Claudia Sahm

@claudia-sahm.bsky.social

macro, fiscal, Fed. creator of the Sahm rule recession indicator. Stay-At-Home Macro (SAHM) Substack.

Credit-card interest rates, which are short-term, move closely with the federal funds rate, so it’s a reasonable place to look for the effects of monetary policy.

November 5, 2025 at 6:29 PM

Credit-card interest rates, which are short-term, move closely with the federal funds rate, so it’s a reasonable place to look for the effects of monetary policy.

An analysis of credit card usage at the Boston Fed showed that after 2022 — the year when the Fed hiked rates — inflation-adjusted spending by low-income consumers has flatlined. Higher-income consumers have driven the growth in real spending with credit cards. www.bostonfed.org/publications...

November 5, 2025 at 6:28 PM

An analysis of credit card usage at the Boston Fed showed that after 2022 — the year when the Fed hiked rates — inflation-adjusted spending by low-income consumers has flatlined. Higher-income consumers have driven the growth in real spending with credit cards. www.bostonfed.org/publications...

The BLS/BEA estimates of consumer spending by income are much less skewed toward the highest income than the Moody's estimate. www.bea.gov/data/special.... Still skewed. While series is shorter, 2004-2022, the upward drift in top share is less clear.

October 15, 2025 at 3:42 PM

The BLS/BEA estimates of consumer spending by income are much less skewed toward the highest income than the Moody's estimate. www.bea.gov/data/special.... Still skewed. While series is shorter, 2004-2022, the upward drift in top share is less clear.

hard to see any reaction to the government shutdown in the Michigan Survey ... typically such dysfunction leaves an imprint. of course, views were already quite downbeat.

October 10, 2025 at 2:46 PM

hard to see any reaction to the government shutdown in the Michigan Survey ... typically such dysfunction leaves an imprint. of course, views were already quite downbeat.

Similar to Miran (and Bessent) in my post, Bowman, in her speech last week, had an anti-data vibe. www.federalreserve.gov/newsevents/s...

September 29, 2025 at 5:19 PM

Similar to Miran (and Bessent) in my post, Bowman, in her speech last week, had an anti-data vibe. www.federalreserve.gov/newsevents/s...

This season of The Apprentice is getting really old.

September 29, 2025 at 12:25 AM

This season of The Apprentice is getting really old.

FT survey is not an outlier. Near unanimous support for Waller in survey of former Fed officials and staff. econ.duke.edu/news/new-sur...

September 28, 2025 at 5:00 PM

FT survey is not an outlier. Near unanimous support for Waller in survey of former Fed officials and staff. econ.duke.edu/news/new-sur...

Hunger is too scary to measure?

September 22, 2025 at 4:02 PM

Hunger is too scary to measure?

Absolute respect for the staff at the stats agencies who keep the innovation going, despite the challenges. These new data will be helpful. Do not take this for granted.

September 21, 2025 at 8:01 PM

Absolute respect for the staff at the stats agencies who keep the innovation going, despite the challenges. These new data will be helpful. Do not take this for granted.

It's frustrating to see data quality undermined by this administration. This week's annual revision to the national accounts hit, too. www.bea.gov/information-.... That data have been important in the past.

September 21, 2025 at 7:58 PM

It's frustrating to see data quality undermined by this administration. This week's annual revision to the national accounts hit, too. www.bea.gov/information-.... That data have been important in the past.

Contra to Scott Alvarez, I believe the President already has taken "adverse action" against the Fed.

September 15, 2025 at 4:40 PM

Contra to Scott Alvarez, I believe the President already has taken "adverse action" against the Fed.

Btw Miran's biggest critic should be himself. Last year he had scathing words for people moving from the the White House to the Fed (my emphasis added). LIKE HIM NOW. Has he changed his mind? Are we naïve or sinister to believe him?

September 4, 2025 at 2:01 PM

Btw Miran's biggest critic should be himself. Last year he had scathing words for people moving from the the White House to the Fed (my emphasis added). LIKE HIM NOW. Has he changed his mind? Are we naïve or sinister to believe him?

My thoughts on Miran's confirmation hearing, including some of his past writings. I would be more sympathetic to his big think ideas in the past if the President weren't being so aggressive in his pressure campaign now.

