Daniel Zhao

@danielzhao.bsky.social

Glassdoor Chief Economist

glassdoor.com/research

I post charts about the job market and workplace trends

Formerly known as @DanielBZhao on Twitter

Maryland born & raised, now in NYC

glassdoor.com/research

I post charts about the job market and workplace trends

Formerly known as @DanielBZhao on Twitter

Maryland born & raised, now in NYC

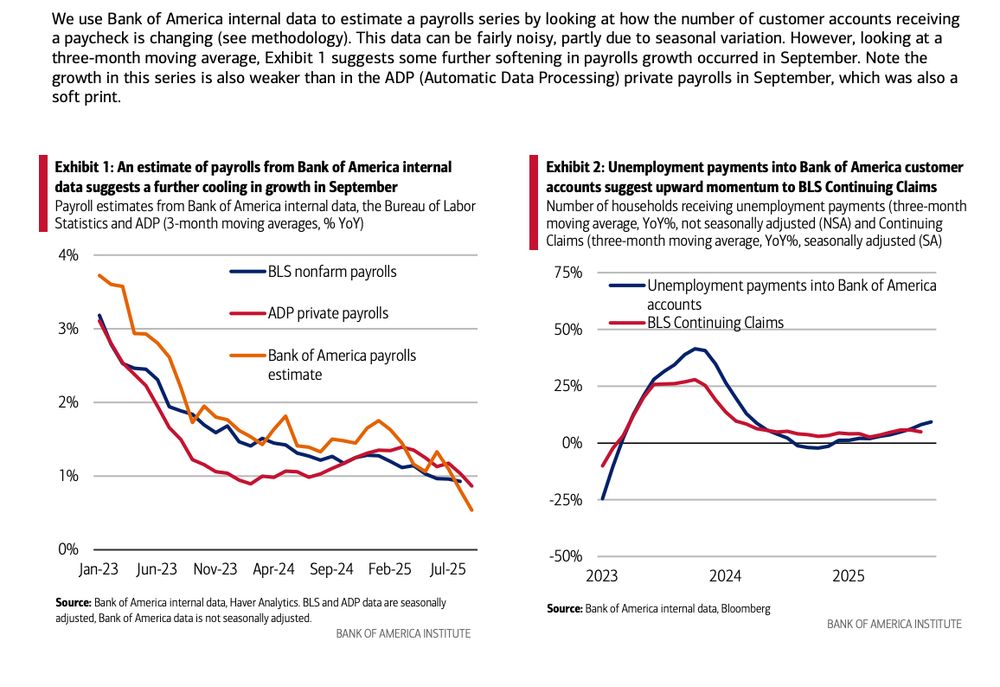

Bank of America Institute data from October points to ongoing job market slowing with estimated payroll growing slightly slower than ADP and unemployment payments growing faster than continuing claims.

institute.bankofamerica.com/content/dam/...

institute.bankofamerica.com/content/dam/...

November 7, 2025 at 1:41 AM

Bank of America Institute data from October points to ongoing job market slowing with estimated payroll growing slightly slower than ADP and unemployment payments growing faster than continuing claims.

institute.bankofamerica.com/content/dam/...

institute.bankofamerica.com/content/dam/...

Employee sentiment tumbled in October, according to the latest Glassdoor Employee Confidence Index. 45.7% of employees reported a positive business outlook for their employers in October, down from 47.8% in September.

www.glassdoor.com/blog/glassdo...

www.glassdoor.com/blog/glassdo...

November 6, 2025 at 3:18 PM

Employee sentiment tumbled in October, according to the latest Glassdoor Employee Confidence Index. 45.7% of employees reported a positive business outlook for their employers in October, down from 47.8% in September.

www.glassdoor.com/blog/glassdo...

www.glassdoor.com/blog/glassdo...

Amazon headcount grew in Q3 2025 to 1,578,000, up 2% QoQ & YoY and now at the highest level since Q1 2022.

