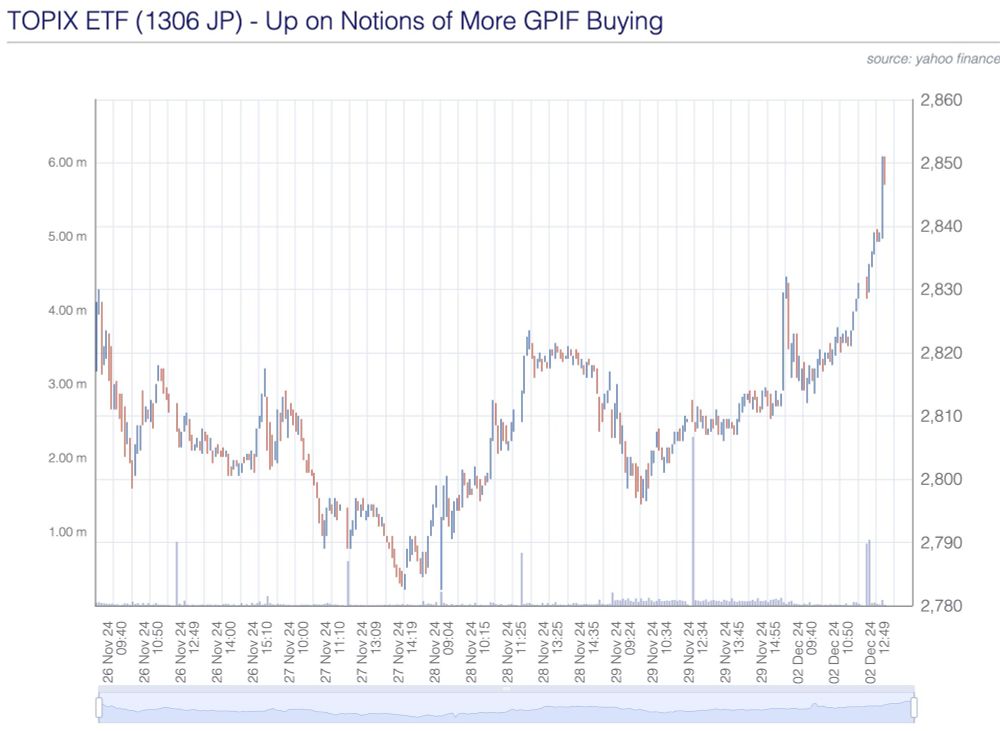

This means less domestic bonds, more Japan and foreign equities.

The "political angle" here is to 'force' a higher target return, more risk, with the 'political goal' being to keep the GPIF

This means less domestic bonds, more Japan and foreign equities.

The "political angle" here is to 'force' a higher target return, more risk, with the 'political goal' being to keep the GPIF

Keisei is getting the boot from MSCI today. A bunch of HFs who had been short are getting a nice lesson in shareholder structure risk.

Keisei is getting the boot from MSCI today. A bunch of HFs who had been short are getting a nice lesson in shareholder structure risk.

