Alas, we all know that this is quickly becoming old news with the incoming tariffs and boatload of uncertainty…

9/9

Alas, we all know that this is quickly becoming old news with the incoming tariffs and boatload of uncertainty…

9/9

In other words, there is a good reason to expect further declines in net exports.

8/

In other words, there is a good reason to expect further declines in net exports.

8/

We know net exports will drag on growth given their bounce in mid-2022 to 2023, which to a large degree was about drop in imports – after all imports were likely to bounce back at least a bit.

7/

We know net exports will drag on growth given their bounce in mid-2022 to 2023, which to a large degree was about drop in imports – after all imports were likely to bounce back at least a bit.

7/

First, we knew they the Q3 boost will not come again, so weakness was expected.

Second, inventories went further away from normal, so they will likely add in future quarters.

x.com/CrisisStuden...

6/

First, we knew they the Q3 boost will not come again, so weakness was expected.

Second, inventories went further away from normal, so they will likely add in future quarters.

x.com/CrisisStuden...

6/

We got at least some consumption growth everywhere – and that was on top of strong Q3.

And we got strong growth in fixed investment everywhere but France (alas for investment it is bounce back from previous quarter).

5/

We got at least some consumption growth everywhere – and that was on top of strong Q3.

And we got strong growth in fixed investment everywhere but France (alas for investment it is bounce back from previous quarter).

5/

4/

4/

All the major economies saw solid increases in final domestic demand, including Germany and France (0.23% and 0.22%).

3/

All the major economies saw solid increases in final domestic demand, including Germany and France (0.23% and 0.22%).

3/

Actually, in my opinion it was great. My preferred measure it was the best quarter in two years: Final domestic demand grew at very strong 0.53%.

In other words, the relatively subdued headline growth comes solely from net exports and inventories.

1/

Actually, in my opinion it was great. My preferred measure it was the best quarter in two years: Final domestic demand grew at very strong 0.53%.

In other words, the relatively subdued headline growth comes solely from net exports and inventories.

1/

One reason, really: drop in transport production drove a lot of the decline, and this is unlikely more than monthly noise to be reversed next year.

(That said, similar thing in reverse applies to jump in pharma production).

5/

One reason, really: drop in transport production drove a lot of the decline, and this is unlikely more than monthly noise to be reversed next year.

(That said, similar thing in reverse applies to jump in pharma production).

5/

4/

4/

3/

3/

Indeed, the jump in Ireland mostly offset drop in Germany, so excluding both meant decline of -1.5%

2/

Indeed, the jump in Ireland mostly offset drop in Germany, so excluding both meant decline of -1.5%

2/

That was the #eurozone industrial production release for December, which showed 1.1% decline on the month.

1/

That was the #eurozone industrial production release for December, which showed 1.1% decline on the month.

1/

So in our mind, the recovery is intact – albeit disappointing one.

5/

So in our mind, the recovery is intact – albeit disappointing one.

5/

Instead, it was net exports which likely dragged on growth – with France and Spain showing as much.

4/

Instead, it was net exports which likely dragged on growth – with France and Spain showing as much.

4/

There was little if any growth to be found outside of Iberian Peninsula. Germany and France saw small contractions, Italy, Austria and Belgium stagnation.

2/

There was little if any growth to be found outside of Iberian Peninsula. Germany and France saw small contractions, Italy, Austria and Belgium stagnation.

2/

Luckily for doves, this won’t change the outcome of January and March meetings.

But I am increasingly more convinced that April will be a skip.

11/

Luckily for doves, this won’t change the outcome of January and March meetings.

But I am increasingly more convinced that April will be a skip.

11/

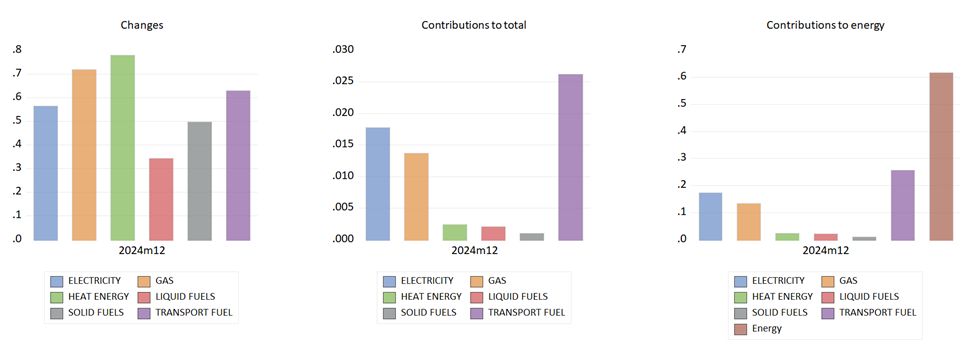

For example, the decline in German gas prices is for now over, which is not a good sign at all.

10/

For example, the decline in German gas prices is for now over, which is not a good sign at all.

10/

9/

9/

8/

8/

There hasn’t been any slowdown in coffee and tea prices yet, and while olive oil prices are dropping quickly, butter is doing its best to compensate.

7/

There hasn’t been any slowdown in coffee and tea prices yet, and while olive oil prices are dropping quickly, butter is doing its best to compensate.

7/

The monthly increase was flattered by large drop in vegetable prices, that subtracted 0.15% from the 0.04% overall increase.

6/

The monthly increase was flattered by large drop in vegetable prices, that subtracted 0.15% from the 0.04% overall increase.

6/

There were some one offs, mainly in clothing, but also some goods news, such as renewed decline in household appliances.

5/

There were some one offs, mainly in clothing, but also some goods news, such as renewed decline in household appliances.

5/

We need more progress next year to keep inflation close to 2%.

4/

We need more progress next year to keep inflation close to 2%.

4/