Realtor - Valery Real Estate Inc., Brokerage

#TORE

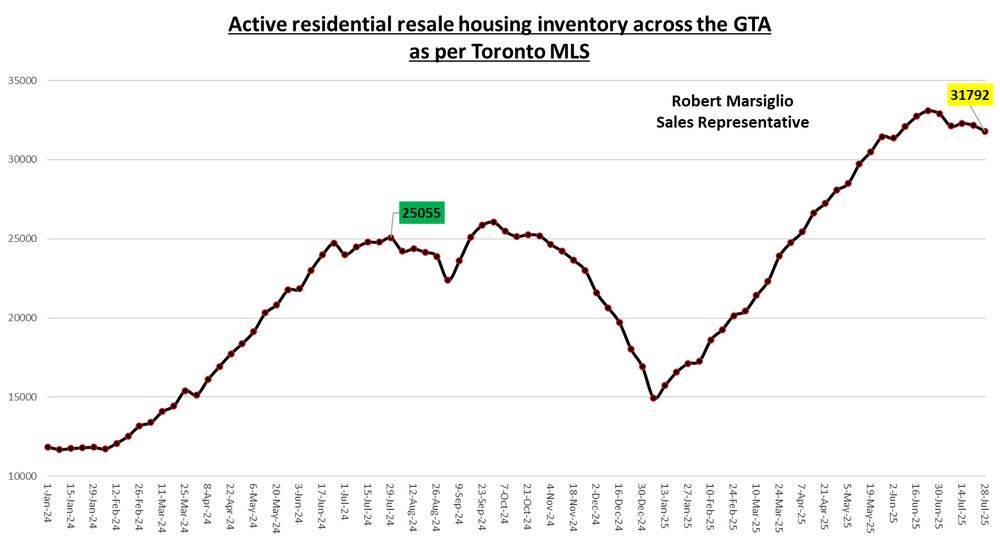

One more drop next week before the (potential?) fall inventory flood.

7/8

One more drop next week before the (potential?) fall inventory flood.

7/8

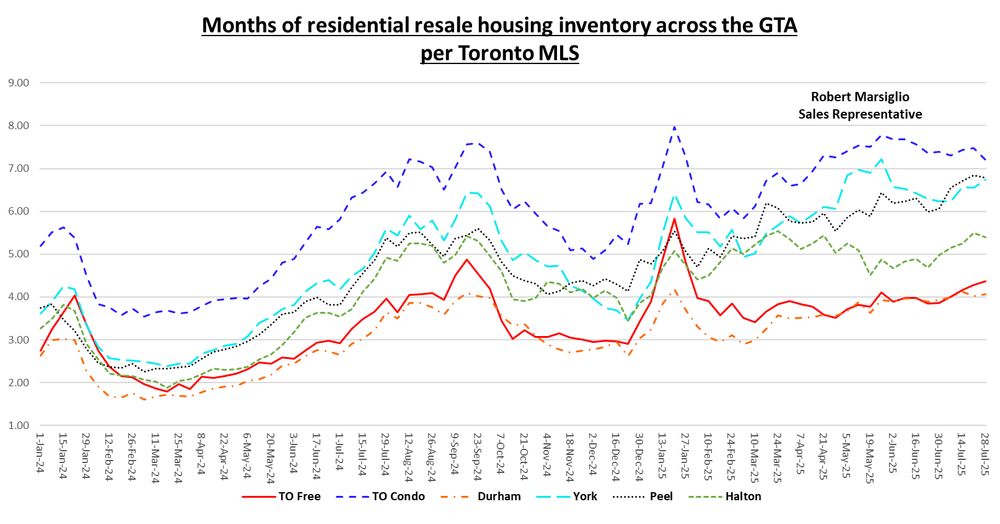

TO Free: 3,738 (🔻72 or 1.89%)

TO Condo: 7,350 (🔻145 or 1.93%)

Durham: 2,981 (🔻160 or 5.09%)

York: 6,075 (🔻69 or 1.12%)

Peel: 6,016 (🔻126 or 2.05%)

Halton: 3,234 (🔻110 or 3.29%)

6/8

TO Free: 3,738 (🔻72 or 1.89%)

TO Condo: 7,350 (🔻145 or 1.93%)

Durham: 2,981 (🔻160 or 5.09%)

York: 6,075 (🔻69 or 1.12%)

Peel: 6,016 (🔻126 or 2.05%)

Halton: 3,234 (🔻110 or 3.29%)

6/8

2025 has seen a slow down that 2024 didn't.

