🌍 Advocating for responsible investment & sustainable finance

📍 Brussels | Views my own | Reposts ≠ endorsements

Before at ActionAid, the European Parliament, MSF

abonnement.volkskrant.nl/studenten

abonnement.volkskrant.nl/studenten

We need your help to face this new threat to the democracy of AGMs. Donate to help us fight for in person AGMs

donate.shareaction.org/page/89342/d...

We need your help to face this new threat to the democracy of AGMs. Donate to help us fight for in person AGMs

donate.shareaction.org/page/89342/d...

To protect the integrity of the EU's sustainable finance framework, we must not mix defending sovereignty and investing sustainably. #KeepDefenceOut!

To protect the integrity of the EU's sustainable finance framework, we must not mix defending sovereignty and investing sustainably. #KeepDefenceOut!

On 9 Sept at 15:00, we’re hosting a webinar on the future of CSDDD & CSRD under #Omnibus. Together with experts from civil society, business & investment, we’ll unpack what’s at stake and the road ahead.

Register here: wwf.zoom.us/webinar/regi...

On 9 Sept at 15:00, we’re hosting a webinar on the future of CSDDD & CSRD under #Omnibus. Together with experts from civil society, business & investment, we’ll unpack what’s at stake and the road ahead.

Register here: wwf.zoom.us/webinar/regi...

Take a look at some of the wins we’ve achieved so far this year 🏆

Take a look at some of the wins we’ve achieved so far this year 🏆

In our latest op-ed, @mcarlucci.bsky.social explains why this rollback would hurt businesses, investors, and citizens alike. Europe needs resilience, not #deregulation.

www.alliancemagazine.org/blog/is-the-...

In our latest op-ed, @mcarlucci.bsky.social explains why this rollback would hurt businesses, investors, and citizens alike. Europe needs resilience, not #deregulation.

www.alliancemagazine.org/blog/is-the-...

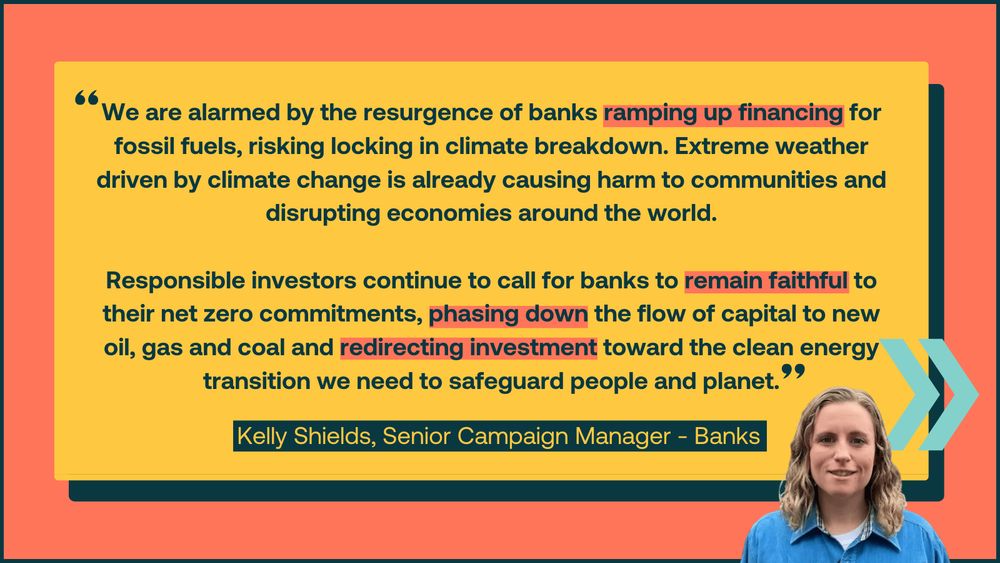

Read more: www.bankingonclimatechaos.org/

Read more: www.bankingonclimatechaos.org/

Despite progress, many asset managers aren’t clear on how they manage the negative impacts of their investments on people & planet. This lack of info prevents investors & consumers from making informed decisions and supporting EU green & social goals ⏬

shareaction.org/reports/brid...

