JamesSmithRF

@jamessmithrf.bsky.social

Research Director at the Resolution Foundation. Previous lives at the Bank of England and in the civil service. Focussed mainly on macroeconomics (mainly).

BUT somehow today's BoE decision has completely ignored the Budget. The chancellor was very clear on Tuesday that policy is tightening and she will act to bring down headline inflation. If the decision today was close, that big policy change means a cut in December is a racing certainty.

November 6, 2025 at 1:54 PM

BUT somehow today's BoE decision has completely ignored the Budget. The chancellor was very clear on Tuesday that policy is tightening and she will act to bring down headline inflation. If the decision today was close, that big policy change means a cut in December is a racing certainty.

So, today's BoE decision was pretty much as expected with the battle ground for the future of rates the issue of whether we are seeing a new era of high wage growth and high headline inflation.

November 6, 2025 at 1:54 PM

So, today's BoE decision was pretty much as expected with the battle ground for the future of rates the issue of whether we are seeing a new era of high wage growth and high headline inflation.

On the growth outlook, here the BoE has been surprised to the upside by the data but think the near term will be weaker in Q3 2025 (partly because of Budget uncertainty!). Looking ahead the forecast is little changed.

November 6, 2025 at 1:54 PM

On the growth outlook, here the BoE has been surprised to the upside by the data but think the near term will be weaker in Q3 2025 (partly because of Budget uncertainty!). Looking ahead the forecast is little changed.

New scenarios show what might happen to rates if the hawkish camp are right. This is a step forward in transparency but the answer is a little hard to understand in that it suggest, yes, rates wd be higher; but they would be higher from 2026 onwards.

November 6, 2025 at 1:54 PM

New scenarios show what might happen to rates if the hawkish camp are right. This is a step forward in transparency but the answer is a little hard to understand in that it suggest, yes, rates wd be higher; but they would be higher from 2026 onwards.

This is all very familiar- those not wanting to cut rates worry that there has been a fundamental shift in the wage-setting process and we will be stuck with higher inflation. For those wanting to cut rates, wage growth is already well on the way down & close to levels consistent with 2% inflation.

November 6, 2025 at 1:54 PM

This is all very familiar- those not wanting to cut rates worry that there has been a fundamental shift in the wage-setting process and we will be stuck with higher inflation. For those wanting to cut rates, wage growth is already well on the way down & close to levels consistent with 2% inflation.

With the Budget in mind, you can see that the BoE (like other forecasters) has a MUCH stronger wage growth projection than the OBR. This is part of the reason why we (at RF) expect a change in view here from the OBR. If so, that will push down on the forecast for borrowing significantly.

November 6, 2025 at 1:54 PM

With the Budget in mind, you can see that the BoE (like other forecasters) has a MUCH stronger wage growth projection than the OBR. This is part of the reason why we (at RF) expect a change in view here from the OBR. If so, that will push down on the forecast for borrowing significantly.

High inflation (and inf expectations) affect future inflation through their impact on domestic costs (i.e. wages). Here there has been more progress than BoE expected in Aug, BUT those voting for a cut are worried that wages will prove stickier than implied by the forecast.

November 6, 2025 at 1:54 PM

High inflation (and inf expectations) affect future inflation through their impact on domestic costs (i.e. wages). Here there has been more progress than BoE expected in Aug, BUT those voting for a cut are worried that wages will prove stickier than implied by the forecast.

The place where higher inflation (and inf expectations) have an impact is on wages. Here there has been more progress than BoE expected, BUT those voting for a cut are worried that wage growth will prove stickier than implied by the BoE forecast.

November 6, 2025 at 1:54 PM

The place where higher inflation (and inf expectations) have an impact is on wages. Here there has been more progress than BoE expected, BUT those voting for a cut are worried that wage growth will prove stickier than implied by the BoE forecast.

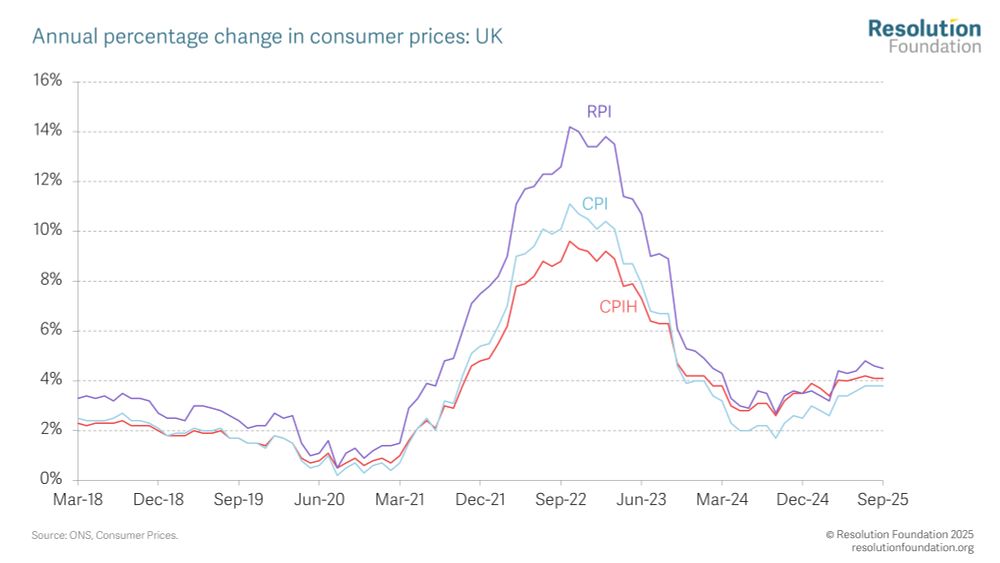

Lets start with *headline* inflation which BoE is very focused on. This is unusual, as it has been focused on prospects for *underlying* inflation until recently (the thing it can control). Here the outlook is v.little changed despite slight undershoot of inflation relative to forecast in September.