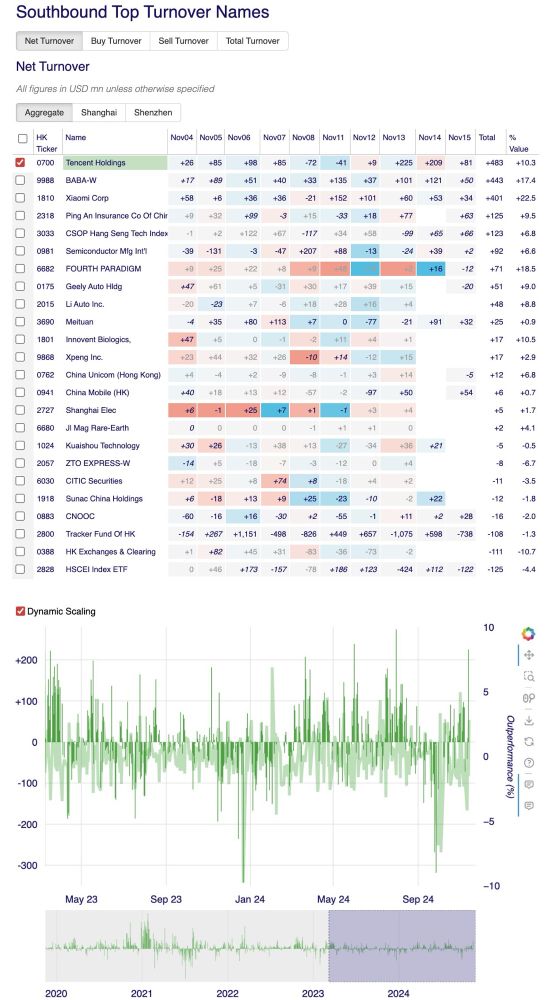

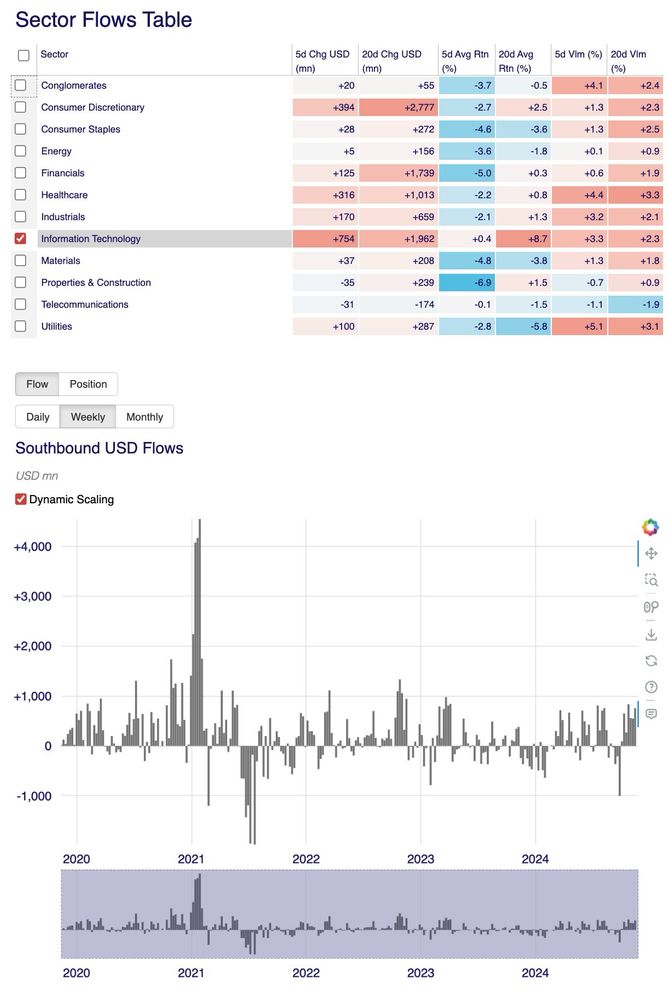

Net buying by SOUTHBOUND in Info/Tech is decent recently, but still nothing like the froth of early 2021.

Net buying by SOUTHBOUND in Info/Tech is decent recently, but still nothing like the froth of early 2021.

