Julian Hinz

@julianhi.nz

Economist focused on international economics—trade policy, sanctions, migration & applied econometrics. Bielefeld University and Kiel Institute.

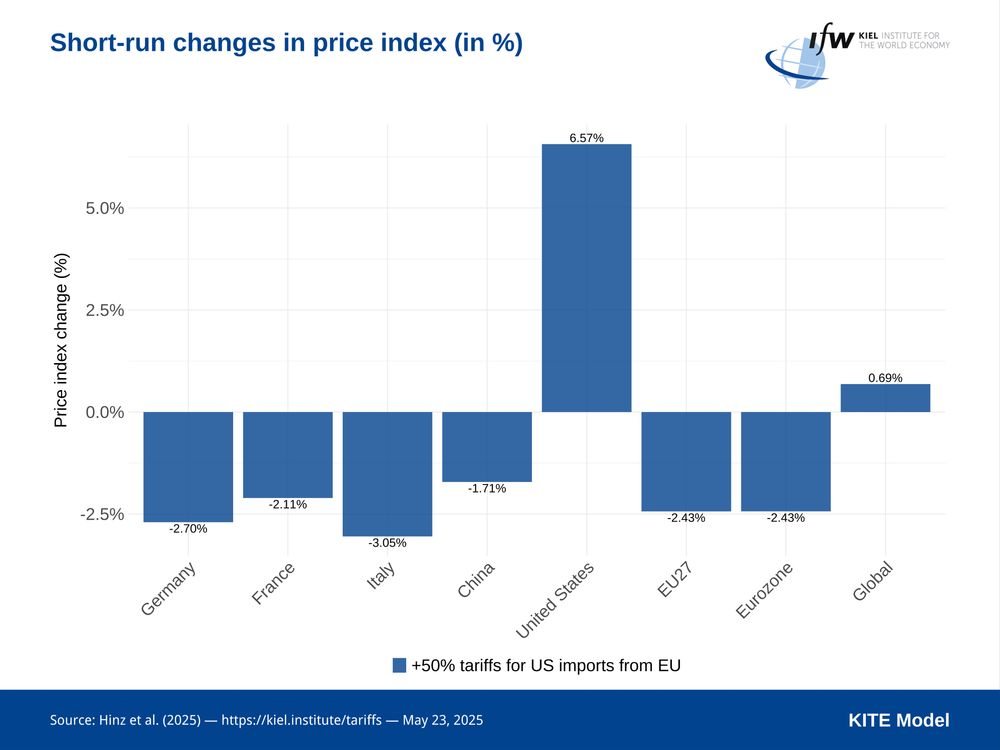

Take the numbers with a huge grain of salt, but the measures obviously also significantly increase deflationary pressure in Eurozone and inflationary pressure in US: Price index dives across Europe, with 🇩🇪 –2.70%, 🇪🇺 EU27 –2.43%, versus global uptick of +0.69%. 3/n

May 23, 2025 at 1:00 PM

Take the numbers with a huge grain of salt, but the measures obviously also significantly increase deflationary pressure in Eurozone and inflationary pressure in US: Price index dives across Europe, with 🇩🇪 –2.70%, 🇪🇺 EU27 –2.43%, versus global uptick of +0.69%. 3/n

