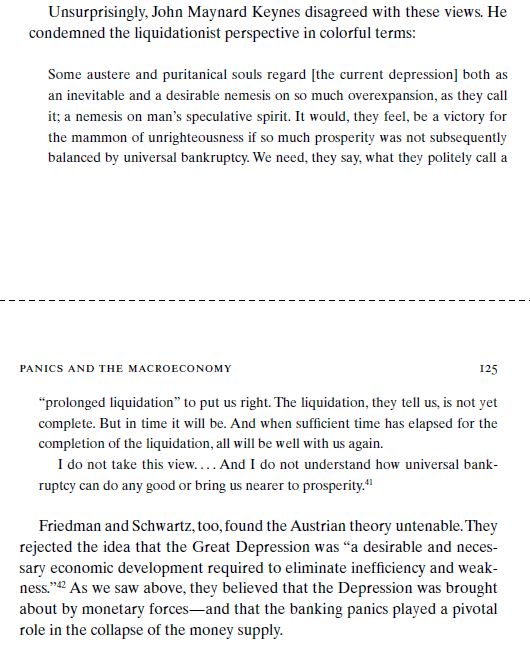

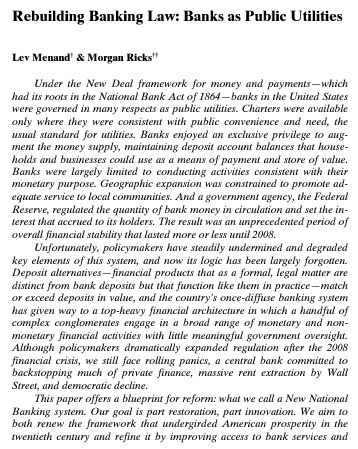

The most fundamental question in all of finance is -- and for hundreds of years has been -- "who gets to issue money [dollars in this case] and subject to what constraints."

The most fundamental question in all of finance is -- and for hundreds of years has been -- "who gets to issue money [dollars in this case] and subject to what constraints."

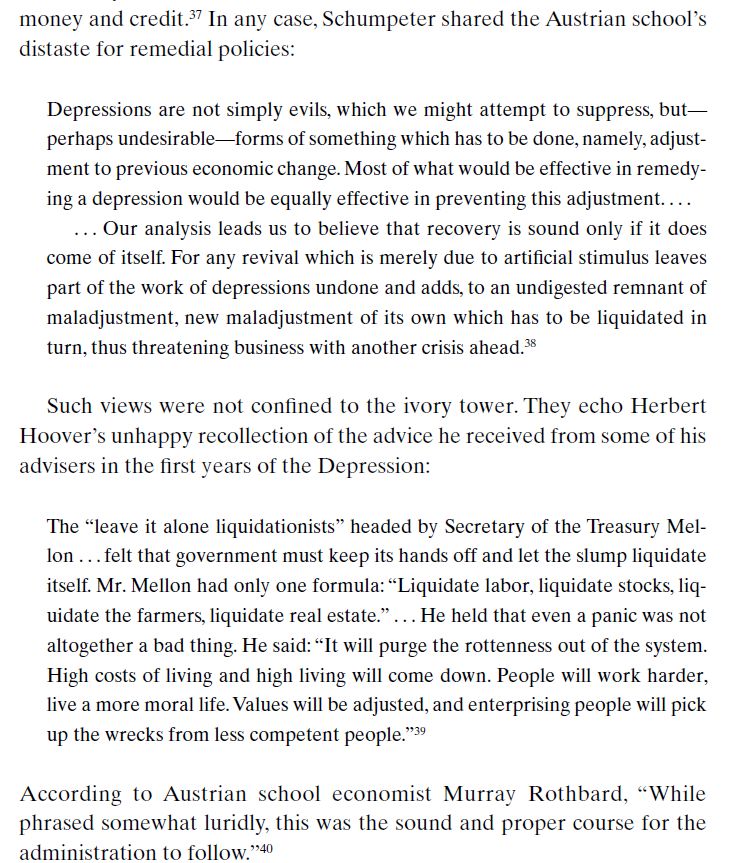

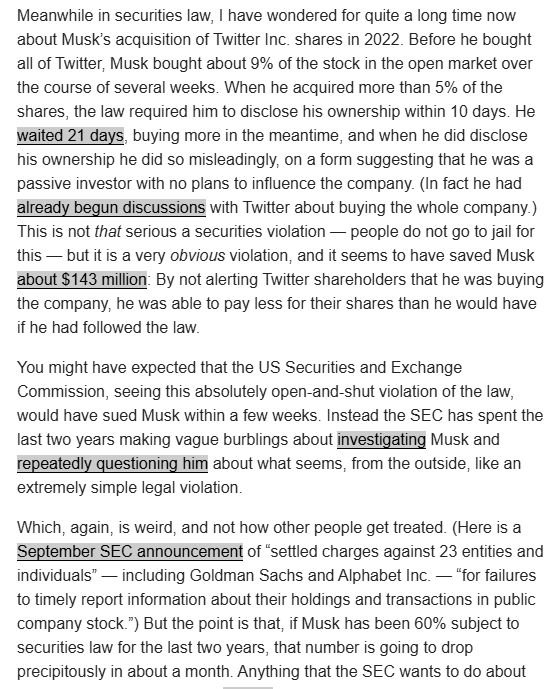

(clip from recent @matt-levine.bsky.social newsletter)

(clip from recent @matt-levine.bsky.social newsletter)

See e.g. the studies on effects of private equity ownership of nursing homes and hospitals.

See e.g. the studies on effects of private equity ownership of nursing homes and hospitals.

* ok, sometimes I tire. From

@matt_levine today:

* ok, sometimes I tire. From

@matt_levine today: