benjaminbraun.org/assets/pubs/...

benjaminbraun.org/assets/pubs/...

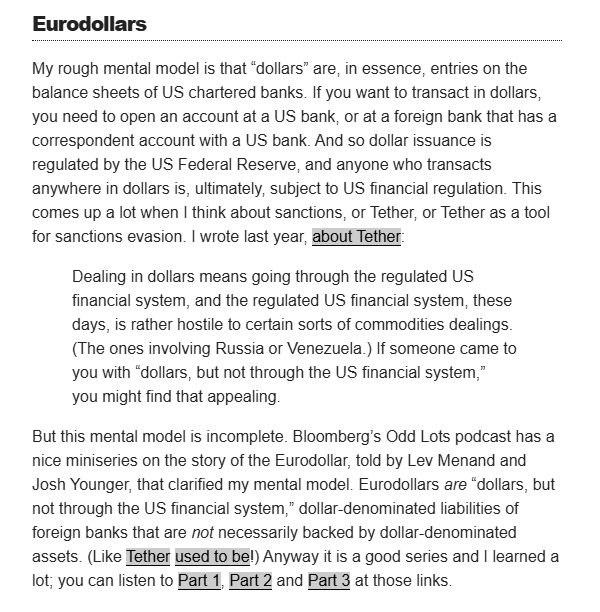

The most fundamental question in all of finance is -- and for hundreds of years has been -- "who gets to issue money [dollars in this case] and subject to what constraints."

The most fundamental question in all of finance is -- and for hundreds of years has been -- "who gets to issue money [dollars in this case] and subject to what constraints."

podcasts.apple.com/us/podcast/t...

podcasts.apple.com/us/podcast/t...

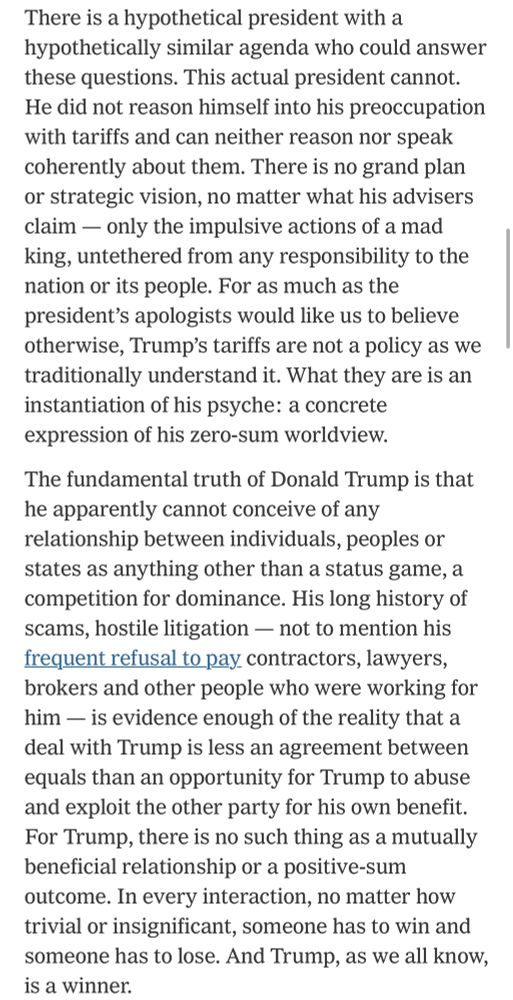

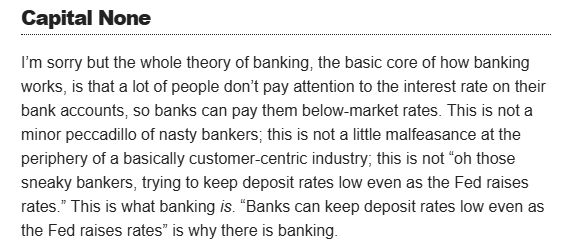

(clip from recent @matt-levine.bsky.social newsletter)

(clip from recent @matt-levine.bsky.social newsletter)

