https://www.linkedin.com/in/econ-parker/

Collapsing mortgage spreads translating to immediate relief for the 30Y fixed rate mortgage.

First time below 6% since early '23 according to MND

#EconSky

Collapsing mortgage spreads translating to immediate relief for the 30Y fixed rate mortgage.

First time below 6% since early '23 according to MND

#EconSky

What's happening? The mortgage market is undergoing a structural repricing following the directive for Fannie & Freddie to deploy $200B into MBS.

Let's dig in a bit in the 🧵

#EconSky

What's happening? The mortgage market is undergoing a structural repricing following the directive for Fannie & Freddie to deploy $200B into MBS.

Let's dig in a bit in the 🧵

#EconSky

Thrilled to announce baby Logan has arrived!

Mom and baby are healthy and happy, and the big bros are over the moon!

Thrilled to announce baby Logan has arrived!

Mom and baby are healthy and happy, and the big bros are over the moon!

But here’s the catch: that capex contribution only captures the domestic slice of the boom.

Imports of Tech capex - up 90% in 2 years - tell the rest of the story.

More in 🧵

#EconThreads

But here’s the catch: that capex contribution only captures the domestic slice of the boom.

Imports of Tech capex - up 90% in 2 years - tell the rest of the story.

More in 🧵

#EconThreads

In terms of contribution to GDP, we've never seen a surge in tech & software investment of this scale.

For some perspective, here's the contribution to real GDP growth from businesses investing in software and technology since 1960.

#EconSky

In terms of contribution to GDP, we've never seen a surge in tech & software investment of this scale.

For some perspective, here's the contribution to real GDP growth from businesses investing in software and technology since 1960.

#EconSky

All of the upward revision was due to stronger than previously reported Consumer spending on of Services, Business Investment and a modest bump to Government consumption.

Details in 🧵

#EconSky

All of the upward revision was due to stronger than previously reported Consumer spending on of Services, Business Investment and a modest bump to Government consumption.

Details in 🧵

#EconSky

Meanwhile, continuing claims also ticked down (1,926k vs 1,928k the week before) but remained near post-pandemic highs.

Details in 🧵

#EconSky

Meanwhile, continuing claims also ticked down (1,926k vs 1,928k the week before) but remained near post-pandemic highs.

Details in 🧵

#EconSky

Data immediately starts rapidly surprising to the upside

#EconSky

Data immediately starts rapidly surprising to the upside

#EconSky

Last week, the Fed's rate normalization process kicked back off & we got updates on the housing market, labor market, the consumer& industrial production.

Some thoughts on the latest developments + a link to this week's report in the 🧵

#EconSky

Last week, the Fed's rate normalization process kicked back off & we got updates on the housing market, labor market, the consumer& industrial production.

Some thoughts on the latest developments + a link to this week's report in the 🧵

#EconSky

Mortgage refinance applications jumped 58% w/w last week as the 30-year fixed rate mortgage fell to the lowest level since last September.

Some more details in the 🧵

#EconSky

Mortgage refinance applications jumped 58% w/w last week as the 30-year fixed rate mortgage fell to the lowest level since last September.

Some more details in the 🧵

#EconSky

www.twc.texas.gov/news/reminde...

#EconSky

www.twc.texas.gov/news/reminde...

#EconSky

After sitting on the backburner for some time, jobless claims are back in the headlines with the highest weekly print since the pandemic.

Initial jobless claims jumped by 32k to 263k during the week ending Sept 6.

Let's see what's going on in the 🧵

#EconSky

After sitting on the backburner for some time, jobless claims are back in the headlines with the highest weekly print since the pandemic.

Initial jobless claims jumped by 32k to 263k during the week ending Sept 6.

Let's see what's going on in the 🧵

#EconSky

What does this mean?

Core goods prices are still rising at an above trend pace, while broader price pressures eased.

Details in the 🧵

#EconSky

What does this mean?