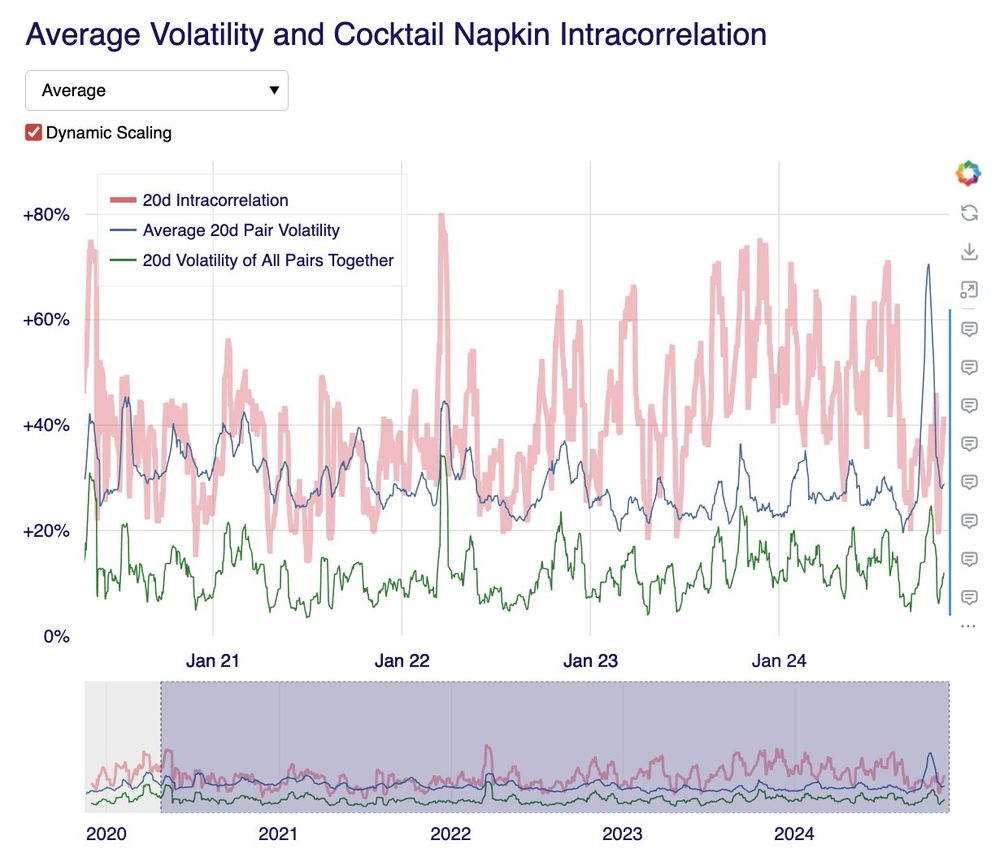

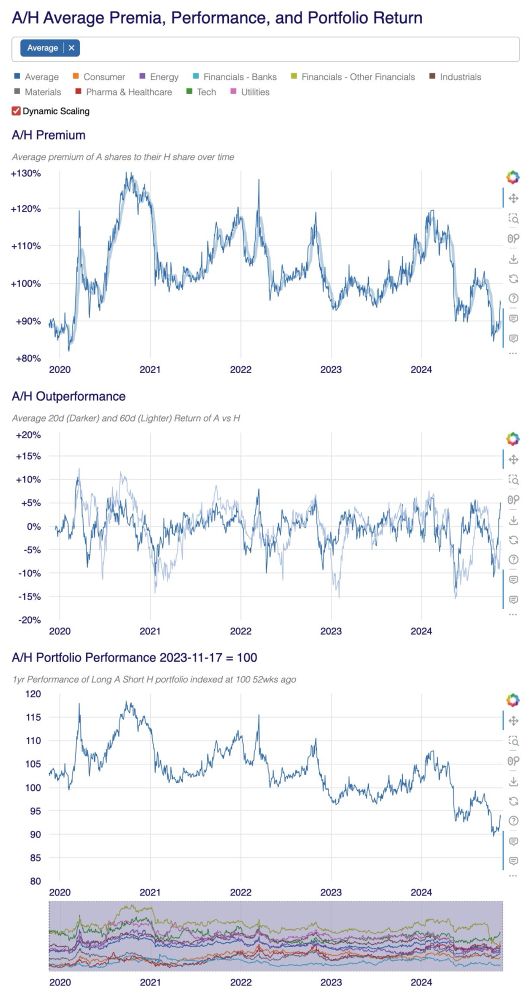

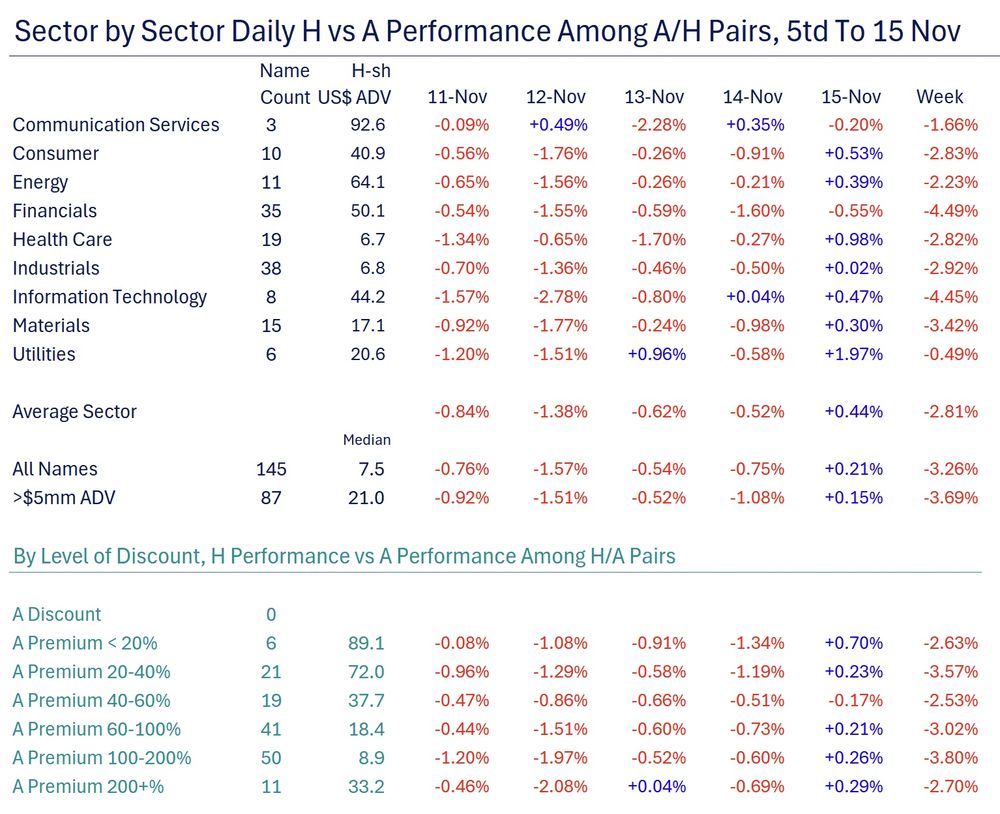

Within the HK/mainland universe, H/A pairs saw H underperformance of 3.7% for the average liquid pair. Tech and Financials were especially hurt.

