🚨 New from Indeed Hiring Lab: The Relationship Between Economic Trends and Time to Hire

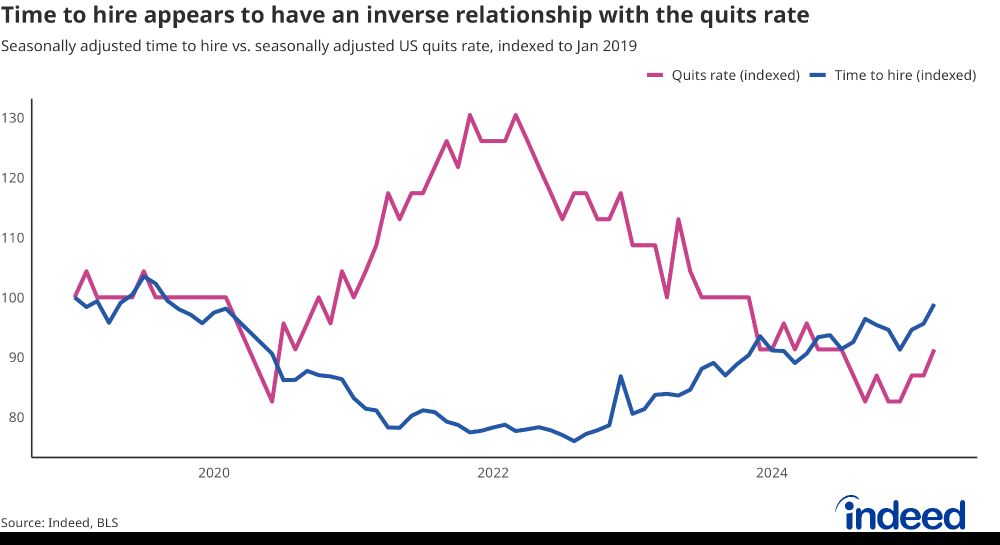

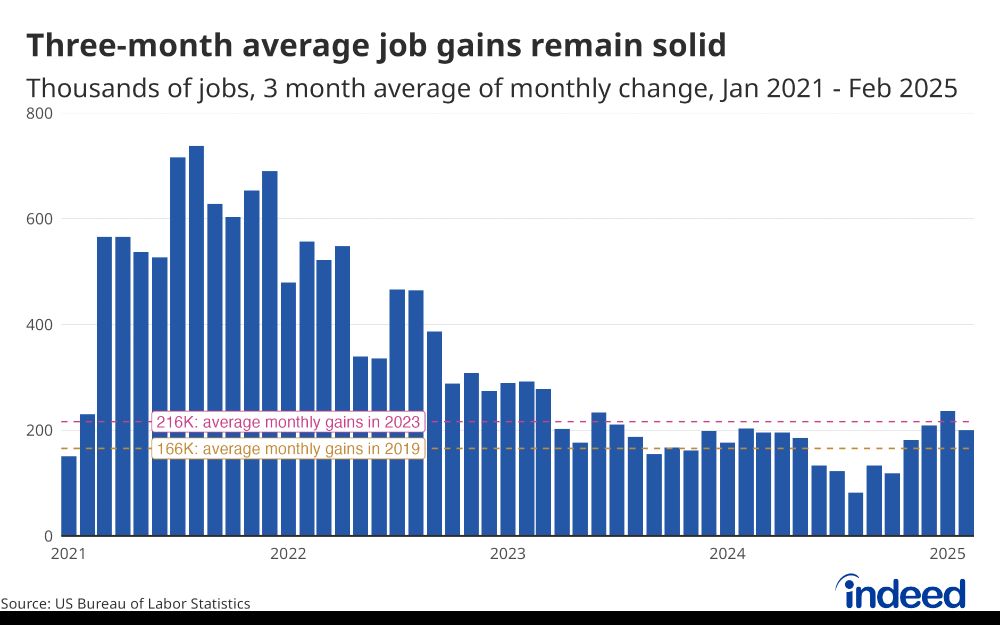

During the post-pandemic hiring boom of 2021 and 2022, job postings and quits surged, and employers sped up hiring to lock in workers. The labor market has cooled since then, and hiring is taking longer.

During the post-pandemic hiring boom of 2021 and 2022, job postings and quits surged, and employers sped up hiring to lock in workers. The labor market has cooled since then, and hiring is taking longer.

May 9, 2025 at 2:39 PM

🚨 New from Indeed Hiring Lab: The Relationship Between Economic Trends and Time to Hire

During the post-pandemic hiring boom of 2021 and 2022, job postings and quits surged, and employers sped up hiring to lock in workers. The labor market has cooled since then, and hiring is taking longer.

During the post-pandemic hiring boom of 2021 and 2022, job postings and quits surged, and employers sped up hiring to lock in workers. The labor market has cooled since then, and hiring is taking longer.

