17x ADV (estimated) to buy on APO.

13x ADV (estimated) to buy on WDAY.

3-4x ADV to sell on QRVO and AMTM

$11bn of funding trade on S&P498

$11bn of reverse funding on S&P Completion -2

$5bn a side for $RSP.

The piece: skr.ma/UgLmN

17x ADV (estimated) to buy on APO.

13x ADV (estimated) to buy on WDAY.

3-4x ADV to sell on QRVO and AMTM

$11bn of funding trade on S&P498

$11bn of reverse funding on S&P Completion -2

$5bn a side for $RSP.

The piece: skr.ma/UgLmN

Koreanists: go.bsky.app/U3Nm5FX

Korea watchers: go.bsky.app/9SrguSU

Korean studies scholars: go.bsky.app/8nRZ5tp

+ @koreajoongangdaily.com

Koreanists: go.bsky.app/U3Nm5FX

Korea watchers: go.bsky.app/9SrguSU

Korean studies scholars: go.bsky.app/8nRZ5tp

+ @koreajoongangdaily.com

The big picture issues will be all over the geopol pundit timelines.

The nuances of how this works out are going to be domestically understood rather than Twitter/bsky experts.

Find the right expert.

(it ain’t me).

The big picture issues will be all over the geopol pundit timelines.

The nuances of how this works out are going to be domestically understood rather than Twitter/bsky experts.

Find the right expert.

(it ain’t me).

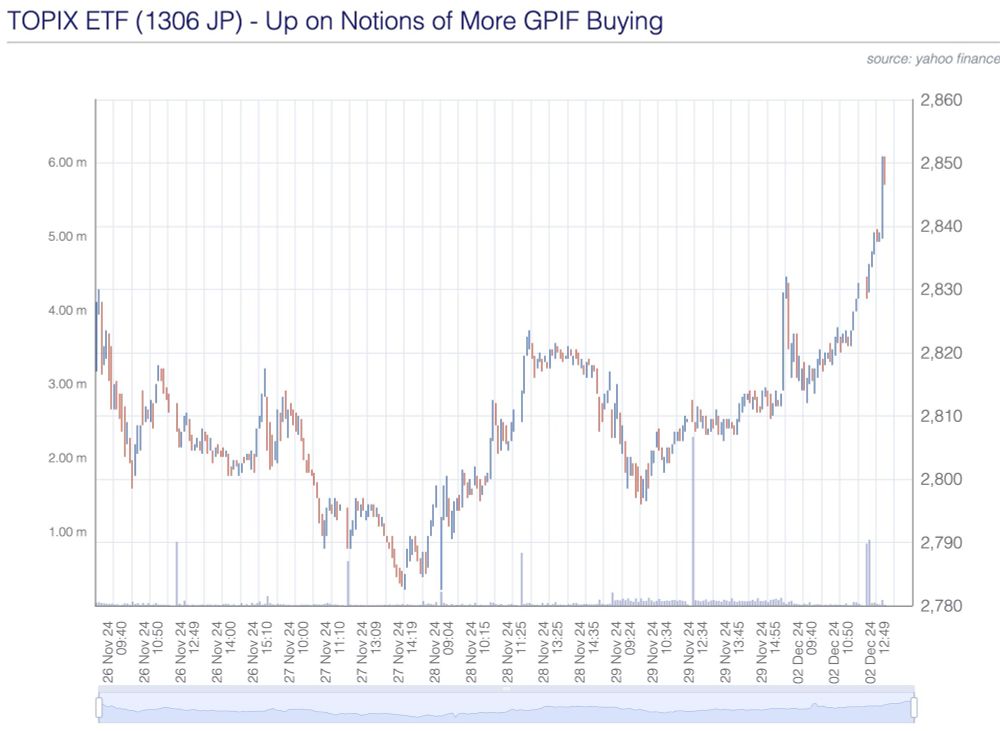

This means less domestic bonds, more Japan and foreign equities.

The "political angle" here is to 'force' a higher target return, more risk, with the 'political goal' being to keep the GPIF

This means less domestic bonds, more Japan and foreign equities.

The "political angle" here is to 'force' a higher target return, more risk, with the 'political goal' being to keep the GPIF

Keisei is getting the boot from MSCI today. A bunch of HFs who had been short are getting a nice lesson in shareholder structure risk.

Keisei is getting the boot from MSCI today. A bunch of HFs who had been short are getting a nice lesson in shareholder structure risk.

