Corey Husak

@chusak.bsky.social

Tax and Labor Policy analysis. Currently Director at

@americanprogress.bsky.social

@americanprogress.bsky.social

Speaker Johnson, incredibly, said that continuing the premium tax credits would be “subsidizing high-income earners.”

I have the receipts and its his 199A deduction that subsidizes high-earners. Premium tax credits do not.

I have the receipts and its his 199A deduction that subsidizes high-earners. Premium tax credits do not.

October 28, 2025 at 3:01 PM

Speaker Johnson, incredibly, said that continuing the premium tax credits would be “subsidizing high-income earners.”

I have the receipts and its his 199A deduction that subsidizes high-earners. Premium tax credits do not.

I have the receipts and its his 199A deduction that subsidizes high-earners. Premium tax credits do not.

New @americanprogress.bsky.social I find that 4.4 million small business owners and self-employed people face a $1,500 mean tax hike this year.

When enhanced marketplace tax credits expire, businesspeople making <$150k, face a larger tax hike than eliminating the passthru deduction

When enhanced marketplace tax credits expire, businesspeople making <$150k, face a larger tax hike than eliminating the passthru deduction

October 28, 2025 at 3:00 PM

New @americanprogress.bsky.social I find that 4.4 million small business owners and self-employed people face a $1,500 mean tax hike this year.

When enhanced marketplace tax credits expire, businesspeople making <$150k, face a larger tax hike than eliminating the passthru deduction

When enhanced marketplace tax credits expire, businesspeople making <$150k, face a larger tax hike than eliminating the passthru deduction

We do 2027 and 2029 because many parts of the OBBBA are temporary or phase in slowly. This gives a view of the law's effects before and after their temporary tax cuts for tips/overtime etc expire, and as Medicaid cuts grow.

In 2029 everyone is in the negative

In 2029 everyone is in the negative

September 10, 2025 at 2:19 PM

We do 2027 and 2029 because many parts of the OBBBA are temporary or phase in slowly. This gives a view of the law's effects before and after their temporary tax cuts for tips/overtime etc expire, and as Medicaid cuts grow.

In 2029 everyone is in the negative

In 2029 everyone is in the negative

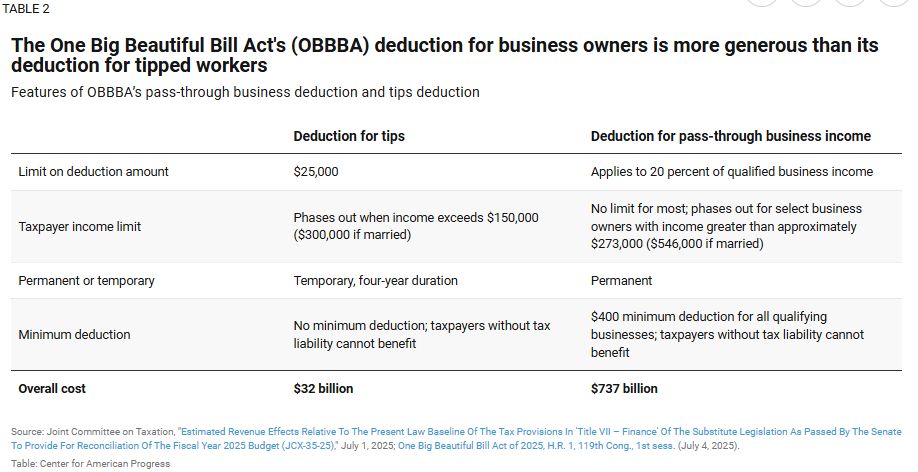

Finally, “No Tax on Tips” will be difficult to access.

Its a tax deduction (not a credit, not a min. wage) with many restrictions. i.e. 1/3 of all tipped workers don’t have a tax liability to deduct from.

Business tax breaks in the bill don’t have similar restrictions…

Its a tax deduction (not a credit, not a min. wage) with many restrictions. i.e. 1/3 of all tipped workers don’t have a tax liability to deduct from.