The QoQ increase of 32,000 employees is ironically almost the same as their plan to cut 30,000 corporate employees, reported earlier this week: www.reuters.com/business/wor...

The QoQ increase of 32,000 employees is ironically almost the same as their plan to cut 30,000 corporate employees, reported earlier this week: www.reuters.com/business/wor...

October 30, 2025 at 9:16 PM

Amazon headcount grew in Q3 2025 to 1,578,000, up 2% QoQ & YoY and now at the highest level since Q1 2022.

The QoQ increase of 32,000 employees is ironically almost the same as their plan to cut 30,000 corporate employees, reported earlier this week: www.reuters.com/business/wor...

The QoQ increase of 32,000 employees is ironically almost the same as their plan to cut 30,000 corporate employees, reported earlier this week: www.reuters.com/business/wor...

Alphabet employee count up 2% QoQ, 5% YoY in Q3 2025, rising to 190,167, up from 187,103. That's also the highest level since Q1 2023 and also close to a new record high.

October 30, 2025 at 12:32 AM

Alphabet employee count up 2% QoQ, 5% YoY in Q3 2025, rising to 190,167, up from 187,103. That's also the highest level since Q1 2023 and also close to a new record high.

Meta employee count up 3% QoQ, 8% YoY in Q3 2025 to 78,450 from 75,945 in Q2

investor.atmeta.com/investor-new...

investor.atmeta.com/investor-new...

October 29, 2025 at 8:11 PM

Meta employee count up 3% QoQ, 8% YoY in Q3 2025 to 78,450 from 75,945 in Q2

investor.atmeta.com/investor-new...

investor.atmeta.com/investor-new...

Vanguard administrative data shows a sharp slowdown in employment growth starting in spring 2024 with employment growth for 21–25 year olds decelerating from +3.5% in April 2024 down to +2.1% as of September 2025

corporate.vanguard.com/content/corp...

corporate.vanguard.com/content/corp...

October 17, 2025 at 5:06 PM

Vanguard administrative data shows a sharp slowdown in employment growth starting in spring 2024 with employment growth for 21–25 year olds decelerating from +3.5% in April 2024 down to +2.1% as of September 2025

corporate.vanguard.com/content/corp...

corporate.vanguard.com/content/corp...

And closing the thread with a quote from the Kansas City Fed

October 15, 2025 at 7:02 PM

And closing the thread with a quote from the Kansas City Fed

AI is also showing up regularly in the Beige Book now with many mentions in October talking about reduced need for workers due to AI, like in this illustrative example from the Atlanta Fed.

October 15, 2025 at 7:00 PM

AI is also showing up regularly in the Beige Book now with many mentions in October talking about reduced need for workers due to AI, like in this illustrative example from the Atlanta Fed.

Similarly, mentions of uncertainty are also elevated but slightly lower compared to earlier in the year.

*One obvious source of uncertainty for Oct, the government shutdown, was only mentioned twice in the Beige Book

*One obvious source of uncertainty for Oct, the government shutdown, was only mentioned twice in the Beige Book

October 15, 2025 at 6:56 PM

Similarly, mentions of uncertainty are also elevated but slightly lower compared to earlier in the year.

*One obvious source of uncertainty for Oct, the government shutdown, was only mentioned twice in the Beige Book

*One obvious source of uncertainty for Oct, the government shutdown, was only mentioned twice in the Beige Book

Tariff concerns are still front and center in today's October Beige Book, though not as prominent as in the last few months post-Liberation Day.

This illustrative quote from the Kansas City Fed highlights pricing concerns have moved from a "boil to a simmer".

This illustrative quote from the Kansas City Fed highlights pricing concerns have moved from a "boil to a simmer".

October 15, 2025 at 6:52 PM

Tariff concerns are still front and center in today's October Beige Book, though not as prominent as in the last few months post-Liberation Day.

This illustrative quote from the Kansas City Fed highlights pricing concerns have moved from a "boil to a simmer".

This illustrative quote from the Kansas City Fed highlights pricing concerns have moved from a "boil to a simmer".

