50% of Amazon sellers are from China

50% of Amazon sellers are from China

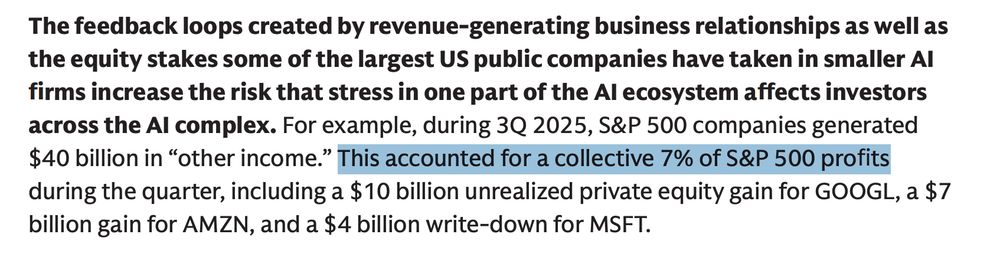

The market is operating in a meta-mode

To be fair, the numbers are so mindbogglingly large, that there only conceptual frameworks apply anymore

The market is operating in a meta-mode

To be fair, the numbers are so mindbogglingly large, that there only conceptual frameworks apply anymore

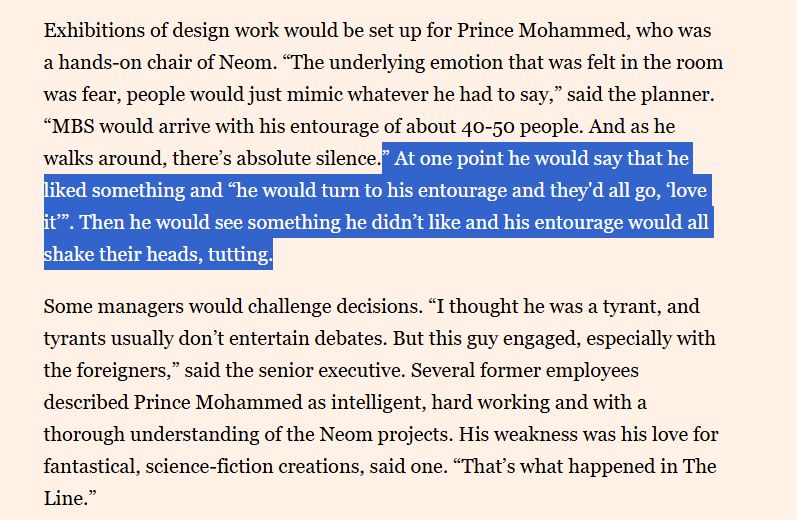

apparently

apparently

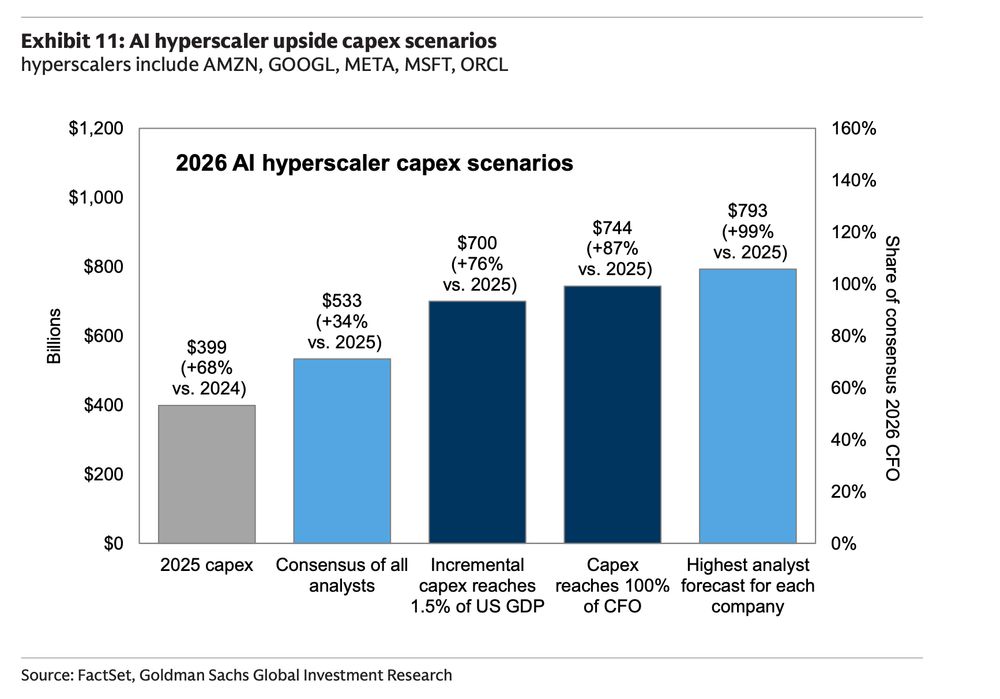

Can't wait for dumb beta

Can't wait for dumb beta

They expecting some pretty heavy currency appreciation for both China and Japan

