Robin Brooks

@robin-j-brooks.bsky.social

Senior Fellow at @brookings.edu. Previously Chief Economist at IIF and Chief FX Strategist at Goldman Sachs.

Reposted by Robin Brooks

just realized @vmrconstancio.bsky.social had a very insightful reply to Brooks over at Substacks re "should the Fed let QT run a bit longer"

substack.com/@vconstancio...

substack.com/@vconstancio...

November 10, 2025 at 4:43 PM

just realized @vmrconstancio.bsky.social had a very insightful reply to Brooks over at Substacks re "should the Fed let QT run a bit longer"

substack.com/@vconstancio...

substack.com/@vconstancio...

Precious metals are having the best day in some time. That's because markets think the US gov't shutdown will end. This is price action worth taking note of. As markets downgrade their odds for US recession, precious metals start rising again because people start worrying about inflation...

November 10, 2025 at 4:45 PM

Precious metals are having the best day in some time. That's because markets think the US gov't shutdown will end. This is price action worth taking note of. As markets downgrade their odds for US recession, precious metals start rising again because people start worrying about inflation...

The premium the US pays on 10-year Treasuries over its G10 peers after those are hedged back into US Dollar is down to its lowest level in many years. The US fiscal picture is bad, but it's not as bad as in many other advanced economies. So - on a relative basis - the US still smells like roses...

November 10, 2025 at 3:30 PM

The premium the US pays on 10-year Treasuries over its G10 peers after those are hedged back into US Dollar is down to its lowest level in many years. The US fiscal picture is bad, but it's not as bad as in many other advanced economies. So - on a relative basis - the US still smells like roses...

The "debasement trade" is a misnomer. What's really going on is a desperate hunt for any and all kind of safe havens from debt monetization, which looks increasingly likely across much of the G10. Sweden is emerging as a key safe haven. It's convenience yield just fell below Switzerland...

November 10, 2025 at 2:00 PM

The "debasement trade" is a misnomer. What's really going on is a desperate hunt for any and all kind of safe havens from debt monetization, which looks increasingly likely across much of the G10. Sweden is emerging as a key safe haven. It's convenience yield just fell below Switzerland...

Today marks the 6 month anniversary of my daily Substack posts. Key themes: (i) gov't manipulation of markets is always bad; (ii) words and deeds of politicians often differ; (iii) the way we talk to each other on genuinely difficult topics is appalling...

robinjbrooks.substack.com/p/my-six-mon...

robinjbrooks.substack.com/p/my-six-mon...

November 10, 2025 at 12:15 PM

Today marks the 6 month anniversary of my daily Substack posts. Key themes: (i) gov't manipulation of markets is always bad; (ii) words and deeds of politicians often differ; (iii) the way we talk to each other on genuinely difficult topics is appalling...

robinjbrooks.substack.com/p/my-six-mon...

robinjbrooks.substack.com/p/my-six-mon...

Germany's AfD is up to 26% in the latest polls from 20% in the election in February. The CDU has repeatedly tried to shift to a tougher stance on immigration - in an effort to stop the rise of the AfD - but every time it does that it gets called racist and worse. So the AfD will keep rising...

November 9, 2025 at 5:58 PM

Germany's AfD is up to 26% in the latest polls from 20% in the election in February. The CDU has repeatedly tried to shift to a tougher stance on immigration - in an effort to stop the rise of the AfD - but every time it does that it gets called racist and worse. So the AfD will keep rising...

Reposted by Robin Brooks

🤔🤔

China has used the basis trade to unsettle the Treasury market and get Trump to fold on tariffs. We need to shut the basis trade down, not backstop it with a return to Fed balance sheet expansion. A piece inspired by the amazing @vmrconstancio.bsky.social.

robinjbrooks.substack.com/p/the-basis-...

robinjbrooks.substack.com/p/the-basis-...

November 9, 2025 at 1:52 PM

🤔🤔

The basis trade is just a carry trade between Treasuries and Treasury futures. The enemy of carry trades is volatility. We need more of that to shut down the basis trade, not a return to Fed balance sheet expansion to artificially suppress volatility. We need more volatility to end the basis trade.

November 9, 2025 at 2:25 PM

The basis trade is just a carry trade between Treasuries and Treasury futures. The enemy of carry trades is volatility. We need more of that to shut down the basis trade, not a return to Fed balance sheet expansion to artificially suppress volatility. We need more volatility to end the basis trade.