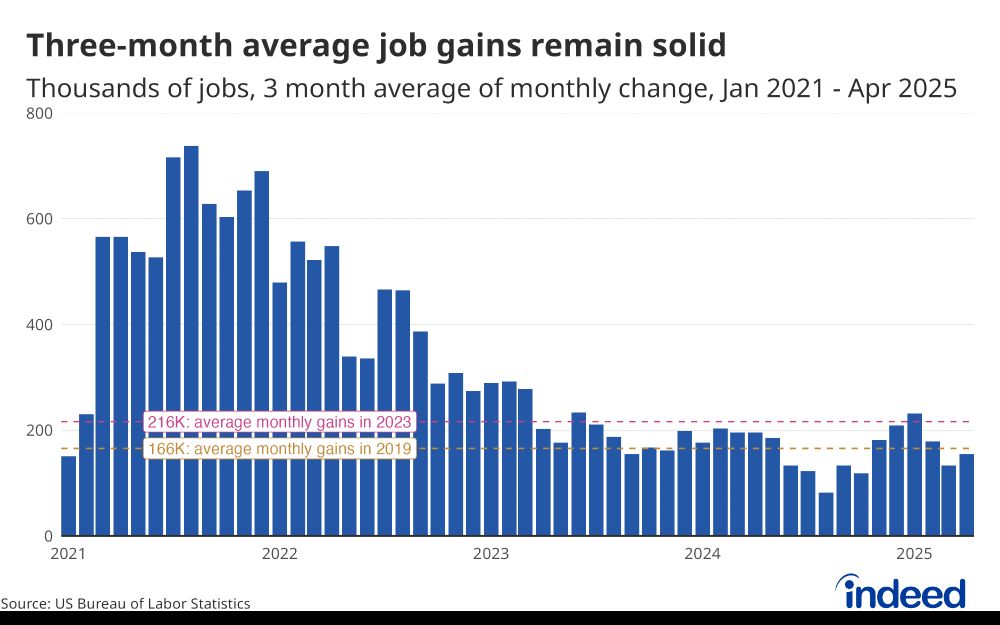

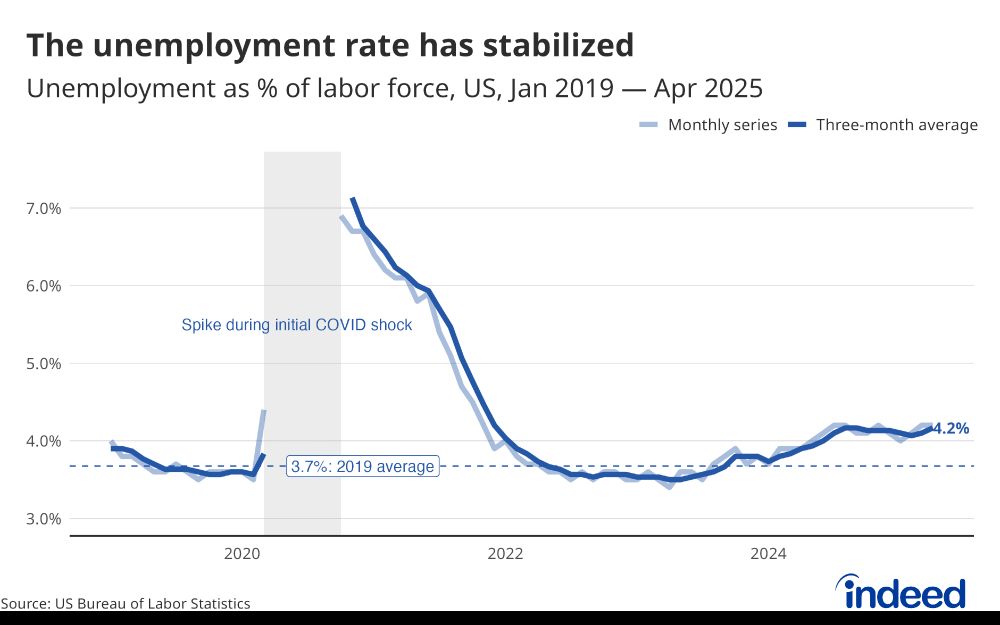

Solid jobs report, but the headline data doesn't match the vibes.

- Jobs: Up 177k

- Unemployment: Flat at 4.2%

- Healthcare jobs: +51k, transportation and warehousing: +29k, federal government: -9k

Good for now, but the market can’t escape rapidly souring business and consumer confidence forever.

- Jobs: Up 177k

- Unemployment: Flat at 4.2%

- Healthcare jobs: +51k, transportation and warehousing: +29k, federal government: -9k

Good for now, but the market can’t escape rapidly souring business and consumer confidence forever.

May 2, 2025 at 1:23 PM

Solid jobs report, but the headline data doesn't match the vibes.

- Jobs: Up 177k

- Unemployment: Flat at 4.2%

- Healthcare jobs: +51k, transportation and warehousing: +29k, federal government: -9k

Good for now, but the market can’t escape rapidly souring business and consumer confidence forever.

- Jobs: Up 177k

- Unemployment: Flat at 4.2%

- Healthcare jobs: +51k, transportation and warehousing: +29k, federal government: -9k

Good for now, but the market can’t escape rapidly souring business and consumer confidence forever.

