Senior Reporter, Global Markets

"That is likely an indicator of broader labor market weakness down the road, or given the lag, maybe now," says @deanbaker13.bsky.social

www.spglobal.com/market-intel...

"That is likely an indicator of broader labor market weakness down the road, or given the lag, maybe now," says @deanbaker13.bsky.social

www.spglobal.com/market-intel...

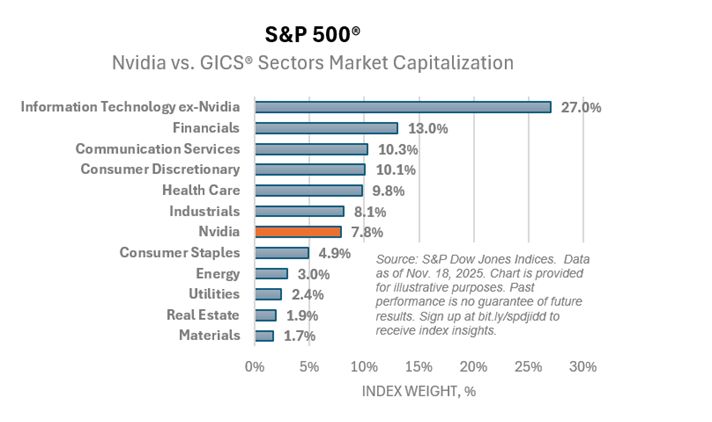

- Benedek Vörös w/ S&P Dow Jones Indices

- Benedek Vörös w/ S&P Dow Jones Indices

"The bull market isn't over. More new highs are coming, but cracks have developed beneath the surface, and that's a story for 2026."

www.spglobal.com/market-intel...

"The bull market isn't over. More new highs are coming, but cracks have developed beneath the surface, and that's a story for 2026."

www.spglobal.com/market-intel...

"Each of those developments in the derivatives space are noteworthy by themselves but not necessarily a reason to panic, however simultaneously combined, they are a more meaningful source of concern"

www.spglobal.com/market-intel...

"Each of those developments in the derivatives space are noteworthy by themselves but not necessarily a reason to panic, however simultaneously combined, they are a more meaningful source of concern"

www.spglobal.com/market-intel...

Goldman Sachs economists see US govt shutdown ending in mid-Nov with BLS releasing the September jobs report within a few days, possibly never releasing the October jobs report and then putting out the November jobs report on time or within a week delay

Goldman Sachs economists see US govt shutdown ending in mid-Nov with BLS releasing the September jobs report within a few days, possibly never releasing the October jobs report and then putting out the November jobs report on time or within a week delay

"Normally, risk appetite rejoices when the Fed pulls forward ... but in this case it might be more a sigh of relief that the Fed is taking note of repo strains"

www.spglobal.com/market-intel...

"Normally, risk appetite rejoices when the Fed pulls forward ... but in this case it might be more a sigh of relief that the Fed is taking note of repo strains"

www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

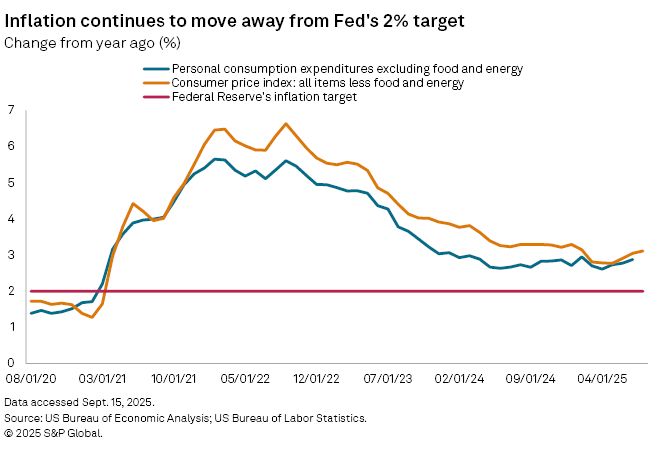

-Realized tariff rate ~10% (18% forecast)

-Effects weaker, delayed on pricing power, demand concerns

-Cost increases passed slowly

-Most price increases have been one offs

-Little sign of spillage into services

-Effects could hit within 3 mos

www.spglobal.com/market-intel...

-Realized tariff rate ~10% (18% forecast)

-Effects weaker, delayed on pricing power, demand concerns

-Cost increases passed slowly

-Most price increases have been one offs

-Little sign of spillage into services

-Effects could hit within 3 mos

www.spglobal.com/market-intel...

"Having less data to price in has been positive for the dollar's recovery"

www.spglobal.com/market-intel...

"Having less data to price in has been positive for the dollar's recovery"

www.spglobal.com/market-intel...

Maybe not, according to some new measures of the market's breakeven rate: www.spglobal.com/market-intel...

Maybe not, according to some new measures of the market's breakeven rate: www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

Ed and health services: +45.6K

Retail: +40.1K

Leisure & hospitality: -34.2K

Govt's Sept. jobs report, to be released tmrw, delayed indefinitely due to shutdown www.reveliolabs.com/public-labor...

Ed and health services: +45.6K

Retail: +40.1K

Leisure & hospitality: -34.2K

Govt's Sept. jobs report, to be released tmrw, delayed indefinitely due to shutdown www.reveliolabs.com/public-labor...

www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

US consumers continue to spend, but are increasingly digging into savings to cover rising costs, a sign that the persistently robust domestic economy could be on shaky ground as the impacts of tariffs take root

www.spglobal.com/market-intel...

US consumers continue to spend, but are increasingly digging into savings to cover rising costs, a sign that the persistently robust domestic economy could be on shaky ground as the impacts of tariffs take root

www.spglobal.com/market-intel...

"Back then, zero rates were one of the main justification for high tech valuations. That valuation prop ultimately got shattered and tech stocks slumped before AI came along."

"Back then, zero rates were one of the main justification for high tech valuations. That valuation prop ultimately got shattered and tech stocks slumped before AI came along."

"I don't think we've seen the bottom just yet," Kyle Rodda, a senior financial market analyst at Capital.com

www.spglobal.com/market-intel...

"I don't think we've seen the bottom just yet," Kyle Rodda, a senior financial market analyst at Capital.com

www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

www.spglobal.com/market-intel...

"It's an unclear path for sure," said Luke Tilley, chief economist of Wilmington Trust

www.spglobal.com/market-intel...

"It's an unclear path for sure," said Luke Tilley, chief economist of Wilmington Trust

www.spglobal.com/market-intel...

-S&P Global Market Intelligence

-S&P Global Market Intelligence

"Both headline and core inflation are expected to move toward 3.3% to 3.5% year over year by early 2026 as the gradual and uneven passthrough from tariffs continues," says @gregdaco.bsky.social

www.spglobal.com/market-intel...

"Both headline and core inflation are expected to move toward 3.3% to 3.5% year over year by early 2026 as the gradual and uneven passthrough from tariffs continues," says @gregdaco.bsky.social

www.spglobal.com/market-intel...

After nearly disappearing from conversations earlier in the year, recession fears returned to the second-quarter earnings calls of S&P 500 companies as concerns over inflation, interest rates and tariffs persisted from the first quarter

www.spglobal.com/market-intel...

After nearly disappearing from conversations earlier in the year, recession fears returned to the second-quarter earnings calls of S&P 500 companies as concerns over inflation, interest rates and tariffs persisted from the first quarter

www.spglobal.com/market-intel...

Trump's efforts to weaken Fed independence could upend markets

www.spglobal.com/market-intel...

Trump's efforts to weaken Fed independence could upend markets

www.spglobal.com/market-intel...