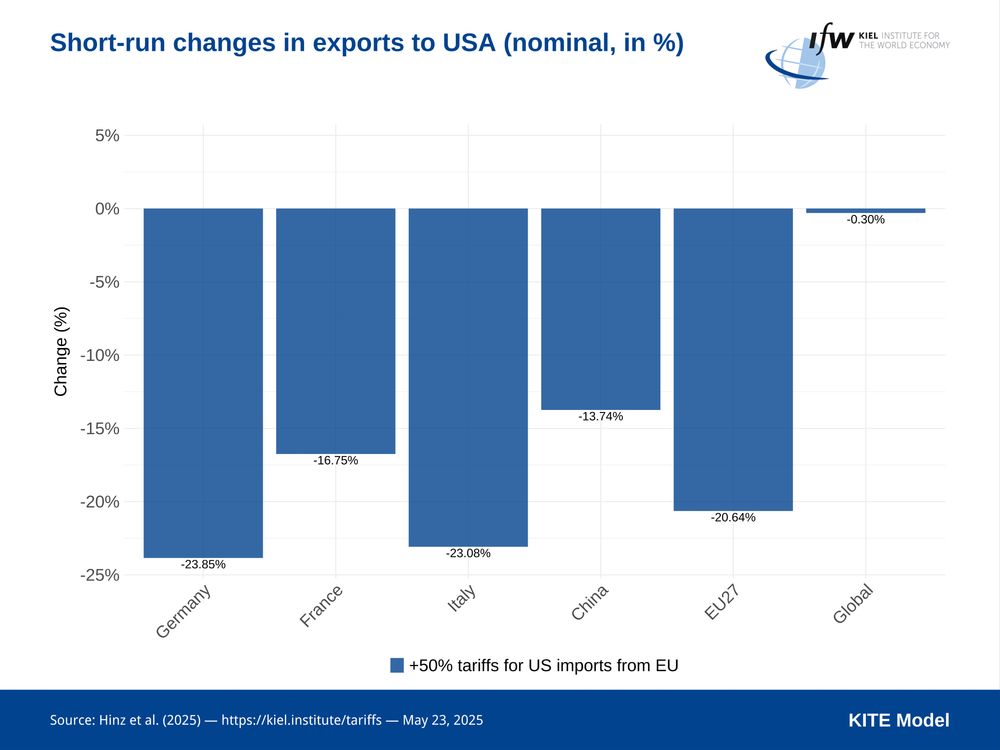

Should this be enacted and stay in place for about a year, we expect exports to the US collapse: 🇩🇪 Germany –23.85%, 🇪🇺 EU27 –20.64%, global trade barely moves at –0.30%. 2/n

May 23, 2025 at 1:00 PM

Should this be enacted and stay in place for about a year, we expect exports to the US collapse: 🇩🇪 Germany –23.85%, 🇪🇺 EU27 –20.64%, global trade barely moves at –0.30%. 2/n

