He’s done.

He’s done.

For @smartkarma subs...

Fy23 GPIF Results and Portfolio Changes - Outlook for FY24. Read more: skr.ma/G7y4o

For @smartkarma subs...

Fy23 GPIF Results and Portfolio Changes - Outlook for FY24. Read more: skr.ma/G7y4o

It is a reasonable "political goal", but it works, in return terms, with a stable USDJPY not a strong USDJPY.

It is a reasonable "political goal", but it works, in return terms, with a stable USDJPY not a strong USDJPY.

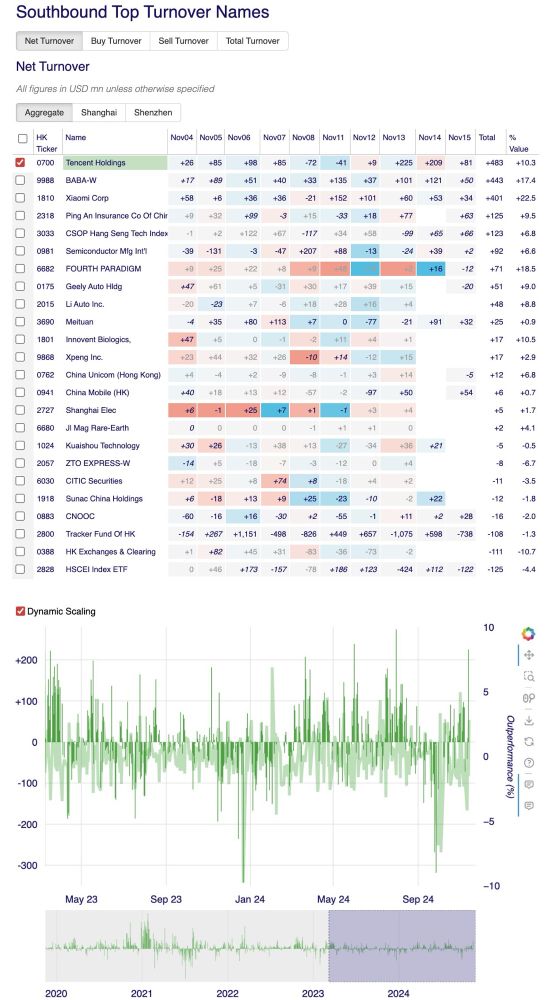

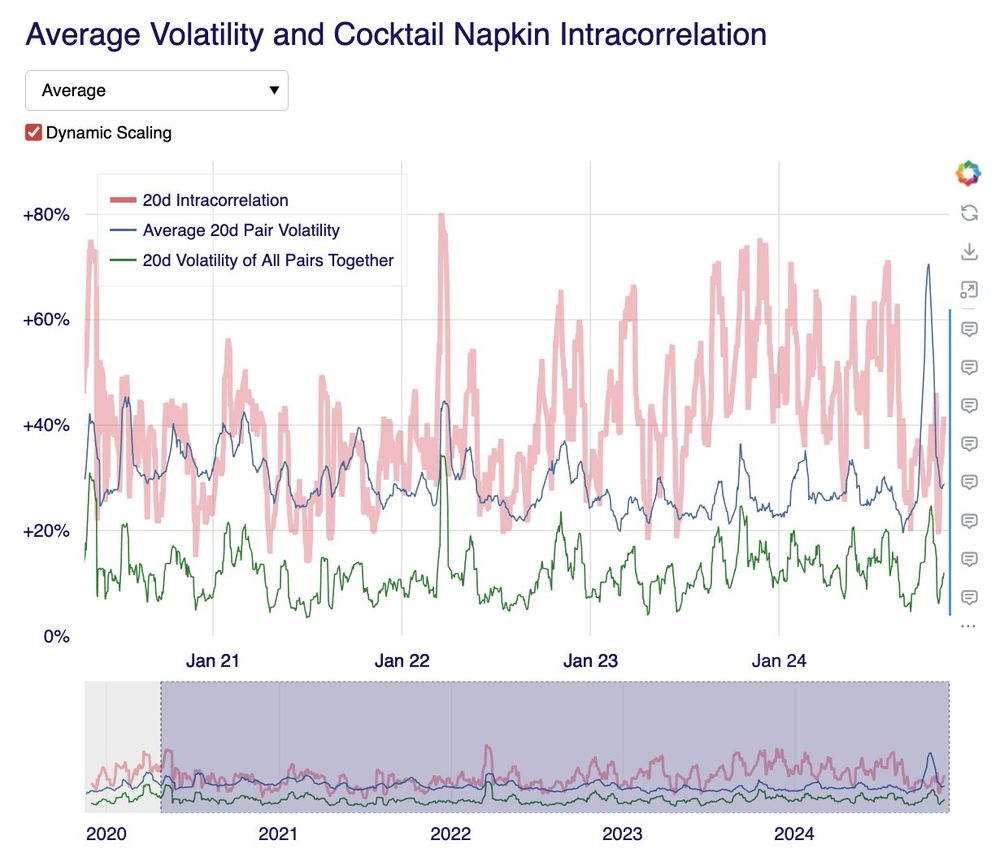

There are tools to see positions and flows over time. Enjoy!

www.smartkarma.com/insights/hk-...

There are tools to see positions and flows over time. Enjoy!

www.smartkarma.com/insights/hk-...