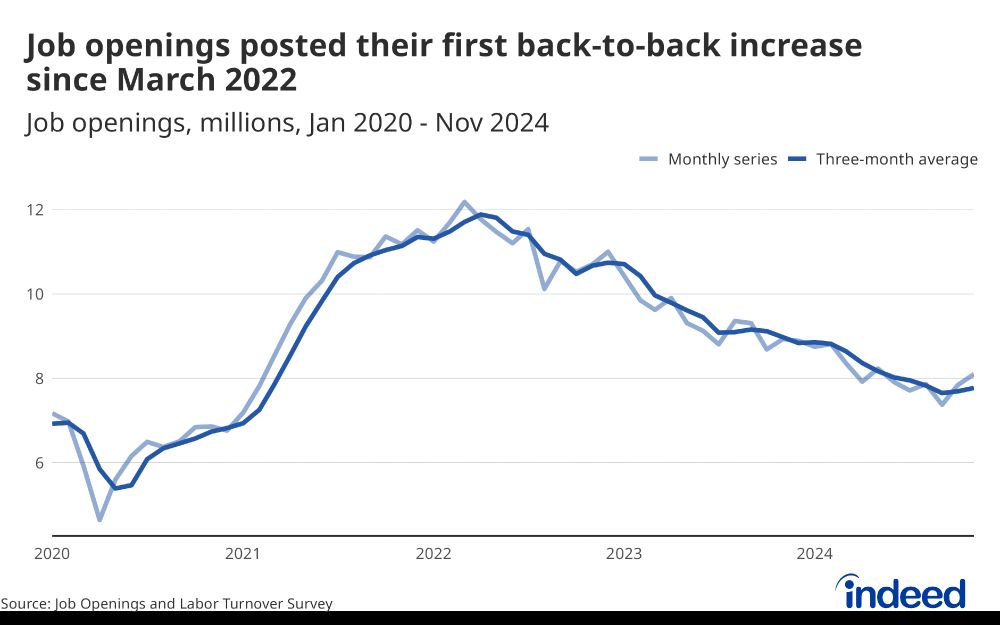

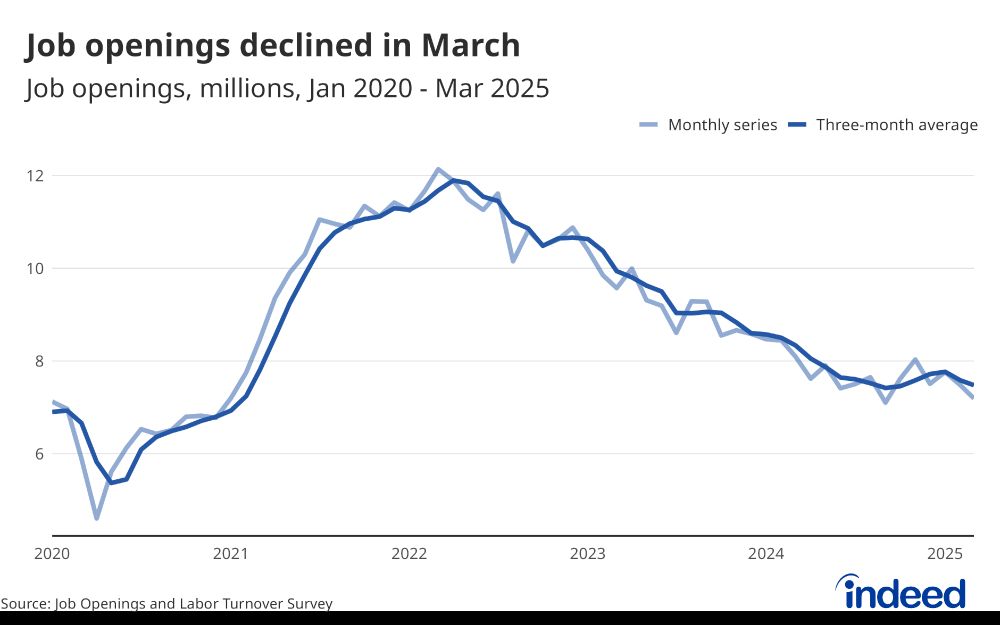

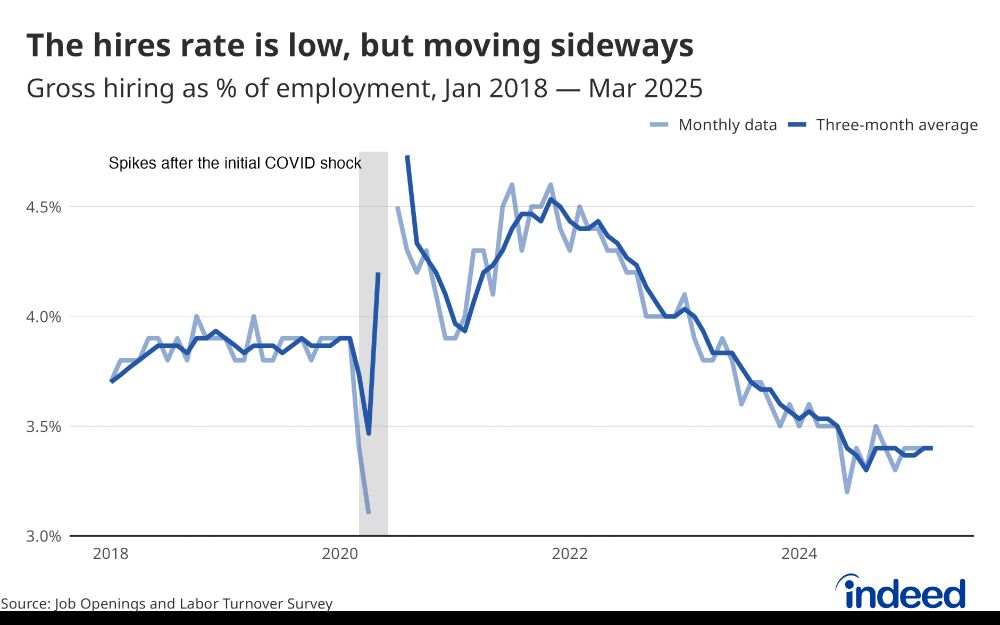

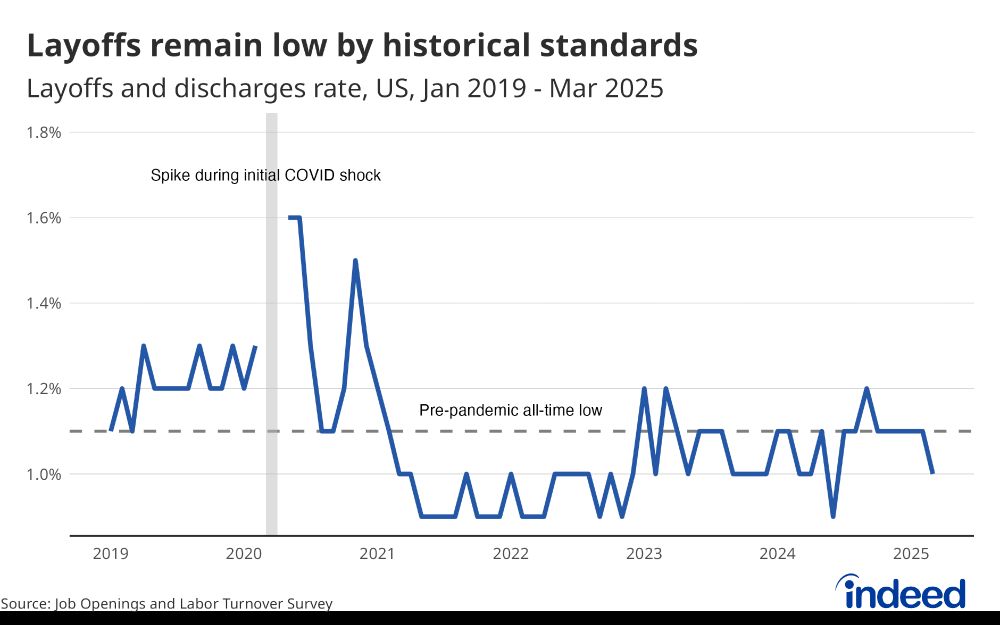

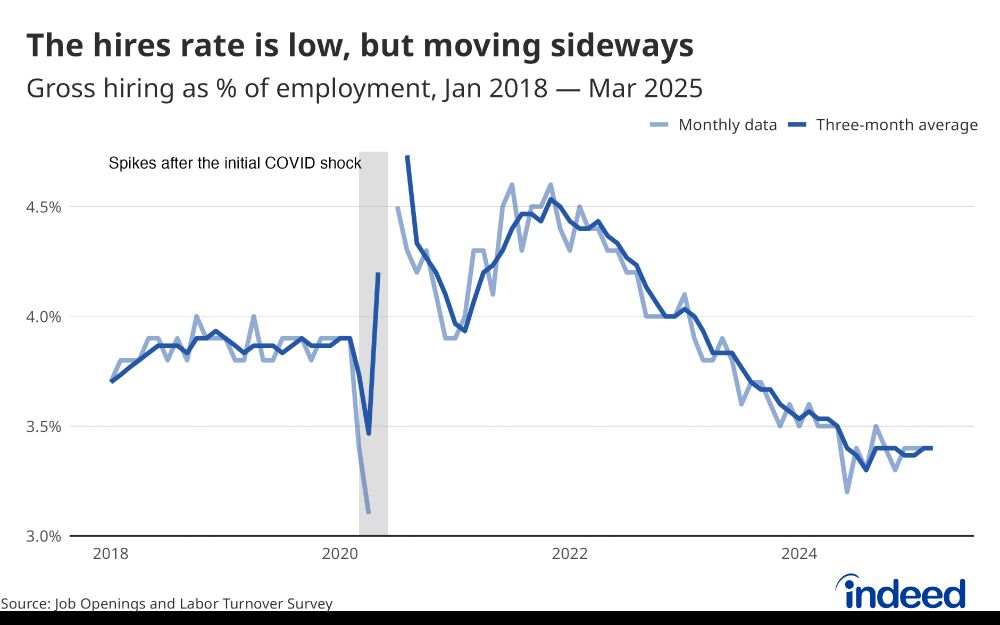

Today’s (March) JOLTS data offers another glimpse of labor market conditions – but only from the rearview mirror.

- Job openings: Down 288k from Feb, but down 901k from Mar 2024.