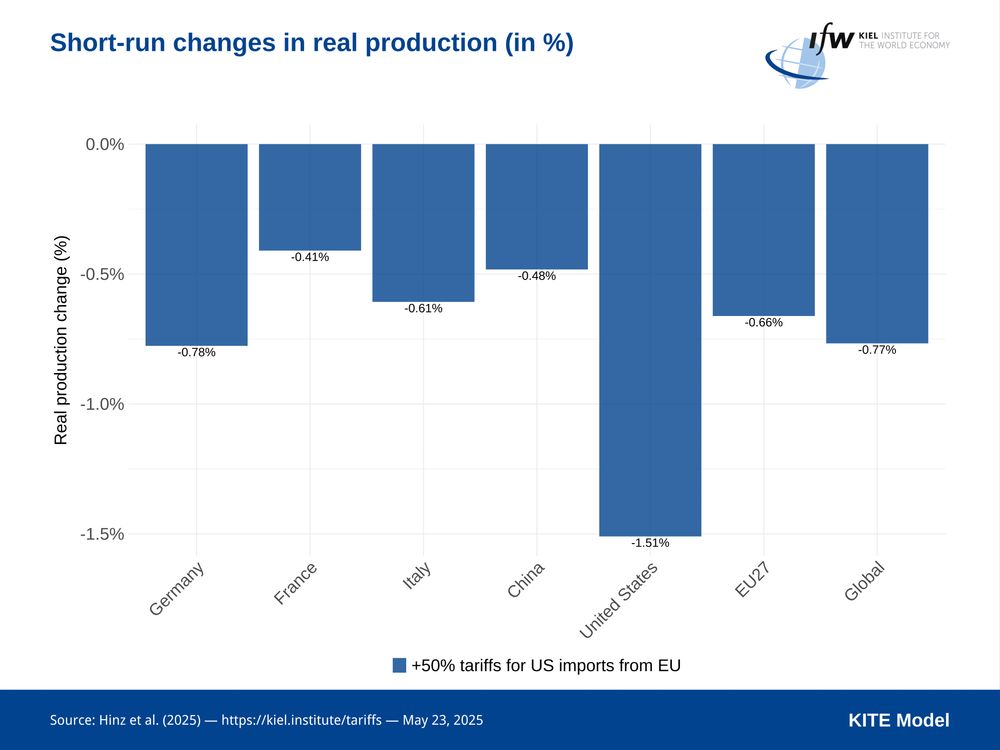

🚨 KITE Insta-Analys: Trump just suggested additional 50% tariff on all goods imports from EU. This one would hurt the EU: 🇩🇪 Germany real output falls –0.78%, 🇪🇺 EU27 –0.66%, 🇺🇸 US -1.51%. In EU hardest hit sector is transportation (automotive, aircraft, etc.): -5% real production. 1/n

May 23, 2025 at 1:00 PM

🚨 KITE Insta-Analys: Trump just suggested additional 50% tariff on all goods imports from EU. This one would hurt the EU: 🇩🇪 Germany real output falls –0.78%, 🇪🇺 EU27 –0.66%, 🇺🇸 US -1.51%. In EU hardest hit sector is transportation (automotive, aircraft, etc.): -5% real production. 1/n

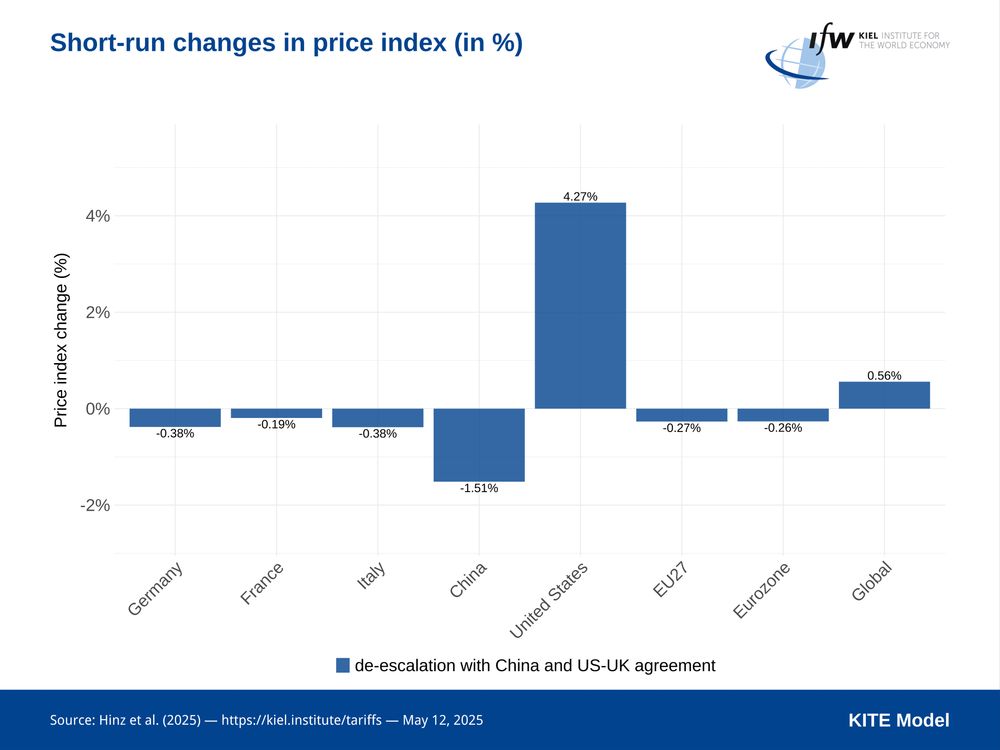

Price impacts remain significant: 🇺🇸 US prices now reduced to (!) +4.27% within 1yr, 🇨🇳 China sees -1.51% deflationary pressure. 🇩🇪 Germany (-0.38%), 🇪🇺 EU (-0.27%) similar to before. 3/n

