Corey Husak

@chusak.bsky.social

Tax and Labor Policy analysis. Currently Director at

@americanprogress.bsky.social

@americanprogress.bsky.social

It's probably the worst provision in the tax code

October 29, 2025 at 2:18 AM

It's probably the worst provision in the tax code

After most Rs spent all year arguing that--letting a less-targeted tax expenditure expire was an intolerable tax increase--it is crazy to be *increasing taxes by more* on the neediest small businesses.

Read more here: www.americanprogress.org/article/cong...

Read more here: www.americanprogress.org/article/cong...

Congress’ Failure To Extend Enhanced Premium Tax Credits Will Greatly Increase Health Insurance Costs for Small-Business People

4.4 million small-business people face an average $1,500 increase in premium costs for 2026 if enhanced tax credits expire.

www.americanprogress.org

October 28, 2025 at 3:01 PM

After most Rs spent all year arguing that--letting a less-targeted tax expenditure expire was an intolerable tax increase--it is crazy to be *increasing taxes by more* on the neediest small businesses.

Read more here: www.americanprogress.org/article/cong...

Read more here: www.americanprogress.org/article/cong...

Speaker Johnson, incredibly, said that continuing the premium tax credits would be “subsidizing high-income earners.”

I have the receipts and its his 199A deduction that subsidizes high-earners. Premium tax credits do not.

I have the receipts and its his 199A deduction that subsidizes high-earners. Premium tax credits do not.

October 28, 2025 at 3:01 PM

Speaker Johnson, incredibly, said that continuing the premium tax credits would be “subsidizing high-income earners.”

I have the receipts and its his 199A deduction that subsidizes high-earners. Premium tax credits do not.

I have the receipts and its his 199A deduction that subsidizes high-earners. Premium tax credits do not.

Letting another temporary tax provision expire, 199A, meant “small business owners would face massive tax hikes” per (R) @senatefinance.bsky.social

Now millions of small businesses are facing a larger tax hike and they do nothing

www.finance.senate.gov/chairmans-ne...

Now millions of small businesses are facing a larger tax hike and they do nothing

www.finance.senate.gov/chairmans-ne...

Republicans are Preventing the Largest Tax Hike in History | The United States Senate Committee on Finance

Republicans are Preventing the Largest Tax Hike in History

www.finance.senate.gov

October 28, 2025 at 3:00 PM

Letting another temporary tax provision expire, 199A, meant “small business owners would face massive tax hikes” per (R) @senatefinance.bsky.social

Now millions of small businesses are facing a larger tax hike and they do nothing

www.finance.senate.gov/chairmans-ne...

Now millions of small businesses are facing a larger tax hike and they do nothing

www.finance.senate.gov/chairmans-ne...

Premium Tax Credits are especially important to small businesspeople. Per Treasury they’re 28% of marketplaces.

Most Americans have employer-sponsored insurance, but self-employed are their own employer. PTCs are how we give them the tax financial support we give everyone else

Most Americans have employer-sponsored insurance, but self-employed are their own employer. PTCs are how we give them the tax financial support we give everyone else

October 28, 2025 at 3:00 PM

Premium Tax Credits are especially important to small businesspeople. Per Treasury they’re 28% of marketplaces.

Most Americans have employer-sponsored insurance, but self-employed are their own employer. PTCs are how we give them the tax financial support we give everyone else

Most Americans have employer-sponsored insurance, but self-employed are their own employer. PTCs are how we give them the tax financial support we give everyone else

Reposted by Corey Husak

We already have a system where the results of most elections are predetermined because the Supreme Court allows partisan gerrymandering. Eliminating the VRA’s representation requirements allows the full slate of members from each state to be predetermined by a single party.

October 15, 2025 at 7:26 PM

We already have a system where the results of most elections are predetermined because the Supreme Court allows partisan gerrymandering. Eliminating the VRA’s representation requirements allows the full slate of members from each state to be predetermined by a single party.

We do 2027 and 2029 because many parts of the OBBBA are temporary or phase in slowly. This gives a view of the law's effects before and after their temporary tax cuts for tips/overtime etc expire, and as Medicaid cuts grow.

In 2029 everyone is in the negative

In 2029 everyone is in the negative

September 10, 2025 at 2:19 PM

We do 2027 and 2029 because many parts of the OBBBA are temporary or phase in slowly. This gives a view of the law's effects before and after their temporary tax cuts for tips/overtime etc expire, and as Medicaid cuts grow.