Business tax breaks in the bill don’t have similar restrictions…

July 31, 2025 at 5:51 PM

Finally, “No Tax on Tips” will be difficult to access.

Its a tax deduction (not a credit, not a min. wage) with many restrictions. i.e. 1/3 of all tipped workers don’t have a tax liability to deduct from.

Business tax breaks in the bill don’t have similar restrictions…

Its a tax deduction (not a credit, not a min. wage) with many restrictions. i.e. 1/3 of all tipped workers don’t have a tax liability to deduct from.

Business tax breaks in the bill don’t have similar restrictions…

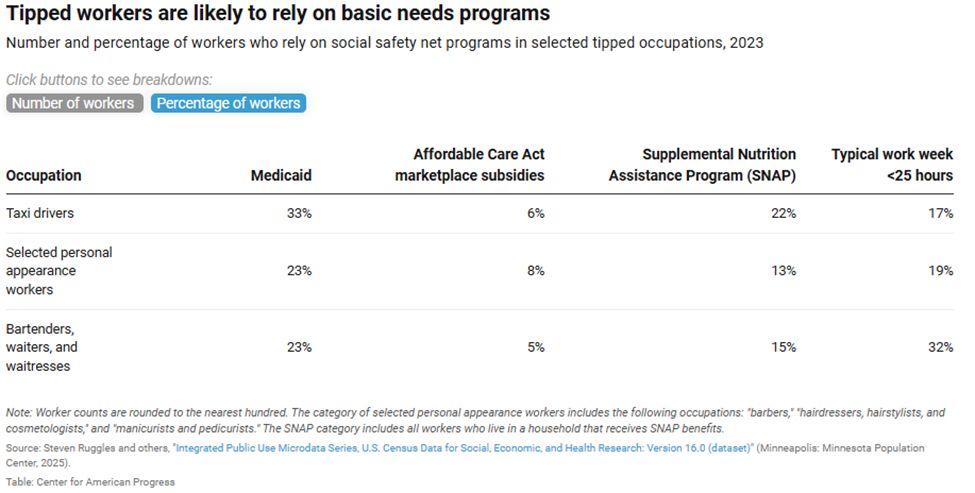

Tipped workers are mostly low-income and only 1/3 get health insurance at work. We present the first estimates of how many tipped workers are vulnerable to the coming Medicaid, ACA and SNAP cuts. Its well over 1 million (over 30%)

July 31, 2025 at 5:49 PM

Tipped workers are mostly low-income and only 1/3 get health insurance at work. We present the first estimates of how many tipped workers are vulnerable to the coming Medicaid, ACA and SNAP cuts. Its well over 1 million (over 30%)

