www.cbc.ca/news/canada/...

www.cbc.ca/news/canada/...

But that seems fine? I'd rather grow the UGB and and not need it than vice versa.

But that seems fine? I'd rather grow the UGB and and not need it than vice versa.

A limited UGB might be adequate in the sense that it could *physically fit* expected pop growth - but if it renders developable land is 2x the price per hectare vs. bigger UGB, shouldn't that factor?

A limited UGB might be adequate in the sense that it could *physically fit* expected pop growth - but if it renders developable land is 2x the price per hectare vs. bigger UGB, shouldn't that factor?

(fully internalized costs is a big "if", I suppose)

(fully internalized costs is a big "if", I suppose)

Growing an existing small urban settlement to a city does happen, yes.

But preventing *brand new* small urban settlements on rural land is still essentially a policy choice by the Province.

Growing an existing small urban settlement to a city does happen, yes.

But preventing *brand new* small urban settlements on rural land is still essentially a policy choice by the Province.

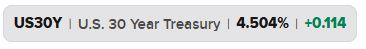

Not sure how Good China News and Bad China News can *both* consistently cause bonds to puke, but that seems to be the new reality.

Not sure how Good China News and Bad China News can *both* consistently cause bonds to puke, but that seems to be the new reality.

Bessent can't be happy ending all this with the US30Y at 4.9%.

Bessent can't be happy ending all this with the US30Y at 4.9%.

www.thebikinglawyer.ca/post/reporti...

www.thebikinglawyer.ca/post/reporti...

These wild swings at the long-end in particular are totally untethered from the macro growth view.

These wild swings at the long-end in particular are totally untethered from the macro growth view.

Funny thing is, the cycle was turning before the tariff war.

But at his own doing, he's now going to get the blame for *all* of it.

Couldn't have happened to a nicer guy.

Funny thing is, the cycle was turning before the tariff war.

But at his own doing, he's now going to get the blame for *all* of it.

Couldn't have happened to a nicer guy.

Level going down though and my guess is it will by passable by evening commute.

Level going down though and my guess is it will by passable by evening commute.

My gut tells me it's below 4700.

Not a comforting thought.

My gut tells me it's below 4700.

Not a comforting thought.