Core goods prices are still rising at an above trend pace, while broader price pressures eased.

Details in the 🧵

#EconSky

Last week brought us updates on the labor market & broader economic trends.

This week's big news will be the last CPI report ahead of next week's Sept. FOMC decision.

Quick thoughts on the latest developments and link to the report in the 🧵

#EconSky

Last week brought us updates on the labor market & broader economic trends.

This week's big news will be the last CPI report ahead of next week's Sept. FOMC decision.

Quick thoughts on the latest developments and link to the report in the 🧵

#EconSky

Glad you asked.

Here's a look at monthly job growth if we include the revised data and carry forward that monthly pace of negative revisions through August.

Details in the 🧵

#EconSky

Glad you asked.

Here's a look at monthly job growth if we include the revised data and carry forward that monthly pace of negative revisions through August.

Details in the 🧵

#EconSky

Last week brought us updates on the consumer, inflation trends, and the manufacturing sector.

This week will be capped by Powell's speech at Jackson Hole.

Some quick thoughts on the latest developments and a link to this week's report in the 🧵

#EconSky

Last week brought us updates on the consumer, inflation trends, and the manufacturing sector.

This week will be capped by Powell's speech at Jackson Hole.

Some quick thoughts on the latest developments and a link to this week's report in the 🧵

#EconSky

I realized I haven't included that metric in my usual jobs report updates, so I whipped up a quick chart.

The trend over the last couple years is rather striking...

#EconSky

I realized I haven't included that metric in my usual jobs report updates, so I whipped up a quick chart.

The trend over the last couple years is rather striking...

#EconSky

On the surface: steady and solid consumer momentum.

Under the hood: a rising share of sales growth is being “paid for” by inflation.

Details in the 🧵

#EconSky

On the surface: steady and solid consumer momentum.

Under the hood: a rising share of sales growth is being “paid for” by inflation.

Details in the 🧵

#EconSky

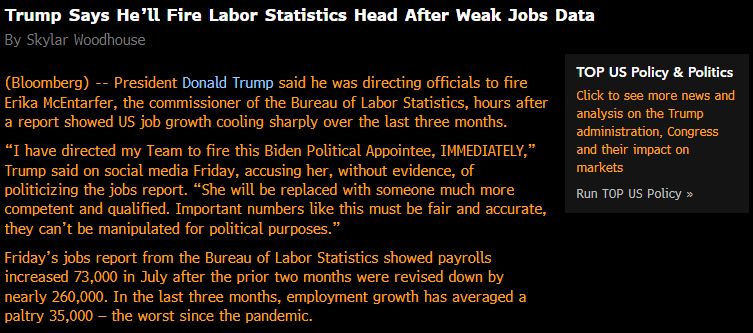

Career civil servants committed to rigorous and well-documented methodologies.

Their work anchors every key economic indicator.

A short 🧵

#EconSky

Career civil servants committed to rigorous and well-documented methodologies.

Their work anchors every key economic indicator.