Within the HK/mainland universe, H/A pairs saw H underperformance of 3.7% for the average liquid pair. Tech and Financials were especially hurt.

As a percentage of volume traded, net buying was pretty decent.

As a percentage of volume traded, net buying was pretty decent.

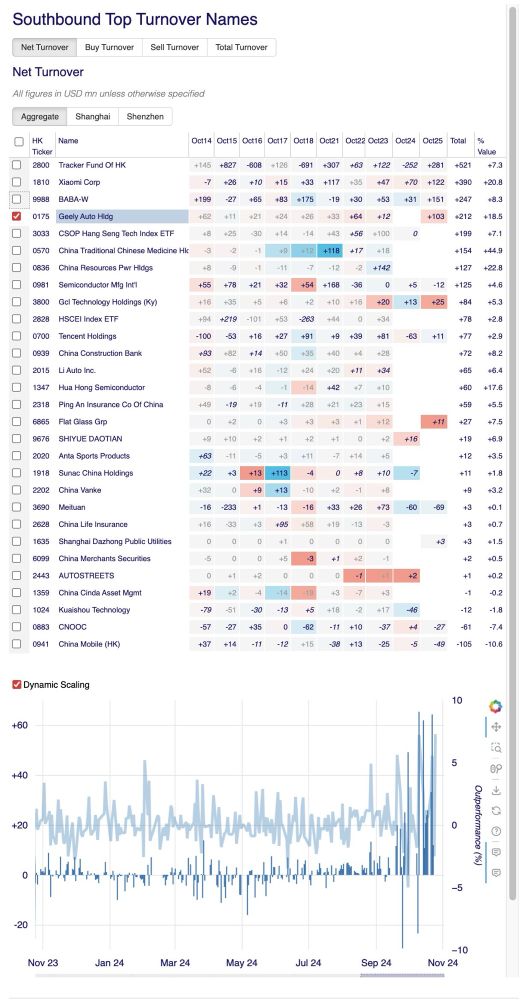

- Geely (175 HK) has seen huge SB inflows

- Only China Mobile (941), CNOOC (883) saw outflows.

- SB bought TCM (570) the day it crashed

- SB ignored Sunac after the offering

- GCL (3800), SMIC (981), Xiaomi (1810) seeing consistent bet buying.

- Geely (175 HK) has seen huge SB inflows

- Only China Mobile (941), CNOOC (883) saw outflows.

- SB bought TCM (570) the day it crashed

- SB ignored Sunac after the offering

- GCL (3800), SMIC (981), Xiaomi (1810) seeing consistent bet buying.

Net buying of HK$36.5bn. Big.

Gross activity of HK$376bn, which is lower than last week and much lower than the week before.

For the first time since it became SOUTHBOUND-eligible, Alibaba was not the top buy on the week.

Net buying of HK$36.5bn. Big.

Gross activity of HK$376bn, which is lower than last week and much lower than the week before.

For the first time since it became SOUTHBOUND-eligible, Alibaba was not the top buy on the week.

I was slightly off.

They got 48.4mm shares on one vote.

I was slightly off.

They got 48.4mm shares on one vote.

Stodgy NTT is in because of its Equity Spread, but would also be in for PBR. So is KDDI and Japan Tobacco.

And Softbank Corp up 3.5% in 4.5yrs since its IPO in Dec2018 is also in for "Equity Spread". But SumiCorp (8053) +80% in the same 4.5y? Nope.

Stodgy NTT is in because of its Equity Spread, but would also be in for PBR. So is KDDI and Japan Tobacco.

And Softbank Corp up 3.5% in 4.5yrs since its IPO in Dec2018 is also in for "Equity Spread". But SumiCorp (8053) +80% in the same 4.5y? Nope.

Jamie (@JamieHalse) runs a great Japan fund and knows a lot about Japan. I am going to comment on this new JPX Prime 150 (JPXI) index with some disagreement.

Yes, JPXI is designed to showcase "blue chips" in Japan which

Jamie (@JamieHalse) runs a great Japan fund and knows a lot about Japan. I am going to comment on this new JPX Prime 150 (JPXI) index with some disagreement.

Yes, JPXI is designed to showcase "blue chips" in Japan which