Jeremy Kress

@jeremykress.bsky.social

Associate Professor of Business Law, University of Michigan Ross School of Business. Views my own.

This is a preposterously poorly reasoned final rule that will let the 36 largest U.S. banks off the hook for their management failures.

Inexplicable that two Democratic Fed appointees supported it.

Inexplicable that two Democratic Fed appointees supported it.

@federalreserve.gov finalizes changes to its supervisory rating framework for large bank holding companies: www.federalreserve.gov/newsevents/p...

Federal Reserve Board finalizes changes to its supervisory rating framework for large bank holding companies

The Federal Reserve Board on Wednesday finalized changes to its supervisory rating framework for large bank holding companies. The finalized framework is subst

www.federalreserve.gov

November 5, 2025 at 10:48 PM

This is a preposterously poorly reasoned final rule that will let the 36 largest U.S. banks off the hook for their management failures.

Inexplicable that two Democratic Fed appointees supported it.

Inexplicable that two Democratic Fed appointees supported it.

"There is simply no legal requirement to turn the stress test into an open-book exam where banks get to help pick the questions. This is a policy choice, and a bad one at that." -- Me, being grumpy about the Fed capitulating to the banks, yet again

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

Stress Tests Give Banks More Say on Criteria in Fed’s Proposal

Wall Street lenders would get an early peek into criteria for upcoming stress tests under a new plan being considered by the Federal Reserve to overhaul its marquee exam.

www.bloomberg.com

October 24, 2025 at 7:51 PM

"There is simply no legal requirement to turn the stress test into an open-book exam where banks get to help pick the questions. This is a policy choice, and a bad one at that." -- Me, being grumpy about the Fed capitulating to the banks, yet again

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

Inexplicable that Lisa Cook continues to support harmful bank deregulation by the administration that's trying to illegally fire her. SMDH.

www.federalreserve.gov/aboutthefed/...

www.federalreserve.gov/aboutthefed/...

October 24, 2025 at 7:32 PM

Inexplicable that Lisa Cook continues to support harmful bank deregulation by the administration that's trying to illegally fire her. SMDH.

www.federalreserve.gov/aboutthefed/...

www.federalreserve.gov/aboutthefed/...

Despite what the Fed claims, there is no legal requirement to turn the stress test into an open-book exam where the banks get to help pick the questions. This is a policy choice, and a bad one at that.

The Fed is making its stress tests more transparent following a lawsuit from the country's biggest banks. The proposal has broad support, but Barr (fmr VC for supervision) says it will make the financial system less safe

www.nytimes.com/2025/10/24/b... @stacycowley.bsky.social @nytimes.com

www.nytimes.com/2025/10/24/b... @stacycowley.bsky.social @nytimes.com

Fed Prepares Bank-Friendly Changes to Annual Stress Tests

www.nytimes.com

October 24, 2025 at 6:01 PM

Despite what the Fed claims, there is no legal requirement to turn the stress test into an open-book exam where the banks get to help pick the questions. This is a policy choice, and a bad one at that.

Reminds me of a cartoon a colleague once taped to my door.

October 24, 2025 at 1:38 PM

Reminds me of a cartoon a colleague once taped to my door.

Earlier this year, JPMorgan refused to comply with new nonbank lending disclosure requirements [left].

Today, JPMorgan attributed recent turmoil in bank stocks to "very poor" nonbank lending disclosure [right].

🫠

Today, JPMorgan attributed recent turmoil in bank stocks to "very poor" nonbank lending disclosure [right].

🫠

October 20, 2025 at 2:48 PM

Earlier this year, JPMorgan refused to comply with new nonbank lending disclosure requirements [left].

Today, JPMorgan attributed recent turmoil in bank stocks to "very poor" nonbank lending disclosure [right].

🫠

Today, JPMorgan attributed recent turmoil in bank stocks to "very poor" nonbank lending disclosure [right].

🫠

Reposted by Jeremy Kress

A deeply unserious statement on the Fed’s decision today to ignore the financial implications of climate change from the supposedly moderate, institutionalist candidate to be the next Fed chair.

October 16, 2025 at 7:24 PM

A deeply unserious statement on the Fed’s decision today to ignore the financial implications of climate change from the supposedly moderate, institutionalist candidate to be the next Fed chair.

The Fed, FDIC, and OCC proposed climate-related financial risk management principles for public comment before adopting them in 2023.

Today, the agencies rescinded them with no notice and comment.

Once again, the APA only applies in one direction. SMDH.

www.federalreserve.gov/newsevents/p...

