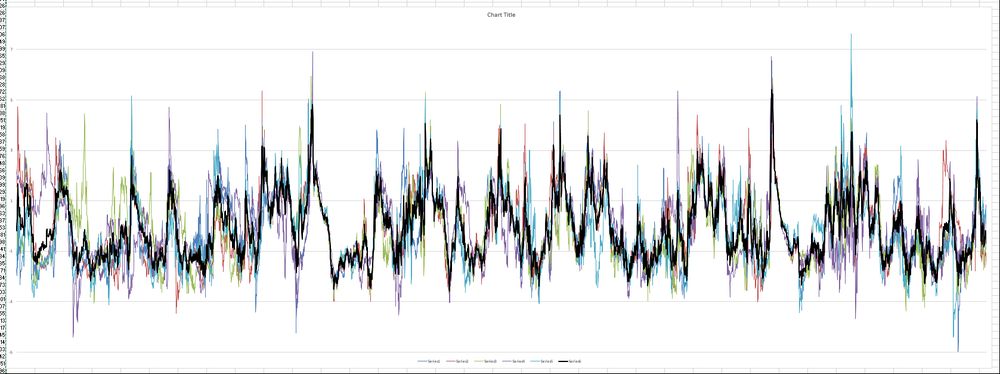

Two proprietary EM indicators (>>0 track):

• 1st = global macro risk support

• 2nd = EM-specific risk sentiment

Interesting divergence: EM risk appetite still well above danger zone, while global macro support for EM just dropped sharply.

Python if people asked

Two proprietary EM indicators (>>0 track):

• 1st = global macro risk support

• 2nd = EM-specific risk sentiment

Interesting divergence: EM risk appetite still well above danger zone, while global macro support for EM just dropped sharply.

Python if people asked

Risk/reward now feels asymmetric, time to reduce risk or to be selective.

TTR by region (25 yrs):

Risk/reward now feels asymmetric, time to reduce risk or to be selective.

TTR by region (25 yrs):

🥳

🥳

2004–07: Sovereigns outperformed on the commodity boom

2010–22: Deficits hurt sovereigns

Since 2022: Fiscal repair + CB credibility = sov tightening cycle

EM sovereigns spreads should continue to outperform corporates.

2004–07: Sovereigns outperformed on the commodity boom

2010–22: Deficits hurt sovereigns

Since 2022: Fiscal repair + CB credibility = sov tightening cycle

EM sovereigns spreads should continue to outperform corporates.

So what I’m saying is just I’m more cautious about spread duration risk locally.

So what I’m saying is just I’m more cautious about spread duration risk locally.

Imo we saw a rebound as mkt was running after papers due to light positioning. Except if we have strong inflows, dynamic should drop.

We are trading at 2-3 z score so prefer to reduce risk.

Imo we saw a rebound as mkt was running after papers due to light positioning. Except if we have strong inflows, dynamic should drop.

We are trading at 2-3 z score so prefer to reduce risk.

A comparison with Angola. Both are trading at c.12% (LE) and, we are still waiting for Senegal audits.

A comparison with Angola. Both are trading at c.12% (LE) and, we are still waiting for Senegal audits.

(I know it’s € vs $ papers but just to illustrate the trade)

(I know it’s € vs $ papers but just to illustrate the trade)

Metinvest 29 is priced 79.5

Just saw ppl sold it at…75

It’s like Private Equity/Debt, don’t confuse resilience and illiquidity 😉

(Teasing mood)

Metinvest 29 is priced 79.5

Just saw ppl sold it at…75

It’s like Private Equity/Debt, don’t confuse resilience and illiquidity 😉

(Teasing mood)

Reduced a lot of risk recently moving into the short part of curves +cash and starting to rebuild CDS positions. I’m still not holding rates outright

Feel consensus is cautious but not sure positioning is

Reduced a lot of risk recently moving into the short part of curves +cash and starting to rebuild CDS positions. I’m still not holding rates outright

Feel consensus is cautious but not sure positioning is

Sold 15%-20% of my CDS. Added a bit on Angola-Nigeria-Egypt on the LE part of the curve.

Still reluctant to step-in into Senegal even if LE low cash price start to be interesting.

Value has been created :

Sold 15%-20% of my CDS. Added a bit on Angola-Nigeria-Egypt on the LE part of the curve.

Still reluctant to step-in into Senegal even if LE low cash price start to be interesting.

Value has been created :

Just to understand the view, are you playing a short term rebound/building position or do you you think market is too worried about tariffs noises?

Tks

Just to understand the view, are you playing a short term rebound/building position or do you you think market is too worried about tariffs noises?

Tks

Frontier Market Spreads :

Frontier Market Spreads :