Paul Waidelich

@pwaidelich.bsky.social

Climate and energy economist | Postdoc at ETH Zurich's Energy and Technology Policy Group

Pinned

Paul Waidelich

@pwaidelich.bsky.social

· Jan 29

Quantifying the shift of public export finance from fossil fuels to renewable energy - Nature Communications

This paper analyzes energy financing patterns of public export credit agencies (ECAs). It demonstrates that mainly European ECAs shifted away from fossil fuels, a transition accompanied by shifting su...

www.nature.com

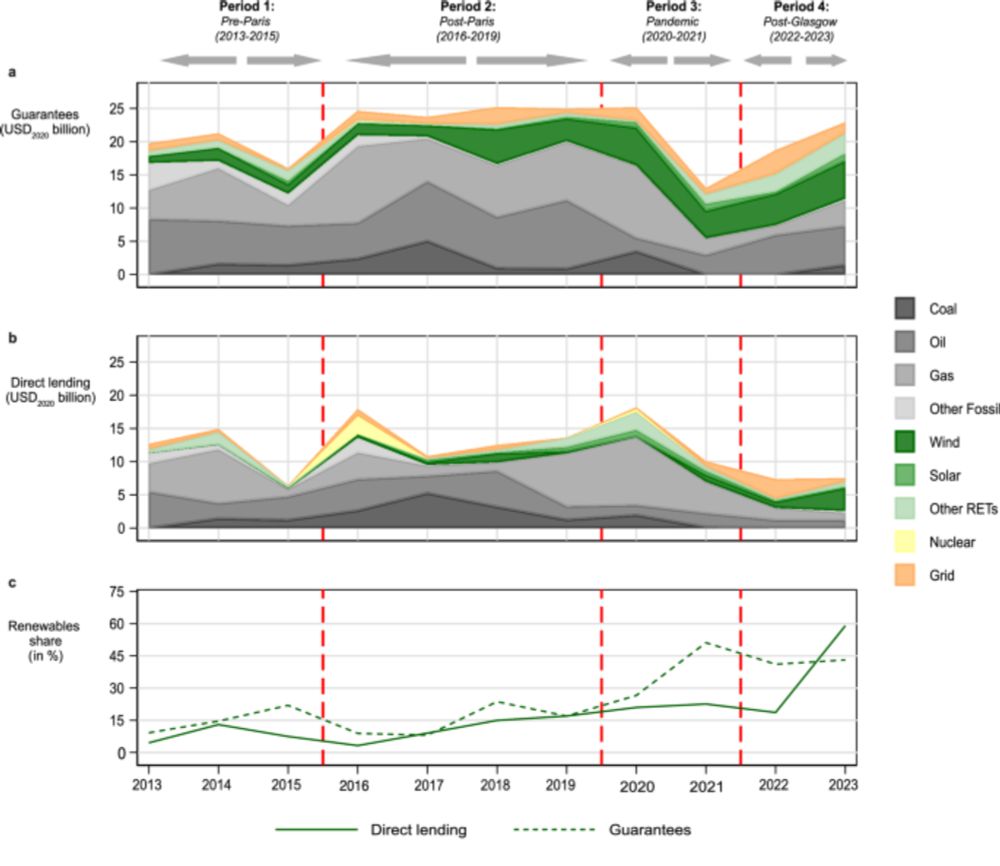

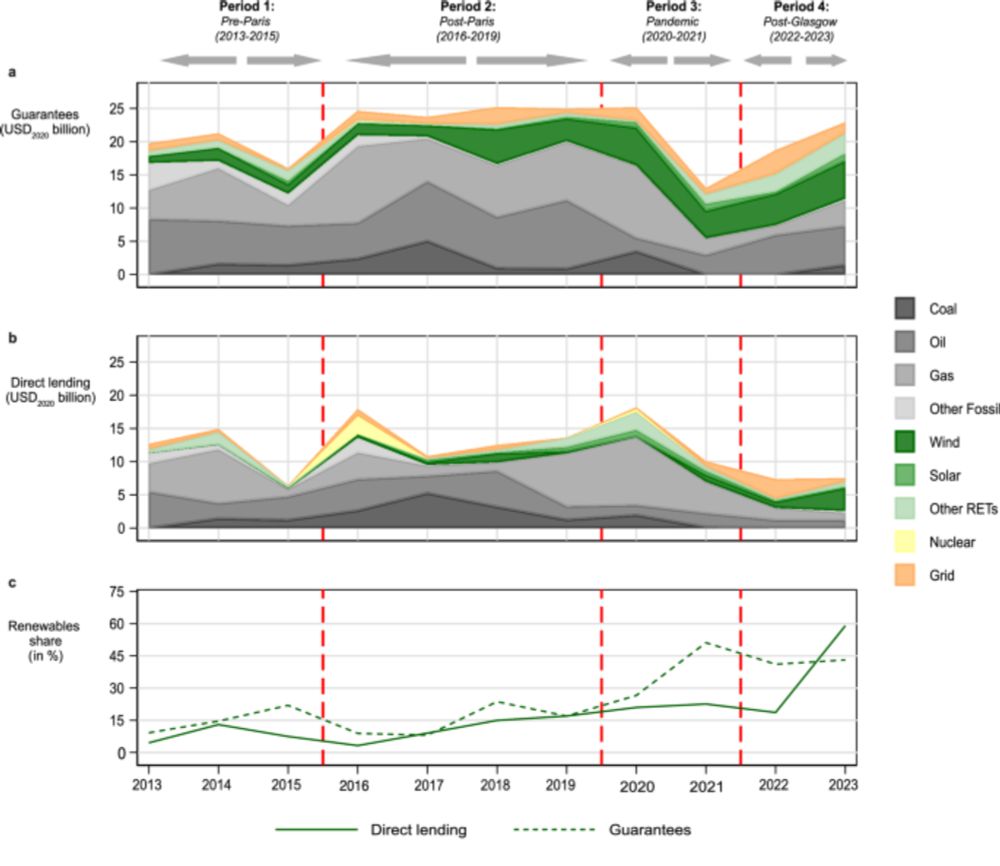

Our🚨new study🚨in @naturecomms.bsky.social shows how export credit agencies (ECAs)—large govt-backed financiers—are boosting renewables ✅ but still pouring billions into oil & gas while shifting finance away from lower-income to wealthier countries❌

www.nature.com/articles/s41...

🧵below (1/7)

www.nature.com/articles/s41...

🧵below (1/7)

Reposted by Paul Waidelich

🚨 First PhD paper in @pnas.org 🥳

🌊 @edualastrue.bsky.social and I looked at how much less CO2 will be taken up by the ocean if the #AMOC weakens - and how this reduced ocean carbon uptake affects the social cost of CO2 emissions.

📝 Read the paper here: doi.org/10.1073/pnas...

🧵 A thread [1/11]

🌊 @edualastrue.bsky.social and I looked at how much less CO2 will be taken up by the ocean if the #AMOC weakens - and how this reduced ocean carbon uptake affects the social cost of CO2 emissions.

📝 Read the paper here: doi.org/10.1073/pnas...

🧵 A thread [1/11]

PNAS

Proceedings of the National Academy of Sciences (PNAS), a peer reviewed journal of the National Academy of Sciences (NAS) - an authoritative source of high-impact, original research that broadly spans...

doi.org

February 25, 2025 at 8:36 AM

🚨 First PhD paper in @pnas.org 🥳

🌊 @edualastrue.bsky.social and I looked at how much less CO2 will be taken up by the ocean if the #AMOC weakens - and how this reduced ocean carbon uptake affects the social cost of CO2 emissions.

📝 Read the paper here: doi.org/10.1073/pnas...

🧵 A thread [1/11]

🌊 @edualastrue.bsky.social and I looked at how much less CO2 will be taken up by the ocean if the #AMOC weakens - and how this reduced ocean carbon uptake affects the social cost of CO2 emissions.