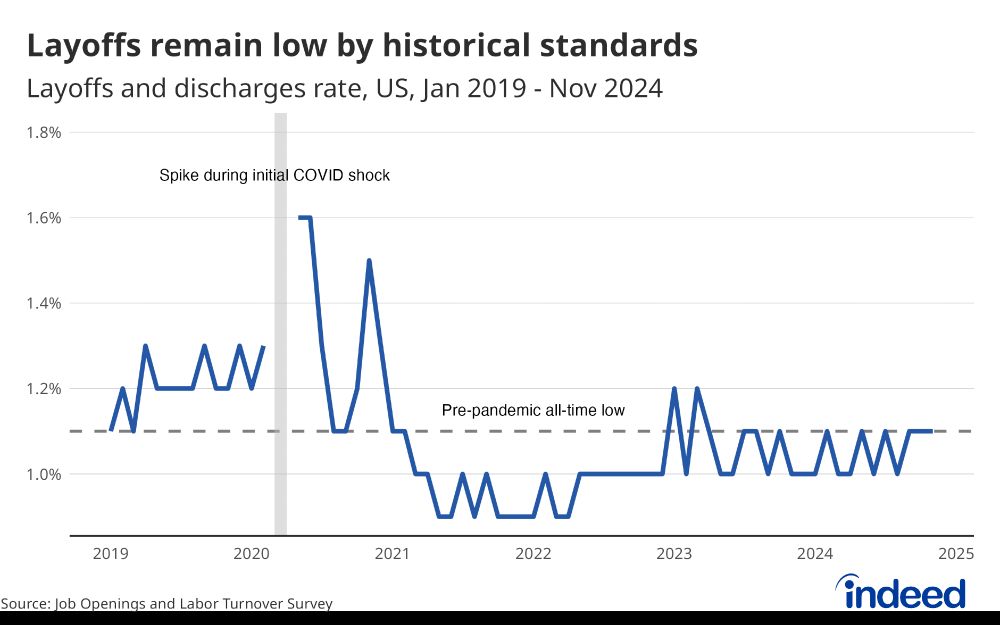

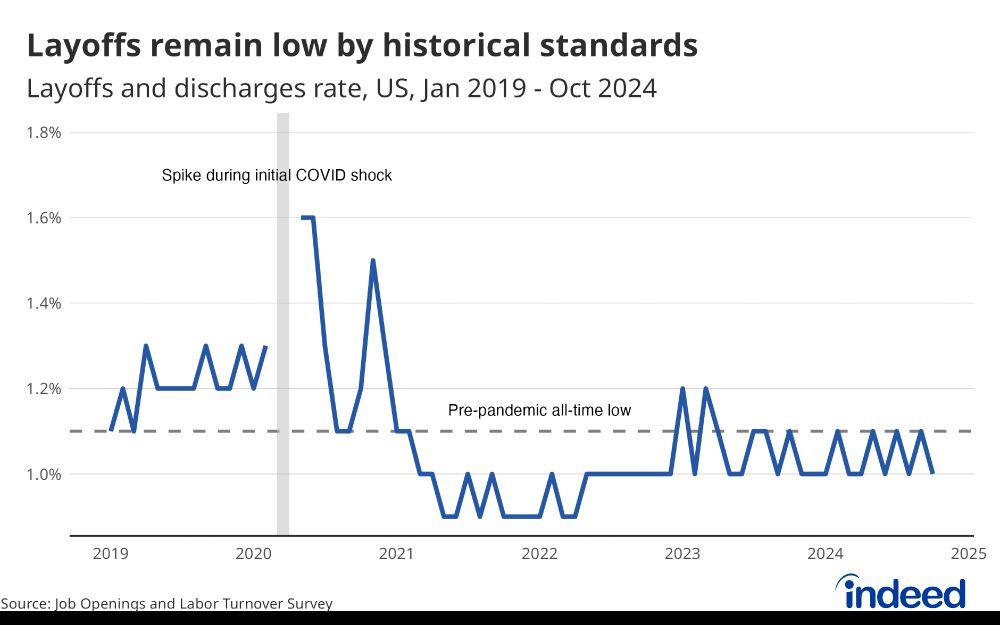

- Layoffs: Low overall at 1.0%

- Hires rate: Stable near 2013 levels

- Quits: Trending up so far this year, now at 2.1%

- Job openings: Down 288k from Feb, but down 901k from Mar 2024.

- Layoffs: Low overall at 1.0%

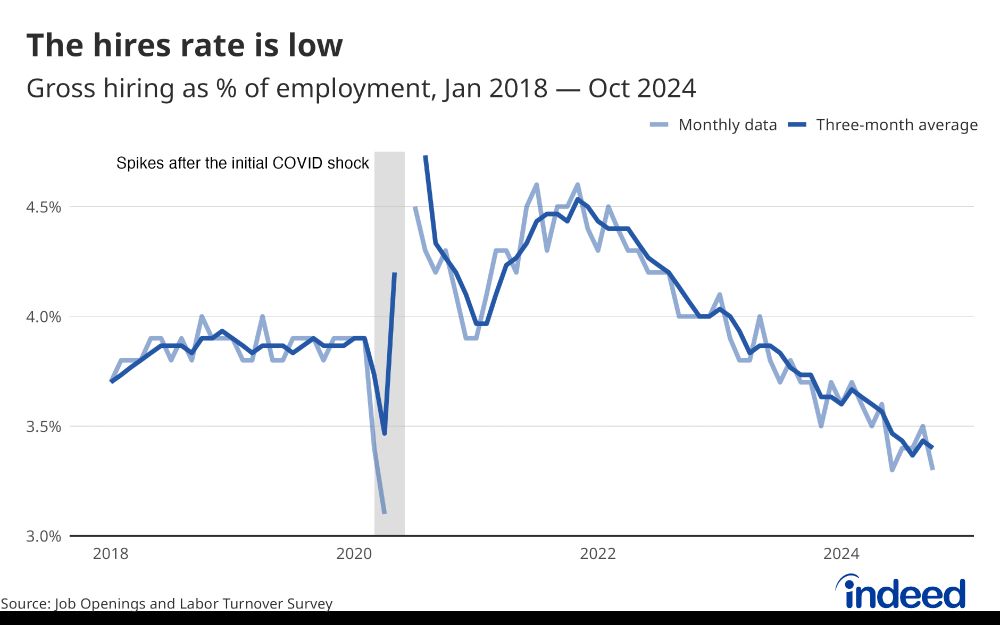

- Hires rate: Stable near 2013 levels

- Quits: Trending up so far this year, now at 2.1%

April 29, 2025 at 3:15 PM

Today’s (March) JOLTS data offers another glimpse of labor market conditions – but only from the rearview mirror.