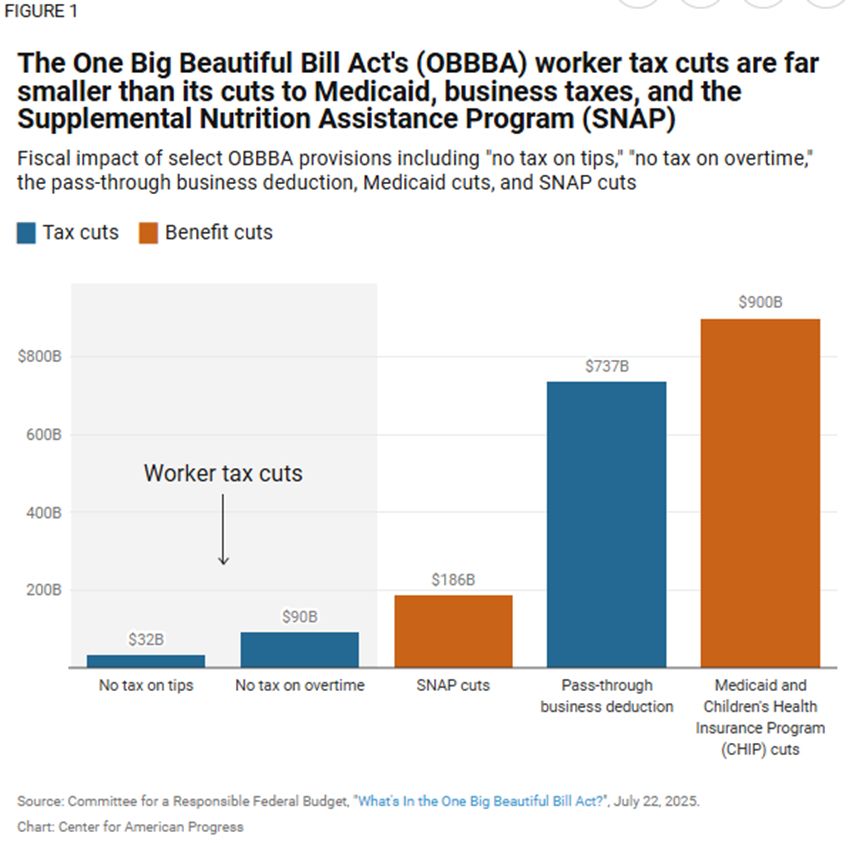

New research from me @americanprogress.bsky.social

today: How will Trump’s OBBBA affect tipped workers?

Most have focused on “no tax on tips”, but tipped workers are esp. vulnerable to the bill’s program cuts. Medicaid & SNAP cuts vastly outweigh the worker tax cuts

today: How will Trump’s OBBBA affect tipped workers?

Most have focused on “no tax on tips”, but tipped workers are esp. vulnerable to the bill’s program cuts. Medicaid & SNAP cuts vastly outweigh the worker tax cuts

July 31, 2025 at 5:49 PM

New research from me @americanprogress.bsky.social

today: How will Trump’s OBBBA affect tipped workers?

Most have focused on “no tax on tips”, but tipped workers are esp. vulnerable to the bill’s program cuts. Medicaid & SNAP cuts vastly outweigh the worker tax cuts

today: How will Trump’s OBBBA affect tipped workers?

Most have focused on “no tax on tips”, but tipped workers are esp. vulnerable to the bill’s program cuts. Medicaid & SNAP cuts vastly outweigh the worker tax cuts

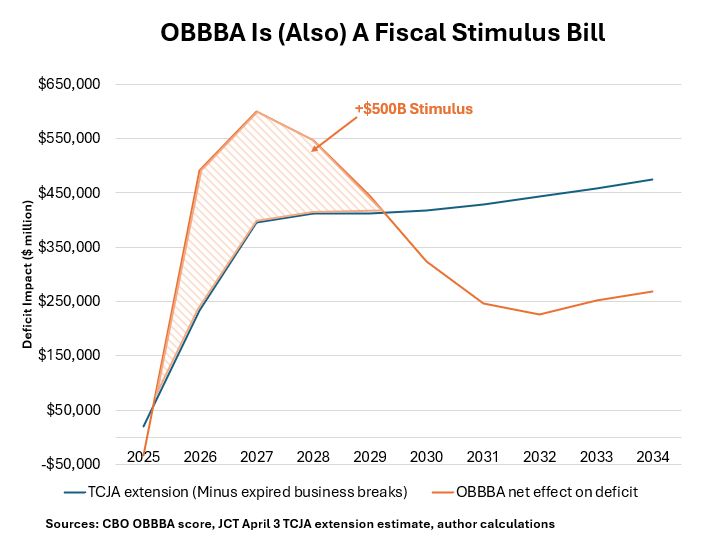

After years of debates about inflation and fiscal stimulus, its striking that Republicans are passing a new fiscal stimulus.

Even relative to current policy, this bill pours $500 billion into the economy, mostly over the next 3 years

Even relative to current policy, this bill pours $500 billion into the economy, mostly over the next 3 years

July 3, 2025 at 4:52 PM

After years of debates about inflation and fiscal stimulus, its striking that Republicans are passing a new fiscal stimulus.

