Substack at: https://notes.archie-hall.com/

1. They put the Brexit hit to GDP at 6-8%..!

2. Their measure of the damage hasn't bottomed out yet

www.nber.org/papers/w34459

1. They put the Brexit hit to GDP at 6-8%..!

2. Their measure of the damage hasn't bottomed out yet

www.nber.org/papers/w34459

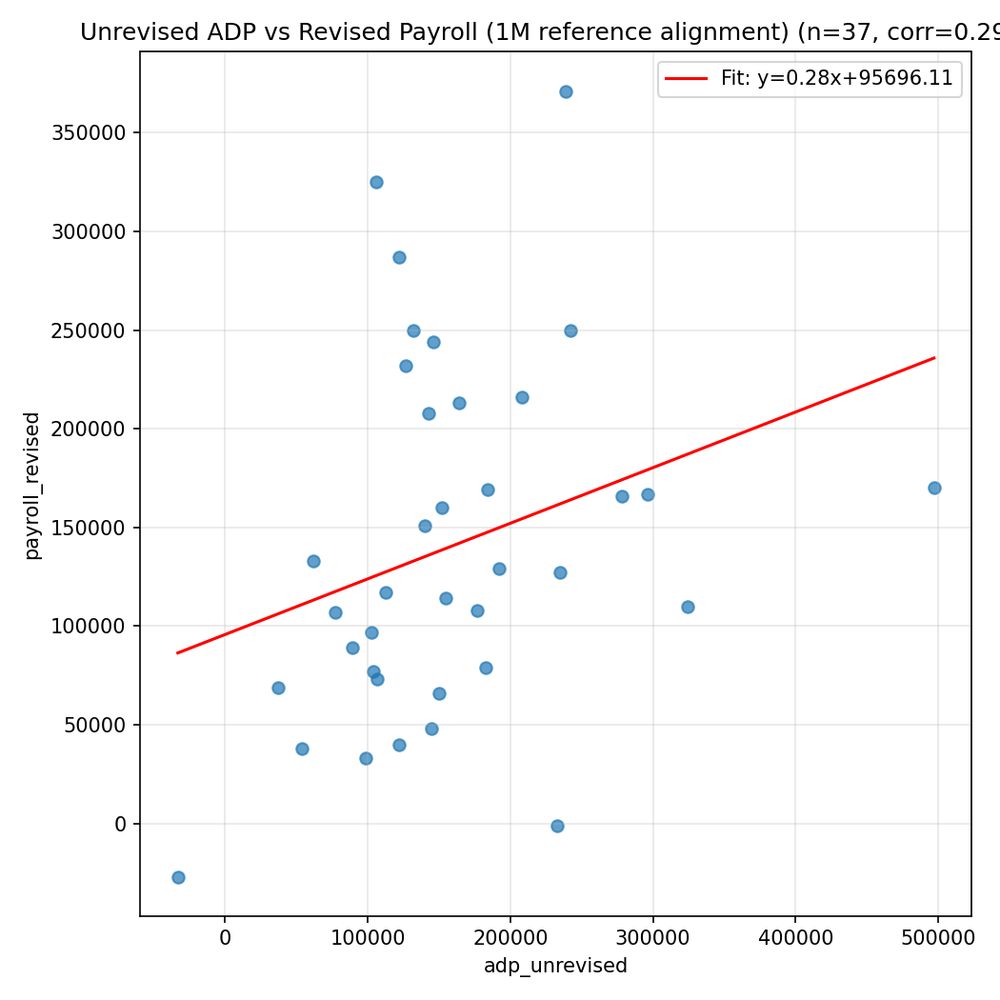

That means even the better sources, like ADP's payrolls measure, look a lot worse when you look at the actual initial releases, not the final revisions.

That means even the better sources, like ADP's payrolls measure, look a lot worse when you look at the actual initial releases, not the final revisions.

Further down, a very quick 🧵 with a few more highlights.

Further down, a very quick 🧵 with a few more highlights.

