This is difficult. I look at liquidity as published by Cross Border and also have my own expectations re Inflation (I think AI will reduce services inflation massively) and debt issues in the US (I think the US Dollar will have a problem). We'll see.

This is difficult. I look at liquidity as published by Cross Border and also have my own expectations re Inflation (I think AI will reduce services inflation massively) and debt issues in the US (I think the US Dollar will have a problem). We'll see.

If we are in a bublle (I don't think we are), these typically end in a violent break out of an already steap upwards channel and price rises 100% in a short time. Then it falls through all previous levels. If this the case now, $BTC would rise to $130k ish.

If we are in a bublle (I don't think we are), these typically end in a violent break out of an already steap upwards channel and price rises 100% in a short time. Then it falls through all previous levels. If this the case now, $BTC would rise to $130k ish.

During all Bull markets, there comes a period when $BTC dominance falls by a large amount (30% or so) quickly. It is often the last leg when everyone gets excited about the newes alts. When $BTC dominance falls to 40%ish again, I will consider selling alts.

During all Bull markets, there comes a period when $BTC dominance falls by a large amount (30% or so) quickly. It is often the last leg when everyone gets excited about the newes alts. When $BTC dominance falls to 40%ish again, I will consider selling alts.

In strong Bull markets, periods of digestion will trend upwards (ie higher lows). When this changes to consolidations beginning to make lower highs instead, I will consider reducing positions.

In strong Bull markets, periods of digestion will trend upwards (ie higher lows). When this changes to consolidations beginning to make lower highs instead, I will consider reducing positions.

Whenever real demand is strong, $BTC (and $ETH) price in USD is typically higher than $USDT price. It means money coming into the market. Since Trump got elected, we've seen a steady Tether discount. If this flips for more than a few days, I lighten positions.

Whenever real demand is strong, $BTC (and $ETH) price in USD is typically higher than $USDT price. It means money coming into the market. Since Trump got elected, we've seen a steady Tether discount. If this flips for more than a few days, I lighten positions.

coinglass.com/FundingRateHea…

Historically, I cannot remember the market putting in a significant top till this map showed yellow and orange for about a week and a half. When that happens, you can be sure that I will cut my leverage.

coinglass.com/FundingRateHea…

Historically, I cannot remember the market putting in a significant top till this map showed yellow and orange for about a week and a half. When that happens, you can be sure that I will cut my leverage.

99.9% chance nothing happens to Binance international. All funds #safu.

BUT is that 0.1% chance losing your funds worth ignoring when you can SO easily self-custody in a wallet, even if just 3 months till DOJ situation is clear? I mean, come on…

99.9% chance nothing happens to Binance international. All funds #safu.

BUT is that 0.1% chance losing your funds worth ignoring when you can SO easily self-custody in a wallet, even if just 3 months till DOJ situation is clear? I mean, come on…

🙏

🙏

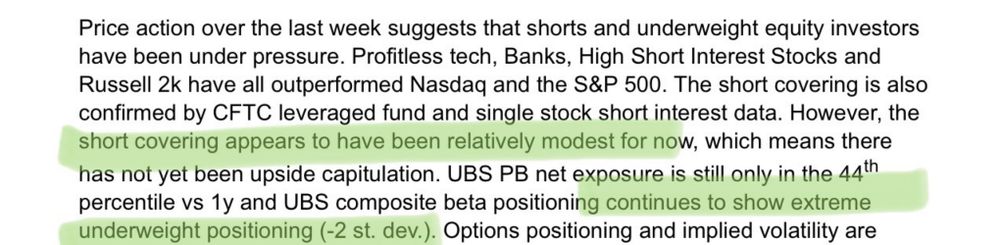

Inflation keeps dropping, Economy is staying strong.

Sure, you can debate 1 more hike or not, but to me this is a goldilocks scenario. 🤷🏻♂️

Inflation keeps dropping, Economy is staying strong.

Sure, you can debate 1 more hike or not, but to me this is a goldilocks scenario. 🤷🏻♂️

Actual inflation:

Actual inflation:

In a hypothetical world in which different AIs dominate global trade, if they were entirely free in their choice, out of all fiat, #crypto and commodities, which currency are they most likely to use for their transactions and why? #AI

Here is the answer. $ETH

In a hypothetical world in which different AIs dominate global trade, if they were entirely free in their choice, out of all fiat, #crypto and commodities, which currency are they most likely to use for their transactions and why? #AI

Here is the answer. $ETH

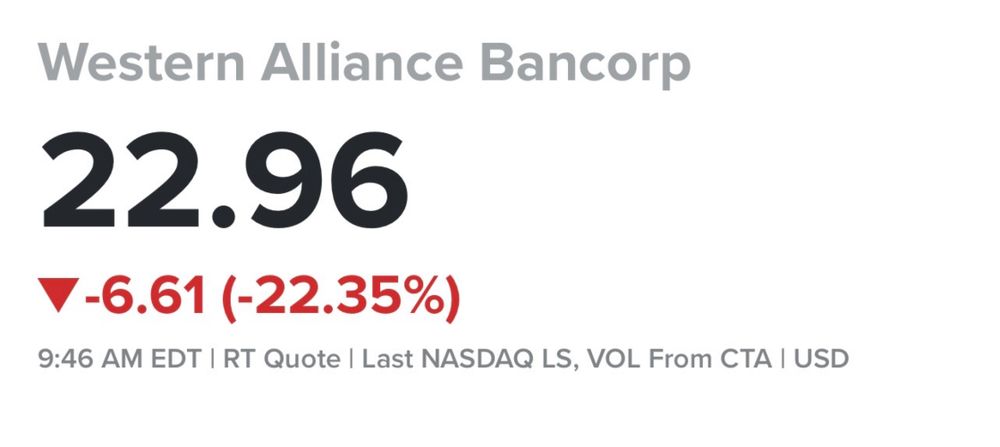

Though to be clear I think they had to mention all options for regulatory reasons. Think most of the other ones more likely than selling $BTC.

Credit to Rhorider on twitter for the screen.

Though to be clear I think they had to mention all options for regulatory reasons. Think most of the other ones more likely than selling $BTC.

Credit to Rhorider on twitter for the screen.