Today, the agencies rescinded them with no notice and comment.

Once again, the APA only applies in one direction. SMDH.

www.federalreserve.gov/newsevents/p...

Agencies announce withdrawal of principles for climate-related financial risk management

The federal bank regulatory agencies today announced the withdrawal of interagency Principles for Climate-Related Financial Risk Management for Large Financial

www.federalreserve.gov

October 16, 2025 at 7:13 PM

The Fed, FDIC, and OCC proposed climate-related financial risk management principles for public comment before adopting them in 2023.

Today, the agencies rescinded them with no notice and comment.

Once again, the APA only applies in one direction. SMDH.

www.federalreserve.gov/newsevents/p...

Today, the agencies rescinded them with no notice and comment.

Once again, the APA only applies in one direction. SMDH.

www.federalreserve.gov/newsevents/p...

Bookmarking for later this week when the Fed proposes further weakening the stress test “to boost lending.”

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

Banks’ Stock Buybacks Jump $10 Billion After Easier Fed Test

Four of the biggest US banks almost doubled their stock buybacks in the first full quarter following the Federal Reserve’s annual stress test, which the lenders all comfortably passed in June.

www.bloomberg.com

October 15, 2025 at 11:24 AM

Bookmarking for later this week when the Fed proposes further weakening the stress test “to boost lending.”

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

All of these Domestic Systemically Important Bank mergers might be less objectionable if regulators had done *literally anything* to improve DSIB regulation in the aftermath of March 2023.

Fifth Third to buy Comerica in $10.9 billion deal reut.rs/48mFBPH

Fifth Third to buy Comerica in $10.9 billion deal

Fifth Third said on Monday it will buy regional lender Comerica in a deal valued at $10.9 billion.

reut.rs

October 6, 2025 at 11:55 AM

All of these Domestic Systemically Important Bank mergers might be less objectionable if regulators had done *literally anything* to improve DSIB regulation in the aftermath of March 2023.

Important story about what we lose when a handful of behemoths dominate the banking system.

“We don’t talk much about small businesses with enduring financial needs that have been forced into shotgun weddings with soulless institutions that are disinterested in their futures.”

“We don’t talk much about small businesses with enduring financial needs that have been forced into shotgun weddings with soulless institutions that are disinterested in their futures.”

Half of all companies in the US use big banks as their primary financial services provider. I document two cases where small businesses were ruined by their big bank. The loss of relationship lending has a cost. 🧵

prospect.org/economy/2025...

prospect.org/economy/2025...

Big Banks Behaving Badly

Decades of consolidation have made large financial institutions the primary partners for small businesses. Two case studies show how this can go awry.

prospect.org

September 25, 2025 at 1:16 AM

Important story about what we lose when a handful of behemoths dominate the banking system.

“We don’t talk much about small businesses with enduring financial needs that have been forced into shotgun weddings with soulless institutions that are disinterested in their futures.”

“We don’t talk much about small businesses with enduring financial needs that have been forced into shotgun weddings with soulless institutions that are disinterested in their futures.”

Reposted by Jeremy Kress

With the US potentially coming to Argentina's financial rescue, I'm sharing my new paper on "Financial Statecraft."

It critiques the government's deployment of the banking system for geopolitical purposes and proposes reforms to rebalance public and private power.

papers.ssrn.com/sol3/papers....

It critiques the government's deployment of the banking system for geopolitical purposes and proposes reforms to rebalance public and private power.

papers.ssrn.com/sol3/papers....

September 23, 2025 at 3:19 PM

With the US potentially coming to Argentina's financial rescue, I'm sharing my new paper on "Financial Statecraft."

It critiques the government's deployment of the banking system for geopolitical purposes and proposes reforms to rebalance public and private power.

papers.ssrn.com/sol3/papers....

It critiques the government's deployment of the banking system for geopolitical purposes and proposes reforms to rebalance public and private power.

papers.ssrn.com/sol3/papers....

Reposted by Jeremy Kress

Kate Judge, Co-Chair, Better Markets Academic Advisory Board & Columbia Law Prof. joins @jeremykress.bsky.social, Assoc. Professor U-M Business and Co-Faculty Dir. U-M Ctr on Finance, Law & Policy; @skandaamarnath.bsky.social, Exec. Dir. @employamerica.bsky.social to discuss what's next for the Fed.

September 19, 2025 at 2:56 PM

Kate Judge, Co-Chair, Better Markets Academic Advisory Board & Columbia Law Prof. joins @jeremykress.bsky.social, Assoc. Professor U-M Business and Co-Faculty Dir. U-M Ctr on Finance, Law & Policy; @skandaamarnath.bsky.social, Exec. Dir. @employamerica.bsky.social to discuss what's next for the Fed.

