@nishinair.bsky.social shows how the plan would take food assistance away from parents and children... all to help fund massive tax breaks for the wealthy.

@nishinair.bsky.social shows how the plan would take food assistance away from parents and children... all to help fund massive tax breaks for the wealthy.

They want massive tax cuts to the rich and health care stripped away from millions.

@amyhanauer.bsky.social on the bill: "It’s hard to imagine a more misplaced set of priorities." itep.org/itep-stateme...

They want massive tax cuts to the rich and health care stripped away from millions.

@amyhanauer.bsky.social on the bill: "It’s hard to imagine a more misplaced set of priorities." itep.org/itep-stateme...

That means they paid a higher effective tax rate than 5 of the richest Americans…and a higher effective tax rate than 55 mega corporations.

So let me ask you: who are the real freeloaders?

That means they paid a higher effective tax rate than 5 of the richest Americans…and a higher effective tax rate than 55 mega corporations.

So let me ask you: who are the real freeloaders?

Learn more from @adri-ramyam.bsky.social

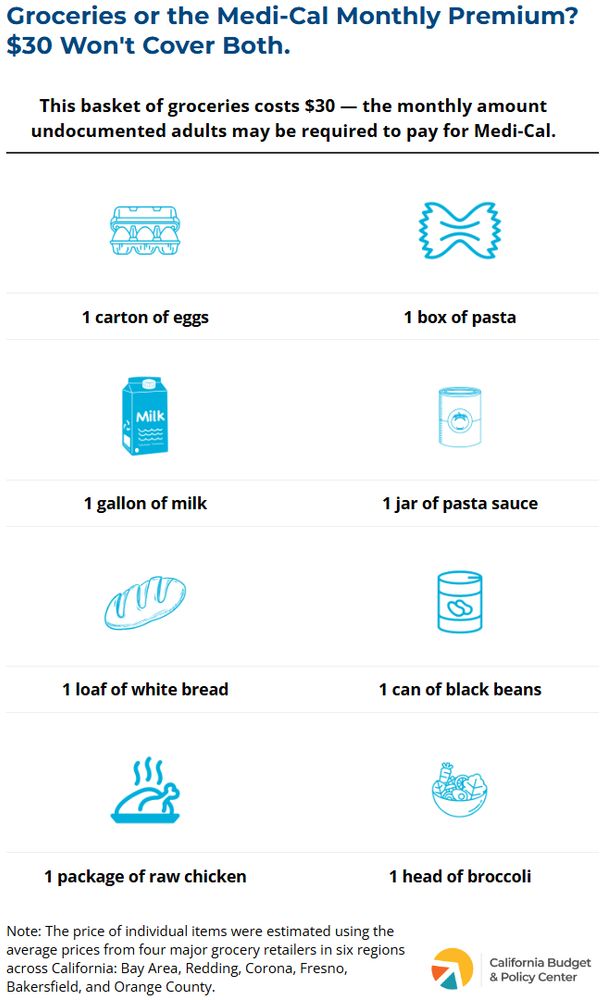

For low-income undocumented adults, that same $30 could become the monthly cost of staying enrolled in Medi-Cal.

#Health4All #CABudget #CALeg

Learn more from @adri-ramyam.bsky.social

calbudgetcenter.org/news/stateme...

calbudgetcenter.org/news/stateme...

Ask the ultra-wealthy and big corporations to pay their fair share in taxes.

#CALeg, which side are you on?

Ask the ultra-wealthy and big corporations to pay their fair share in taxes.

#CALeg, which side are you on?

calbudgetcenter.org/resources/pe...

calbudgetcenter.org/resources/pe...

@sacbee.com amp.sacbee.com/news/politic...

@sacbee.com amp.sacbee.com/news/politic...

It would create a profitable tax shelter for wealthy people who agree to help funnel public funds into private schools. itep.org/house-tax-bi...

It would create a profitable tax shelter for wealthy people who agree to help funnel public funds into private schools. itep.org/house-tax-bi...

www.bloomberg.com/opinion/arti...

www.bloomberg.com/opinion/arti...

Let’s be clear: they voted to take health care and food assistance away from millions of vulnerable Californians.

calbudgetcenter.org/resources/ho...

Let’s be clear: they voted to take health care and food assistance away from millions of vulnerable Californians.

calbudgetcenter.org/resources/ho...

Read the full statement from @awright2care.bsky.social here: familiesusa.org/press-releas...

They’re planning to pass it through Rules shortly & through the full House TOMORROW MORNING w/out anyone understanding how the changes work & w/out any analysis of how it would affect people.

Deliberately because they don’t want to wait for the analysis.

They’re planning to pass it through Rules shortly & through the full House TOMORROW MORNING w/out anyone understanding how the changes work & w/out any analysis of how it would affect people.

Deliberately because they don’t want to wait for the analysis.

www.cbpp.org/research/hea...

www.cbpp.org/research/hea...