A short 🧵

#EconSky

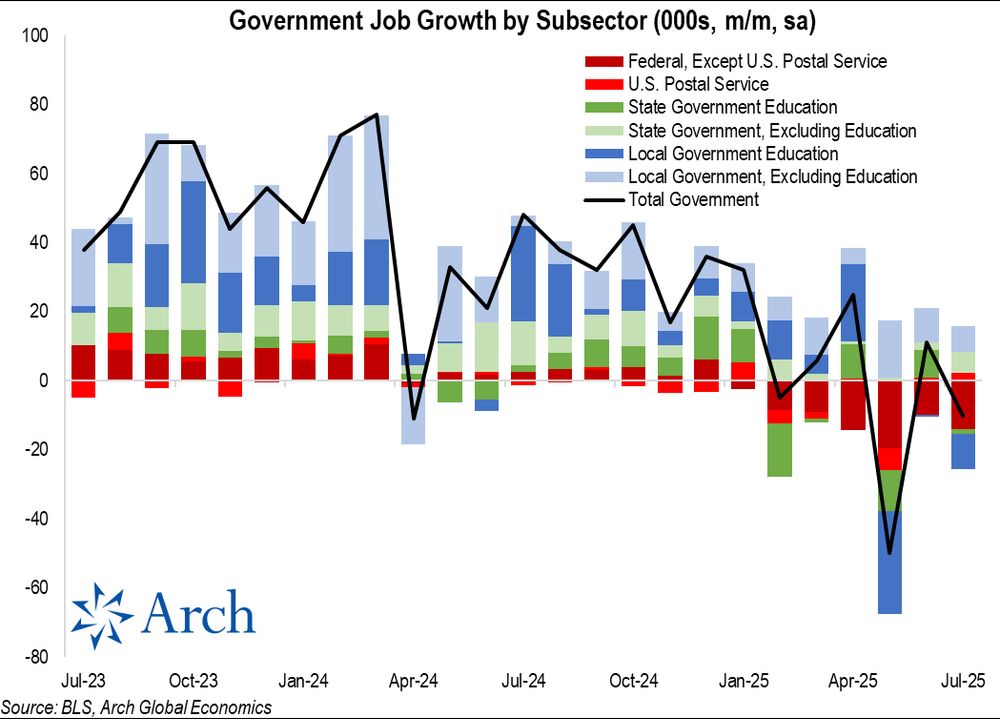

The government sector lost -10k jobs, thanks to a -14k decline in Federal workers (non-USPS).

This shouldn't have been a big surprise, but it was to consensus economists...

A quick 🧵

#EconSky

The government sector lost -10k jobs, thanks to a -14k decline in Federal workers (non-USPS).

This shouldn't have been a big surprise, but it was to consensus economists...

A quick 🧵

#EconSky

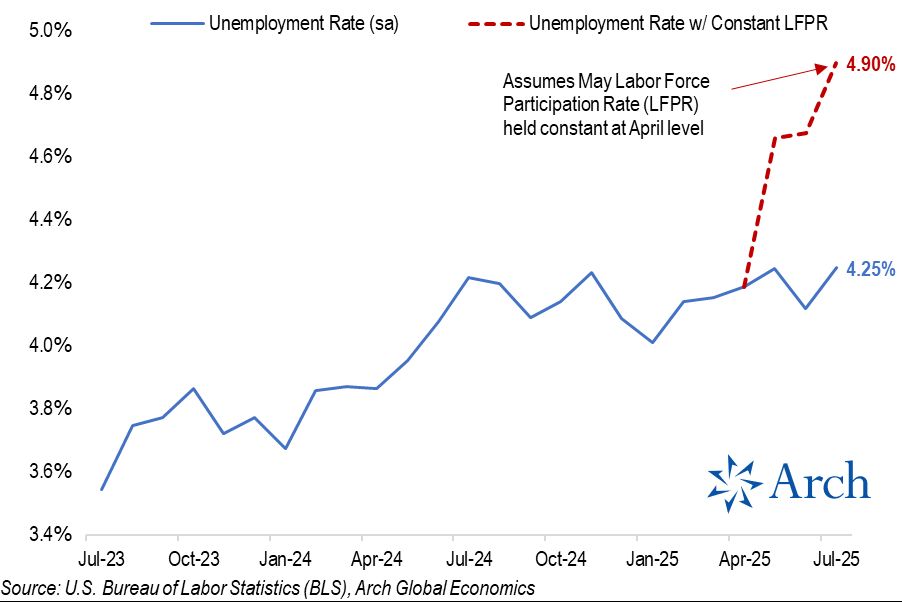

I think this one chart sums up what's wrong with anyone pointing to unemployment as a sign the labor market is "solid."

A lot to unpack in the 🧵

#EconSky

I think this one chart sums up what's wrong with anyone pointing to unemployment as a sign the labor market is "solid."

A lot to unpack in the 🧵

#EconSky