Here are key takeaways:

Here are key takeaways:

When I was an investor, I hated when everyone agreed.

Debate at moment within the Fed are some of the richest and should be healthy given we have two things happening at once - inflation & weak employment.

When I was an investor, I hated when everyone agreed.

Debate at moment within the Fed are some of the richest and should be healthy given we have two things happening at once - inflation & weak employment.

In person Powell emphasizes MAYBE we have seen growth pick up. Learn more dovish than his text, with rising downside risks to employment. BUT evolving outcomes - more caution next year

In person Powell emphasizes MAYBE we have seen growth pick up. Learn more dovish than his text, with rising downside risks to employment. BUT evolving outcomes - more caution next year

AI can’t save us - debt and deficits on unsustainable path & crisis risks rising.

Quote of day:

“We might find someone who argues we are on a sustainable path, but they would not be qualified to speak on this panel.

AI can’t save us - debt and deficits on unsustainable path & crisis risks rising.

Quote of day:

“We might find someone who argues we are on a sustainable path, but they would not be qualified to speak on this panel.

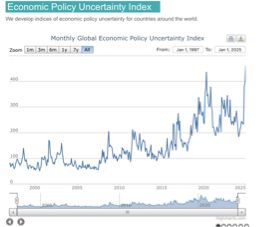

Telling graph:

Telling graph:

swans coming…

swans coming…

“The drag is stronger on investment than on consumption…” but hits both

That little blip before now…the onset of the pandemic. Stunning.

“The drag is stronger on investment than on consumption…” but hits both

That little blip before now…the onset of the pandemic. Stunning.

Raises risk of stagflation & tough tradeoffs. Watching inflation expectations closely. #nabe2025

Raises risk of stagflation & tough tradeoffs. Watching inflation expectations closely. #nabe2025

Higher inflation, lower growth in all three counties - vehicle sector hit hardest given the number of times parts cross the border before it becomes a 🚘

Higher inflation, lower growth in all three counties - vehicle sector hit hardest given the number of times parts cross the border before it becomes a 🚘

Why do we care? Uncertainty acts a tax on economic activity and will weigh on global growth if it persists.

Why do we care? Uncertainty acts a tax on economic activity and will weigh on global growth if it persists.