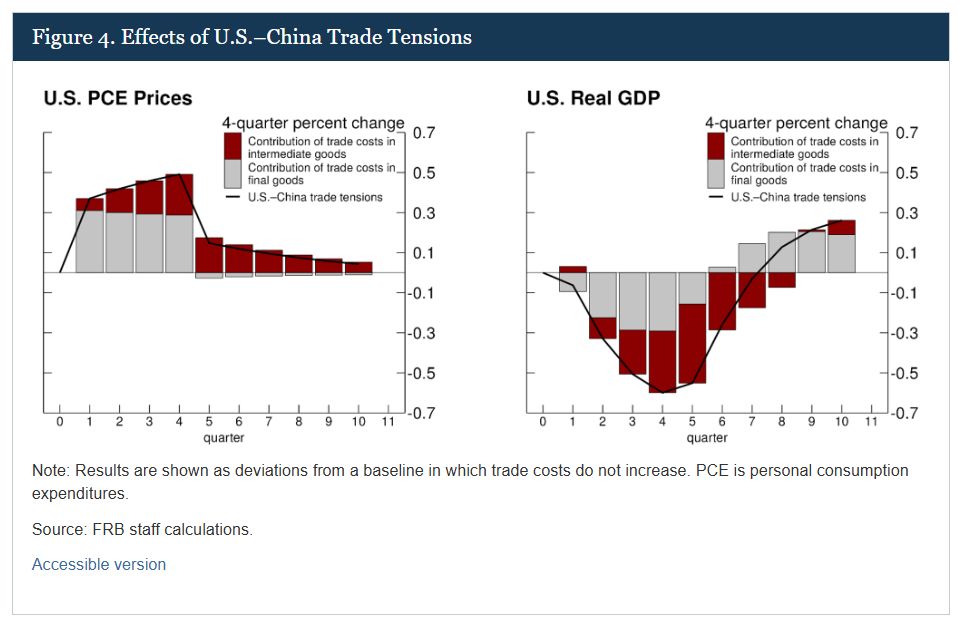

PCE prices are estimated to rise by 0.5 pp. Tariffs on final goods lead to a one-time increase in prices. Tariffs on intermediate goods lead to more persistent effects www.federalreserve.gov/econres/note...

PCE prices are estimated to rise by 0.5 pp. Tariffs on final goods lead to a one-time increase in prices. Tariffs on intermediate goods lead to more persistent effects www.federalreserve.gov/econres/note...

The newspaper highlights how China's aggressive export-led growth model, which is hammering the German economy, is having serious knock-on effects for Italy.

The German crisis is a European crisis.

1/x

1 in 3 vehicles priced below $30,000 are built in Mexico, up from 1 in 5 a decade ago

“Everyone’s got a pretty big case of anxiety here,” said the head of Kia’s U.S. operations. “In two words: Please don’t.”

www.wsj.com/business/aut...

1 in 3 vehicles priced below $30,000 are built in Mexico, up from 1 in 5 a decade ago

“Everyone’s got a pretty big case of anxiety here,” said the head of Kia’s U.S. operations. “In two words: Please don’t.”

www.wsj.com/business/aut...

www.reuters.com/markets/rate...

www.reuters.com/markets/rate...