No tax cut in the history of tax cuts has ever paid for itself. Not a one.

No tax cut in the history of tax cuts has ever paid for itself. Not a one.

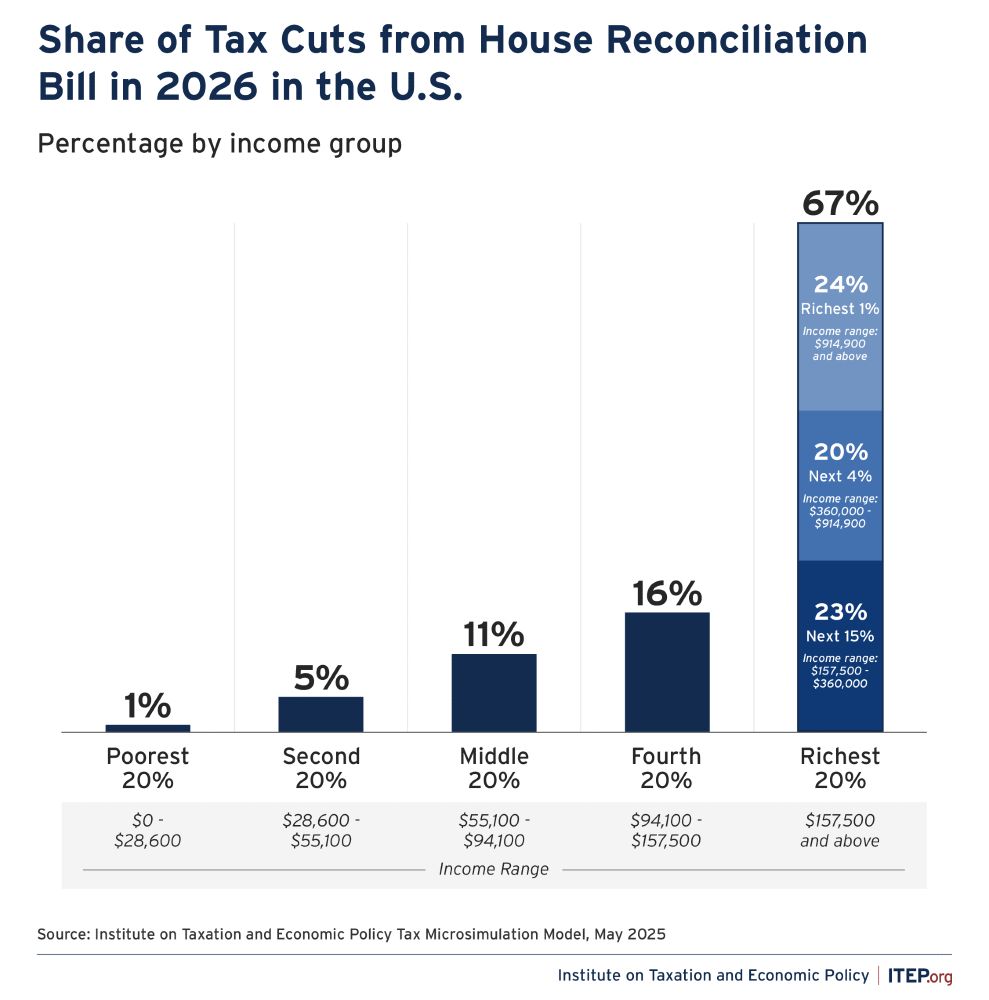

The top 1% of earners — making more than $920,000 — would receive an average tax cut of close to $70,000 in the first year after enactment.

www.washingtonpost.com/business/202...

The top 1% of earners — making more than $920,000 — would receive an average tax cut of close to $70,000 in the first year after enactment.

www.washingtonpost.com/business/202...

www.commondreams.org/opinion/gop-...

www.commondreams.org/opinion/gop-...

The downgrade, from the highest rating to one notch below, comes as the president’s budget bill suffered a blow in Congress.

The downgrade, from the highest rating to one notch below, comes as the president’s budget bill suffered a blow in Congress.