Even relative to current policy, this bill pours $500 billion into the economy, mostly over the next 3 years

Even relative to current policy, this bill pours $500 billion into the economy, mostly over the next 3 years

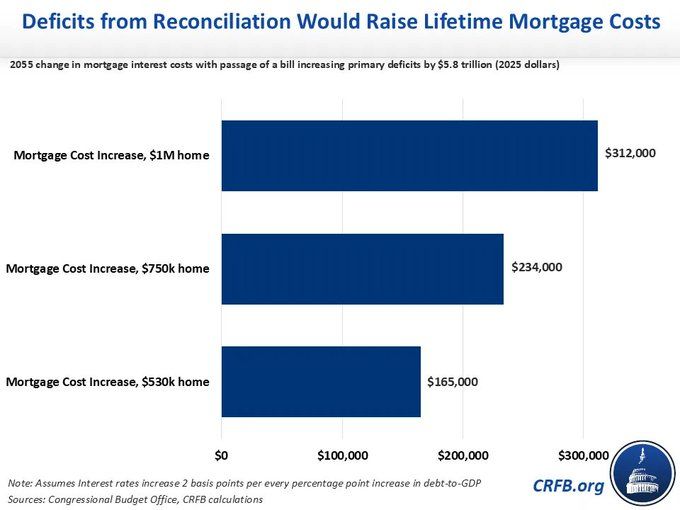

We use CBO's conservative estimate, but if the true number is closer to the Fed or AEI, then anyone who borrows money (mortgages, credit cards, business loans, etc) is in for high cost growth.

Even with CBO's number, mortgage interest costs grow a lot over the coming decades

Even with CBO's number, mortgage interest costs grow a lot over the coming decades

June 6, 2025 at 3:28 PM

We use CBO's conservative estimate, but if the true number is closer to the Fed or AEI, then anyone who borrows money (mortgages, credit cards, business loans, etc) is in for high cost growth.

Even with CBO's number, mortgage interest costs grow a lot over the coming decades

Even with CBO's number, mortgage interest costs grow a lot over the coming decades

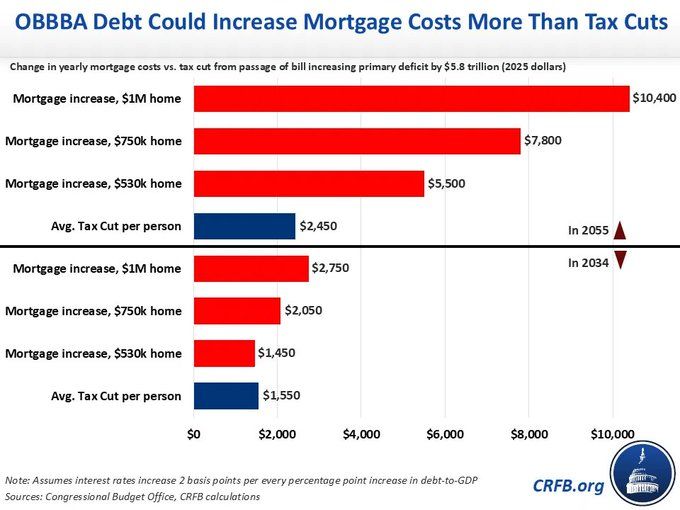

New from CRFB, we estimate how mortgage costs will increase in 2034 as a result of the OBBBA. The bill's deficits ⬆️ mortgage costs, meeting or exceed the tax cut for many families:

-Avg mortgage payment +$1,450

-vs pp tax cut of $1,550

By 2055, costs skyrocket

-Avg mortgage payment +$1,450

-vs pp tax cut of $1,550

By 2055, costs skyrocket

June 6, 2025 at 3:27 PM

New from CRFB, we estimate how mortgage costs will increase in 2034 as a result of the OBBBA. The bill's deficits ⬆️ mortgage costs, meeting or exceed the tax cut for many families:

-Avg mortgage payment +$1,450

-vs pp tax cut of $1,550

By 2055, costs skyrocket

-Avg mortgage payment +$1,450

-vs pp tax cut of $1,550

By 2055, costs skyrocket

The House plan will also add more to debt and deficits than any recent law.