China has used the basis trade to unsettle the Treasury market and get Trump to fold on tariffs. We need to shut the basis trade down, not backstop it with a return to Fed balance sheet expansion. A piece inspired by the amazing @vmrconstancio.bsky.social.

robinjbrooks.substack.com/p/the-basis-...

robinjbrooks.substack.com/p/the-basis-...

November 9, 2025 at 1:50 PM

China has used the basis trade to unsettle the Treasury market and get Trump to fold on tariffs. We need to shut the basis trade down, not backstop it with a return to Fed balance sheet expansion. A piece inspired by the amazing @vmrconstancio.bsky.social.

robinjbrooks.substack.com/p/the-basis-...

robinjbrooks.substack.com/p/the-basis-...

The survival of the Euro is wrongly linked to avoidance of debt crises, creating a pretend universe where high-debt countries muddle on. Europe has to change course on this.

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

November 8, 2025 at 1:33 PM

The survival of the Euro is wrongly linked to avoidance of debt crises, creating a pretend universe where high-debt countries muddle on. Europe has to change course on this.

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

Brazil's transformation into a large trade surplus country is unique in EM. But the current account deficit remains wide, as lots of the farms that export crops are foreign owned, so the profits from the trade surplus go abroad. That will change over time...

robinjbrooks.substack.com/p/when-will-...

robinjbrooks.substack.com/p/when-will-...

November 8, 2025 at 12:50 PM

Brazil's transformation into a large trade surplus country is unique in EM. But the current account deficit remains wide, as lots of the farms that export crops are foreign owned, so the profits from the trade surplus go abroad. That will change over time...

robinjbrooks.substack.com/p/when-will-...

robinjbrooks.substack.com/p/when-will-...

Why would Germans at the ECB cheerlead the TPI when it so obviously runs counter to the cause of low-debt countries? ECB is dominated by high-debt countries, so you only get ahead by doing their bidding. Germany has a principal-agent problem at the ECB...

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/the-princi...

November 7, 2025 at 3:09 PM

Why would Germans at the ECB cheerlead the TPI when it so obviously runs counter to the cause of low-debt countries? ECB is dominated by high-debt countries, so you only get ahead by doing their bidding. Germany has a principal-agent problem at the ECB...

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/the-princi...

The Euro is broken. High-debt countries don't want that, as they usurped the ECB and use it to extract rents from others. Germany and its low-debt allies must pull the plug.

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

November 7, 2025 at 1:04 PM

The Euro is broken. High-debt countries don't want that, as they usurped the ECB and use it to extract rents from others. Germany and its low-debt allies must pull the plug.

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

Reposted by Robin Brooks

Well said. 100% agree!

The reason the EU gets pushed around by the US and China is this: Russian shadow fleet oil tankers operate with impunity in the Baltic, keeping Putin's war machine running. If you want to be feared and respected, you have to confront the challenge right in front of you. Nothing else really matters.

November 7, 2025 at 12:48 PM

Well said. 100% agree!

The China bots are very active recently and like to portray China as a benevolent global superpower. So here's a quick reminder that China has become Russia's biggest trading partner since the invasion, which is the only reason Putin's war machine can keep fighting in Ukraine...

November 7, 2025 at 12:41 PM

The China bots are very active recently and like to portray China as a benevolent global superpower. So here's a quick reminder that China has become Russia's biggest trading partner since the invasion, which is the only reason Putin's war machine can keep fighting in Ukraine...

The reason the EU gets pushed around by the US and China is this: Russian shadow fleet oil tankers operate with impunity in the Baltic, keeping Putin's war machine running. If you want to be feared and respected, you have to confront the challenge right in front of you. Nothing else really matters.

November 7, 2025 at 12:28 PM

The reason the EU gets pushed around by the US and China is this: Russian shadow fleet oil tankers operate with impunity in the Baltic, keeping Putin's war machine running. If you want to be feared and respected, you have to confront the challenge right in front of you. Nothing else really matters.

Brazil transformed itself into a huge trade surplus country in the past decade. This is mostly agricultural products being exported to China and is unlike anything in the rest of EM. Over time this will give Brazil lift-off from the rest of South America...

robinjbrooks.substack.com/p/brazils-re...

robinjbrooks.substack.com/p/brazils-re...

November 7, 2025 at 11:58 AM

Brazil transformed itself into a huge trade surplus country in the past decade. This is mostly agricultural products being exported to China and is unlike anything in the rest of EM. Over time this will give Brazil lift-off from the rest of South America...

robinjbrooks.substack.com/p/brazils-re...

robinjbrooks.substack.com/p/brazils-re...