May 12, 2025 at 2:07 PM

Price impacts remain significant: 🇺🇸 US prices now reduced to (!) +4.27% within 1yr, 🇨🇳 China sees -1.51% deflationary pressure. 🇩🇪 Germany (-0.38%), 🇪🇺 EU (-0.27%) similar to before. 3/n

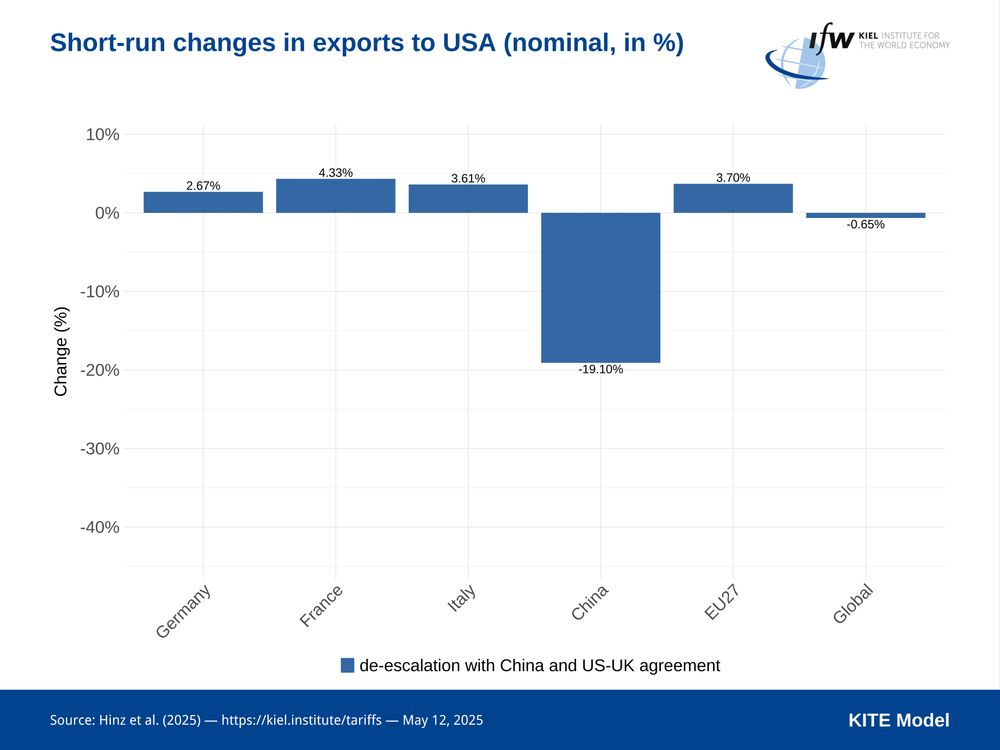

There will be a big catching-up in Chinese exports to the US now — but remember, exports still face +30% tariffs: Within 1 year, we still see 🇨🇳 China’s export drop to US by -19.10%. 2/n

May 12, 2025 at 2:07 PM

There will be a big catching-up in Chinese exports to the US now — but remember, exports still face +30% tariffs: Within 1 year, we still see 🇨🇳 China’s export drop to US by -19.10%. 2/n