The House bill would be *twice* as large as the original Tax Cuts and Jobs Act it is extending.

It could even be twice as large as the covid-era CARES Act. Its 50% more than Biden's American Rescue Plan.

The House bill would be *twice* as large as the original Tax Cuts and Jobs Act it is extending.

It could even be twice as large as the covid-era CARES Act. Its 50% more than Biden's American Rescue Plan.

March 11, 2025 at 7:44 PM

The House plan will also add more to debt and deficits than any recent law.

The House bill would be *twice* as large as the original Tax Cuts and Jobs Act it is extending.

It could even be twice as large as the covid-era CARES Act. Its 50% more than Biden's American Rescue Plan.

The House bill would be *twice* as large as the original Tax Cuts and Jobs Act it is extending.

It could even be twice as large as the covid-era CARES Act. Its 50% more than Biden's American Rescue Plan.

The House Budget Resolution allows for $2.8 trillion in debt (possibly more). That's big. In fact its more than all our projected future spending on

:Foreign Aid

+student loans and Penn Grants

+EITC and CTC

+SNAP (food stamps)

COMBINED

:Foreign Aid

+student loans and Penn Grants

+EITC and CTC

+SNAP (food stamps)

COMBINED

March 11, 2025 at 7:44 PM

The House Budget Resolution allows for $2.8 trillion in debt (possibly more). That's big. In fact its more than all our projected future spending on

:Foreign Aid

+student loans and Penn Grants

+EITC and CTC

+SNAP (food stamps)

COMBINED

:Foreign Aid

+student loans and Penn Grants

+EITC and CTC

+SNAP (food stamps)

COMBINED

The complexity is the point. Its easy to allocate+ avoid taxes, and hard for the IRS, or anyone outside, to track

I do take issue with one thing.

@dsmitch28.bsky.social says this is a "particularly complex" example. Its not. GAO actually says this is a fairly simple partnership web 😱

I do take issue with one thing.

@dsmitch28.bsky.social says this is a "particularly complex" example. Its not. GAO actually says this is a fairly simple partnership web 😱

February 13, 2025 at 8:29 PM

The complexity is the point. Its easy to allocate+ avoid taxes, and hard for the IRS, or anyone outside, to track

I do take issue with one thing.

@dsmitch28.bsky.social says this is a "particularly complex" example. Its not. GAO actually says this is a fairly simple partnership web 😱

I do take issue with one thing.

@dsmitch28.bsky.social says this is a "particularly complex" example. Its not. GAO actually says this is a fairly simple partnership web 😱

Look, I'm trying to understand your argument about why we lost (it affects me quite directly!)

Food asst was still like 50% higher in 2023 vs 2020, even if it declined 2022-2023. One version of this argument is to never temporarily expand a program cause voters won't remember 4 years back

Food asst was still like 50% higher in 2023 vs 2020, even if it declined 2022-2023. One version of this argument is to never temporarily expand a program cause voters won't remember 4 years back

January 6, 2025 at 8:47 PM

Look, I'm trying to understand your argument about why we lost (it affects me quite directly!)

Food asst was still like 50% higher in 2023 vs 2020, even if it declined 2022-2023. One version of this argument is to never temporarily expand a program cause voters won't remember 4 years back

Food asst was still like 50% higher in 2023 vs 2020, even if it declined 2022-2023. One version of this argument is to never temporarily expand a program cause voters won't remember 4 years back

Love to see this Wmata frequency! 5 trains in 7 minutes

October 19, 2023 at 12:49 PM

Love to see this Wmata frequency! 5 trains in 7 minutes