Reposted by Robin Brooks

October's dollar strengthening. Right now quality is in a holding pattern, and if we are indeed entering a bear market, we're going to see medium term tension with this upswing against assets like Gold.

Good time to square away and free up some capital.

Good time to square away and free up some capital.

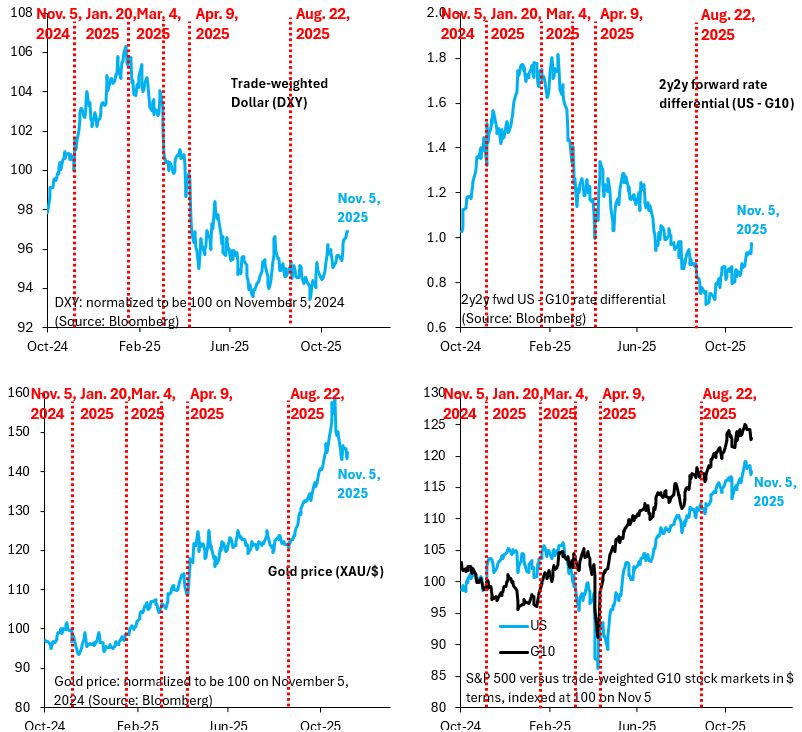

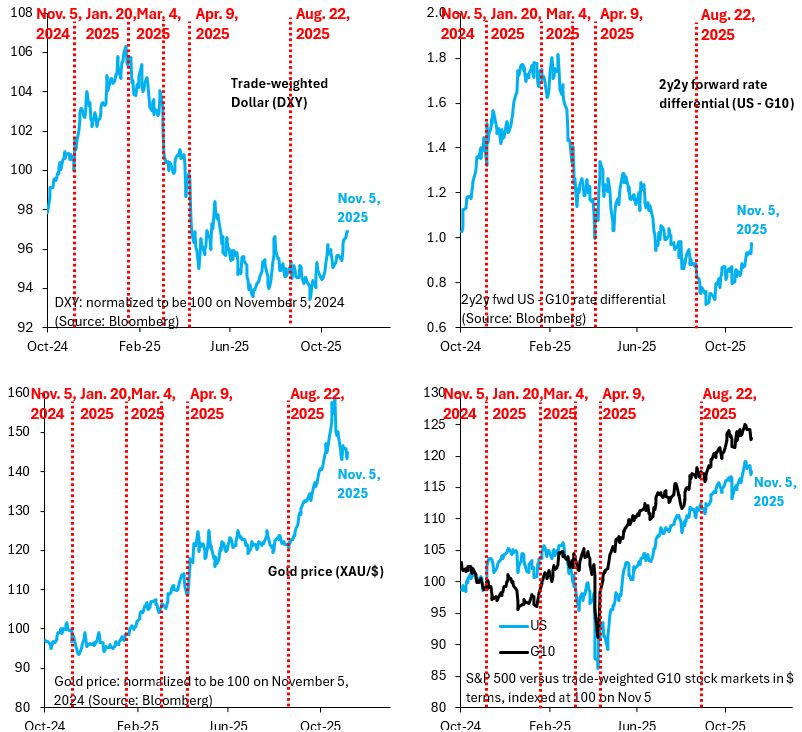

The Dollar is back up to its strongest level since May. Two things are driving that: (i) loss of reserve currency status was never realistic, as there's no credible alternative, especially not the Euro; (ii) markets got way too negative on the US economy...

robinjbrooks.substack.com/p/good-thing...

robinjbrooks.substack.com/p/good-thing...