Despite progress, many asset managers aren’t clear on how they manage the negative impacts of their investments on people & planet. This lack of info prevents investors & consumers from making informed decisions and supporting EU green & social goals ⏬

shareaction.org/reports/brid...

This would gut transparency & accountability in a sector key to managing climate risks, with serious consequences for financial stability and society ⬇️

bit.ly/4dhFeGh

This would gut transparency & accountability in a sector key to managing climate risks, with serious consequences for financial stability and society ⬇️

bit.ly/4dhFeGh

❌No civil society on the panel

✅Good to see some EU policymakers question some recommendations: #simplification can actually lead to more complexity and risk, not more stability or #competitiveness.

❌No civil society on the panel

✅Good to see some EU policymakers question some recommendations: #simplification can actually lead to more complexity and risk, not more stability or #competitiveness.

Regulation is the only way to drive them to transition.

As we evaluated their transition plans on 5 dimensions, here’s what we’ve learned: ⤵️🧵

[1/6]

Regulation is the only way to drive them to transition.

As we evaluated their transition plans on 5 dimensions, here’s what we’ve learned: ⤵️🧵

[1/6]

Banks must be held accountable & responsible investors have a critical role to play in keeping the pressure on. 👇

![Quote from Jeanne Martin, Co-Director of Corporate Engagement, discussing the Net Zero Banking Alliance's decision to relax its guidelines. The quote highlights the importance of limiting global temperature rise to 1.5 degrees Celsius and calls for banks to strengthen their climate commitments. The full quote reads: 'The Net Zero Banking Alliance has watered down its guidelines - notably those that say member banks should align their portfolios with a 1.5C warming limit. Every 0.1 of a degree matters and the higher global temperatures get, the harder it will be to deal with these impacts, and the greater the financial risks for banks and their investors [...] Responsible investors must double down on pressure to hold banks accountable to their climate commitments and urge them to play their part in fast tracking the transition rather than delaying progress.'](https://cdn.bsky.app/img/feed_thumbnail/plain/did:plc:4owfe4qncahe4sfk64mpphyg/bafkreifv3p6riatoujjc3gnntnlmfr4nh4adohkpwcrqmupz4n3gi7niqe@jpeg)

Banks must be held accountable & responsible investors have a critical role to play in keeping the pressure on. 👇

Today, we travelled to their AGM to ask the bank to explain the change in policy that flies in the face of its previous climate commitments⏬

Today, we travelled to their AGM to ask the bank to explain the change in policy that flies in the face of its previous climate commitments⏬

The EU’s climate ambition sets the tone globally. Watering down the #2040Target with "flexibilities" (aka loopholes👎) would send the wrong message and cost the EU far more in the long term 🫰 www.politico.eu/article/eu-e...

The EU’s climate ambition sets the tone globally. Watering down the #2040Target with "flexibilities" (aka loopholes👎) would send the wrong message and cost the EU far more in the long term 🫰 www.politico.eu/article/eu-e...

Looking forward to discussions with @bothends.bsky.social @fairfinanceint.bsky.social , @wikirate.bsky.social & more!

Looking forward to discussions with @bothends.bsky.social @fairfinanceint.bsky.social , @wikirate.bsky.social & more!

Kritsche Aktionare, Winson Sonsini

With new challenges arising, we’re identifying barriers & opportunities to ensure investors can support the EU transition 💪

Kritsche Aktionare, Winson Sonsini

With new challenges arising, we’re identifying barriers & opportunities to ensure investors can support the EU transition 💪

With key sustainability laws like #CSRD, #CSDDD, and the EU #Taxonomy under threat, it’s crucial to join forces and push back against #deregulation🤝

With key sustainability laws like #CSRD, #CSDDD, and the EU #Taxonomy under threat, it’s crucial to join forces and push back against #deregulation🤝