- Job openings: Down 288k from Feb, but down 901k from Mar 2024.

- Layoffs: Low overall at 1.0%

- Hires rate: Stable near 2013 levels

- Quits: Trending up so far this year, now at 2.1%

- Job openings: Down 288k from Feb, but down 901k from Mar 2024.

- Layoffs: Low overall at 1.0%

- Hires rate: Stable near 2013 levels

- Quits: Trending up so far this year, now at 2.1%

Reposted by Cory Stahle

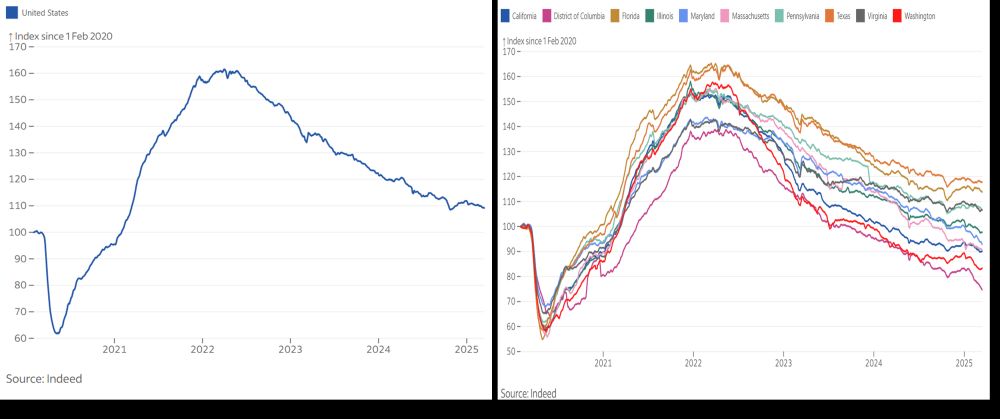

Is uncertainty starting to affect the labor market? Indeed's daily index of job postings thru Mar 14 points to ongoing cooling in listings w/ largest declines in DC/Md but also Illinois & Wash & every state + national index below early Oct levels--no crash here outside DC but some loss of momentum

March 24, 2025 at 7:36 PM

Is uncertainty starting to affect the labor market? Indeed's daily index of job postings thru Mar 14 points to ongoing cooling in listings w/ largest declines in DC/Md but also Illinois & Wash & every state + national index below early Oct levels--no crash here outside DC but some loss of momentum

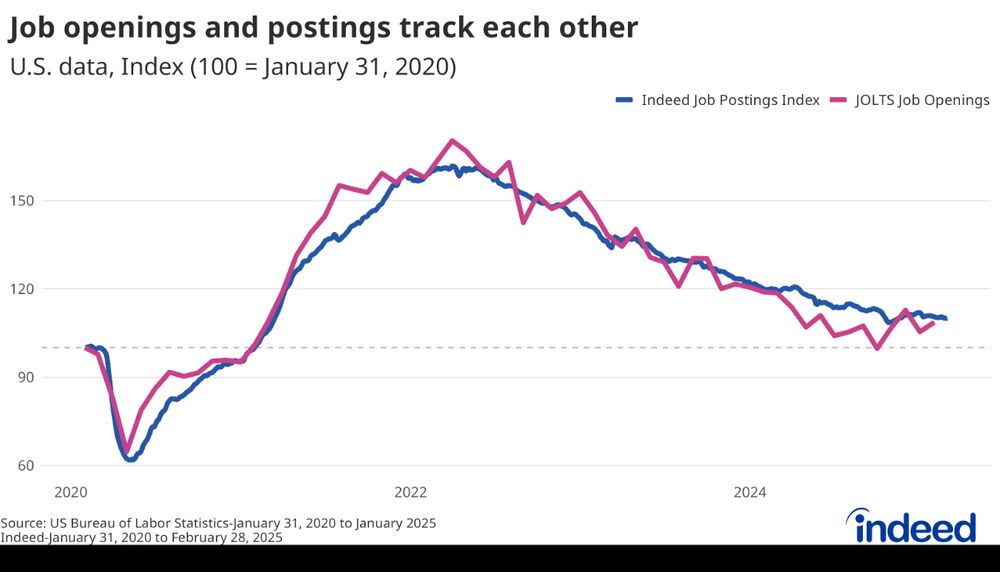

Today's JOLTS report showed that the US labor market remained stable (frozen?) in January.

A lot has obviously happened since January that didn't show up in this report. More recent data from the Indeed Job Postings Index suggests a potential scenario of renewed cooling in the coming months.

A lot has obviously happened since January that didn't show up in this report. More recent data from the Indeed Job Postings Index suggests a potential scenario of renewed cooling in the coming months.

March 11, 2025 at 3:40 PM

Today's JOLTS report showed that the US labor market remained stable (frozen?) in January.

A lot has obviously happened since January that didn't show up in this report. More recent data from the Indeed Job Postings Index suggests a potential scenario of renewed cooling in the coming months.

A lot has obviously happened since January that didn't show up in this report. More recent data from the Indeed Job Postings Index suggests a potential scenario of renewed cooling in the coming months.

