$GOOGL

sources.news/p/demis-hass...

$GOOGL

sources.news/p/demis-hass...

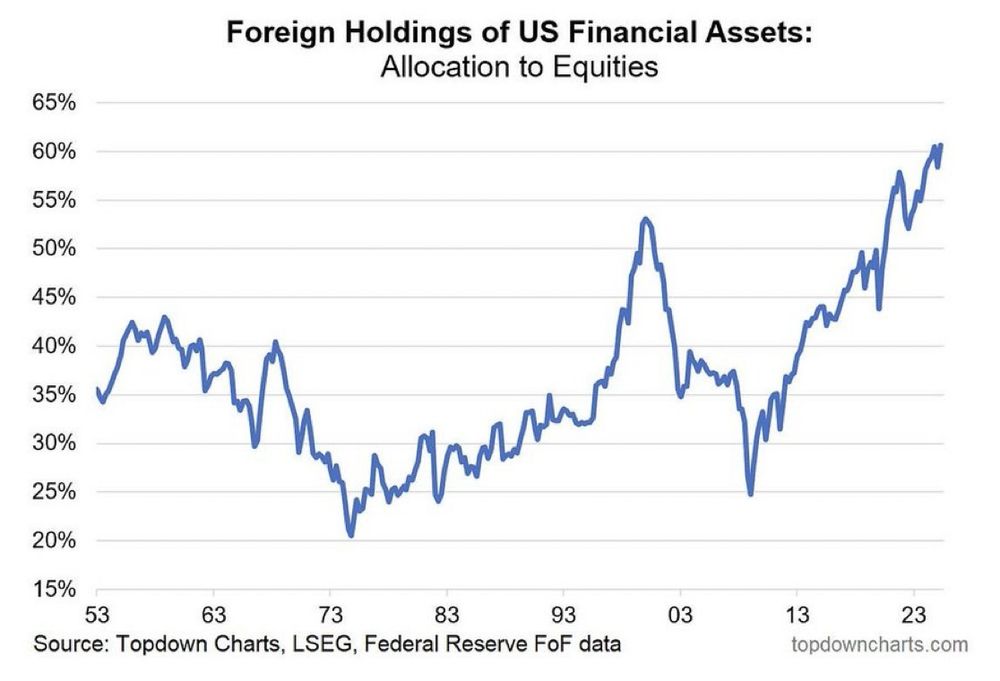

Also fund managers: near record-low cash and nearly max-long equities… otherwise known as over-invested.

sherwood.news/markets/fund...

Also fund managers: near record-low cash and nearly max-long equities… otherwise known as over-invested.

sherwood.news/markets/fund...

Lowest in 15 years

Lowest in 15 years

Get investing and trading insights inside the #1 newsletter for Elliott wave: tinyurl.com/454j3h75

Get investing and trading insights inside the #1 newsletter for Elliott wave: tinyurl.com/454j3h75

www.bloomberg.com/opinion/news...

www.bloomberg.com/opinion/news...

robinjbrooks.substack.com/p/debunking-...

robinjbrooks.substack.com/p/debunking-...

www.citadelsecurities.com/news-and-ins...

www.citadelsecurities.com/news-and-ins...

www.citadelsecurities.com/news-and-ins...

www.citadelsecurities.com/news-and-ins...

www.citadelsecurities.com/news-and-ins...

www.citadelsecurities.com/news-and-ins...

DailyChartbook.com

DailyChartbook.com

sherwood.news/markets/gold...

sherwood.news/markets/gold...