📝 Read the paper here: doi.org/10.1073/pnas...

🧵 A thread [1/11]

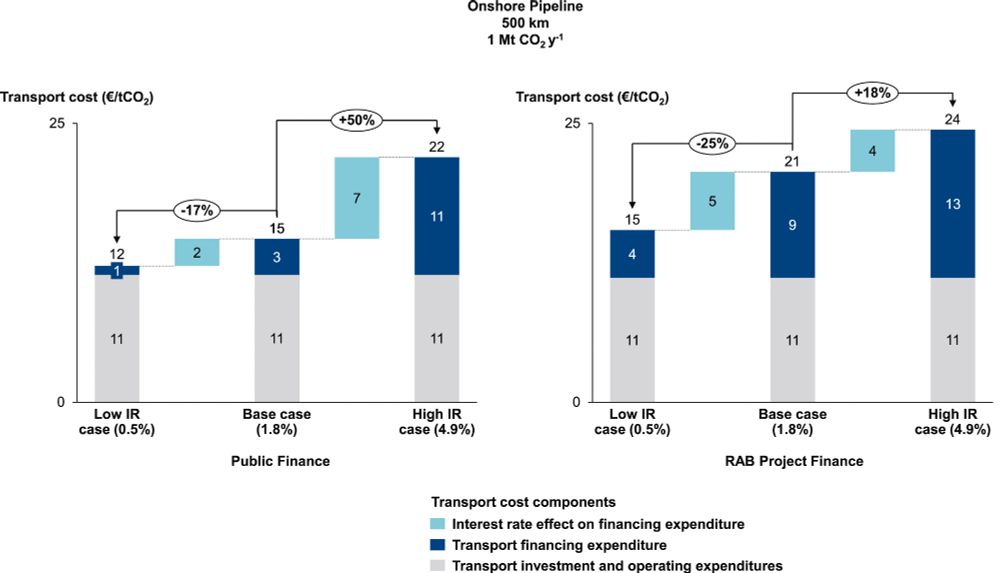

Scaling up carbon removal requires cheap ways to transport CO2. This new paper examines how interest rate levels and financing conditions can make or break the economics of CO2 pipelines

doi.org/10.1016/j.en...

doi.org/10.1016/j.en...

February 10, 2025 at 9:05 AM

Scaling up carbon removal requires cheap ways to transport CO2. This new paper examines how interest rate levels and financing conditions can make or break the economics of CO2 pipelines

doi.org/10.1016/j.en...

doi.org/10.1016/j.en...

Reposted by Paul Waidelich

💰⚡ Who’s funding the energy shift?

A new study finds that many governments are backing more renewables, but many still fund fossil fuels.

Europe is leading the change, but will others follow?

🔗 doi.org/10.1038/s414...

#ClimateAction #CleanEnergy #SciComm 🧪

A new study finds that many governments are backing more renewables, but many still fund fossil fuels.

Europe is leading the change, but will others follow?

🔗 doi.org/10.1038/s414...

#ClimateAction #CleanEnergy #SciComm 🧪

Quantifying the shift of public export finance from fossil fuels to renewable energy - Nature Communications

This paper analyzes energy financing patterns of public export credit agencies (ECAs). It demonstrates that mainly European ECAs shifted away from fossil fuels, a transition accompanied by shifting su...

doi.org

January 31, 2025 at 5:31 PM

💰⚡ Who’s funding the energy shift?

A new study finds that many governments are backing more renewables, but many still fund fossil fuels.

Europe is leading the change, but will others follow?

🔗 doi.org/10.1038/s414...

#ClimateAction #CleanEnergy #SciComm 🧪

A new study finds that many governments are backing more renewables, but many still fund fossil fuels.

Europe is leading the change, but will others follow?

🔗 doi.org/10.1038/s414...

