I think the answer to both questions is “No”.

A longish thread motivated by @bob.

1/

Actually, in my opinion it was great. My preferred measure it was the best quarter in two years: Final domestic demand grew at very strong 0.53%.

In other words, the relatively subdued headline growth comes solely from net exports and inventories.

1/

Actually, in my opinion it was great. My preferred measure it was the best quarter in two years: Final domestic demand grew at very strong 0.53%.

In other words, the relatively subdued headline growth comes solely from net exports and inventories.

1/

That was the #eurozone industrial production release for December, which showed 1.1% decline on the month.

1/

That was the #eurozone industrial production release for December, which showed 1.1% decline on the month.

1/

It definitively wasn’t a good month, but neither was it a terrible month.

1/

It definitively wasn’t a good month, but neither was it a terrible month.

1/

0.2% increase for eurozone aggregate, and bigger jump of 0.7% when excluding Ireland.

1/

0.2% increase for eurozone aggregate, and bigger jump of 0.7% when excluding Ireland.

1/

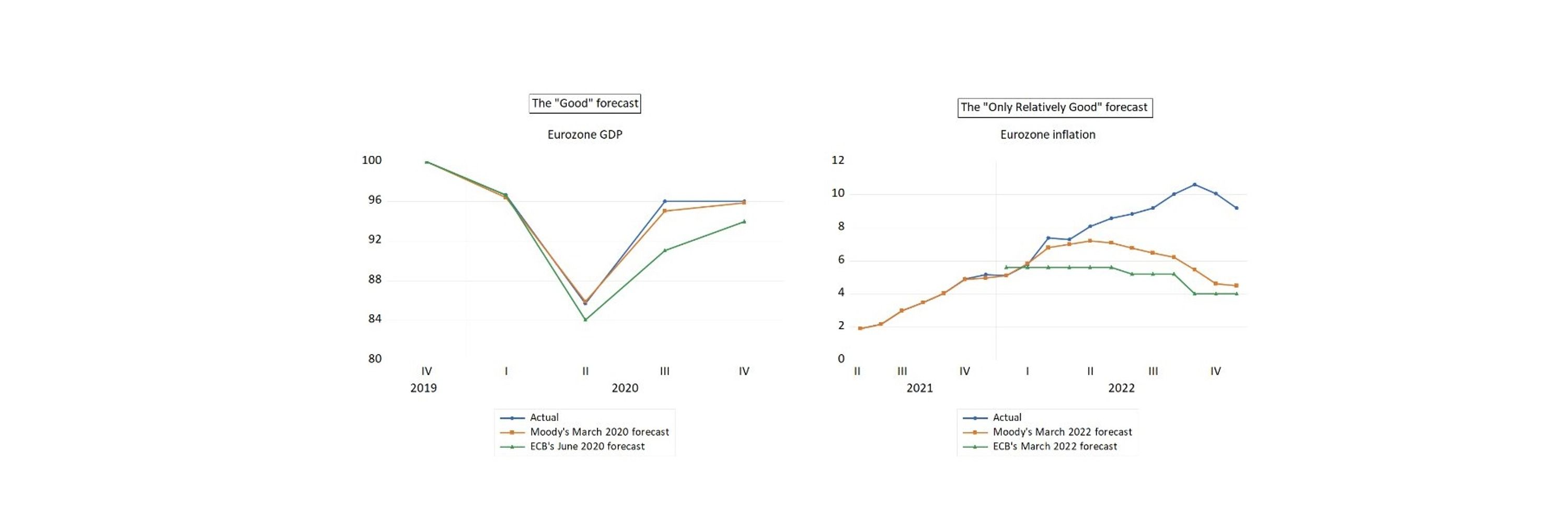

I think the answer to both questions is “No”.

A longish thread motivated by @bob.

1/

I think the answer to both questions is “No”.

A longish thread motivated by @bob.

1/

Headline inflation surprised significantly on the upside (2.44% vs our expectation of 2.29%), with energy and especially services the main culprit.

1/

Headline inflation surprised significantly on the upside (2.44% vs our expectation of 2.29%), with energy and especially services the main culprit.

1/

While headline number showed no change, stripping volatile Ireland there was a 0.5% decline.

And while this was mostly about Germany, we even saw another moderate decline elsewhere.

1/

While headline number showed no change, stripping volatile Ireland there was a 0.5% decline.

And while this was mostly about Germany, we even saw another moderate decline elsewhere.

1/

Once you don't distort the left axis by including pandemic period, you can see that the increase in savings rate is both dramatic and unprecedented.

Friday data should show a decline, but still..

Once you don't distort the left axis by including pandemic period, you can see that the increase in savings rate is both dramatic and unprecedented.

Friday data should show a decline, but still..

Headlines will be full of rebound in overall inflation, but that is old news driven by last November’s base effects.

Instead, the main news was the soft services, which actually declined during the month.

1/

Headlines will be full of rebound in overall inflation, but that is old news driven by last November’s base effects.

Instead, the main news was the soft services, which actually declined during the month.

1/

The main takeaway is that October numbers were juiced up.

At the same time there is clear evidence that the disinflationary forces are waning.

1/

The main takeaway is that October numbers were juiced up.

At the same time there is clear evidence that the disinflationary forces are waning.

1/