-- gregmankiw.blogspot.com/2009/10/valu...

-- project-syndicate.org/commentary/b...

-- pubs.aeaweb.org/doi/pdfplus/...

-- hoover.org/research/fla...

-- heritage.org/taxes/commen...

-- taxpolicycenter.org/briefing-boo...

But in every storm there is a ray of light.

The team of economists around President Trump has been heavily criticized by their peers. Here is a suggestion for them to rally around and come out on top.

But in every storm there is a ray of light.

The team of economists around President Trump has been heavily criticized by their peers. Here is a suggestion for them to rally around and come out on top.

What if the end point is a flat-rate consumption tax with a universal transfer?

(You can call it an X-tax, FairTax, business transfer tax, or flat tax, in case VAT sounds too European.)

What if the end point is a flat-rate consumption tax with a universal transfer?

(You can call it an X-tax, FairTax, business transfer tax, or flat tax, in case VAT sounds too European.)

You have achieved progressivity, helping the poor ✅🏆

You have achieved progressivity, helping the poor ✅🏆

There are some grounds to suggest that you will end up with the same tax rate for every good. That is production efficiency ✅🏆

There are some grounds to suggest that you will end up with the same tax rate for every good. That is production efficiency ✅🏆

Fentanyl (from Canada) or luxury cars (from Europe) will get taxed more ✅🏆

Fentanyl (from Canada) or luxury cars (from Europe) will get taxed more ✅🏆

I'm quite confident that Treasury yields will go down. ✅🏆

I'm quite confident that Treasury yields will go down. ✅🏆

If this makes Americans consume less and save more then no more current account deficit. ✅🏆

If this makes Americans consume less and save more then no more current account deficit. ✅🏆

You may call this "cheating" by other countries, hiding under that US label.

A tax over all consumption goods, as opposed to only those labelled “imported", gets to all. No more cheating. ✅🏆

You may call this "cheating" by other countries, hiding under that US label.

A tax over all consumption goods, as opposed to only those labelled “imported", gets to all. No more cheating. ✅🏆

President Tump loves tariffs.

Tariffs are taxes on the consumption of imported goods.

What about boldly following through and... extending his favorite policy tool to all goods?

Hear me out…

President Tump loves tariffs.

Tariffs are taxes on the consumption of imported goods.

What about boldly following through and... extending his favorite policy tool to all goods?

Hear me out…

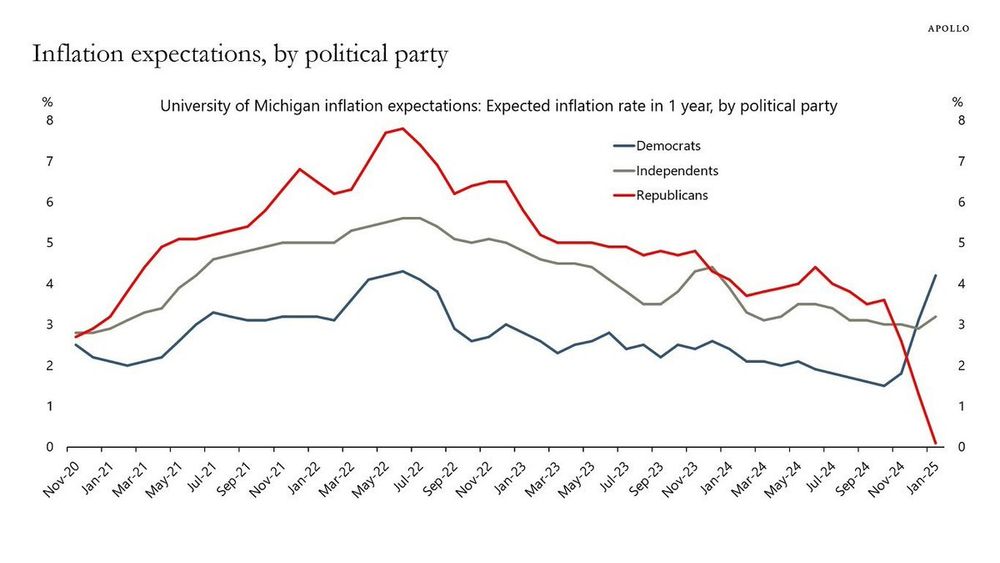

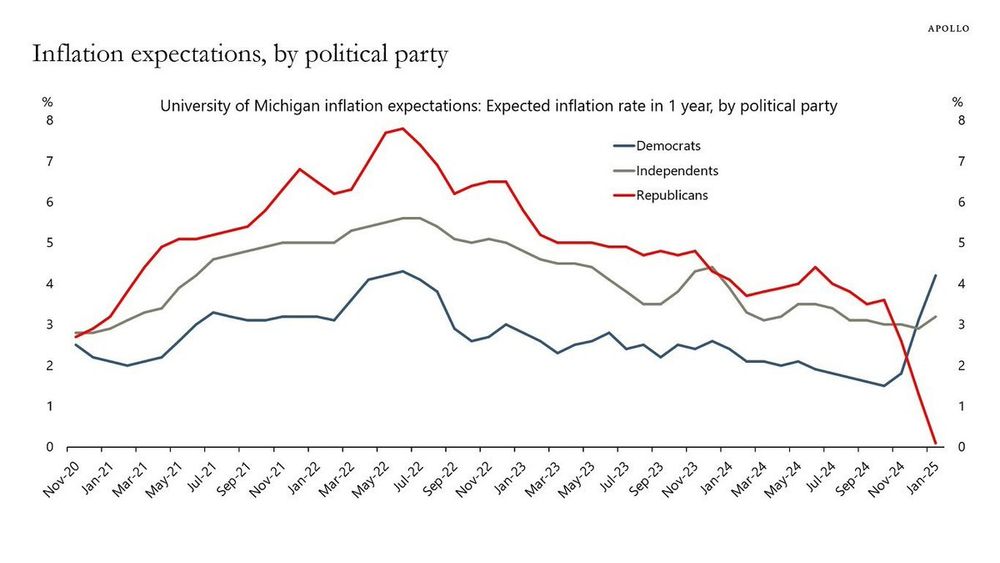

"...had all expectations become as unanchored as those of Republicans, average inflation would have been two to four percentage points higher for much of the pandemic period"

www.sciencedirect.com/science/arti...

"...had all expectations become as unanchored as those of Republicans, average inflation would have been two to four percentage points higher for much of the pandemic period"

www.sciencedirect.com/science/arti...

Recent references for those interested:

-- bfi.uchicago.edu/wp-content/u...

-- personal.lse.ac.uk/reisr/papers...

Recent references for those interested:

-- bfi.uchicago.edu/wp-content/u...

-- personal.lse.ac.uk/reisr/papers...

That's right.

Please give it to me and I'll pay you the same interest.

Ok.

Actually, paying you interest is subsidising you, forget about it.

Uh?

I'm the govt, I could require you to give it to me.

🤔

cepr.org/voxeu/column...

That's right.

Please give it to me and I'll pay you the same interest.

Ok.

Actually, paying you interest is subsidising you, forget about it.

Uh?

I'm the govt, I could require you to give it to me.

🤔

cepr.org/voxeu/column...