#ClimateAction #CleanEnergy #SciComm 🧪

Our🚨new study🚨in @naturecomms.bsky.social shows how export credit agencies (ECAs)—large govt-backed financiers—are boosting renewables ✅ but still pouring billions into oil & gas while shifting finance away from lower-income to wealthier countries❌

www.nature.com/articles/s41...

🧵below (1/7)

www.nature.com/articles/s41...

🧵below (1/7)

Quantifying the shift of public export finance from fossil fuels to renewable energy - Nature Communications

This paper analyzes energy financing patterns of public export credit agencies (ECAs). It demonstrates that mainly European ECAs shifted away from fossil fuels, a transition accompanied by shifting su...

www.nature.com

January 29, 2025 at 11:55 AM

Our🚨new study🚨in @naturecomms.bsky.social shows how export credit agencies (ECAs)—large govt-backed financiers—are boosting renewables ✅ but still pouring billions into oil & gas while shifting finance away from lower-income to wealthier countries❌

www.nature.com/articles/s41...

🧵below (1/7)

www.nature.com/articles/s41...

🧵below (1/7)

The Munich Re finding that Hurricanes Helene and Milton were “the most destructive disasters of 2024” made me wonder how things would look relative to countries' GDP.

Through that lens, Hurricane Beryl's damages in the Caribbean were by far the worst. Helene's US impacts rank 11th at ~0.19% of GDP

Through that lens, Hurricane Beryl's damages in the Caribbean were by far the worst. Helene's US impacts rank 11th at ~0.19% of GDP

January 9, 2025 at 5:40 PM

The Munich Re finding that Hurricanes Helene and Milton were “the most destructive disasters of 2024” made me wonder how things would look relative to countries' GDP.

Through that lens, Hurricane Beryl's damages in the Caribbean were by far the worst. Helene's US impacts rank 11th at ~0.19% of GDP

Through that lens, Hurricane Beryl's damages in the Caribbean were by far the worst. Helene's US impacts rank 11th at ~0.19% of GDP

Reposted by Paul Waidelich

We are advertising a PostDoc position in the Sustainability Economics Group at ETH Zurich (1-6 yrs, >$100K salary), offering excellent conditions to pursue innovative research projects & prepare for a professorship. Please spread the word to interested candidates: jobs.ethz.ch/job/view/JOP...

Postdoctoral Position in the Sustainability Economics Group

jobs.ethz.ch

December 12, 2024 at 12:00 PM

We are advertising a PostDoc position in the Sustainability Economics Group at ETH Zurich (1-6 yrs, >$100K salary), offering excellent conditions to pursue innovative research projects & prepare for a professorship. Please spread the word to interested candidates: jobs.ethz.ch/job/view/JOP...

"Our findings reveal the dominating impact of material sourcing over production location, with nickel and lithium identified as major contributors"

A neat new paper on lithium-ion batteries' carbon footprint, revealing that where you get your metals is critical.

A neat new paper on lithium-ion batteries' carbon footprint, revealing that where you get your metals is critical.

Carbon footprint distributions of lithium-ion batteries and their materials - Nature Communications

A cost-based method to assess lithium-ion battery carbon footprints was developed, finding that sourcing nickel and lithium influences emissions more than production location. This aids in designing g...

doi.org

November 29, 2024 at 9:36 AM

"Our findings reveal the dominating impact of material sourcing over production location, with nickel and lithium identified as major contributors"

A neat new paper on lithium-ion batteries' carbon footprint, revealing that where you get your metals is critical.

A neat new paper on lithium-ion batteries' carbon footprint, revealing that where you get your metals is critical.