September CPI will be released in two weeks on Friday, Oct 24, 2025 at 8:30 AM ET to accommodate the SSA COLA adjustments despite the government shutdown.

Jobs report won't be released though

www.bls.gov/bls/092025-c...

Jobs report won't be released though

www.bls.gov/bls/092025-c...

October 10, 2025 at 3:49 PM

September CPI will be released in two weeks on Friday, Oct 24, 2025 at 8:30 AM ET to accommodate the SSA COLA adjustments despite the government shutdown.

Jobs report won't be released though

www.bls.gov/bls/092025-c...

Jobs report won't be released though

www.bls.gov/bls/092025-c...

Bank of America Institute data shows divergence in spending trends with higher-income household spending accelerating to 2.6% year-over-year in September while lower-income household spending grows at just 0.6% year-over-year

Source: institute.bankofamerica.com/economic-ins...

Source: institute.bankofamerica.com/economic-ins...

October 10, 2025 at 2:23 PM

Bank of America Institute data shows divergence in spending trends with higher-income household spending accelerating to 2.6% year-over-year in September while lower-income household spending grows at just 0.6% year-over-year

Source: institute.bankofamerica.com/economic-ins...

Source: institute.bankofamerica.com/economic-ins...

By contrast, furloughed federal workers were classified as unemployed on temporary layoff in the household survey, which boosted the unemployment rate during the 2019 shutdown.

October 8, 2025 at 2:57 PM

By contrast, furloughed federal workers were classified as unemployed on temporary layoff in the household survey, which boosted the unemployment rate during the 2019 shutdown.

Reading through the BLS's 2019 FAQ on govt shutdown and in the establishment survey, furloughed federal employees were still counted as employed because they were expected to receive back pay for the period.

www.bls.gov/bls/shutdown...

www.bls.gov/bls/shutdown...

October 8, 2025 at 2:55 PM

Reading through the BLS's 2019 FAQ on govt shutdown and in the establishment survey, furloughed federal employees were still counted as employed because they were expected to receive back pay for the period.

www.bls.gov/bls/shutdown...

www.bls.gov/bls/shutdown...

Some good details on the mechanics of when pay arrives for government workers from @gregorykorte.com

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

October 8, 2025 at 2:12 PM

Some good details on the mechanics of when pay arrives for government workers from @gregorykorte.com

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

I think making it enticing for people to get emotionally invested in the Jets is NOT a social good

source: @matt-levine.bsky.social, www.bloomberg.com/opinion/news...

source: @matt-levine.bsky.social, www.bloomberg.com/opinion/news...

October 7, 2025 at 9:37 PM

I think making it enticing for people to get emotionally invested in the Jets is NOT a social good

source: @matt-levine.bsky.social, www.bloomberg.com/opinion/news...

source: @matt-levine.bsky.social, www.bloomberg.com/opinion/news...

Bank of America Institute released internal data on the job market which showed further slowing in Sep.

Their continuing UI claims estimate is up +10% YoY vs. +5% YoY in recent govt data. And jobs growth is at about +0.5% YoY vs. +1% in Aug BLS data.

institute.bankofamerica.com/content/dam/...

Their continuing UI claims estimate is up +10% YoY vs. +5% YoY in recent govt data. And jobs growth is at about +0.5% YoY vs. +1% in Aug BLS data.

institute.bankofamerica.com/content/dam/...

October 7, 2025 at 5:08 PM

Bank of America Institute released internal data on the job market which showed further slowing in Sep.

Their continuing UI claims estimate is up +10% YoY vs. +5% YoY in recent govt data. And jobs growth is at about +0.5% YoY vs. +1% in Aug BLS data.

institute.bankofamerica.com/content/dam/...

Their continuing UI claims estimate is up +10% YoY vs. +5% YoY in recent govt data. And jobs growth is at about +0.5% YoY vs. +1% in Aug BLS data.

institute.bankofamerica.com/content/dam/...

