But behind the headlines are real struggles. 🧵

IRS survey on this question is now live:

IRS survey on this question is now live:

Then overnight I got it again, this time to my personal account. And I heard from lots of others who did, too. 🧵

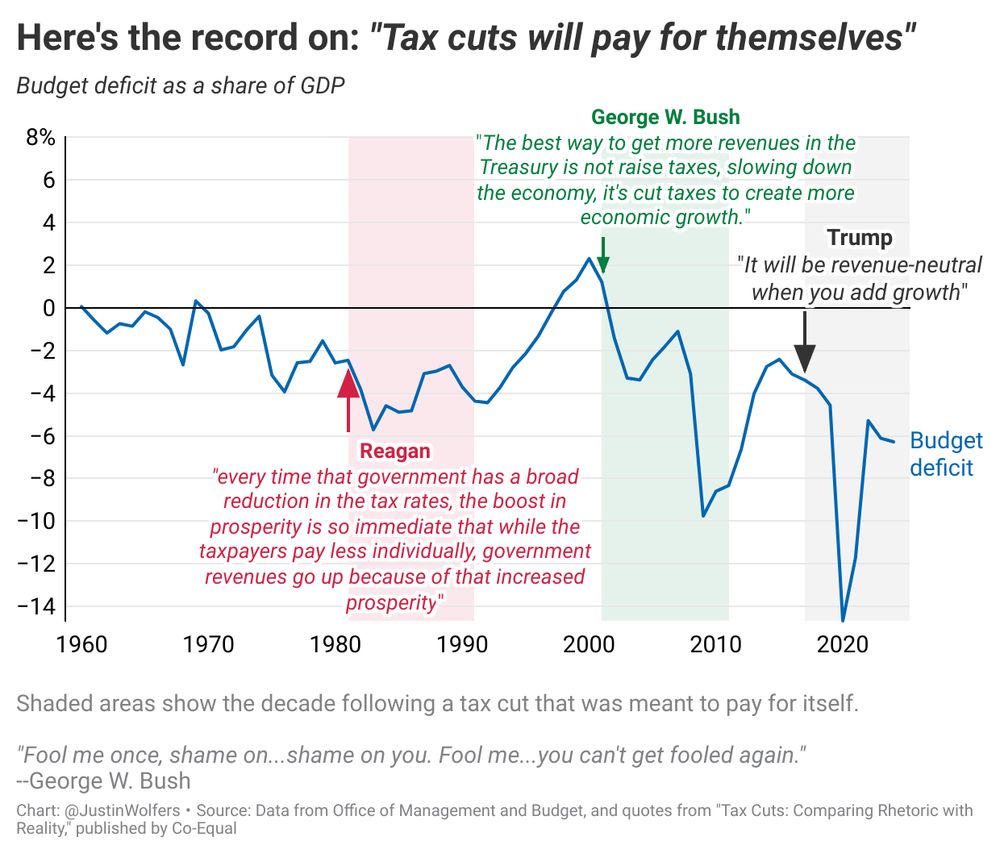

It's a lie.

CBO projects 11.8 million more uninsured from the Big Bill.

An additional 5.1 million uninsured from allowing enhanced ACA tax credits to expire and administrative actions.

CBO preliminary score for Senate bill is up to $930 billion in Medicaid cuts.

CBO preliminary score for Senate bill is up to $930 billion in Medicaid cuts.

Across the political spectrum, tax wonks have found little to love. The bill is utterly unprincipled. By the bipartisan policy principles I outlined in Feb, it scores ~0.5 out of 8. Let’s take the issues 1 by 1.

www.piie.com/publications...

New @taxlawcenter.org post: taxlawcenter.org/blog/the-hou...