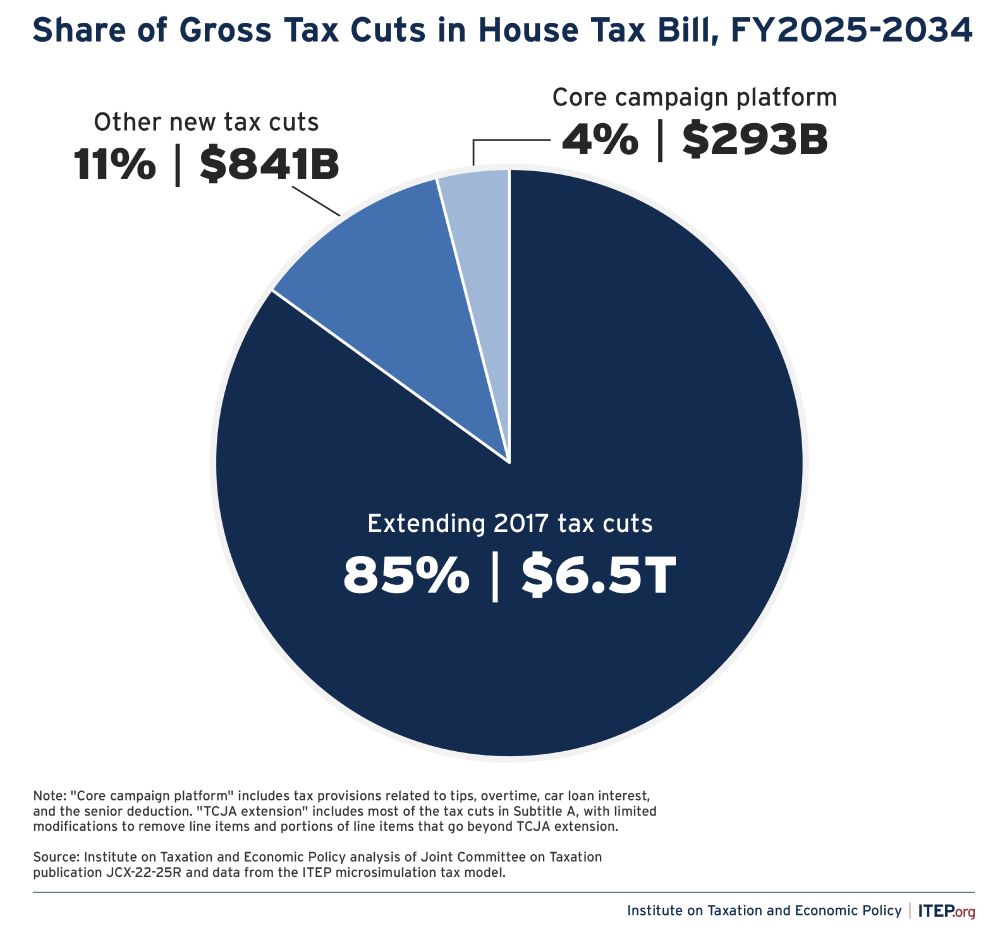

Thing is, those only amount to 4% - YES, 4% - of the tax cuts in the bill. No wonder the thing is regressive.

itep.org/house-tax-pl...

Thing is, those only amount to 4% - YES, 4% - of the tax cuts in the bill. No wonder the thing is regressive.

itep.org/house-tax-pl...

1) take away food assistance from as many as 4 million kids and 7 million adults

2) give an estate tax cut to a few thousand people who will leave behind more than $7 million to their heirs

Talk about priorities!

itep.org/house-tax-bi...

1) take away food assistance from as many as 4 million kids and 7 million adults

2) give an estate tax cut to a few thousand people who will leave behind more than $7 million to their heirs

Talk about priorities!

itep.org/house-tax-bi...

Corporation to SEC: I'm taking some tax breaks that, if investigated, would likely be illegal.

IRS: zzzzzz

Statute of limitations: Time's up!

Corporation: Yay, I get to keep those tax breaks!

itep.org/what-corpora...

Corporation to SEC: I'm taking some tax breaks that, if investigated, would likely be illegal.

IRS: zzzzzz

Statute of limitations: Time's up!

Corporation: Yay, I get to keep those tax breaks!

itep.org/what-corpora...

www.forbes.com/sites/kellyp...

www.forbes.com/sites/kellyp...

1. easy

2. fast

3. free

Direct File was the vehicle to accomplish this. Destroying it hurts taxpayers and enriches the profitable corporations that charge Americans for tax filing.

itep.org/trump-admini...

1. easy

2. fast

3. free

Direct File was the vehicle to accomplish this. Destroying it hurts taxpayers and enriches the profitable corporations that charge Americans for tax filing.

itep.org/trump-admini...

ICE's entire annual budget is ~$9 billion.

Inside the Trump administration's plan for the real mass deportation campaign: www.theatlantic.com/politics/arc... @theatlantic.com

ICE's entire annual budget is ~$9 billion.

Inside the Trump administration's plan for the real mass deportation campaign: www.theatlantic.com/politics/arc... @theatlantic.com

(Published 2019)

(Published 2019)

Dozens of Republicans are now trying to kill the tool.

But it's still available and helping millions of taxpayers in 25 states right now.

See if you qualify: directfile.irs.gov

Dozens of Republicans are now trying to kill the tool.

But it's still available and helping millions of taxpayers in 25 states right now.

See if you qualify: directfile.irs.gov