5/8

2025 has seen a slow down that 2024 didn't.

5/8

It's down about 900 in the last three weeks.

4/8

It's down about 900 in the last three weeks.

4/8

TO Free: 741 (🔻62 or 7.72%)

TO Condo: 978 (🔻38 or 3.74%)

Durham: 662 (🔻35 or 5.02%)

York: 944 (🔻13 or 1.36%)

Peel: 886 (🔻30 or 3.28%)

Halton: 620 (🔻13 or 2.05%)

3/8

TO Free: 741 (🔻62 or 7.72%)

TO Condo: 978 (🔻38 or 3.74%)

Durham: 662 (🔻35 or 5.02%)

York: 944 (🔻13 or 1.36%)

Peel: 886 (🔻30 or 3.28%)

Halton: 620 (🔻13 or 2.05%)

3/8

Expect a drop next week when we get the month end expiries roll through.

2/8

Expect a drop next week when we get the month end expiries roll through.

2/8

(change from last week)

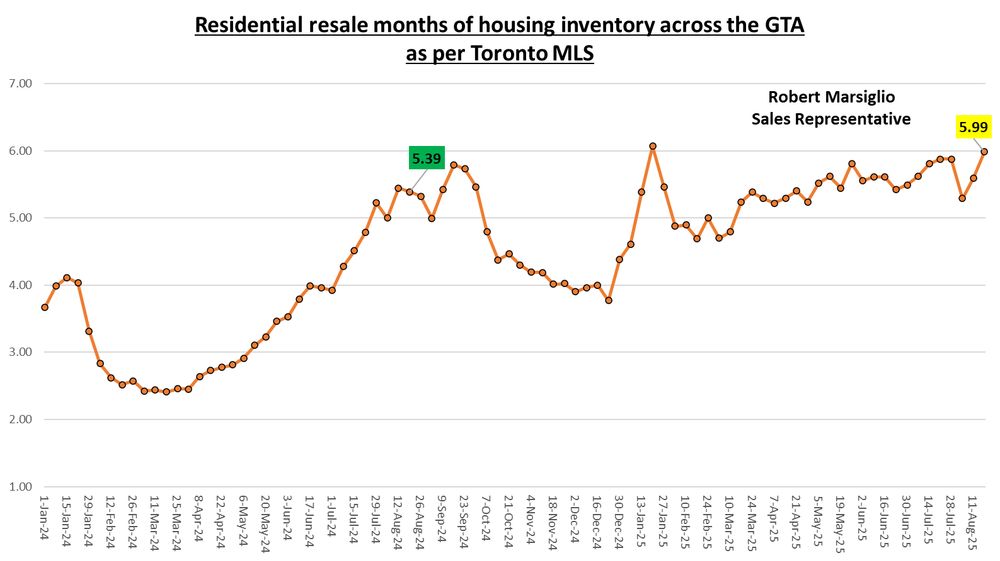

TO Free: 5.04 (⬆️0.30 or 6.32%)

TO Condo: 7.52 (⬆️0.14 or 1.88%)

Durham: 4.50 (🔻0.01 or 0.08%)

York: 6.44 (⬆️0.02 or 0.24%)

Peel: 6.79 (⬆️0.08 or 1.27%)

Halton: 5.22 (🔻0.07 or 1.26%)

1/8

(change from last week)

TO Free: 5.04 (⬆️0.30 or 6.32%)

TO Condo: 7.52 (⬆️0.14 or 1.88%)

Durham: 4.50 (🔻0.01 or 0.08%)

York: 6.44 (⬆️0.02 or 0.24%)

Peel: 6.79 (⬆️0.08 or 1.27%)

Halton: 5.22 (🔻0.07 or 1.26%)

1/8

Does it dip below next week?