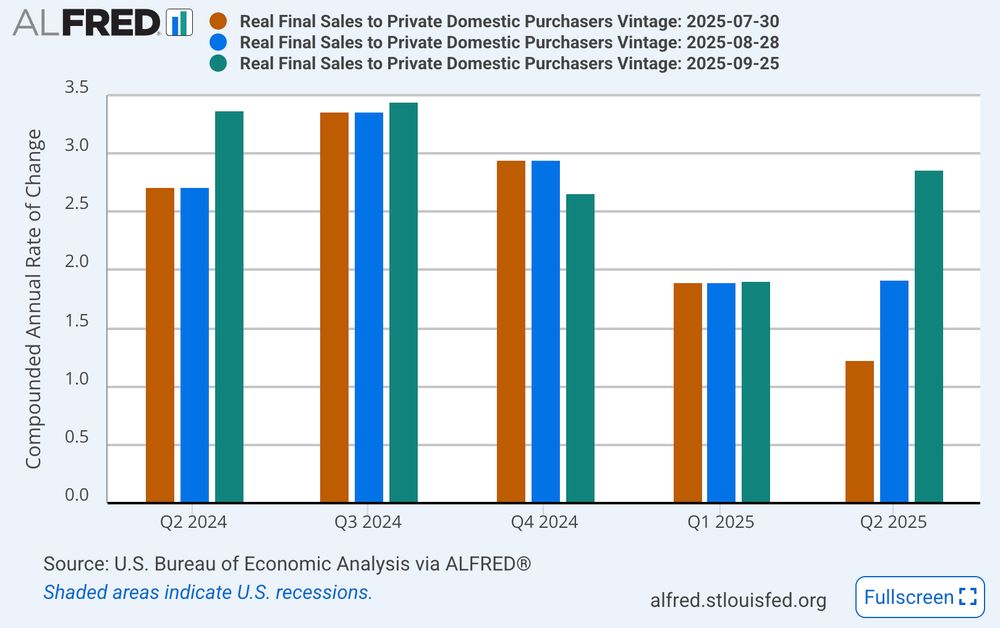

No pretty chart but see that roughly below:

No pretty chart but see that roughly below:

But backlash is brewing. My latest, on the politics of the data centre: www.economist.com/united-state...

But backlash is brewing. My latest, on the politics of the data centre: www.economist.com/united-state...

Public opinion on migration has rebounded sharply upward this year. 79% of Americans now thing immigration is good for the country, the highest on record.

Public opinion on migration has rebounded sharply upward this year. 79% of Americans now thing immigration is good for the country, the highest on record.

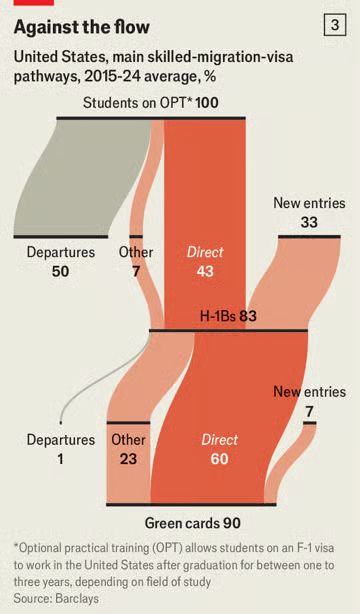

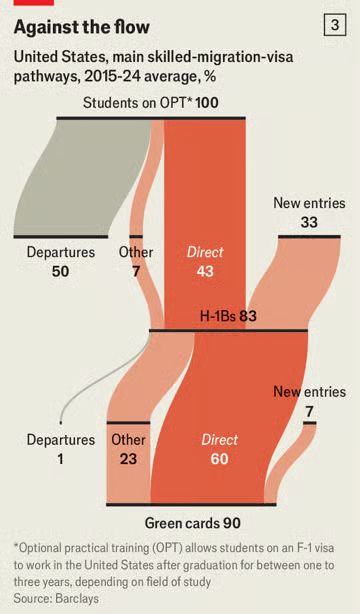

The H1-B fee mess showed a fairly clear direction of travel on the Trump admin's desire to pull down skilled migration. The next place to watch is OPT, the post-grad work status that gets most talented foreigners into the US.

The H1-B fee mess showed a fairly clear direction of travel on the Trump admin's desire to pull down skilled migration. The next place to watch is OPT, the post-grad work status that gets most talented foreigners into the US.

Deportations are up and skilled-worker visa are already creeping down (even before talk of the $100k H1-B fee).

That is a stark reversal: net migration was ~2-3m in 2023 and 2024.

Deportations are up and skilled-worker visa are already creeping down (even before talk of the $100k H1-B fee).

That is a stark reversal: net migration was ~2-3m in 2023 and 2024.

My latest for @economist.com: Welcome to Zero Migration America

Link: www.economist.com/finance-and...

🧵 below

My latest for @economist.com: Welcome to Zero Migration America

Link: www.economist.com/finance-and...

🧵 below

Public opinion on migration has rebounded sharply upward this year. 79% of Americans now thing immigration is good for the country, the highest on record.

Public opinion on migration has rebounded sharply upward this year. 79% of Americans now thing immigration is good for the country, the highest on record.

The H1-B fee mess showed a fairly clear direction of travel on the Trump admin's desire to pull down skilled migration. The next place to watch is OPT, the post-grad work status that gets most talented foreigners into the US.

The H1-B fee mess showed a fairly clear direction of travel on the Trump admin's desire to pull down skilled migration. The next place to watch is OPT, the post-grad work status that gets most talented foreigners into the US.

Deportations are up and skilled-worker visa are already creeping down (even before talk of the $100k H1-B fee).

That is a stark reversal: net migration was ~2-3m in 2023 and 2024.

Deportations are up and skilled-worker visa are already creeping down (even before talk of the $100k H1-B fee).

That is a stark reversal: net migration was ~2-3m in 2023 and 2024.