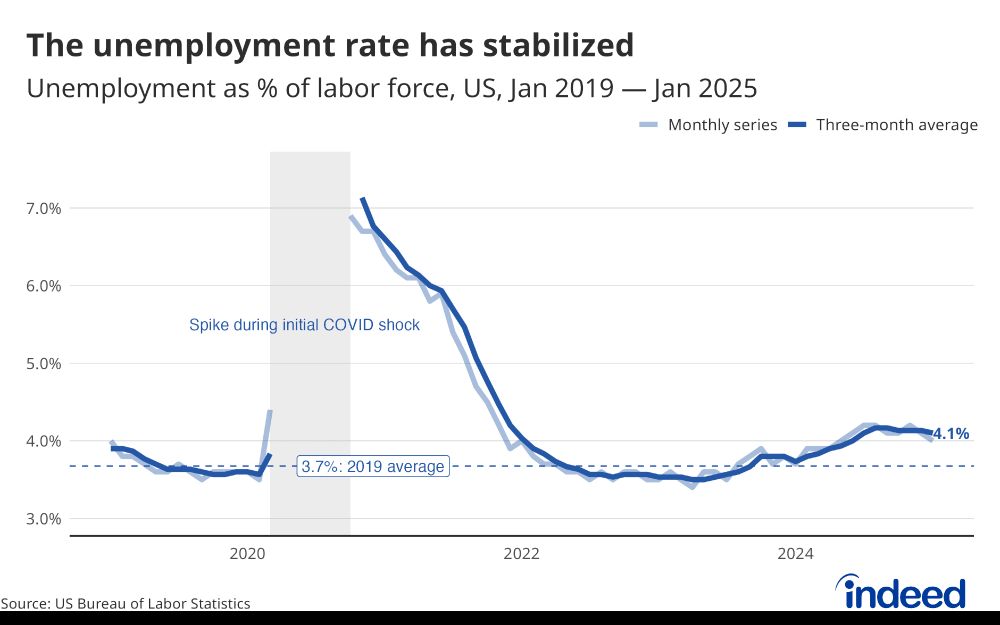

Feb 2025 Jobs Day takeaways:

- Solid headline job growth numbers: +151,000

- Unemployment ticked up to 4.1% but remains low

- Federal employment fell by 10,000, but the total number was likely higher, given data collection that happened relatively early in February.

- Solid headline job growth numbers: +151,000

- Unemployment ticked up to 4.1% but remains low

- Federal employment fell by 10,000, but the total number was likely higher, given data collection that happened relatively early in February.

March 7, 2025 at 2:27 PM

Feb 2025 Jobs Day takeaways:

- Solid headline job growth numbers: +151,000

- Unemployment ticked up to 4.1% but remains low

- Federal employment fell by 10,000, but the total number was likely higher, given data collection that happened relatively early in February.

- Solid headline job growth numbers: +151,000

- Unemployment ticked up to 4.1% but remains low

- Federal employment fell by 10,000, but the total number was likely higher, given data collection that happened relatively early in February.

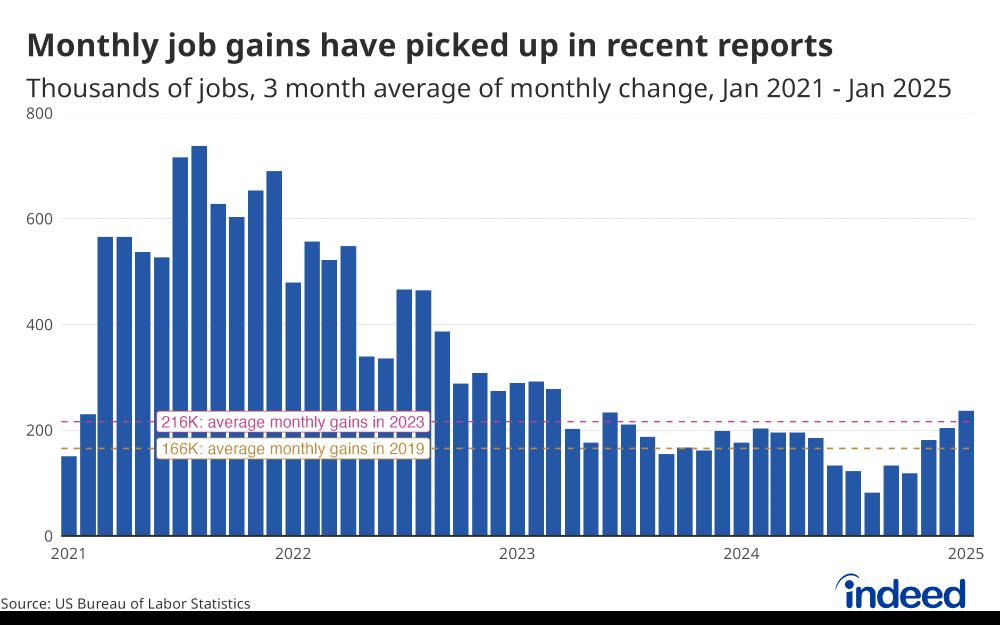

Revisions put a fresh coat of paint on today's jobs report but didn't change the story.

This is still a solid labor market defined by low unemployment, low layoffs, and payroll gains above the estimated 100,000 needed to keep up with population growth.

#numbersday

This is still a solid labor market defined by low unemployment, low layoffs, and payroll gains above the estimated 100,000 needed to keep up with population growth.

#numbersday

February 7, 2025 at 2:36 PM

Revisions put a fresh coat of paint on today's jobs report but didn't change the story.

This is still a solid labor market defined by low unemployment, low layoffs, and payroll gains above the estimated 100,000 needed to keep up with population growth.

#numbersday

This is still a solid labor market defined by low unemployment, low layoffs, and payroll gains above the estimated 100,000 needed to keep up with population growth.