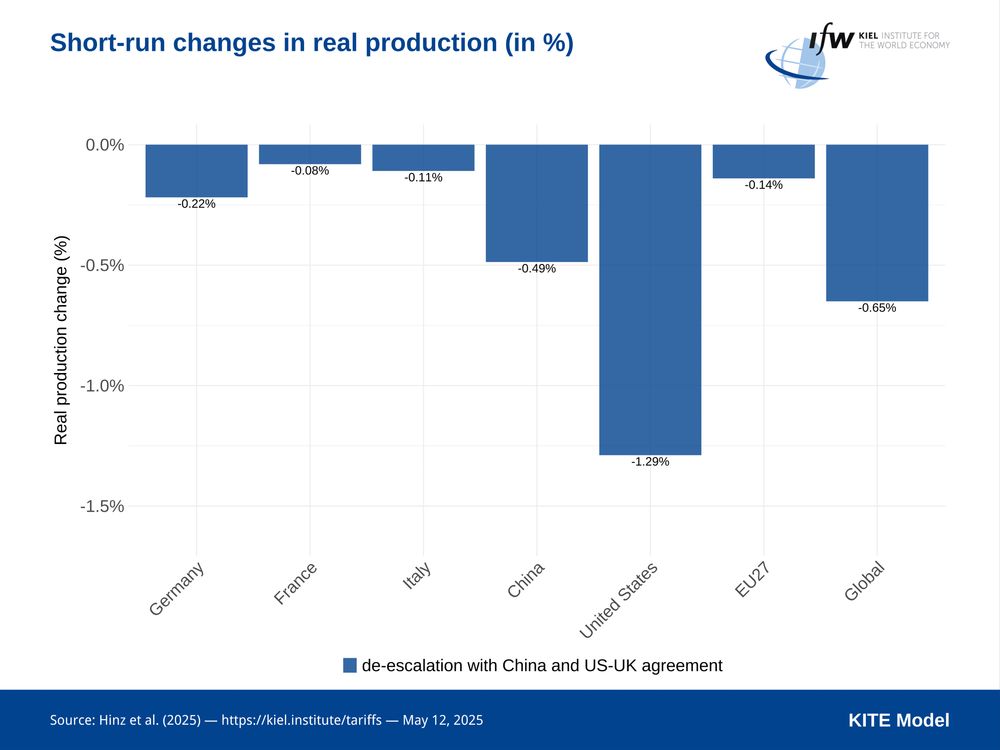

🚨 KITE Insta-Analys: US-China 90-day tariff pause provides short-term relief. US real GDP impact improves from -1.6% to -1.29%, and inflation eases to +4.3%. 🇨🇳 China’s real GDP loss shrinks to -0.5%. 🇩🇪 Germany and 🇪🇺 EU hardly move compared to previous situation (-0.22% and -0.14%). 1/n

May 12, 2025 at 2:07 PM

🚨 KITE Insta-Analys: US-China 90-day tariff pause provides short-term relief. US real GDP impact improves from -1.6% to -1.29%, and inflation eases to +4.3%. 🇨🇳 China’s real GDP loss shrinks to -0.5%. 🇩🇪 Germany and 🇪🇺 EU hardly move compared to previous situation (-0.22% and -0.14%). 1/n