November 6, 2025 at 11:44 PM

October's dollar strengthening. Right now quality is in a holding pattern, and if we are indeed entering a bear market, we're going to see medium term tension with this upswing against assets like Gold.

Good time to square away and free up some capital.

Good time to square away and free up some capital.

The Euro isn't working. High-debt countries have too much power at the ECB, using it for fiscal bailouts. Spain & Italy muddle along with no fiscal space & can't help Ukraine

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

November 6, 2025 at 2:46 PM

The Euro isn't working. High-debt countries have too much power at the ECB, using it for fiscal bailouts. Spain & Italy muddle along with no fiscal space & can't help Ukraine

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/what-the-e...

If you'd told me that we'd have an onslaught of tariffs and global services sector activity would remain solid, I would never have believed you. But that's where we are. There's very solid services sector activity (red) across all major economies, which is really remarkable...

November 6, 2025 at 12:56 PM

If you'd told me that we'd have an onslaught of tariffs and global services sector activity would remain solid, I would never have believed you. But that's where we are. There's very solid services sector activity (red) across all major economies, which is really remarkable...

The Dollar is back up to its strongest level since May. Two things are driving that: (i) loss of reserve currency status was never realistic, as there's no credible alternative, especially not the Euro; (ii) markets got way too negative on the US economy...

robinjbrooks.substack.com/p/good-thing...

robinjbrooks.substack.com/p/good-thing...

November 6, 2025 at 12:35 PM

The Dollar is back up to its strongest level since May. Two things are driving that: (i) loss of reserve currency status was never realistic, as there's no credible alternative, especially not the Euro; (ii) markets got way too negative on the US economy...

robinjbrooks.substack.com/p/good-thing...

robinjbrooks.substack.com/p/good-thing...

The Euro is like a bad marriage. Many think it should end, but divorce is scary, especially when one side keeps threatening the apocalypse. The truth is that Europe would be stronger without the Euro and better able to confront the many external threats...

robinjbrooks.substack.com/p/what-the-e...

robinjbrooks.substack.com/p/what-the-e...

November 5, 2025 at 3:45 PM

The Euro is like a bad marriage. Many think it should end, but divorce is scary, especially when one side keeps threatening the apocalypse. The truth is that Europe would be stronger without the Euro and better able to confront the many external threats...

robinjbrooks.substack.com/p/what-the-e...

robinjbrooks.substack.com/p/what-the-e...

So-called hawks at the ECB in 2022 led the introduction of the TPI anti-fragmentation tool. They did that so they could hike along with the Fed and protect the high-debt periphery from the resulting fiscal stress. That's not hawkish. That's fiscal capture...

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/the-princi...

November 5, 2025 at 11:21 AM

So-called hawks at the ECB in 2022 led the introduction of the TPI anti-fragmentation tool. They did that so they could hike along with the Fed and protect the high-debt periphery from the resulting fiscal stress. That's not hawkish. That's fiscal capture...

robinjbrooks.substack.com/p/the-princi...

robinjbrooks.substack.com/p/the-princi...

The end of the Euro will see the periphery devalue. The sovereign debt crisis a decade ago was a "sudden stop" in capital flows. In EM, those cause currencies to fall 30% (lhs), which brings recovery (rhs). Devaluation sounds scary, but it'll bring growth...

robinjbrooks.substack.com/p/what-the-e...

robinjbrooks.substack.com/p/what-the-e...

November 5, 2025 at 11:04 AM

The end of the Euro will see the periphery devalue. The sovereign debt crisis a decade ago was a "sudden stop" in capital flows. In EM, those cause currencies to fall 30% (lhs), which brings recovery (rhs). Devaluation sounds scary, but it'll bring growth...

robinjbrooks.substack.com/p/what-the-e...

robinjbrooks.substack.com/p/what-the-e...

The Euro is just a system of exchange rate pegs. It doesn't define Europe and isn't necessary for things like joint foreign policy or defense. Exchange rate pegs don't work unless countries run responsible fiscal policy. In the Euro zone, they don't...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/why-german...

November 4, 2025 at 4:11 PM

The Euro is just a system of exchange rate pegs. It doesn't define Europe and isn't necessary for things like joint foreign policy or defense. Exchange rate pegs don't work unless countries run responsible fiscal policy. In the Euro zone, they don't...

robinjbrooks.substack.com/p/why-german...

robinjbrooks.substack.com/p/why-german...