You're Misreading This Bull Market | Jim Paulsen on the Major Supports That Are About to Flip

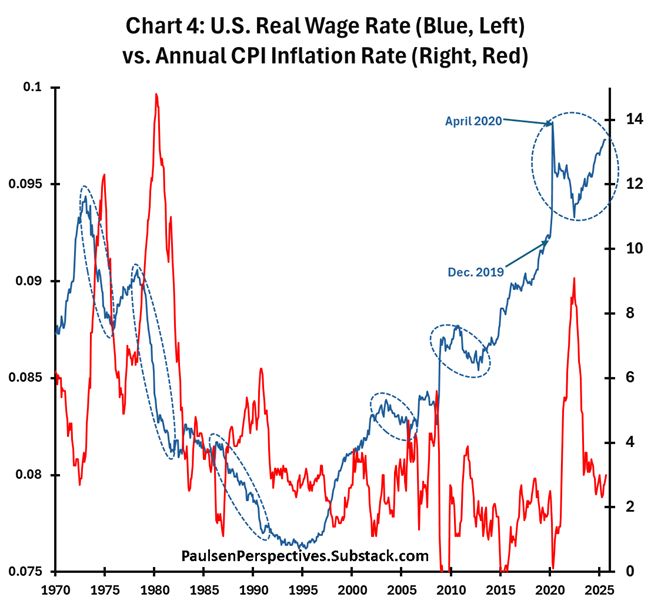

Follow Jim at https://paulsenperspectives.substack.com/ In this episode, we sit down with Jim Paulsen to analyze the latest economic and market data through his lens of decades of market experience. Jim shares insights from his Paulsen Perspectives research, covering the job market, the Fed, inflation, valuations, investor confidence, and what they all mean for the future of the economy and markets. We explore why confidence is so low despite a bull market, how Fed policy is shaping market dynamics, and where investors might want to focus as the cycle evolves. Topics covered in the episode: * The job market’s pivotal role in driving the economy and Fed decisions * Why recent Fed rate cuts may mark a turning point in market support systems * The narrowness of the bull market and how innovation-driven firms diverge from traditional cycles * Investor confidence, the “misery index,” and recession probability models * How easing may broaden market participation beyond large-cap growth * What “animal spirits” mean for small caps, high beta, and IPOs * The disconnect between inflation, bond yields, and growth measures * Gold, cash, crypto, and tech as “fear assets” in today’s environment * The impact of tariffs on profits, wages, and inflation expectations * Valuations in context: historical perspective and the upward bias of multiples Timestamps: 00:00 Introduction and market overview 02:00 Fed easing, inflation, and recession risks 09:00 Bull market without normal supports 17:00 Narrow leadership and innovative companies 23:55 Confidence and the misery index 29:35 Yield curve, recession probabilities, and Fed policy 34:00 Broadening of market participation 37:00 Animal spirit stocks and small caps 38:00 Inflation, bond yields, and resource unemployment 43:20 Copper-gold ratio and yields 45:10 The role of gold in portfolios 50:00 Cash, crypto, and tech as defensive assets 54:00 Tariffs, inflation, and profit margins 59:00 Inflation persistence vs. wage growth 01:01:10 Valuations and the upward bias in multiples 01:07:00 Closing thoughts and takeaways