September 4, 2025 at 1:07 PM

My thoughts on Miran's confirmation hearing, including some of his past writings. I would be more sympathetic to his big think ideas in the past if the President weren't being so aggressive in his pressure campaign now.

Q: "Are there things about the Fed that you felt majorly needed changing?"

Me: "I’m all for innovation and improvement and thinking outside the box ... but it should come from a place of “we’re trying to do better” as opposed to burning it all down. "

www.ft.com/content/6835...

Me: "I’m all for innovation and improvement and thinking outside the box ... but it should come from a place of “we’re trying to do better” as opposed to burning it all down. "

www.ft.com/content/6835...

August 28, 2025 at 5:46 PM

Q: "Are there things about the Fed that you felt majorly needed changing?"

Me: "I’m all for innovation and improvement and thinking outside the box ... but it should come from a place of “we’re trying to do better” as opposed to burning it all down. "

www.ft.com/content/6835...

Me: "I’m all for innovation and improvement and thinking outside the box ... but it should come from a place of “we’re trying to do better” as opposed to burning it all down. "

www.ft.com/content/6835...

Treating the Fed’s independence as a joke is very disturbing. And so predictable at this point.

August 20, 2025 at 3:16 PM

Treating the Fed’s independence as a joke is very disturbing. And so predictable at this point.

this week’s my first time fishing since I was a kid … caught some (and released).

August 9, 2025 at 9:28 PM

this week’s my first time fishing since I was a kid … caught some (and released).

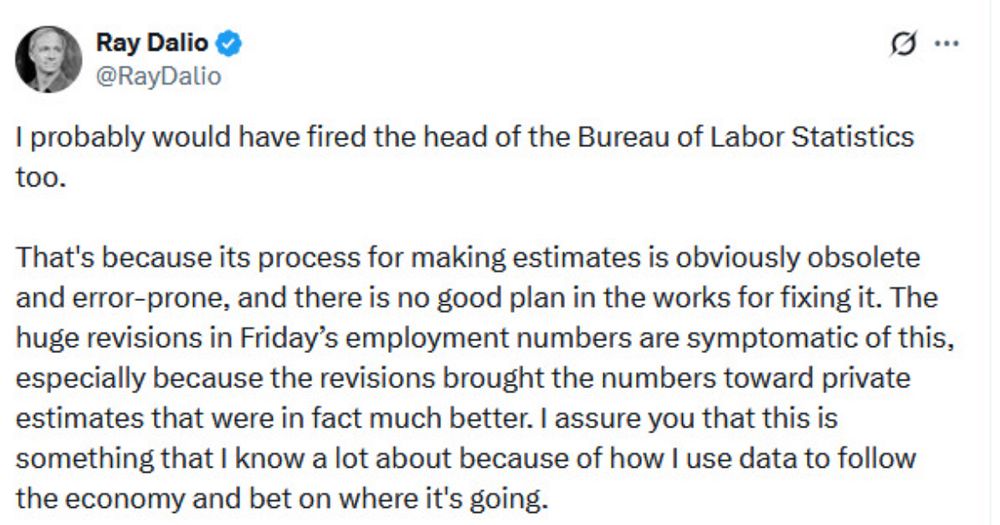

My 'inspiration' for the piece was Ray Dalio, but he is hardly the only person who pointed to private data being better.

August 8, 2025 at 7:56 PM

My 'inspiration' for the piece was Ray Dalio, but he is hardly the only person who pointed to private data being better.

my first lobster roll (very good), looking forward to Camp Kotok

August 6, 2025 at 8:19 PM

my first lobster roll (very good), looking forward to Camp Kotok

Yes, I talk about the revisions.

The problem is not the Bureau of Labor Statistics. Large, unpredictable shifts in economic policy are placing unusual strains on our measurement apparatus because they are causing large, unpredictable changes in the behavior of consumers and businesses.

The problem is not the Bureau of Labor Statistics. Large, unpredictable shifts in economic policy are placing unusual strains on our measurement apparatus because they are causing large, unpredictable changes in the behavior of consumers and businesses.

August 5, 2025 at 6:30 PM

Yes, I talk about the revisions.

The problem is not the Bureau of Labor Statistics. Large, unpredictable shifts in economic policy are placing unusual strains on our measurement apparatus because they are causing large, unpredictable changes in the behavior of consumers and businesses.