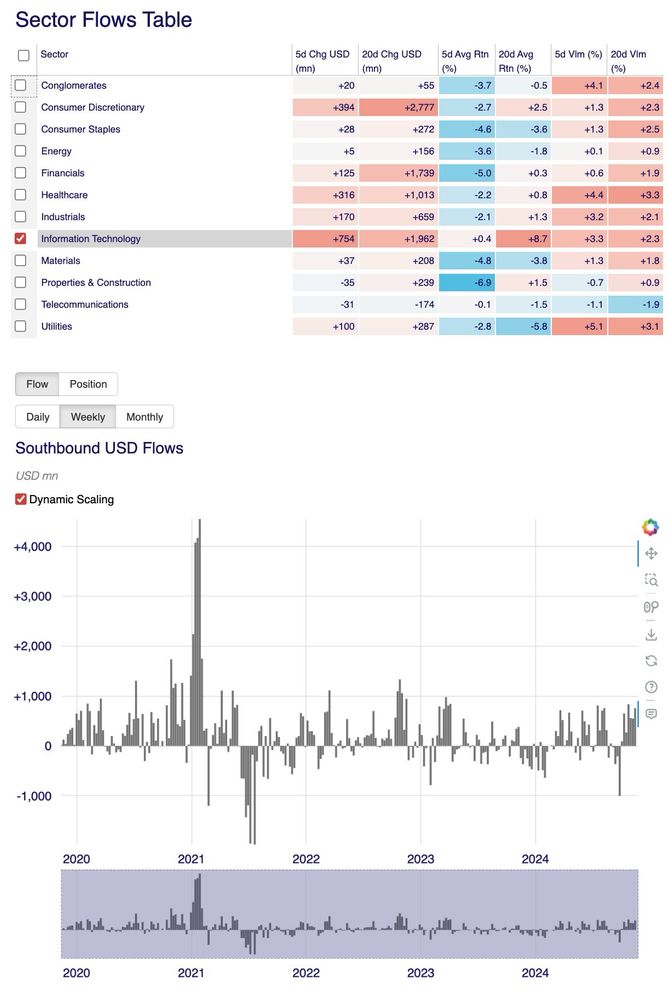

Net buying by SOUTHBOUND in Info/Tech is decent recently, but still nothing like the froth of early 2021.

Net buying by SOUTHBOUND in Info/Tech is decent recently, but still nothing like the froth of early 2021.

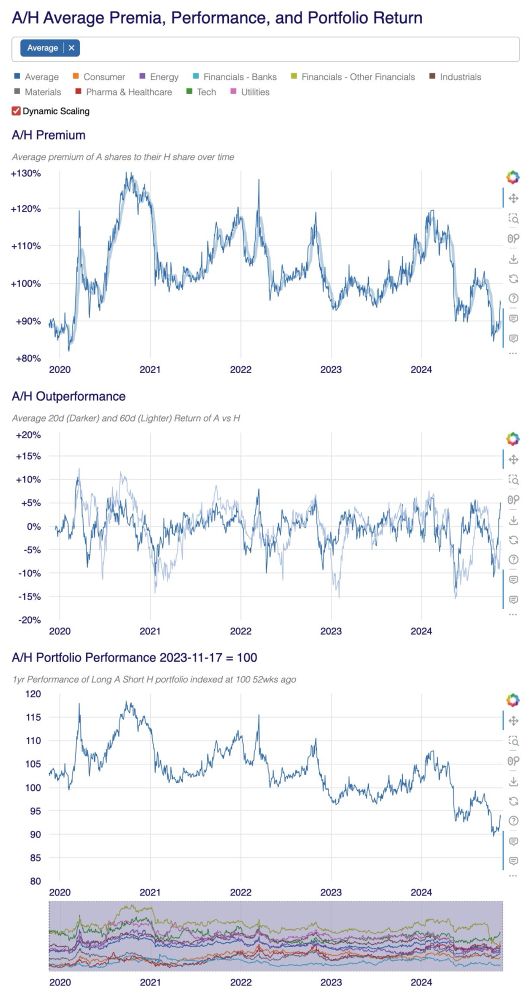

There are lots of tools to play around with. Please enjoy!

Hint, if clicking on a name to see the chart, unclick the one already clicked.

www.smartkarma.com/insights/a-h...

There are lots of tools to play around with. Please enjoy!

Hint, if clicking on a name to see the chart, unclick the one already clicked.

www.smartkarma.com/insights/a-h...

And that tells you where EPS will trend to in a few years’ time.

And that tells you where EPS will trend to in a few years’ time.

But… if they buy say ¥350-400bn a year, that puts Toyota Motors closer to a legal voting rights border problem. So they’d sell some too.

This buyback is ¥450bn. I expect there is

But… if they buy say ¥350-400bn a year, that puts Toyota Motors closer to a legal voting rights border problem. So they’d sell some too.

This buyback is ¥450bn. I expect there is

But Toyota Group shareholders are selling crossholdings and that will likely include big holdings in a large unlisted Toyota Group member. And that member will have to sell its ¥300bn of Denso to fund it.

But Toyota Group shareholders are selling crossholdings and that will likely include big holdings in a large unlisted Toyota Group member. And that member will have to sell its ¥300bn of Denso to fund it.

Also today, TIC said it would sell its 185mm shares from Dec24 through Mar27. No method decided but as it is ¥400bn, it’ll probably be a 28mo VWAP trade. That’s about ¥160bn in the next

Also today, TIC said it would sell its 185mm shares from Dec24 through Mar27. No method decided but as it is ¥400bn, it’ll probably be a 28mo VWAP trade. That’s about ¥160bn in the next