May help explain why Bessent threatened to punch Pulte “in his fucking face”?

(Bloomberg) - US Treasury Secretary Scott Bessent once agreed to occupy two different houses as his “principal residence” at the same time, mortgage documents show — the same kind of contradictory pledges that .. Trump has been using to try to oust .. Lisa Cook.

www.bloomberg.com/news/article...

www.bloomberg.com/news/article...

September 17, 2025 at 1:05 PM

May help explain why Bessent threatened to punch Pulte “in his fucking face”?

Looking forward to speaking at this event on Friday, where I will try to answer the question, "What's Next for the Federal Reserve?" 👇

This week! Join us on Friday, September 19 for the State of Economic & Financial Policymaking Conference, hosted by our Academic Advisory Board—bold ideas, expert panels. bettermarkets.org/analysis/bet...

September 16, 2025 at 8:08 PM

Looking forward to speaking at this event on Friday, where I will try to answer the question, "What's Next for the Federal Reserve?" 👇

The story tonight is not that Gov. Cook gets to vote this week.

The Katsas dissent is *the* story.

That the only Trump-appointed judge to opine on this case would effectively eliminate Fed independence is an ominous sign for what SCOTUS may ultimately do…

The Katsas dissent is *the* story.

That the only Trump-appointed judge to opine on this case would effectively eliminate Fed independence is an ominous sign for what SCOTUS may ultimately do…

BREAKING: The DC Circuit has *rejected* Trump's bid to fire Lisa Cook from the Fed board, allowing her to participate in tomorrow's interest-rate setting meeting.

Trump's last hope is a quick stay from SCOTUS. storage.courtlistener.com/recap/gov.us...

Trump's last hope is a quick stay from SCOTUS. storage.courtlistener.com/recap/gov.us...

September 16, 2025 at 1:15 AM

The story tonight is not that Gov. Cook gets to vote this week.

The Katsas dissent is *the* story.

That the only Trump-appointed judge to opine on this case would effectively eliminate Fed independence is an ominous sign for what SCOTUS may ultimately do…

The Katsas dissent is *the* story.

That the only Trump-appointed judge to opine on this case would effectively eliminate Fed independence is an ominous sign for what SCOTUS may ultimately do…

I was delighted to contribute to the Yale JREG symposium on @seanvanatta.bsky.social and @petercontibrown.bsky.social's excellent new book.

My essay examines what the book can teach us about efforts to eliminate management ratings from the supervisory toolkit.

www.yalejreg.com/nc/in-defens...

My essay examines what the book can teach us about efforts to eliminate management ratings from the supervisory toolkit.

www.yalejreg.com/nc/in-defens...

www.yalejreg.com

September 12, 2025 at 5:34 PM

I was delighted to contribute to the Yale JREG symposium on @seanvanatta.bsky.social and @petercontibrown.bsky.social's excellent new book.

My essay examines what the book can teach us about efforts to eliminate management ratings from the supervisory toolkit.

www.yalejreg.com/nc/in-defens...

My essay examines what the book can teach us about efforts to eliminate management ratings from the supervisory toolkit.

www.yalejreg.com/nc/in-defens...

Nobel laureate Peter Diamond's Fed nomination languished in the Senate for more than a year.

Stephan Miran is going to get confirmed in less than two weeks.

Stephan Miran is going to get confirmed in less than two weeks.

ML Thune filed cloture Executive Calendar #366, Stephan Miran, of New York, to be a member of the Board of Governors for the Federal Reserve System.

September 12, 2025 at 12:40 PM

Nobel laureate Peter Diamond's Fed nomination languished in the Senate for more than a year.

Stephan Miran is going to get confirmed in less than two weeks.

Stephan Miran is going to get confirmed in less than two weeks.

Today, the FSOC cut its own budget by >30%.

The FSOC is funded through fees paid by large financial institutions, so this saves taxpayers $0.

home.treasury.gov/policy-issue...

The FSOC is funded through fees paid by large financial institutions, so this saves taxpayers $0.

home.treasury.gov/policy-issue...

September 10, 2025 at 10:41 PM

Today, the FSOC cut its own budget by >30%.

The FSOC is funded through fees paid by large financial institutions, so this saves taxpayers $0.

home.treasury.gov/policy-issue...

The FSOC is funded through fees paid by large financial institutions, so this saves taxpayers $0.

home.treasury.gov/policy-issue...