We're not getting a jobs report today, so what does Glassdoor data say about the Sep job market? It's a mixed bag (which highlights how important it is even for alternative data to have BLS data set the context):

[1] The Glassdoor Employee Confidence Index improved in Sep rising to 47.7% from 45.6%

[1] The Glassdoor Employee Confidence Index improved in Sep rising to 47.7% from 45.6%

October 3, 2025 at 12:39 PM

We're not getting a jobs report today, so what does Glassdoor data say about the Sep job market? It's a mixed bag (which highlights how important it is even for alternative data to have BLS data set the context):

[1] The Glassdoor Employee Confidence Index improved in Sep rising to 47.7% from 45.6%

[1] The Glassdoor Employee Confidence Index improved in Sep rising to 47.7% from 45.6%

Been a while since we've updated our stats on this, but it's similar to what we saw on Glassdoor

Our 2024 intern, Luna Liu, also estimated how accurate ranges are & found many workers self-reporting pay outside the stated ranges (*this estimate is likely an upper bound on noncompliance)

1/2

Our 2024 intern, Luna Liu, also estimated how accurate ranges are & found many workers self-reporting pay outside the stated ranges (*this estimate is likely an upper bound on noncompliance)

1/2

October 2, 2025 at 5:02 PM

Been a while since we've updated our stats on this, but it's similar to what we saw on Glassdoor

Our 2024 intern, Luna Liu, also estimated how accurate ranges are & found many workers self-reporting pay outside the stated ranges (*this estimate is likely an upper bound on noncompliance)

1/2

Our 2024 intern, Luna Liu, also estimated how accurate ranges are & found many workers self-reporting pay outside the stated ranges (*this estimate is likely an upper bound on noncompliance)

1/2

September saw a modest rebound in the Glassdoor Employee Confidence Index, with 47.7% of employees reporting a positive business outlook for their employers.

Confidence is still down 0.5pp vs. a year ago, but sentiment has rebounded slightly from the record low in June.

1/

Confidence is still down 0.5pp vs. a year ago, but sentiment has rebounded slightly from the record low in June.

1/

October 2, 2025 at 1:39 PM

September saw a modest rebound in the Glassdoor Employee Confidence Index, with 47.7% of employees reporting a positive business outlook for their employers.

Confidence is still down 0.5pp vs. a year ago, but sentiment has rebounded slightly from the record low in June.

1/

Confidence is still down 0.5pp vs. a year ago, but sentiment has rebounded slightly from the record low in June.