In 2029 everyone is in the negative

In 2029 everyone is in the negative

This measures changes enacted, so: how will Americans' pocketbooks change Jan 2025-2027?

Includes only *new* parts of the Big Beautiful Bill, plus tariffs. (With healthcare subsidy expiration, Middle Class would be ~$300 lower)

www.americanprogress.org/article/new-...

Includes only *new* parts of the Big Beautiful Bill, plus tariffs. (With healthcare subsidy expiration, Middle Class would be ~$300 lower)

www.americanprogress.org/article/new-...

New Trump Administration Policies Will Decrease Average Incomes for All Americans Except the Top 1 Percent

New policies in the One Big Beautiful Bill Act, paired with the Trump administration’s tariffs, will leave the bottom 99 percent of Americans with less after-tax-and-transfer income by 2027, while the...

www.americanprogress.org

September 10, 2025 at 2:18 PM

This measures changes enacted, so: how will Americans' pocketbooks change Jan 2025-2027?

Includes only *new* parts of the Big Beautiful Bill, plus tariffs. (With healthcare subsidy expiration, Middle Class would be ~$300 lower)

www.americanprogress.org/article/new-...

Includes only *new* parts of the Big Beautiful Bill, plus tariffs. (With healthcare subsidy expiration, Middle Class would be ~$300 lower)

www.americanprogress.org/article/new-...

Read more here: www.americanprogress.org/article/desp...

Despite ‘No Tax on Tips,’ Trump’s Big ‘Beautiful’ Bill Is Bad for Tipped Workers

“No tax on tips” is a symbolic tax break that is very limited and poorly targets the workers who need tax relief the most. Many among the small number of workers who will benefit will also face the bi...

www.americanprogress.org

July 31, 2025 at 5:52 PM

Read more here: www.americanprogress.org/article/desp...

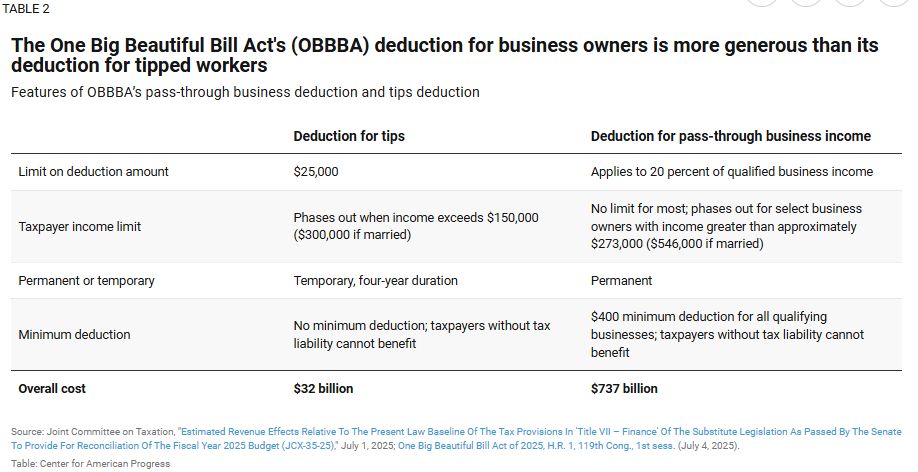

Finally, “No Tax on Tips” will be difficult to access.

Its a tax deduction (not a credit, not a min. wage) with many restrictions. i.e. 1/3 of all tipped workers don’t have a tax liability to deduct from.

Business tax breaks in the bill don’t have similar restrictions…

Its a tax deduction (not a credit, not a min. wage) with many restrictions. i.e. 1/3 of all tipped workers don’t have a tax liability to deduct from.

Business tax breaks in the bill don’t have similar restrictions…

July 31, 2025 at 5:51 PM

Finally, “No Tax on Tips” will be difficult to access.

Its a tax deduction (not a credit, not a min. wage) with many restrictions. i.e. 1/3 of all tipped workers don’t have a tax liability to deduct from.

Business tax breaks in the bill don’t have similar restrictions…

Its a tax deduction (not a credit, not a min. wage) with many restrictions. i.e. 1/3 of all tipped workers don’t have a tax liability to deduct from.

Business tax breaks in the bill don’t have similar restrictions…