They expecting some pretty heavy currency appreciation for both China and Japan

60bps differential in EPS growth, 200bps differential in total return driven entirely by relative multiple expansion

60bps differential in EPS growth, 200bps differential in total return driven entirely by relative multiple expansion

$XLP $SPY

$XLP $SPY

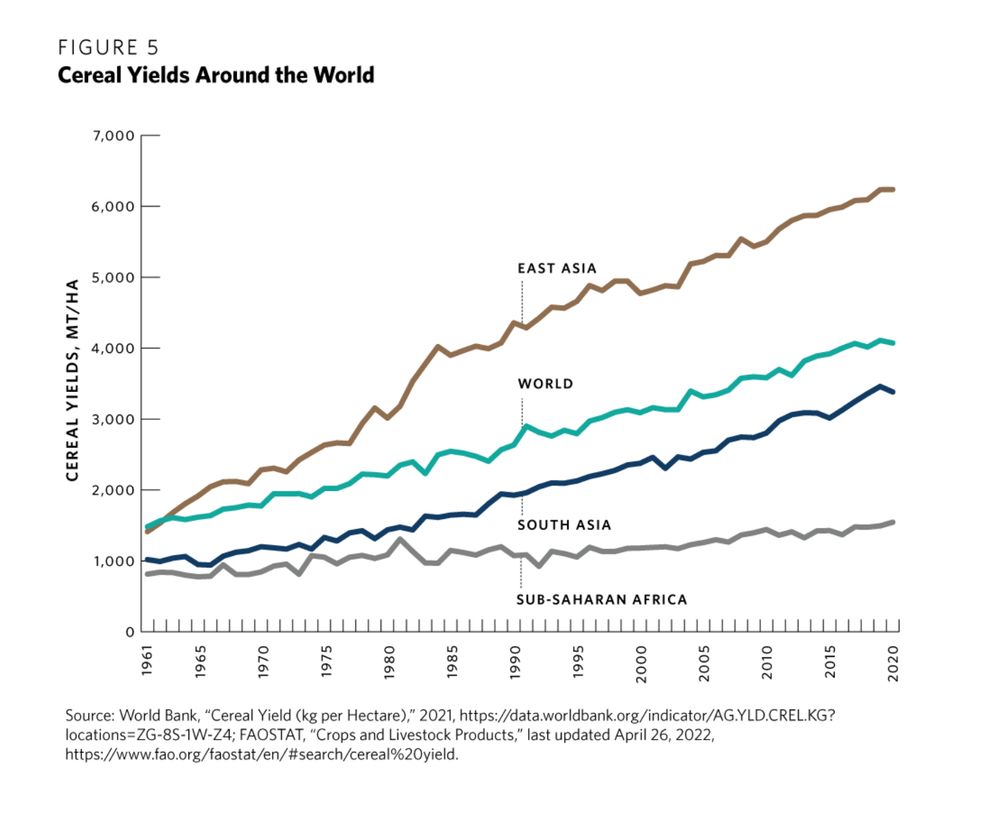

Could we have known? Yes, it was obvious for years

Could we have known? Yes, it was obvious for years

Zero migration would make that negative

Taiwan and Korea... woof

Zero migration would make that negative

Taiwan and Korea... woof