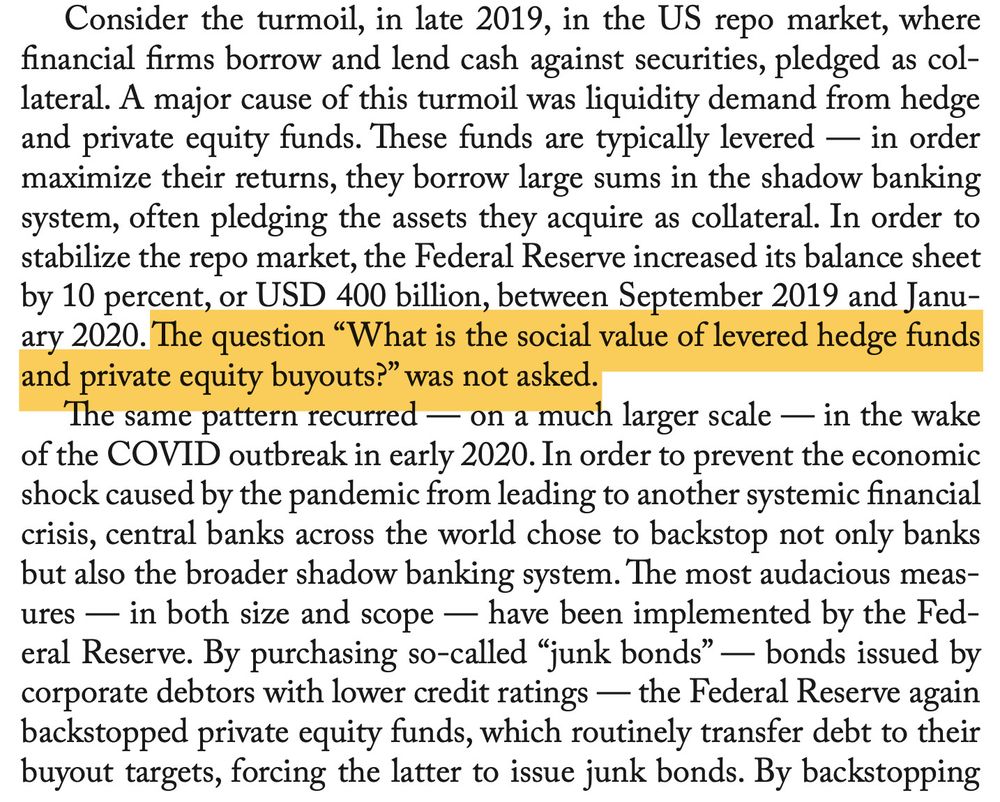

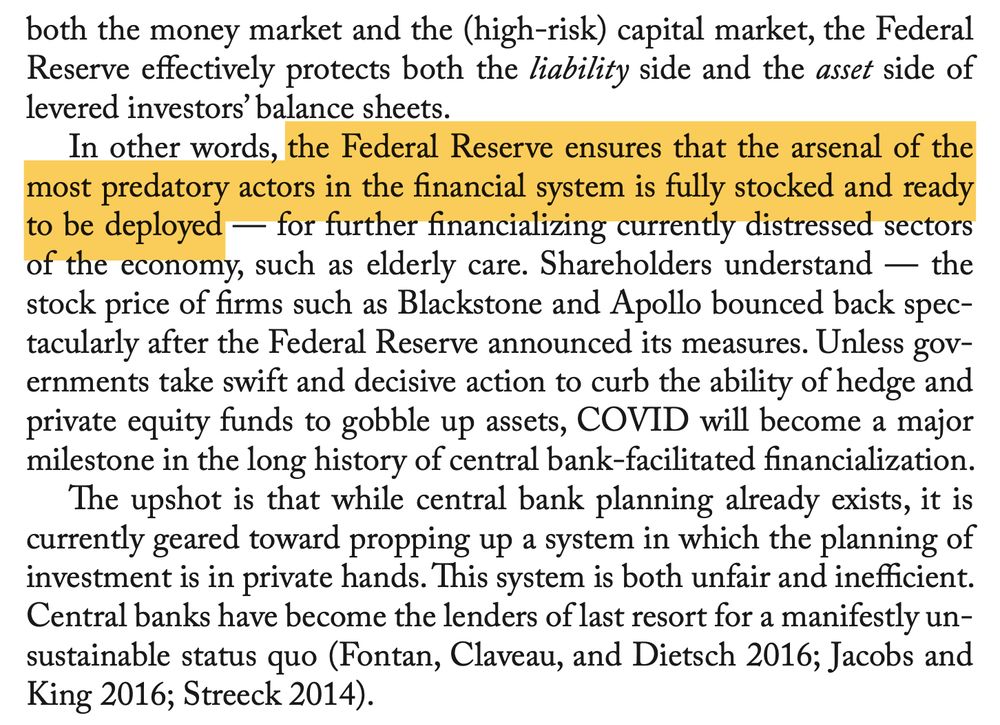

www.boundary2.org/the-gordian-...

It would be nice to see some leadership from the Fed in this area.

t.co/2qGESBLwBy

It would be nice to see some leadership from the Fed in this area.

t.co/2qGESBLwBy

See e.g. the studies on effects of private equity ownership of nursing homes and hospitals.

See e.g. the studies on effects of private equity ownership of nursing homes and hospitals.