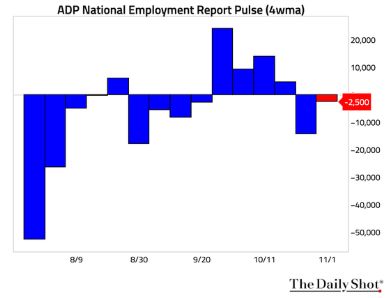

Weaker data has renewed hopes for easy money ahead. While assets bounced, the moves have been muted vs the October euphoria, suggesting the ‘bad news is good news’ trade may be running out of steam.

open.substack.com/pub/bobeunli...

Weaker data has renewed hopes for easy money ahead. While assets bounced, the moves have been muted vs the October euphoria, suggesting the ‘bad news is good news’ trade may be running out of steam.

open.substack.com/pub/bobeunli...

Lower mortgage rates aren’t reviving housing b/c prices remain too high, with ~15% price drop *and* 3% mortgage rates required for a cycle bottom. And with it neutering the Fed's top easing lever.

bobeunlimited.substack.com/p/us-house-p...

Lower mortgage rates aren’t reviving housing b/c prices remain too high, with ~15% price drop *and* 3% mortgage rates required for a cycle bottom. And with it neutering the Fed's top easing lever.

bobeunlimited.substack.com/p/us-house-p...

Takaichi’s modest stimulus is colliding with a tighter BoJ, pushing yields higher. With economic malaise endemic, Japan requires much more aggressive policy efforts to reach escape velocity.

bobeunlimited.substack.com/p/the-haunti...

Takaichi’s modest stimulus is colliding with a tighter BoJ, pushing yields higher. With economic malaise endemic, Japan requires much more aggressive policy efforts to reach escape velocity.

bobeunlimited.substack.com/p/the-haunti...

bobeunlimited.substack.com/p/europe-low...

bobeunlimited.substack.com/p/europe-low...

bobeunlimited.substack.com/p/housing-sl...

bobeunlimited.substack.com/p/housing-sl...

bobeunlimited.substack.com/p/the-uk-adj...

bobeunlimited.substack.com/p/the-uk-adj...

More here:

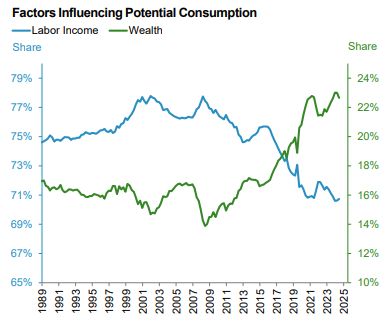

unlimitedfunds.com/elusive-pers...

More here:

unlimitedfunds.com/elusive-pers...

bobeunlimited.substack.com/p/the-ism-an...

bobeunlimited.substack.com/p/the-ism-an...

AI mania and easy-policy bets pushed assets to highs, but not even a good NVDA print and an employment report opening the door for a Dec easing could do enough to keep the euphoria from fading.

bobeunlimited.substack.com/p/boy-that-e...

AI mania and easy-policy bets pushed assets to highs, but not even a good NVDA print and an employment report opening the door for a Dec easing could do enough to keep the euphoria from fading.

bobeunlimited.substack.com/p/boy-that-e...

With job gains near zero and wage growth slipping toward pre-covid levels, HH income is weakening just as inflation rises. That's creating a real challenge for a continued income-driven expansion.

bobeunlimited.substack.com/p/sputtering...

With job gains near zero and wage growth slipping toward pre-covid levels, HH income is weakening just as inflation rises. That's creating a real challenge for a continued income-driven expansion.

bobeunlimited.substack.com/p/sputtering...

Three years into widespread adoption, AI has delivered a 0.4% productivity growth bump, putting it on pace with PC-scale lift at best (~1/2 the time) rather than radically reshaping the macroeconomy.

bobeunlimited.substack.com/p/ais-modest...

Three years into widespread adoption, AI has delivered a 0.4% productivity growth bump, putting it on pace with PC-scale lift at best (~1/2 the time) rather than radically reshaping the macroeconomy.

bobeunlimited.substack.com/p/ais-modest...

So the best replication approach focuses on the returns before fees. It's not too hard to estimate in real time with the combination of data on fees, manager dispersion, and timely net index returns.

So the best replication approach focuses on the returns before fees. It's not too hard to estimate in real time with the combination of data on fees, manager dispersion, and timely net index returns.

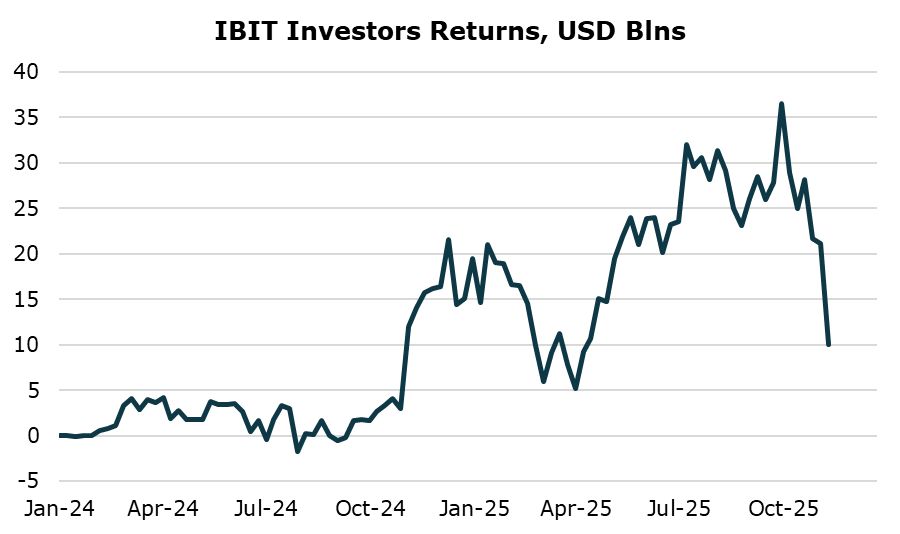

Crypto’s $1T plunge sounds big, but the US macro hit is tiny on par with a typical 1d S&P 500 swing. While those concentrated in the assets will feel pain, the broader economy won't notice.

bobeunlimited.substack.com/p/crypto-cra...

Crypto’s $1T plunge sounds big, but the US macro hit is tiny on par with a typical 1d S&P 500 swing. While those concentrated in the assets will feel pain, the broader economy won't notice.

bobeunlimited.substack.com/p/crypto-cra...

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...