November 6, 2025 at 1:54 PM

Lets start with *headline* inflation which BoE is very focused on. This is unusual, as it has been focused on prospects for *underlying* inflation until recently (the thing it can control). Here the outlook is v.little changed despite slight undershoot of inflation relative to forecast in September.

Overall, a welcome downside inflation surprise. But this chart reminds you that UK inflation is still the highest in the G7. A big question going forward, then, is whether this is the start of a faster fall in inflation, or whether this will prove erratic.

October 22, 2025 at 8:21 AM

Overall, a welcome downside inflation surprise. But this chart reminds you that UK inflation is still the highest in the G7. A big question going forward, then, is whether this is the start of a faster fall in inflation, or whether this will prove erratic.

Today's lower-than-expected inflation is good news for mortgagors as it's a key piece of data ahead of next month's BoE rate decision. Sticky headline inf has been a worry, so today's number shd give more room for a cut. We shd now see inflation fall back towards 2% over the coming months.

October 22, 2025 at 8:21 AM

Today's lower-than-expected inflation is good news for mortgagors as it's a key piece of data ahead of next month's BoE rate decision. Sticky headline inf has been a worry, so today's number shd give more room for a cut. We shd now see inflation fall back towards 2% over the coming months.

This is not a huge difference. And it won't matter in the long run. But if it Sep 2025 inflation proves to be erratically weak, benefits won't catchup until April 2027! So while lower inflation is welcome, this cd prove bad timing for those on benefits.

October 22, 2025 at 8:21 AM

This is not a huge difference. And it won't matter in the long run. But if it Sep 2025 inflation proves to be erratically weak, benefits won't catchup until April 2027! So while lower inflation is welcome, this cd prove bad timing for those on benefits.

With inflation at 3.8% the UC standard allowance will be uprated by at least 6.2% – a boost that is worth nearly £6 per week. While this uplift will be welcomed by many, it is smaller than the 6.4 per cent boost they would have seen had September inflation been 4 per cent, as widely forecast.

October 22, 2025 at 8:21 AM

With inflation at 3.8% the UC standard allowance will be uprated by at least 6.2% – a boost that is worth nearly £6 per week. While this uplift will be welcomed by many, it is smaller than the 6.4 per cent boost they would have seen had September inflation been 4 per cent, as widely forecast.

So good news that inflation is a lower. But September CPI inflation is used to uprate the benefits which millions of families rely on. This year, benefits were uprated by 1.7%, which was low outturn for 2024, but next year’s figure it will be today's 3.8% outturn.

October 22, 2025 at 8:21 AM

So good news that inflation is a lower. But September CPI inflation is used to uprate the benefits which millions of families rely on. This year, benefits were uprated by 1.7%, which was low outturn for 2024, but next year’s figure it will be today's 3.8% outturn.

The biggest contribution to the downside surprise came from services inflation. This was expected to rise to 5% but remained at 4.7%. A big part of this was a sharp fall in erratic airfares- which always drop between Aug and Sep but fell much more than usual this time.

October 22, 2025 at 8:21 AM

The biggest contribution to the downside surprise came from services inflation. This was expected to rise to 5% but remained at 4.7%. A big part of this was a sharp fall in erratic airfares- which always drop between Aug and Sep but fell much more than usual this time.

On the month the biggest upward contribution came from petrol (in transport on the left-hand chart). This is not because petrol is rising hugely in price (although it is a bit) this is past falls dropping out of the calculation (right chart).

October 22, 2025 at 8:21 AM

On the month the biggest upward contribution came from petrol (in transport on the left-hand chart). This is not because petrol is rising hugely in price (although it is a bit) this is past falls dropping out of the calculation (right chart).

Starting with the headline rates. CPI was 3.8% in September and how now been there for 3 months. This is the highest rate since early last year but the key thing for today is that it was expected to rise to 4% (by markets and BoE). So the is a BIG (and welcome) downside surprise.

October 22, 2025 at 8:21 AM

Starting with the headline rates. CPI was 3.8% in September and how now been there for 3 months. This is the highest rate since early last year but the key thing for today is that it was expected to rise to 4% (by markets and BoE). So the is a BIG (and welcome) downside surprise.

So while there's some good news for the Chancellor in today's public finances data, borrowing is still above forecast, and there are signs that receipts are disappointing given faster growth. So there's still a worry for the govt that the OBR may mark down its forecast for the tax take.

October 21, 2025 at 8:19 AM

So while there's some good news for the Chancellor in today's public finances data, borrowing is still above forecast, and there are signs that receipts are disappointing given faster growth. So there's still a worry for the govt that the OBR may mark down its forecast for the tax take.