1/

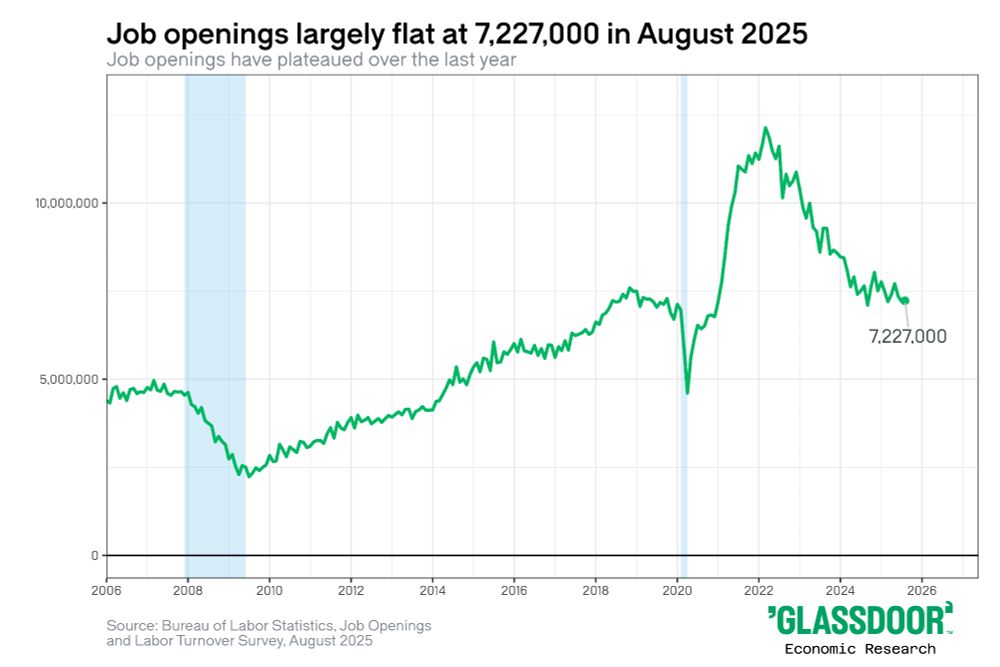

Chart from Wells Fargo Economics with JOLTS job openings compared to alternative labor demand indicators from Indeed and the Conference Board. All point to cooling demand for workers over the last year.

Source: wellsfargo.bluematrix.com/links2/html/...

Source: wellsfargo.bluematrix.com/links2/html/...

September 30, 2025 at 3:13 PM

Chart from Wells Fargo Economics with JOLTS job openings compared to alternative labor demand indicators from Indeed and the Conference Board. All point to cooling demand for workers over the last year.

Source: wellsfargo.bluematrix.com/links2/html/...

Source: wellsfargo.bluematrix.com/links2/html/...

The hires rate (3.2%) remains remarkably low given the current unemployment rate (4.3%). From 2008–13, when the hires rate was 3.2%, the unemployment rate averaged 8.8%, more than twice the current unemployment rate.

6/

6/

September 30, 2025 at 2:37 PM

The hires rate (3.2%) remains remarkably low given the current unemployment rate (4.3%). From 2008–13, when the hires rate was 3.2%, the unemployment rate averaged 8.8%, more than twice the current unemployment rate.

6/

6/

Construction job openings dropped sharply in August, falling to the lowest level since 2017, even lower than during Covid.

Note: Industry-level JOLTS data is very volatile month-to-month, but construction job openings are clearly sharply lower than their late-2023 peak.

5/

Note: Industry-level JOLTS data is very volatile month-to-month, but construction job openings are clearly sharply lower than their late-2023 peak.

5/

September 30, 2025 at 2:25 PM

Construction job openings dropped sharply in August, falling to the lowest level since 2017, even lower than during Covid.

Note: Industry-level JOLTS data is very volatile month-to-month, but construction job openings are clearly sharply lower than their late-2023 peak.

5/

Note: Industry-level JOLTS data is very volatile month-to-month, but construction job openings are clearly sharply lower than their late-2023 peak.

5/

Job openings were largely unchanged at 7,227,000. Openings have been mostly moving sideways since mid-2024.

At the same time, unemployment has been ticking up slightly, resulting in a ratio of job openings to unemployed workers falling below 1 in July and sinking further to 0.98 in August.

4/

At the same time, unemployment has been ticking up slightly, resulting in a ratio of job openings to unemployed workers falling below 1 in July and sinking further to 0.98 in August.

4/

September 30, 2025 at 2:18 PM

Job openings were largely unchanged at 7,227,000. Openings have been mostly moving sideways since mid-2024.

At the same time, unemployment has been ticking up slightly, resulting in a ratio of job openings to unemployed workers falling below 1 in July and sinking further to 0.98 in August.

4/

At the same time, unemployment has been ticking up slightly, resulting in a ratio of job openings to unemployed workers falling below 1 in July and sinking further to 0.98 in August.

4/

The quits rate also dropped to 1.9% in August from 2% in July, the lowest level all year. Quits are more comparable to 2015 levels, faring slightly better than hires, but still point to a tepid job market where workers aren't finding (or don't feel confident in their ability to find) other jobs.

3/

3/

September 30, 2025 at 2:15 PM

The quits rate also dropped to 1.9% in August from 2% in July, the lowest level all year. Quits are more comparable to 2015 levels, faring slightly better than hires, but still point to a tepid job market where workers aren't finding (or don't feel confident in their ability to find) other jobs.

3/

3/