Paul Waidelich

@pwaidelich.bsky.social

Climate and energy economist | Postdoc at ETH Zurich's Energy and Technology Policy Group

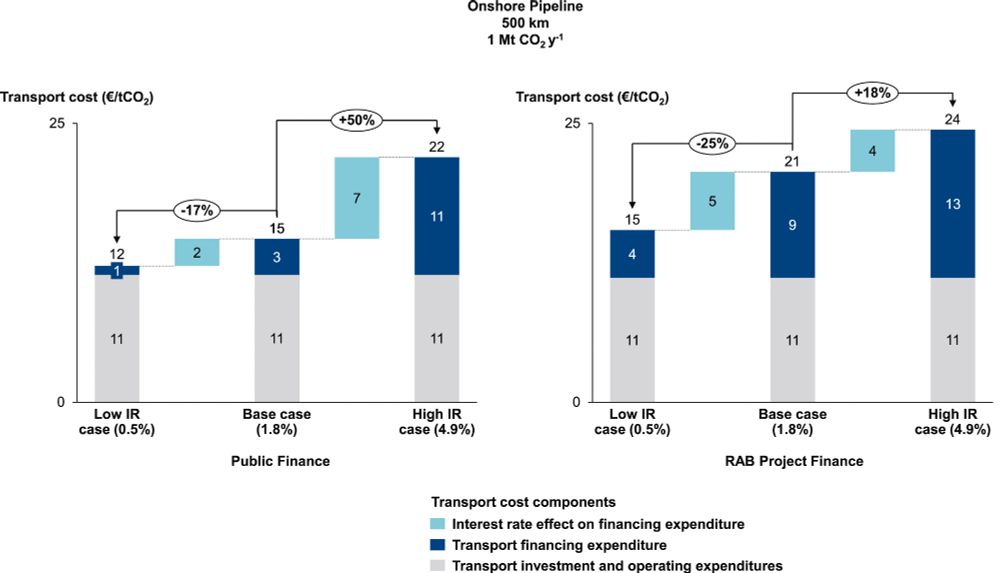

Scaling up carbon removal requires cheap ways to transport CO2. This new paper examines how interest rate levels and financing conditions can make or break the economics of CO2 pipelines

doi.org/10.1016/j.en...

doi.org/10.1016/j.en...

February 10, 2025 at 9:05 AM

Scaling up carbon removal requires cheap ways to transport CO2. This new paper examines how interest rate levels and financing conditions can make or break the economics of CO2 pipelines

doi.org/10.1016/j.en...

doi.org/10.1016/j.en...

However, greening ECAs’ energy finance has an unintended side effect: Developing countries are losing out.

ECA support increasingly shifts toward wealthier countries in the same regions where RE projects are more likely located—leaving those with the greatest financing needs behind ⚠️

(4/7)

ECA support increasingly shifts toward wealthier countries in the same regions where RE projects are more likely located—leaving those with the greatest financing needs behind ⚠️

(4/7)

January 29, 2025 at 11:55 AM

However, greening ECAs’ energy finance has an unintended side effect: Developing countries are losing out.

ECA support increasingly shifts toward wealthier countries in the same regions where RE projects are more likely located—leaving those with the greatest financing needs behind ⚠️

(4/7)

ECA support increasingly shifts toward wealthier countries in the same regions where RE projects are more likely located—leaving those with the greatest financing needs behind ⚠️

(4/7)

National disparities loom large. Overall, Europe’s Export Finance for Future (E3F) coalition is “greening” their ECA energy finance faster and growing in relative importance, driving the trend toward renewables.

Yet many countries, like Italy or Korea, still mainly support oil & gas projects

(3/7)

Yet many countries, like Italy or Korea, still mainly support oil & gas projects

(3/7)

January 29, 2025 at 11:55 AM

National disparities loom large. Overall, Europe’s Export Finance for Future (E3F) coalition is “greening” their ECA energy finance faster and growing in relative importance, driving the trend toward renewables.

Yet many countries, like Italy or Korea, still mainly support oil & gas projects

(3/7)

Yet many countries, like Italy or Korea, still mainly support oil & gas projects

(3/7)

We examined 900+ ECA-backed deals in 31 countries btw 2013–2023 and saw a big leap in renewables—up to ~40% from under 10% just a decade ago! 📈

Great news? Partly. Because ECAs have shunned coal but are still committing vast sums for oil & gas projects

(2/7)

Great news? Partly. Because ECAs have shunned coal but are still committing vast sums for oil & gas projects

(2/7)

January 29, 2025 at 11:55 AM

We examined 900+ ECA-backed deals in 31 countries btw 2013–2023 and saw a big leap in renewables—up to ~40% from under 10% just a decade ago! 📈

Great news? Partly. Because ECAs have shunned coal but are still committing vast sums for oil & gas projects

(2/7)

Great news? Partly. Because ECAs have shunned coal but are still committing vast sums for oil & gas projects

(2/7)

The Munich Re finding that Hurricanes Helene and Milton were “the most destructive disasters of 2024” made me wonder how things would look relative to countries' GDP.

Through that lens, Hurricane Beryl's damages in the Caribbean were by far the worst. Helene's US impacts rank 11th at ~0.19% of GDP

Through that lens, Hurricane Beryl's damages in the Caribbean were by far the worst. Helene's US impacts rank 11th at ~0.19% of GDP

January 9, 2025 at 5:40 PM

The Munich Re finding that Hurricanes Helene and Milton were “the most destructive disasters of 2024” made me wonder how things would look relative to countries' GDP.

Through that lens, Hurricane Beryl's damages in the Caribbean were by far the worst. Helene's US impacts rank 11th at ~0.19% of GDP

Through that lens, Hurricane Beryl's damages in the Caribbean were by far the worst. Helene's US impacts rank 11th at ~0.19% of GDP