Many thanks to @igorletina.bsky.social and @jsndr.bsky.social for putting together a fantastic program.

🧵 1/7

🧵 1/7

🗣️Jonathan Kanter @lugaricano.bsky.social @imarinescu.bsky.social @igorletina.bsky.social Hans Zenger

Moderator: @florianederer.bsky.social

Register: cepr.org/events/ai-ac...

#EconSky

🗣️Jonathan Kanter @lugaricano.bsky.social @imarinescu.bsky.social @igorletina.bsky.social Hans Zenger

Moderator: @florianederer.bsky.social

Register: cepr.org/events/ai-ac...

#EconSky

Reverse acquihires are characterized by two things: 1) the buyer takes over the most important/talented employees and 2) the buyer pays a hefty sum to the target firm via a side deal.

They are becoming common in the AI space:

Reverse acquihires are characterized by two things: 1) the buyer takes over the most important/talented employees and 2) the buyer pays a hefty sum to the target firm via a side deal.

They are becoming common in the AI space:

Paper: arxiv.org/abs/2412.100...

Happy to hear you thoughts!

Paper: arxiv.org/abs/2412.100...

Happy to hear you thoughts!

(1) Hierarchical organizations: our results suggest balancing diversity and uniformity in employees’ preferences as a function of hierarchical distance.

(2) Political discrimination: Opposed advisors can balance biased policymakers.

(1) Hierarchical organizations: our results suggest balancing diversity and uniformity in employees’ preferences as a function of hierarchical distance.

(2) Political discrimination: Opposed advisors can balance biased policymakers.

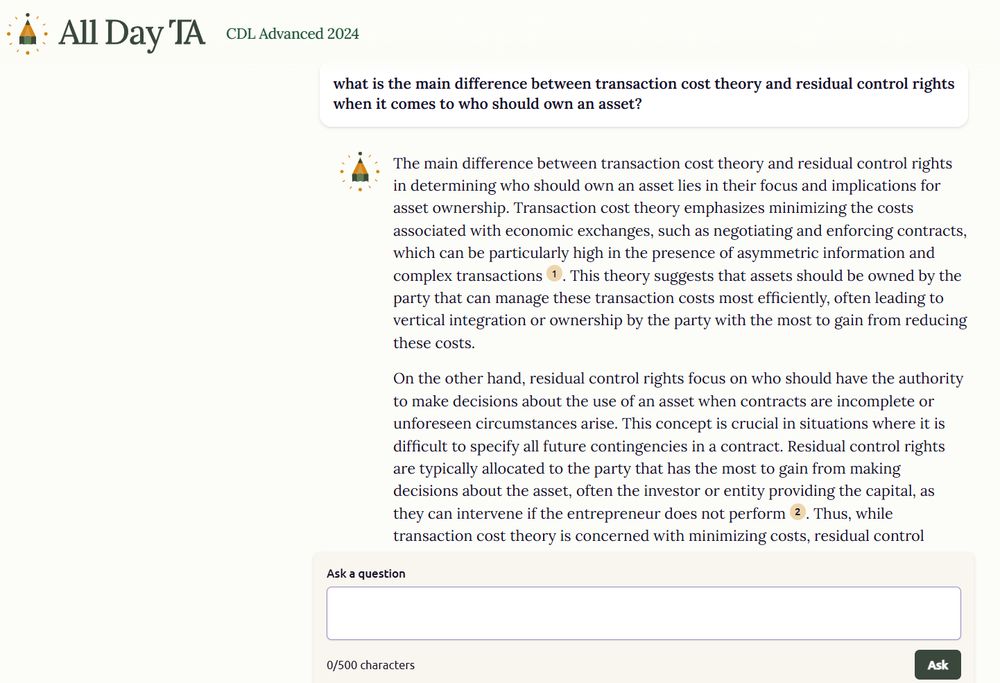

The question that we are interested in is this: when should you stop searching for an innovation?

Surprisingly (to us) the answer in our model is: never.

Link to the paper: arxiv.org/abs/2412.03227

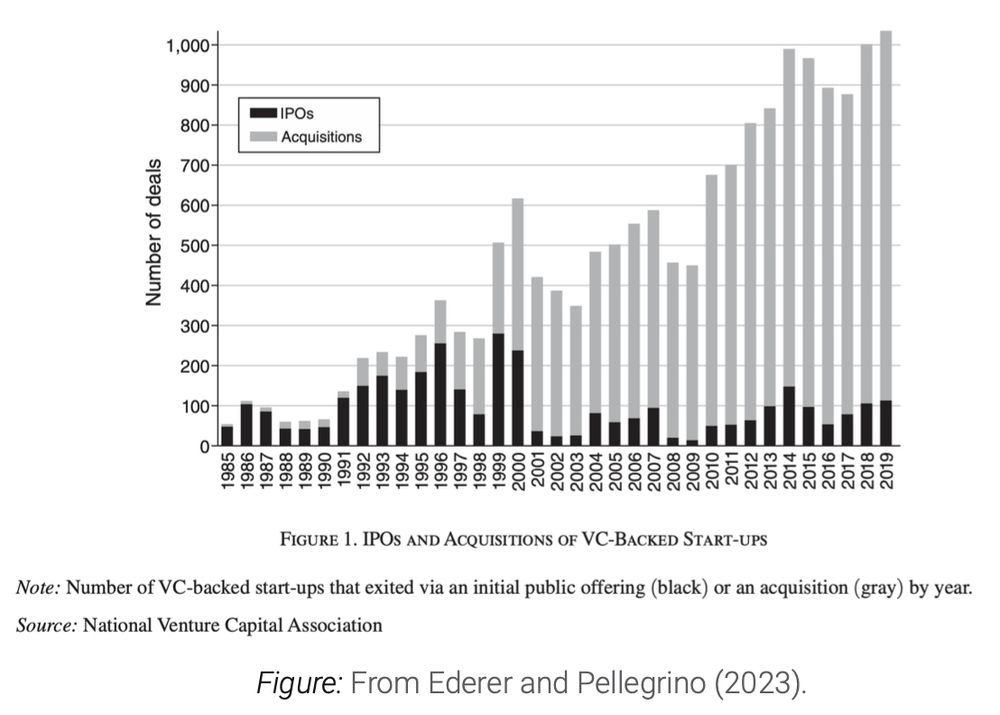

1/ Since ~2001, acquisitions have overtaken IPOs as the primary "exit" for VC-backed startups. This shift impacts how competition plays out.

1/ Since ~2001, acquisitions have overtaken IPOs as the primary "exit" for VC-backed startups. This shift impacts how competition plays out.

We welcome theoretical and empirical papers on killer acquisitions, acquihires, incentives to innovate, and other topics related to startup acquisitions.

CfP: www.igorletina.com/files/cfp_es...

📈📉

www.economist.com/science-and-...

www.economist.com/science-and-...

👉 4-year Postdoc position in Macroeconomics / Banking / Finance

👉 Dept. of Economics, University of Bern, group of Profs. Cyril Monnet and Dirk Niepelt

👉 Project on "Money and Debt in the 21st Century: Liquidity, Safety, Redistribution"

📈📉

econjobmarket.org/statuses?oid...

👉 4-year Postdoc position in Macroeconomics / Banking / Finance

👉 Dept. of Economics, University of Bern, group of Profs. Cyril Monnet and Dirk Niepelt

👉 Project on "Money and Debt in the 21st Century: Liquidity, Safety, Redistribution"

📈📉

econjobmarket.org/statuses?oid...