bobeunlimited.substack.com/p/latent-tar...

bobeunlimited.substack.com/p/latent-tar...

bobeunlimited.substack.com/p/strong-hh-...

bobeunlimited.substack.com/p/strong-hh-...

bobeunlimited.substack.com/p/feds-dead-...

bobeunlimited.substack.com/p/feds-dead-...

www.marketwatch.com/story/why-in...

www.marketwatch.com/story/why-in...

youtu.be/h5NRE4nv_XA?...

youtu.be/h5NRE4nv_XA?...

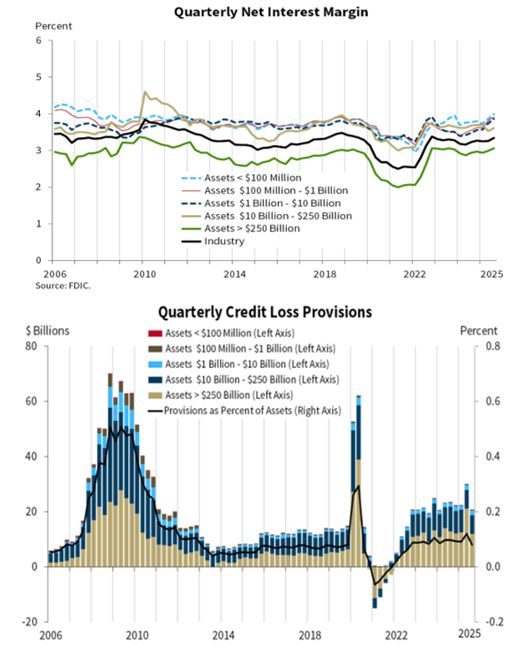

Investors counting on a Fed pump ahead are likely to be disappointed given limited balance sheet expansion and rate cuts that are doing little to boost borrowing for the real economy.

bobeunlimited.substack.com/p/feds-dead-...

Investors counting on a Fed pump ahead are likely to be disappointed given limited balance sheet expansion and rate cuts that are doing little to boost borrowing for the real economy.

bobeunlimited.substack.com/p/feds-dead-...

It's an asset class with punishingly high fees and huge dispersion desperately in need of a lower-cost, more diversified solutions for investors. More to come!

unlimitedfunds.com/press-releas...

It's an asset class with punishingly high fees and huge dispersion desperately in need of a lower-cost, more diversified solutions for investors. More to come!

unlimitedfunds.com/press-releas...

With households now absorbing nearly all the higher costs from directly imported consumer goods, the question for ‘26 is whether biz start passing higher imported input costs on to consumers.

bobeunlimited.substack.com/p/latent-tar...

With households now absorbing nearly all the higher costs from directly imported consumer goods, the question for ‘26 is whether biz start passing higher imported input costs on to consumers.

bobeunlimited.substack.com/p/latent-tar...

youtu.be/dgrwW4BTQvQ?...

youtu.be/dgrwW4BTQvQ?...

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

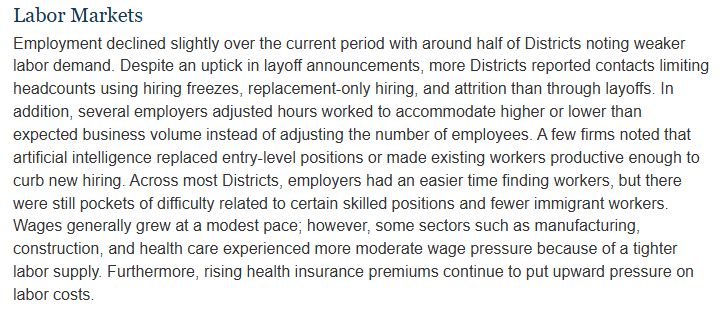

Recent announcements by the admin suggest an expanding efforts to reduce immigration, even to green cards. The rhetoric suggests the labor supply drag seen so far may accelerate into '26.

bobeunlimited.substack.com/p/admins-new...

Recent announcements by the admin suggest an expanding efforts to reduce immigration, even to green cards. The rhetoric suggests the labor supply drag seen so far may accelerate into '26.

bobeunlimited.substack.com/p/admins-new...

unlimitedfunds.com/tis-the-seas...

unlimitedfunds.com/tis-the-seas...

Despite a falling FX and low rates, the yen carry trade remains muted. Naked FX borrowing ended with the GFC, with the only thing left a lingering nostalgia for a trade that mattered 20yrs ago.

bobeunlimited.substack.com/p/the-yen-ca...

Despite a falling FX and low rates, the yen carry trade remains muted. Naked FX borrowing ended with the GFC, with the only thing left a lingering nostalgia for a trade that mattered 20yrs ago.

bobeunlimited.substack.com/p/the-yen-ca...

Last few years showed once again much better to 1) increase diversification and 2) hold cash to meet risk targets.

unlimitedfunds.com/diversified-...

Last few years showed once again much better to 1) increase diversification and 2) hold cash to meet risk targets.

unlimitedfunds.com/diversified-...

Headline Black Friday sales rose ~4%, but weakening e-commerce reads suggest a bit softer demand. With jobs flat and wages soft, the holiday season will test whether households can keep spending.

bobeunlimited.substack.com/p/squinting-...

Headline Black Friday sales rose ~4%, but weakening e-commerce reads suggest a bit softer demand. With jobs flat and wages soft, the holiday season will test whether households can keep spending.

bobeunlimited.substack.com/p/squinting-...

bobeunlimited.substack.com/p/continued-...

bobeunlimited.substack.com/p/continued-...

youtu.be/c_P2mN6h5gc?...

youtu.be/c_P2mN6h5gc?...

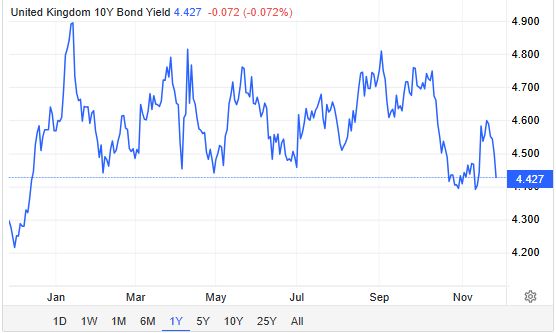

bobeunlimited.substack.com/p/the-uk-adj...

bobeunlimited.substack.com/p/the-uk-adj...

bobeunlimited.substack.com/p/australias...

bobeunlimited.substack.com/p/australias...

bobeunlimited.substack.com/p/us-house-p...

bobeunlimited.substack.com/p/us-house-p...