The problem is not the Bureau of Labor Statistics. Large, unpredictable shifts in economic policy are placing unusual strains on our measurement apparatus because they are causing large, unpredictable changes in the behavior of consumers and businesses.

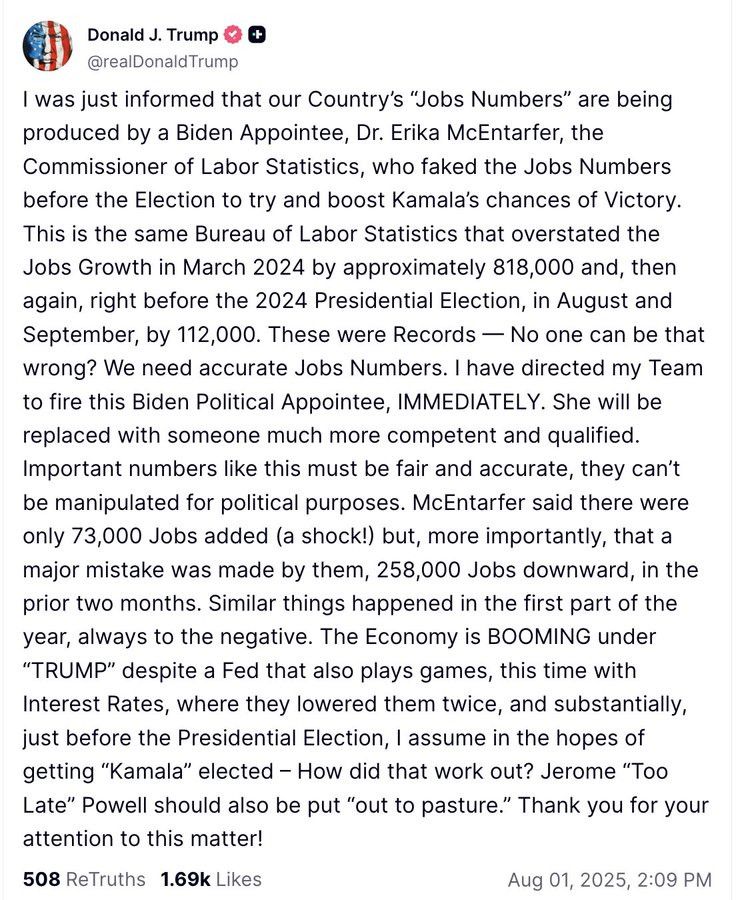

Excusing the inexcusable. The firing was political retribution for bad news. President’s own words.

August 4, 2025 at 9:10 PM

Excusing the inexcusable. The firing was political retribution for bad news. President’s own words.

Firing the BLS Commissioner because you don't like the data is a dark day.

August 1, 2025 at 6:24 PM

Firing the BLS Commissioner because you don't like the data is a dark day.

Disruptions from less immigration would be greater since the economy is now close to full employment. Plus, there's a job mismatch. For example, unauthorized immigrants are 8 times more likely than US-born workers to be house cleaners, and more than twice as likely as authorized immigrants.

July 18, 2025 at 7:44 PM

Disruptions from less immigration would be greater since the economy is now close to full employment. Plus, there's a job mismatch. For example, unauthorized immigrants are 8 times more likely than US-born workers to be house cleaners, and more than twice as likely as authorized immigrants.

After a surge from 2021 to '24, unauthorized immigration is expected to fall sharply. Researchers at the Dallas Fed studied scenarios of immigration/deportation. In their baseline (black line) vs CBO (green), GDP growth is 0.8 percentage point lower this year. www.dallasfed.org/research/eco...

July 18, 2025 at 7:19 PM

After a surge from 2021 to '24, unauthorized immigration is expected to fall sharply. Researchers at the Dallas Fed studied scenarios of immigration/deportation. In their baseline (black line) vs CBO (green), GDP growth is 0.8 percentage point lower this year. www.dallasfed.org/research/eco...

more like resigning in 2028 when his term as a Fed Governor is up.

July 11, 2025 at 8:50 PM

more like resigning in 2028 when his term as a Fed Governor is up.

“The hottest country in the world.”

That’s exactly what the Fed’s worried about. Inflation.

That’s exactly what the Fed’s worried about. Inflation.

July 9, 2025 at 7:48 PM

“The hottest country in the world.”

That’s exactly what the Fed’s worried about. Inflation.

That’s exactly what the Fed’s worried about. Inflation.