Reposted by Paul Waidelich

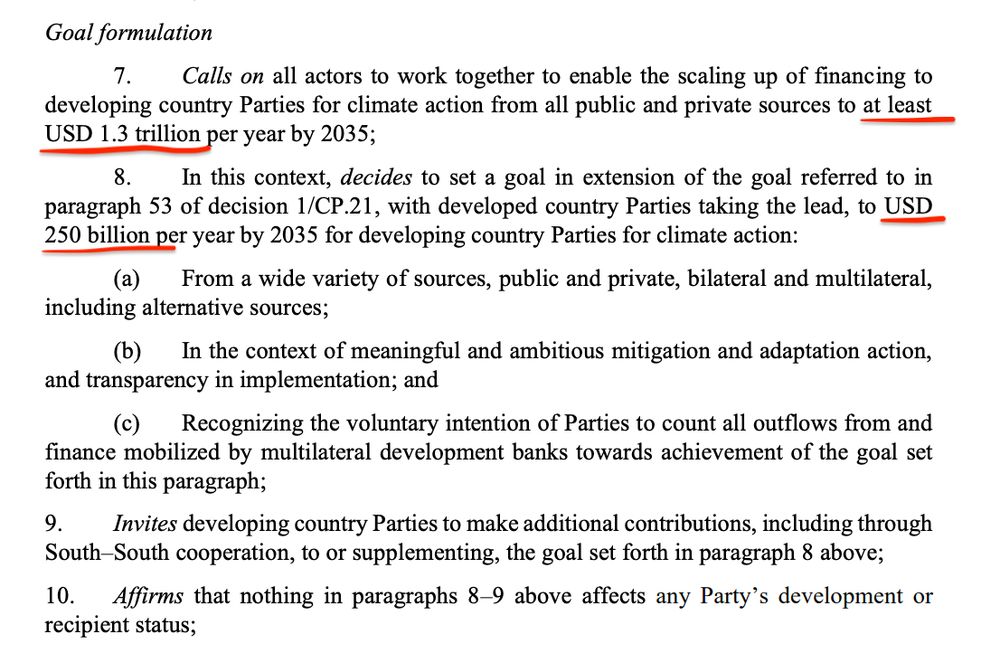

++NEW CLIMATE FINANCE TEXT++

It finally includes the core number that developed countries have so far resisted: $250bn a year for developing countries.

It also has a target of $1.3tn a year... but only as part of a wider goal including "all public and private sources"

It finally includes the core number that developed countries have so far resisted: $250bn a year for developing countries.

It also has a target of $1.3tn a year... but only as part of a wider goal including "all public and private sources"

November 22, 2024 at 11:36 AM

++NEW CLIMATE FINANCE TEXT++

It finally includes the core number that developed countries have so far resisted: $250bn a year for developing countries.

It also has a target of $1.3tn a year... but only as part of a wider goal including "all public and private sources"

It finally includes the core number that developed countries have so far resisted: $250bn a year for developing countries.

It also has a target of $1.3tn a year... but only as part of a wider goal including "all public and private sources"

Reposted by Paul Waidelich

++NEW CLIMATE FINANCE TEXT++

Cut from 25 pages to 10.

Number of bits in square brackets, which are undecided, cut from 415 to 46.

It contains 2 options for the goal "emanating from the ministerial consultations” - one with developing country priorities and one with developed.

Cut from 25 pages to 10.

Number of bits in square brackets, which are undecided, cut from 415 to 46.

It contains 2 options for the goal "emanating from the ministerial consultations” - one with developing country priorities and one with developed.

November 21, 2024 at 5:44 AM

++NEW CLIMATE FINANCE TEXT++

Cut from 25 pages to 10.

Number of bits in square brackets, which are undecided, cut from 415 to 46.

It contains 2 options for the goal "emanating from the ministerial consultations” - one with developing country priorities and one with developed.

Cut from 25 pages to 10.

Number of bits in square brackets, which are undecided, cut from 415 to 46.

It contains 2 options for the goal "emanating from the ministerial consultations” - one with developing country priorities and one with developed.

"We show that firms experience, on average, a 0.41% fall in stock returns following a climate-related filing or an unfavourable court decision."

Court decisions against Carbon Majors (= biggest fossil fuel producers) reduce their stock returns on average by 1.50%

doi.org/10.1038/s418...

Court decisions against Carbon Majors (= biggest fossil fuel producers) reduce their stock returns on average by 1.50%

doi.org/10.1038/s418...

