Priors: IRS, IHS Global Insight, DRI, WEFA, Wall Street (J&W Seligman)

Former PCBE President (Philly NABE)

#EconTwitterIRL 2023 & 2024

Views my own, not my employers’

"We can count if we want to, or we can leave our data behind,

’cause if we don’t count and if we don’t measure, then the narratives will leave us blind."

— “The Safety Dance,” Men Without Hats (1982)

— “The Data Dance,” MD (2025)"

...keep my day job?

"We can count if we want to, or we can leave our data behind,

’cause if we don’t count and if we don’t measure, then the narratives will leave us blind."

— “The Safety Dance,” Men Without Hats (1982)

— “The Data Dance,” MD (2025)"

...keep my day job?

about 10% of Federal workers during shutdowns claim UI and then have to pay it back after getting back pay. Its a hassle, but this shutdown is longer. Rent and mortgages are due Nov 1. What could UI claims look like if Fed workers need it?

Roughly this

about 10% of Federal workers during shutdowns claim UI and then have to pay it back after getting back pay. Its a hassle, but this shutdown is longer. Rent and mortgages are due Nov 1. What could UI claims look like if Fed workers need it?

Roughly this

Green FRN's are already in QE, Blue T-bills and Red Bonds have ended QT. Only item on the Fed's balance sheet still contracting is MBS (which makes sense)

Green FRN's are already in QE, Blue T-bills and Red Bonds have ended QT. Only item on the Fed's balance sheet still contracting is MBS (which makes sense)

Brazil? Demand destruction when price rose 10% y/y in Feb

Brazil? Demand destruction when price rose 10% y/y in Feb

330% Yes

125% also Yes

Which housing price is being discussed matters. A Lot.

330% Yes

125% also Yes

Which housing price is being discussed matters. A Lot.

did the same on my gun homicide chart, ~25 states you are more likely to die by gun violence then by, suicide by hanging or suffocation in 2019, and 3 states you are more likely to die by gun violence than motor vehicle accident

did the same on my gun homicide chart, ~25 states you are more likely to die by gun violence then by, suicide by hanging or suffocation in 2019, and 3 states you are more likely to die by gun violence than motor vehicle accident

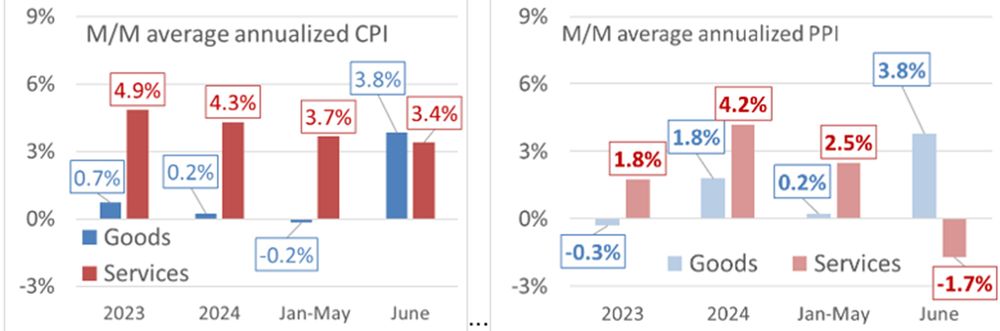

Goods prices were constrained 2023-May 2025, but soared in June.

PPI services prices fell a clear sign of slumping activity despite favorable USD$ tailwind. Travel to the US is down 9%.

Goods prices were constrained 2023-May 2025, but soared in June.

PPI services prices fell a clear sign of slumping activity despite favorable USD$ tailwind. Travel to the US is down 9%.

www.bea.gov/news/2025/gr...

www.bea.gov/news/2025/gr...