvqP

#TheSaaSReport

Median CAC payback across public SaaS has stretched from 29 → 35 months in just two years - a 21% jump in acquisition cost.

Full episode here - https://youtu.be/Y4Jd6o-AGPQ?si=FBh6E5zdQwzAFquw

#CACpayback #GTM

Median CAC payback across public SaaS has stretched from 29 → 35 months in just two years - a 21% jump in acquisition cost.

Full episode here - https://youtu.be/Y4Jd6o-AGPQ?si=FBh6E5zdQwzAFquw

#CACpayback #GTM

Median ARR growth:

→ 25% (2023)

→ 23% (2024)

→ 20% (2025)

Full State of SaaS breakdown → https://youtu.be/4Vwk5jM6haE

#SaaS #Growth #Metrics #ARR #SaaSInsights

Median ARR growth:

→ 25% (2023)

→ 23% (2024)

→ 20% (2025)

Full State of SaaS breakdown → https://youtu.be/4Vwk5jM6haE

#SaaS #Growth #Metrics #ARR #SaaSInsights

Rubrik 55%

Palantir 48%

Top 3 fastest-growing public SaaS companies in Q2 - from our new State of SaaS report.

Watch the full breakdown → https://youtu.be/4Vwk5jM6haE

#SaaS #ARR #Growth #Metrics #SaaSInsights

Rubrik 55%

Palantir 48%

Top 3 fastest-growing public SaaS companies in Q2 - from our new State of SaaS report.

Watch the full breakdown → https://youtu.be/4Vwk5jM6haE

#SaaS #ARR #Growth #Metrics #SaaSInsights

Net new $100K+ customer adds have been steady - but no real spike so far.

One to watch closely as UiPath looks to reaccelerate ARR growth.

Full analysis here - https://youtu.be/4Vwk5jM6haE

#UiPath #GoToMarket #SaaSmetrics #SaaS

Net new $100K+ customer adds have been steady - but no real spike so far.

One to watch closely as UiPath looks to reaccelerate ARR growth.

Full analysis here - https://youtu.be/4Vwk5jM6haE

#UiPath #GoToMarket #SaaSmetrics #SaaS

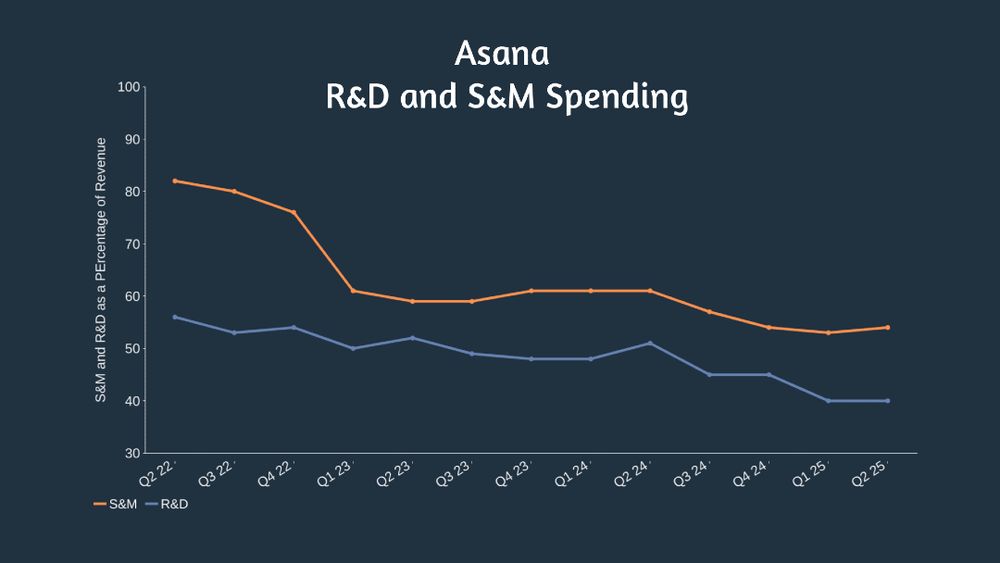

S&M spend ↓ from 80% → 60%

R&D ↓ from 57% → 42%

Efficiency’s up - growth still the question.

Full context in last week’s State of SaaS episode →https://youtu.be/4Vwk5jM6haE

#SaaS #OperatingMargins #Efficiency #Asana

S&M spend ↓ from 80% → 60%

R&D ↓ from 57% → 42%

Efficiency’s up - growth still the question.

Full context in last week’s State of SaaS episode →https://youtu.be/4Vwk5jM6haE

#SaaS #OperatingMargins #Efficiency #Asana

Efficiency is improving, but growth can’t slow without risk.

Watch the full episode for the complete breakdown - https://youtu.be/4Vwk5jM6haE

#SaaS #ARR #OperatingMargin #Metrics #Rubrik

Efficiency is improving, but growth can’t slow without risk.

Watch the full episode for the complete breakdown - https://youtu.be/4Vwk5jM6haE

#SaaS #ARR #OperatingMargin #Metrics #Rubrik

From 126% in Q2 ’22 → 102% in Q2 ’25

Watch the breakdown here - https://youtu.be/4Vwk5jM6haE

#SaaS #NRR #ARR #Pagerduty

From 126% in Q2 ’22 → 102% in Q2 ’25

Watch the breakdown here - https://youtu.be/4Vwk5jM6haE

#SaaS #NRR #ARR #Pagerduty

We break it down in last weeks episode of The SaaS Report - https://youtu.be/4Vwk5jM6haE

#ARR #SaaS #Metrics

We break it down in last weeks episode of The SaaS Report - https://youtu.be/4Vwk5jM6haE

#ARR #SaaS #Metrics