6/7

Does it dip below next week?

6/7

TO Free: 3,810 (🔻117 or 2.98%)

TO Condo: 7,495 (🔻146 or 1.91%)

Durham: 3,141 (🔻3 or 0.10%)

York: 6,144 (🔻66 or 1.06%)

Peel: 6,142 (🔻4 or 0.07%)

Halton: 3,344 (🔻29 or 0.86%)

5/7

TO Free: 3,810 (🔻117 or 2.98%)

TO Condo: 7,495 (🔻146 or 1.91%)

Durham: 3,141 (🔻3 or 0.10%)

York: 6,144 (🔻66 or 1.06%)

Peel: 6,142 (🔻4 or 0.07%)

Halton: 3,344 (🔻29 or 0.86%)

5/7

August 2025 has given us the biggest two week drop of the year.

Does this indicate that we are in for a slower fall market?

4/7

August 2025 has given us the biggest two week drop of the year.

Does this indicate that we are in for a slower fall market?

4/7

TO Free: 803 (🔻105 or 11.56%)

TO Condo: 1,016 (🔻63 or 5.84%)

Durham: 697 (🔻70 or 9.13%)

York: 957 (🔻33 or 3.33%)

Peel: 916 (🔻100 or 9.84%)

Halton: 633 (🔻51 or 7.46%)

3/7

TO Free: 803 (🔻105 or 11.56%)

TO Condo: 1,016 (🔻63 or 5.84%)

Durham: 697 (🔻70 or 9.13%)

York: 957 (🔻33 or 3.33%)

Peel: 916 (🔻100 or 9.84%)

Halton: 633 (🔻51 or 7.46%)

3/7

Durham Region is the only market that set a YTD high this week. In fact, it is the highest weekly reading I have recorded in the 3+ years I've been tracking.

2/7

Durham Region is the only market that set a YTD high this week. In fact, it is the highest weekly reading I have recorded in the 3+ years I've been tracking.

2/7

(change from last week)

TO Free: 4.74 (⬆️0.42 or 9.71%)

TO Condo: 7.38 (⬆️0.30 or 4.17%)

Durham: 4.51 (⬆️0.41 or 9.94%)

York: 6.42 (⬆️0.15 or 2.35%)

Peel: 6.71 (⬆️0.66 or 10.84%)

Halton: 5.28 (⬆️0.35 or 7.13%)

1/7

(change from last week)

TO Free: 4.74 (⬆️0.42 or 9.71%)

TO Condo: 7.38 (⬆️0.30 or 4.17%)

Durham: 4.51 (⬆️0.41 or 9.94%)

York: 6.42 (⬆️0.15 or 2.35%)

Peel: 6.71 (⬆️0.66 or 10.84%)

Halton: 5.28 (⬆️0.35 or 7.13%)