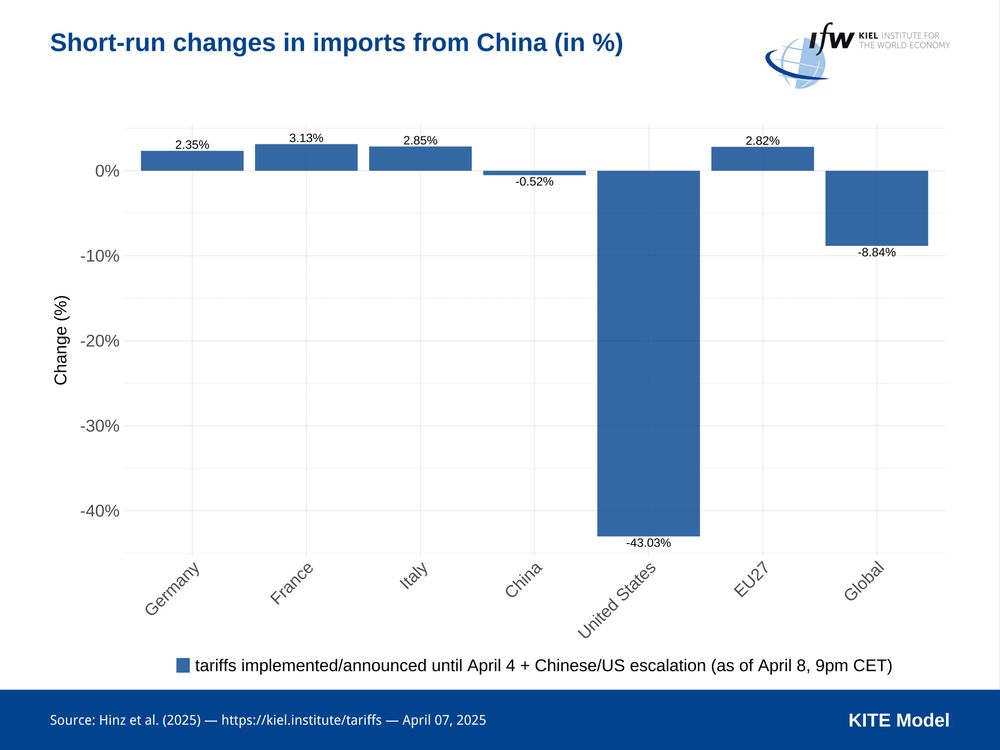

Should these new tariffs stay for some time, 🇺🇸 US imports from 🇪🇺 EU could rise (!), as they’re now cheaper than those from 🇨🇳 China, where imports collapse. 🇪🇺 imports from 🇨🇳 obviously increase, but far from flood: 🇨🇳 also redirects exports to other markets—as long as they don’t raise barriers too. 2/3

April 8, 2025 at 8:43 PM

Should these new tariffs stay for some time, 🇺🇸 US imports from 🇪🇺 EU could rise (!), as they’re now cheaper than those from 🇨🇳 China, where imports collapse. 🇪🇺 imports from 🇨🇳 obviously increase, but far from flood: 🇨🇳 also redirects exports to other markets—as long as they don’t raise barriers too. 2/3

🚨 KITE Insta-Analysis Update: Additional +34% tariffs by 🇨🇳 China on imports from 🇺🇸 USA, and in response an additional +50% tariffs vice versa (total 104% 🤯). Numbers largely speak for themselves, with relatively stable figures for bystanders (EU, also BRICS) hiding significant trade diversion. 1/3

April 8, 2025 at 8:43 PM

🚨 KITE Insta-Analysis Update: Additional +34% tariffs by 🇨🇳 China on imports from 🇺🇸 USA, and in response an additional +50% tariffs vice versa (total 104% 🤯). Numbers largely speak for themselves, with relatively stable figures for bystanders (EU, also BRICS) hiding significant trade diversion. 1/3

Export collapse is staggering: 🇺🇸 exports plunge -24.52% under "reciprocal" tariffs, from an already steep -13.66%. 🇨🇳 China: -3.05%, 🇪🇺 EU27: -1.06%. Global trade takes a beating. 4/n

April 2, 2025 at 9:38 PM

Export collapse is staggering: 🇺🇸 exports plunge -24.52% under "reciprocal" tariffs, from an already steep -13.66%. 🇨🇳 China: -3.05%, 🇪🇺 EU27: -1.06%. Global trade takes a beating. 4/n

Price effects (HUGE grain of salt) are even more dramatic: 🇺🇸 consumer prices up 9.16% (!?!), while 🇩🇪 Germany (-1.42%) and 🇨🇳 China (-2.97%) see deflationary pressure. Not sure what to make of this, really. 3/n

April 2, 2025 at 9:38 PM

Price effects (HUGE grain of salt) are even more dramatic: 🇺🇸 consumer prices up 9.16% (!?!), while 🇩🇪 Germany (-1.42%) and 🇨🇳 China (-2.97%) see deflationary pressure. Not sure what to make of this, really. 3/n

🚨 KITE Insta-Analysis: New "reciprocal" US tariffs are serious. We ran both status quo (tariffs until April 2 incl. retaliation) and newly announced reciprocal tariff regime through the KITE model. (Non-) spoiler: 🇺🇸 hits itself the hardest. NB: Short-run, extremely ad-hoc. 1/n

April 2, 2025 at 9:38 PM

🚨 KITE Insta-Analysis: New "reciprocal" US tariffs are serious. We ran both status quo (tariffs until April 2 incl. retaliation) and newly announced reciprocal tariff regime through the KITE model. (Non-) spoiler: 🇺🇸 hits itself the hardest. NB: Short-run, extremely ad-hoc. 1/n

Simulations suggest significant price effects, especially in the 🇺🇸 US +1%, with downward pressure in car producing countries. 3/n.