Impacts of climate litigation on firm value - Nature Sustainability

Climate lawsuits can cause direct changes in corporate behaviour, but market impacts are less understood. This study examines 15 years of litigation to find how much stock values fall when lawsuits ar...

doi.org

November 20, 2024 at 10:04 AM

"We show that firms experience, on average, a 0.41% fall in stock returns following a climate-related filing or an unfavourable court decision."

Court decisions against Carbon Majors (= biggest fossil fuel producers) reduce their stock returns on average by 1.50%

doi.org/10.1038/s418...

Court decisions against Carbon Majors (= biggest fossil fuel producers) reduce their stock returns on average by 1.50%

doi.org/10.1038/s418...

Reposted by Paul Waidelich

Here is a starter pack of scientists based in Switzerland🇨🇭active in climate/environmental research (in nat. & soc. sciences) @retoknutti.bsky.social @robertfinger.bsky.social @jksteinberger.bsky.social @rarohde.bsky.social @florianaltermatt.bsky.social @kariningold.bsky.social

go.bsky.app/5cJemte

go.bsky.app/5cJemte

November 16, 2024 at 2:00 PM

Here is a starter pack of scientists based in Switzerland🇨🇭active in climate/environmental research (in nat. & soc. sciences) @retoknutti.bsky.social @robertfinger.bsky.social @jksteinberger.bsky.social @rarohde.bsky.social @florianaltermatt.bsky.social @kariningold.bsky.social

go.bsky.app/5cJemte

go.bsky.app/5cJemte

Implication: to offset one ton of CO2, you'd need carbon credits for 6.25 tons (on average). At a credit price of $7/ton in the voluntary carbon market, that's $44

For comparison, UK ETS prices are currently at $49/ton 🤔

So much for "cheap" credits...

For comparison, UK ETS prices are currently at $49/ton 🤔

So much for "cheap" credits...

"We estimate that less than 16% of the carbon credits issued to the investigated projects constitute real emission reductions." www.nature.com/articles/s41...

Systematic assessment of the achieved emission reductions of carbon crediting projects - Nature Communications

Carbon markets are key in climate strategies, but only 16% of carbon credits represent real emission reductions, based on a study of 2,346 projects. Reforms are needed to improve the effectiveness of ...

www.nature.com

November 15, 2024 at 9:29 AM

Implication: to offset one ton of CO2, you'd need carbon credits for 6.25 tons (on average). At a credit price of $7/ton in the voluntary carbon market, that's $44

For comparison, UK ETS prices are currently at $49/ton 🤔

So much for "cheap" credits...

For comparison, UK ETS prices are currently at $49/ton 🤔

So much for "cheap" credits...

Reposting from X to reconnect here and given #COP29 talks on climate finance:

Curious about how lowering the cost of capital in developing countries can reduce energy transition costs and boost equity?

Check out our🚨new paper🚨in Nature Energy led by EIEE's Matteo Calcaterra:

doi.org/10.1038/s415...

Curious about how lowering the cost of capital in developing countries can reduce energy transition costs and boost equity?

Check out our🚨new paper🚨in Nature Energy led by EIEE's Matteo Calcaterra:

doi.org/10.1038/s415...

Reducing the cost of capital to finance the energy transition in developing countries - Nature Energy

Fair finance in the energy sector is modelled in five climate–energy–economy models. The results show that convergence costs of capital could improve energy availability, affordability and sustainabil...

doi.org

November 14, 2024 at 1:18 PM

Reposting from X to reconnect here and given #COP29 talks on climate finance:

Curious about how lowering the cost of capital in developing countries can reduce energy transition costs and boost equity?

Check out our🚨new paper🚨in Nature Energy led by EIEE's Matteo Calcaterra:

doi.org/10.1038/s415...

Curious about how lowering the cost of capital in developing countries can reduce energy transition costs and boost equity?

Check out our🚨new paper🚨in Nature Energy led by EIEE's Matteo Calcaterra:

doi.org/10.1038/s415...