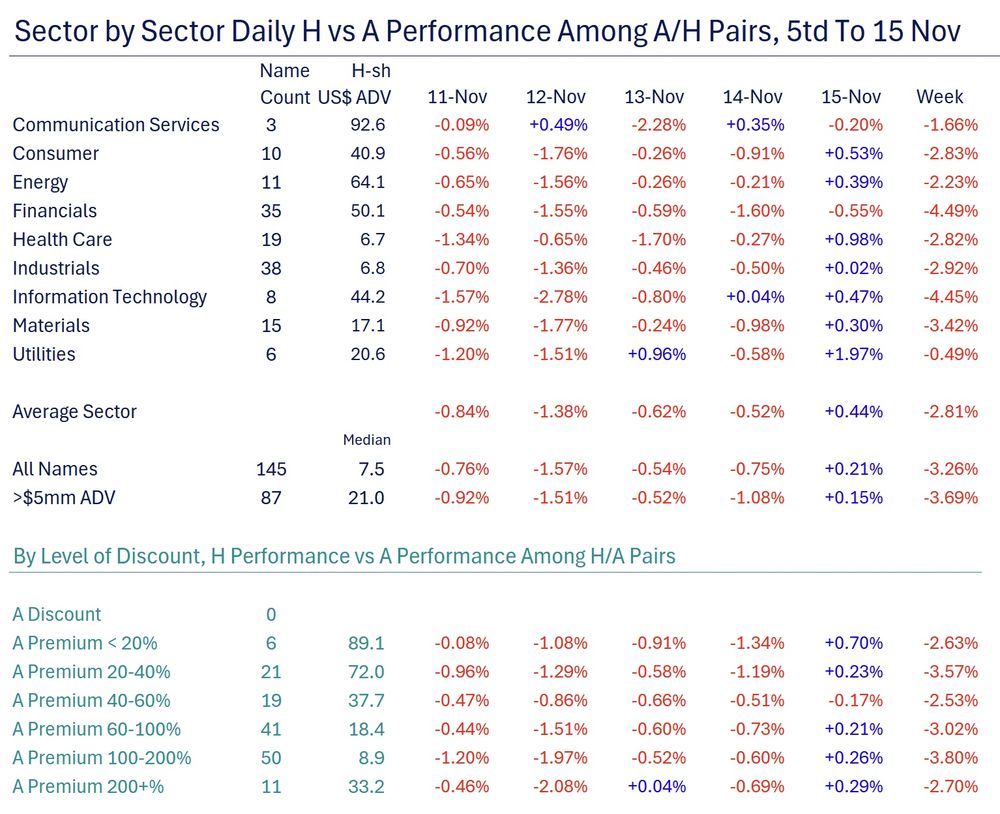

Within the HK/mainland universe, H/A pairs saw H underperformance of 3.7% for the average liquid pair. Tech and Financials were especially hurt.

Within the HK/mainland universe, H/A pairs saw H underperformance of 3.7% for the average liquid pair. Tech and Financials were especially hurt.

In November, a bunch of small sell downs occurred across the group. Then in late Nov23, the first big name selldown as

In November, a bunch of small sell downs occurred across the group. Then in late Nov23, the first big name selldown as

Net buying of HK$36.5bn. Big.

Gross activity of HK$376bn, which is lower than last week and much lower than the week before.

For the first time since it became SOUTHBOUND-eligible, Alibaba was not the top buy on the week.

Net buying of HK$36.5bn. Big.

Gross activity of HK$376bn, which is lower than last week and much lower than the week before.

For the first time since it became SOUTHBOUND-eligible, Alibaba was not the top buy on the week.

It was +45% on Day1.

Volumes still big as 44.8mm shs (~16% of the IPO) traded in the AM session.

Some disappointed by apparent denial of MSCI fast-entry. It was to be smaller than FTSE and TOPIX in any case, and will get added in early 2025.

It was +45% on Day1.

Volumes still big as 44.8mm shs (~16% of the IPO) traded in the AM session.

Some disappointed by apparent denial of MSCI fast-entry. It was to be smaller than FTSE and TOPIX in any case, and will get added in early 2025.

Now it goes to the Taiwan Fair Trade Commission and the Financial Supervisory Commission to approve the combination.

Now it goes to the Taiwan Fair Trade Commission and the Financial Supervisory Commission to approve the combination.

¥2,035,267,728,055 to buy. Exactly.

¥2,035,267,728,055 to sell. Exactly.

¥2,035,267,728,055 to buy. Exactly.

¥2,035,267,728,055 to sell. Exactly.

I have followed the situation in great detail since the Infroneer offer in March 2022.

A few weeks weeks ago I wrote and said I expected the AGM to be close but I expected YFO would lose.

Instead they got 7 of 9 directors elected by a shareholder register bent on

I have followed the situation in great detail since the Infroneer offer in March 2022.

A few weeks weeks ago I wrote and said I expected the AGM to be close but I expected YFO would lose.

Instead they got 7 of 9 directors elected by a shareholder register bent on

Jamie (@JamieHalse) runs a great Japan fund and knows a lot about Japan. I am going to comment on this new JPX Prime 150 (JPXI) index with some disagreement.

Yes, JPXI is designed to showcase "blue chips" in Japan which

Jamie (@JamieHalse) runs a great Japan fund and knows a lot about Japan. I am going to comment on this new JPX Prime 150 (JPXI) index with some disagreement.

Yes, JPXI is designed to showcase "blue chips" in Japan which

My tome is now out. It has it all. Laughter, tears, hand-wringing, and Judy Blume title angst.

tl;dr: The Shinsei Board dropped the ball.

My tome is now out. It has it all. Laughter, tears, hand-wringing, and Judy Blume title angst.

tl;dr: The Shinsei Board dropped the ball.

This week:

140+ cos announcing buybacks: 3 tenders, 26 ToSTNeT-3 buybacks, 120 on-market buys.

Total buyback programme value announced ¥2.1trln+

Average is 7-9% of ADV. Every day during the program.

For SK subs…

This week:

140+ cos announcing buybacks: 3 tenders, 26 ToSTNeT-3 buybacks, 120 on-market buys.

Total buyback programme value announced ¥2.1trln+

Average is 7-9% of ADV. Every day during the program.

For SK subs…

Anyone can sign up to listen. You don’t have to be a Smartkarma subscriber.

8:30 JST, 7:30 HKT Monday 15 May

Anyone can sign up to listen. You don’t have to be a Smartkarma subscriber.

8:30 JST, 7:30 HKT Monday 15 May

Rs 125bn for Ent.

Rs 85bn for Trans.

Green Energy delayed its Board mtg to 24 May.

Postal ballots ensue.

Expect IHC and GQG to anchor.

Rs 125bn for Ent.

Rs 85bn for Trans.

Green Energy delayed its Board mtg to 24 May.

Postal ballots ensue.

Expect IHC and GQG to anchor.