March 26, 2025 at 9:47 PM

Simulations suggest significant price effects, especially in the 🇺🇸 US +1%, with downward pressure in car producing countries. 3/n.

Trade impact muted, cars tend to be sold relatively close to where they are built: Total exports 🇩🇪 -0.4%, 🇲🇽 -1.6%, and most impacted 🇺🇸 -2.8% (!). Nerdy explanation: Lerner symmetry hitting hard. 2/n

March 26, 2025 at 9:47 PM

Trade impact muted, cars tend to be sold relatively close to where they are built: Total exports 🇩🇪 -0.4%, 🇲🇽 -1.6%, and most impacted 🇺🇸 -2.8% (!). Nerdy explanation: Lerner symmetry hitting hard. 2/n

🚨 KITE Insta-Analysis: President Trump just announced an additional 25% on US automotive imports. While the industry has global visibility, short-run impact likely small, except for 🇲🇽 Mexico and 🇨🇦 Canada: -1.81% and -0.6% real GDP impact. Even Germany only -0.18%. Note: No retaliation here. 1/n

March 26, 2025 at 9:47 PM

🚨 KITE Insta-Analysis: President Trump just announced an additional 25% on US automotive imports. While the industry has global visibility, short-run impact likely small, except for 🇲🇽 Mexico and 🇨🇦 Canada: -1.81% and -0.6% real GDP impact. Even Germany only -0.18%. Note: No retaliation here. 1/n

Nerdy econometric side-note: For the trade estimations we used a triple‑difference gravity framework combining Turkish firm-level data with country-level COMTRADE data. Allows us control for Russian demand effects — more on this "trick" soon. 6/n

March 11, 2025 at 11:25 AM

Nerdy econometric side-note: For the trade estimations we used a triple‑difference gravity framework combining Turkish firm-level data with country-level COMTRADE data. Allows us control for Russian demand effects — more on this "trick" soon. 6/n

(2) However, at the macro-level trade of affected products permanently remained subdued. Recovery in relative terms, but not in absolute terms. 4/n

March 11, 2025 at 11:25 AM

(2) However, at the macro-level trade of affected products permanently remained subdued. Recovery in relative terms, but not in absolute terms. 4/n

Key findings: (1) At the firm-product-destination level, the embargo impact was immediate, but trade recovered when the embargo was lifted. 3/n

March 11, 2025 at 11:25 AM

Key findings: (1) At the firm-product-destination level, the embargo impact was immediate, but trade recovered when the embargo was lifted. 3/n

🚨New paper: “Shooting down trade: Firm‑level effects of embargoes” – by @uguraytun.bsky.social & Cem Özgüzel, and myself – just published in JEBO. We ask: How do firms adjust when geopolitical shocks disrupt trade? 1/n

March 11, 2025 at 11:25 AM

🚨New paper: “Shooting down trade: Firm‑level effects of embargoes” – by @uguraytun.bsky.social & Cem Özgüzel, and myself – just published in JEBO. We ask: How do firms adjust when geopolitical shocks disrupt trade? 1/n

Speaking of sectoral impact: 🇩🇪 Germany’s manufacturing sector would be hit hardest. Nominal automotive production alone could decline by up to 4%, with ripple effects across machinery, equipment, and supply chains. 4/5

February 26, 2025 at 10:42 PM

Speaking of sectoral impact: 🇩🇪 Germany’s manufacturing sector would be hit hardest. Nominal automotive production alone could decline by up to 4%, with ripple effects across machinery, equipment, and supply chains. 4/5