I am very much done with the histrionics about *Biden* politicizing the Fed.

Senate Banking approves Miran nomination on party line vote, 13-11. Now goes to the floor. @bloomberg.com reporting a likely confirmation vote on Monday. FOMC meeting begins Tuesday.

September 10, 2025 at 2:31 PM

I am very much done with the histrionics about *Biden* politicizing the Fed.

Judge to Trump: Either prosecute and convict Gov. Cook or GTFO.

September 10, 2025 at 2:30 AM

Judge to Trump: Either prosecute and convict Gov. Cook or GTFO.

People who rent out dubiously mortgaged houses shouldn’t throw stones.

Fed gov. nominee Miran notes in new disclosure form a property he mortgaged in 2022 is now an investment property/rental, document endnote says "previously reported as a mortgage on a primary residence; began renting out the property during the reporting period.”

Fed nominee Miran notes primary residence now used as rental property

President Donald Trump's nominee to the U.S. Federal Reserve Board of Governors, Stephen Miran, has a mortgage on a home formerly listed as his primary residence that he is now using as a rental property, according to his latest financial disclosure statement.

www.reuters.com

September 8, 2025 at 9:56 PM

People who rent out dubiously mortgaged houses shouldn’t throw stones.

The ease with which the Senate Banking Committee let Stephan Miran disown his past writings contrasts sharply with how they forced Saule Omarova to defend mischaracterization of her scholarship just four years ago.

September 4, 2025 at 5:21 PM

The ease with which the Senate Banking Committee let Stephan Miran disown his past writings contrasts sharply with how they forced Saule Omarova to defend mischaracterization of her scholarship just four years ago.

By my count, a solid majority of the comment letters on the banking agencies' supplementary leverage ratio proposal oppose the rule.

Definitely inconsistent with Powell's standard that final rules should have "broad support among the broader community of commenters on all sides."

Definitely inconsistent with Powell's standard that final rules should have "broad support among the broader community of commenters on all sides."

August 27, 2025 at 7:11 PM

By my count, a solid majority of the comment letters on the banking agencies' supplementary leverage ratio proposal oppose the rule.

Definitely inconsistent with Powell's standard that final rules should have "broad support among the broader community of commenters on all sides."

Definitely inconsistent with Powell's standard that final rules should have "broad support among the broader community of commenters on all sides."

I’m starting to think the Fed appeasing Trump at every step of the way was not the right move.

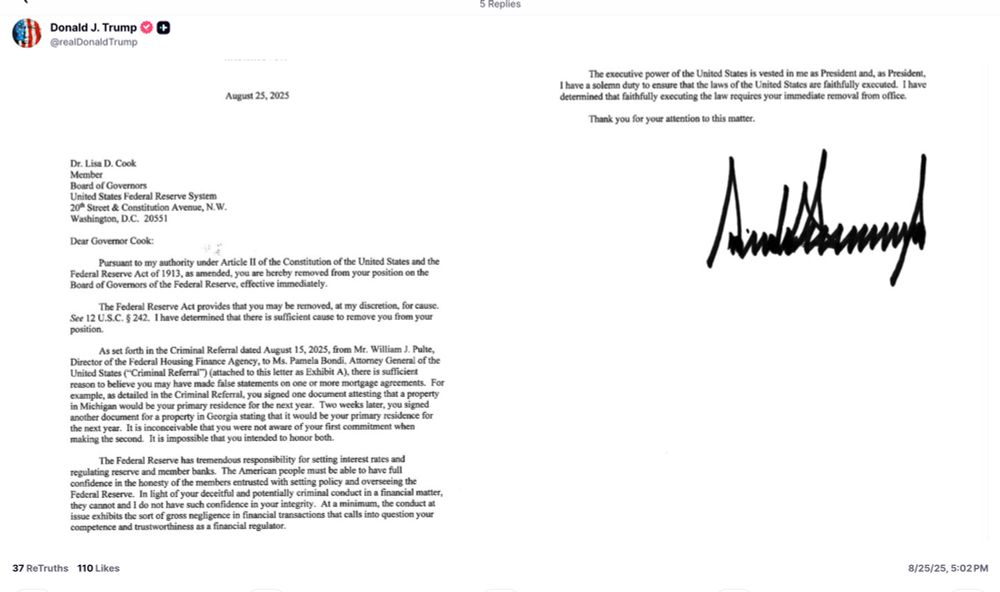

Trump posts a letter stating that he is removing Fed Governor Lisa Cook

August 26, 2025 at 12:34 AM

I’m starting to think the Fed appeasing Trump at every step of the way was not the right move.