project manager for @globalenergymon.bsky.social 's global oil and gas extraction tracker, but all opinions/views are my own | also: 🏃 ⛷️ 🚲 📷

You can now search the over 1.000 experts by:

🌏Region/country

🔬Expertise

♀Gender

🗣Language

That means, if you are looking for a Pakistani health expert that speaks Urdu, we got you.

🔗bit.ly/GSClimateDatabase

Check out the Global South Climate Database.

This publicly available, searchable database features 1,000+ climate scientists and experts from the global south.

🌍🔗 bit.ly/GSClimateDatabase

You can now search the over 1.000 experts by:

🌏Region/country

🔬Expertise

♀Gender

🗣Language

That means, if you are looking for a Pakistani health expert that speaks Urdu, we got you.

🔗bit.ly/GSClimateDatabase

high concentration in supply among today’s major resource holders"

iea.blob.core.windows.net/assets/41800...

high concentration in supply among today’s major resource holders"

iea.blob.core.windows.net/assets/41800...

media.rff.org/documents/Re...

media.rff.org/documents/Re...

Trump admin and 🛢️ pressure got their way, but its worth noting this is a different framing but not a difference in the underlying truths:

1) Flat supply is oversupply.

2) 1.5 demand is *still* met without new fields

3) lots of stranded asset risk incoming

Trump admin and 🛢️ pressure got their way, but its worth noting this is a different framing but not a difference in the underlying truths:

1) Flat supply is oversupply.

2) 1.5 demand is *still* met without new fields

3) lots of stranded asset risk incoming

In a new @nature.com study, we cross-check established academic and industry estimates with various risk factors.

We find a prudent geological CO2 storage limit that is about 10x smaller. /1

In a new @nature.com study, we cross-check established academic and industry estimates with various risk factors.

We find a prudent geological CO2 storage limit that is about 10x smaller. /1

An uptick of annual additions are expected through the end of the decade.

🔎 Explore the dashboard: globalenergymonitor.org/projects/glo...

An uptick of annual additions are expected through the end of the decade.

🔎 Explore the dashboard: globalenergymonitor.org/projects/glo...

A quick review of the DOE's new 'critical review' of climate science. Whether it's worth a formal community response - I'm still not sure, but here's my first thoughts

/thread/

A quick review of the DOE's new 'critical review' of climate science. Whether it's worth a formal community response - I'm still not sure, but here's my first thoughts

/thread/

www.chevron.com/newsroom/202...

www.chevron.com/newsroom/202...

Under his guidance, GEM grew from a bold idea into a global nonprofit tracking 130,000+ energy assets.

We’re excited to welcome Justin Locke as our new ED: globalenergymonitor.org/press-releas...

www.gem.wiki/Bay_du_Nord_...

www.gem.wiki/Bay_du_Nord_...

First oil from the project is now anticipated around "late 2028"

www.greenpeace.org/static/plane...

First oil from the project is now anticipated around "late 2028"

www.greenpeace.org/static/plane...

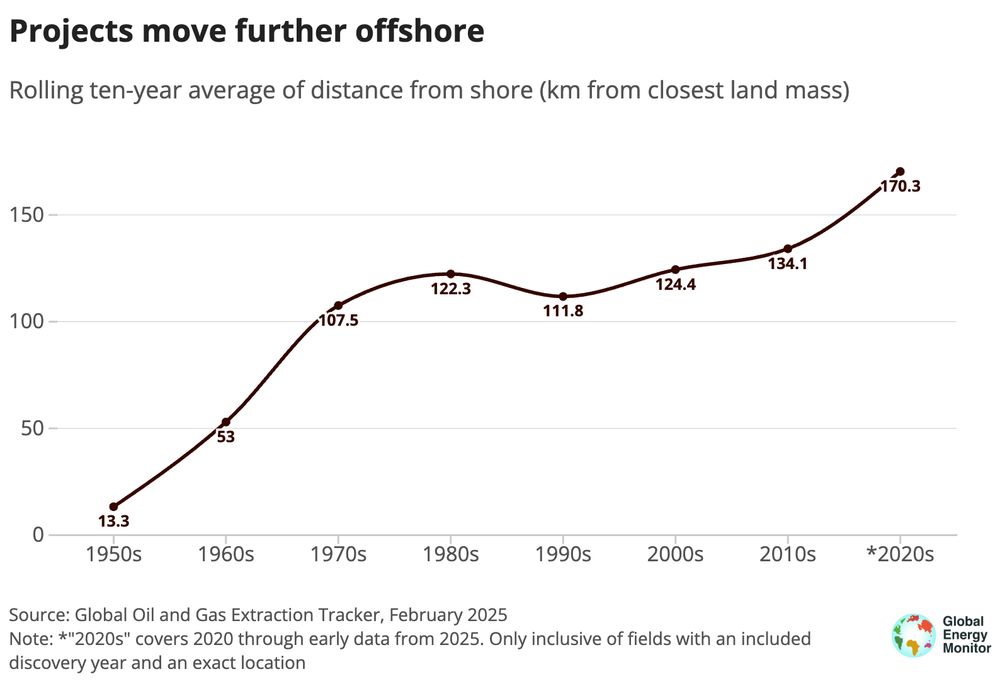

Discoveries are trending further offshore, targeting extraction in deeper water. Some of the discoveries furtherest offshore include Bay du Nord (~500 km offshore) which is in international waters.

Discoveries are trending further offshore, targeting extraction in deeper water. Some of the discoveries furtherest offshore include Bay du Nord (~500 km offshore) which is in international waters.

These projects took about 15 years from discovery to first production, if that trend holds, any exploration done now might not produce hydrocarbons until nearly 2040.

These projects took about 15 years from discovery to first production, if that trend holds, any exploration done now might not produce hydrocarbons until nearly 2040.

In total, these 12 projects account for at least $43 billion in investment in new oil and gas projects.

In total, these 12 projects account for at least $43 billion in investment in new oil and gas projects.