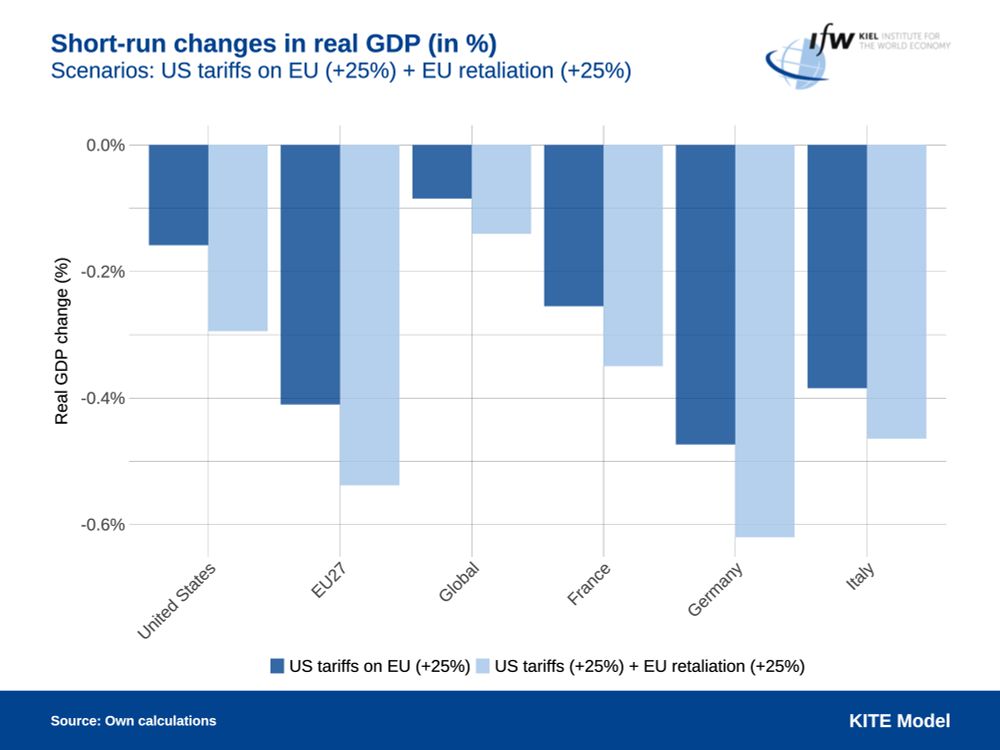

Trade impact: EU exports to the US would decline by 15-17%, with 🇩🇪 Germany hit hardest (-20%). While this translates to only -1.5% of Germany’s total exports, the disruption in key industries like autos and machinery could be significant. 3/5

February 26, 2025 at 10:42 PM

Trade impact: EU exports to the US would decline by 15-17%, with 🇩🇪 Germany hit hardest (-20%). While this translates to only -1.5% of Germany’s total exports, the disruption in key industries like autos and machinery could be significant. 3/5

🚨 KITE Insta-Analysis: Trump has announced his intention to put 25% tariffs on all EU goods. The impact would be significant for the EU, but the US would also face major costs—especially if the EU retaliates. 1/5 @kiel.institute

February 26, 2025 at 10:42 PM

🚨 KITE Insta-Analysis: Trump has announced his intention to put 25% tariffs on all EU goods. The impact would be significant for the EU, but the US would also face major costs—especially if the EU retaliates. 1/5 @kiel.institute

Second day starts with a great keynote on the labor market impact of Taiwan’s accession to the WTO.

February 25, 2025 at 8:52 AM

Second day starts with a great keynote on the labor market impact of Taiwan’s accession to the WTO.

Kick-off for the workshop on “Economic Security and the Future of the Global Trading System” — extremely timely topic with papers on the impact of the democratic dividend and environmental policy on trade. @kiel.institute @rethink-gsc.bsky.social @joschkawanner.bsky.social

February 24, 2025 at 8:51 AM

Kick-off for the workshop on “Economic Security and the Future of the Global Trading System” — extremely timely topic with papers on the impact of the democratic dividend and environmental policy on trade. @kiel.institute @rethink-gsc.bsky.social @joschkawanner.bsky.social

NB: Unlike 🇺🇸 US, almost all countries have VAT. Standard rates typically somewhere between 12-22%, and, *it does not favor domestic production over imports*.

February 13, 2025 at 10:56 PM

NB: Unlike 🇺🇸 US, almost all countries have VAT. Standard rates typically somewhere between 12-22%, and, *it does not favor domestic production over imports*.