1/7

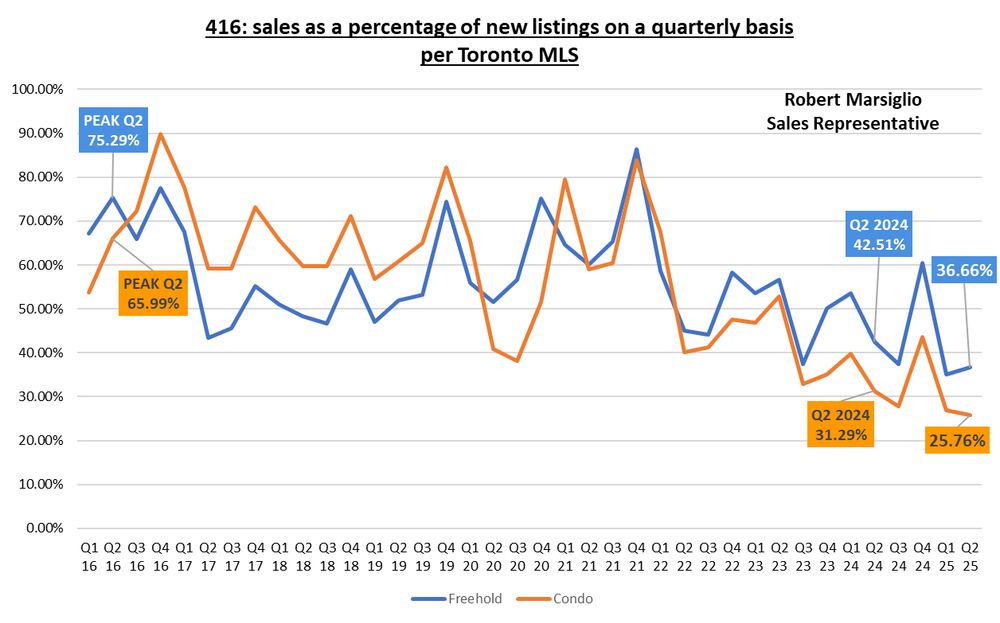

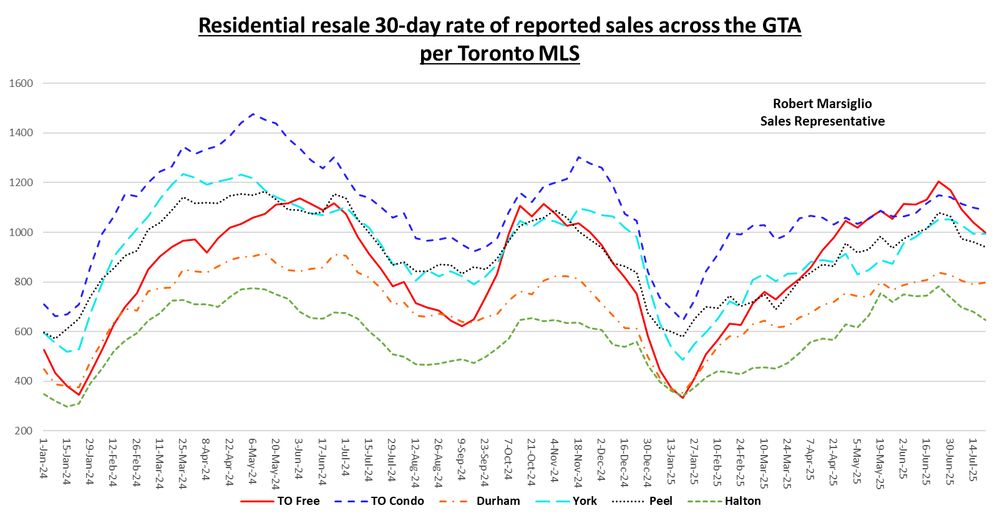

July 2025 is shaping up to be the busiest July in terms of reported sales since 2021.

Freehold sales are projected to outpace 2017.

The doors are by no means being blow off, but have we hit the bottom for volume?

July 2025 is shaping up to be the busiest July in terms of reported sales since 2021.

Freehold sales are projected to outpace 2017.

The doors are by no means being blow off, but have we hit the bottom for volume?

2024 saw a slow build while 2025 has seen a slow drop.

630 active listings have an expiry date between now and July 31, so expect a further drop in next week's reading.

6/7

2024 saw a slow build while 2025 has seen a slow drop.

630 active listings have an expiry date between now and July 31, so expect a further drop in next week's reading.

