Capex plans for 2025-26 are now solid at +7.1%y

Capex plans for 2025-26 are now solid at +7.1%y

Sep durable goods orders +0.5%mom (as exp) but capital goods orders & shipments ex aircraft and defence both up 0.9%mom and trending higher

(Bloomberg chart)

Sep durable goods orders +0.5%mom (as exp) but capital goods orders & shipments ex aircraft and defence both up 0.9%mom and trending higher

(Bloomberg chart)

Market related price inflation has picked up to 2.8%yoy…

…but prices which are largely govt administered or indexed under govt regulation are up 7.8%yoy

Market related price inflation has picked up to 2.8%yoy…

…but prices which are largely govt administered or indexed under govt regulation are up 7.8%yoy

Sep retail sales just +0.2%m, control -0.1%m

Nov consumer confidence -7pts and nearly back to Liberation Day lows. Jobs plentiful/hard to get slightly better but weak

Cotality Sept home prices +0.1%m/1.4%y

Sept core PPI 0.1%m/2.6%y

Adds to case for Dec rate cut

(Bloomberg chart)

Sep retail sales just +0.2%m, control -0.1%m

Nov consumer confidence -7pts and nearly back to Liberation Day lows. Jobs plentiful/hard to get slightly better but weak

Cotality Sept home prices +0.1%m/1.4%y

Sept core PPI 0.1%m/2.6%y

Adds to case for Dec rate cut

(Bloomberg chart)

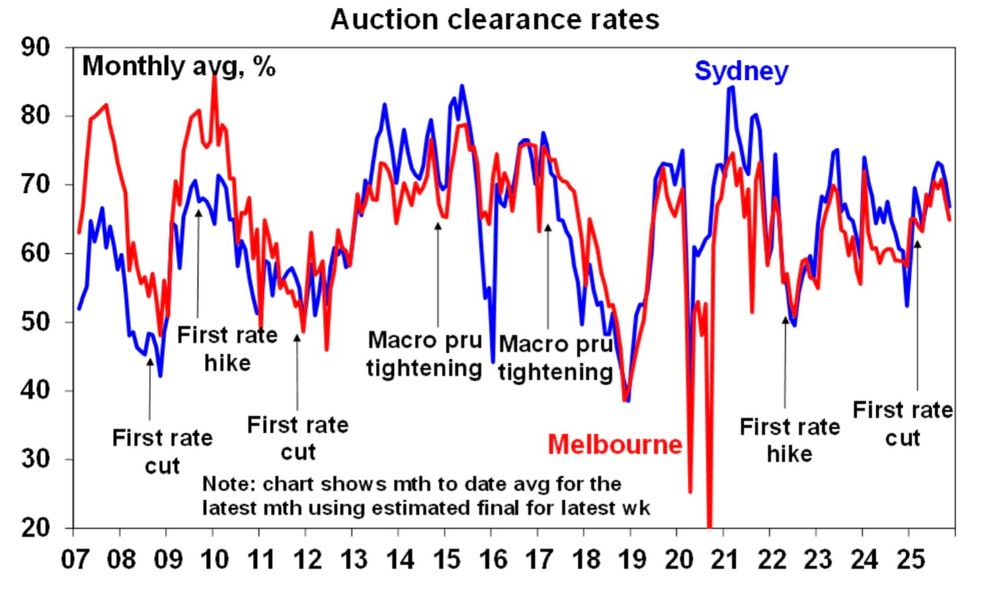

Syd 64%=final ~62%,Nov avg 60

Mel 65%=final ~63%,Nov avg 61

Clearances slowing with less rate cut optimism & rising listings but looks partly seasonal. Avg clearances fall ~6-7% Aug to Nov. Support remains from the 3 rate cuts & low deposit FHB scheme.

#ausecon

Syd 64%=final ~62%,Nov avg 60

Mel 65%=final ~63%,Nov avg 61

Clearances slowing with less rate cut optimism & rising listings but looks partly seasonal. Avg clearances fall ~6-7% Aug to Nov. Support remains from the 3 rate cuts & low deposit FHB scheme.

#ausecon

1 yr ahead inflation expectations fell to 4.5% from 4.7%

5-10 yr ahead inflation expectations fell to 3.4% from 3.6% (which is getting closer to levels more consistent with the 2% inflation target)

(Bloomberg charts)

1 yr ahead inflation expectations fell to 4.5% from 4.7%

5-10 yr ahead inflation expectations fell to 3.4% from 3.6% (which is getting closer to levels more consistent with the 2% inflation target)

(Bloomberg charts)

US shares +1% (-1.9% wk) as Feds Williams see room for a near term rate cut (mkt back to 60% prob for Dec)

US 10 yr yld -2bp to 4.06%

Oil -1.6% to $58

Gold -0.3% to $4065

Iron ore -0.05% to $104.3

Bitcoin $84.2k

ASX futures +1.1%

$A 0.645 w $US flat

US shares +1% (-1.9% wk) as Feds Williams see room for a near term rate cut (mkt back to 60% prob for Dec)

US 10 yr yld -2bp to 4.06%

Oil -1.6% to $58

Gold -0.3% to $4065

Iron ore -0.05% to $104.3

Bitcoin $84.2k

ASX futures +1.1%

$A 0.645 w $US flat

Output prices rose but the trend is down suggesting softer December quarter inflation.

(Macquarie Macro Strategy charts)

Output prices rose but the trend is down suggesting softer December quarter inflation.

(Macquarie Macro Strategy charts)

(No clear signal here for Fed)

(No clear signal here for Fed)

(EvercoreISI charts)

(EvercoreISI charts)

Overall this is neutral for Fed interest rates.

(EvercoreISI charts)

Overall this is neutral for Fed interest rates.

(EvercoreISI charts)

(Bloomberg chart)

(Bloomberg chart)

Our wages leading indicator still points to a further slowing in wages growth ahead.

Our wages leading indicator still points to a further slowing in wages growth ahead.

(ABS charts)

(ABS charts)

Stable wages grth at 3.4%y is consistent with the jobs mkt being balanced, not tight.

Slowing priv wages grth (more important for infl) leaves the door open for another rate cut but the RBA wont be hurrying

Stable wages grth at 3.4%y is consistent with the jobs mkt being balanced, not tight.

Slowing priv wages grth (more important for infl) leaves the door open for another rate cut but the RBA wont be hurrying

Syd +0.5% (=0.8% at mthly rate)

Mel +0.2%

Bri +0.9%

Ade +0.8%

Per +1.2%

5 city av +0.6% (=1.1% at mthly rate)

Property price growth remains strong so far this mth despite talk rates may have bottomed with 5% deposit scheme likely helping

Syd +0.5% (=0.8% at mthly rate)

Mel +0.2%

Bri +0.9%

Ade +0.8%

Per +1.2%

5 city av +0.6% (=1.1% at mthly rate)

Property price growth remains strong so far this mth despite talk rates may have bottomed with 5% deposit scheme likely helping

Syd 67%=final ~66%,Nov avg 60

Mel 66%=final ~63%,Nov avg 61

Clearances r continuing to slow reflecting talk of less rate cuts & rising listings but looks partly seasonal. Support remains from 3 rate cuts this yr & the low deposit scheme.

#ausecon

Syd 67%=final ~66%,Nov avg 60

Mel 66%=final ~63%,Nov avg 61

Clearances r continuing to slow reflecting talk of less rate cuts & rising listings but looks partly seasonal. Support remains from 3 rate cuts this yr & the low deposit scheme.

#ausecon

US shares -0.05%(+0.1% wk) up from -1.3% with 50 day av holding so far.Nas +0.1%

US 10 yr yld +3bp to 4.15%

Oil +2.1% to $59.9

Gold -2.1% to $4084

Iron ore -0.2% to $103.5

Bitcoin $94.7k as risk off tone weighs

ASX futures -0.2%

$A 0.6537 w $US +0.1%

US shares -0.05%(+0.1% wk) up from -1.3% with 50 day av holding so far.Nas +0.1%

US 10 yr yld +3bp to 4.15%

Oil +2.1% to $59.9

Gold -2.1% to $4084

Iron ore -0.2% to $103.5

Bitcoin $94.7k as risk off tone weighs

ASX futures -0.2%

$A 0.6537 w $US +0.1%

GDP grth this yr is probably still on track for just below 5% but incremental policy stimulus is still likely

(Bloomberg table)

GDP grth this yr is probably still on track for just below 5% but incremental policy stimulus is still likely

(Bloomberg table)