6/7

TO Free: 4,173 (🔻103 or 2.41%)

TO Condo: 8,018 (🔻125 or 1.54%)

Durham: 3,187 (🔻22 or 0.69%)

York: 6,504 (🔻15 or 0.23%)

Peel: 6,422 (🔻26 or 0.40%)

Halton: 3,488 (🔻73 or 2.05%)

5/7

TO Free: 4,173 (🔻103 or 2.41%)

TO Condo: 8,018 (🔻125 or 1.54%)

Durham: 3,187 (🔻22 or 0.69%)

York: 6,504 (🔻15 or 0.23%)

Peel: 6,422 (🔻26 or 0.40%)

Halton: 3,488 (🔻73 or 2.05%)

5/7

2025 -🔻9.7%

2024 -🔻21.6%

4/7

2025 -🔻9.7%

2024 -🔻21.6%

4/7

TO Free: 956 (🔻44 or 4.40%)

TO Condo: 1,113 (⬆️23 or 2.11%)

Durham: 783 (🔻14 or 1.76%)

York: 966 (🔻29 or 2.91%)

Peel: 946 (⬆️4 or 0.42%)

Halton: 647 (🔻1 or 0.15%)

3/7

TO Free: 956 (🔻44 or 4.40%)

TO Condo: 1,113 (⬆️23 or 2.11%)

Durham: 783 (🔻14 or 1.76%)

York: 966 (🔻29 or 2.91%)

Peel: 946 (⬆️4 or 0.42%)

Halton: 647 (🔻1 or 0.15%)

3/7

It all resulted in a big nothing burger week-over-week.

2/7

It all resulted in a big nothing burger week-over-week.

2/7

(change from last week)

TO Free: 4.37 (⬆️0.09 or 2.08%)

TO Condo: 7.20 (🔻0.27 or 3.57%)

Durham: 4.07 (⬆️0.04 or 1.09%)

York: 6.73 (⬆️0.18 or 2.77%)

Peel: 6.79 (🔻0.06 or 0.82%)

Halton: 5.39 (🔻0.10 or 1.90%)

1/7

(change from last week)

TO Free: 4.37 (⬆️0.09 or 2.08%)

TO Condo: 7.20 (🔻0.27 or 3.57%)

Durham: 4.07 (⬆️0.04 or 1.09%)

York: 6.73 (⬆️0.18 or 2.77%)

Peel: 6.79 (🔻0.06 or 0.82%)

Halton: 5.39 (🔻0.10 or 1.90%)

1/7

I think this slow grind continues until we see sales volume pick up. Once it does pick up, I think we will get a better idea of where the price floor sits.

3/3

I think this slow grind continues until we see sales volume pick up. Once it does pick up, I think we will get a better idea of where the price floor sits.

3/3

Similar trends with Q2 SNLR peaking in 2016 and setting 10-year lows in 2025.

2/3

Similar trends with Q2 SNLR peaking in 2016 and setting 10-year lows in 2025.

2/3

By this metric, 416 and 905 markets have been in buyer's market territory for the last 6+ months.

416 has been in a balanced to buyers market for the past 3 years.

1/3

By this metric, 416 and 905 markets have been in buyer's market territory for the last 6+ months.

416 has been in a balanced to buyers market for the past 3 years.

1/3

The rate of sales has dropped by 10.4% over the past four weeks.

Over the same time last year, rate of sales fell 17.0%.

6/7

The rate of sales has dropped by 10.4% over the past four weeks.

Over the same time last year, rate of sales fell 17.0%.

6/7

TO Free: 1,000 (🔻40 or 3.85%)

TO Condo: 1,090 (🔻10 or 0.91%)

Durham: 797 (⬆️6 or 0.76%)

York: 995 (⬆️2 or 0.20%)

Peel: 942 (🔻19 or 1.98%)

Halton: 648 (🔻33 or 4.85%)

5/7

TO Free: 1,000 (🔻40 or 3.85%)

TO Condo: 1,090 (🔻10 or 0.91%)

Durham: 797 (⬆️6 or 0.76%)

York: 995 (⬆️2 or 0.20%)

Peel: 942 (🔻19 or 1.98%)

Halton: 648 (🔻33 or 4.85%)

5/7