#numbersday

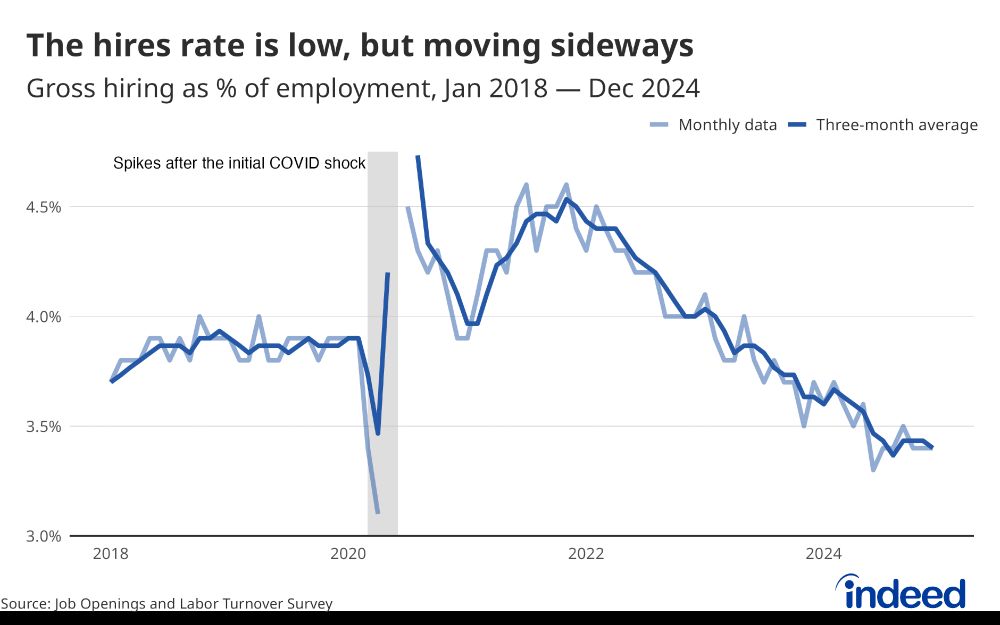

Today's JOLTS report continued to show potential signs of labor market stabilization with several measures moving sideways from the previous month.

- Quits rate low but unchanged @ 2%

- Hires rate low but unchanged @ 3.4%

Read my full statement here: www.hiringlab.org/2025/02/04/d...

- Quits rate low but unchanged @ 2%

- Hires rate low but unchanged @ 3.4%

Read my full statement here: www.hiringlab.org/2025/02/04/d...

February 4, 2025 at 4:38 PM

Today's JOLTS report continued to show potential signs of labor market stabilization with several measures moving sideways from the previous month.

- Quits rate low but unchanged @ 2%

- Hires rate low but unchanged @ 3.4%

Read my full statement here: www.hiringlab.org/2025/02/04/d...

- Quits rate low but unchanged @ 2%

- Hires rate low but unchanged @ 3.4%

Read my full statement here: www.hiringlab.org/2025/02/04/d...

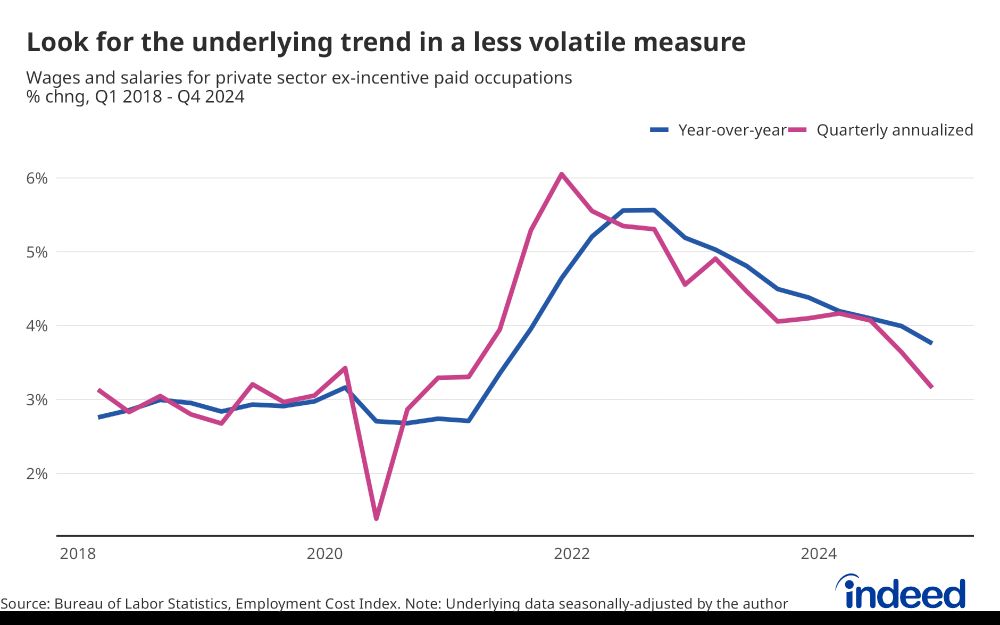

More evidence of Chair Powell's statement that “the labor market is not a source of significant inflationary pressures” in today's ECI data.

- YoY private-sector wage growth down to 3.6% in Q4 (compared to 4.3% the year before)

- Clear quarterly and annual slowing for among ex-incentive paid jobs

- YoY private-sector wage growth down to 3.6% in Q4 (compared to 4.3% the year before)

- Clear quarterly and annual slowing for among ex-incentive paid jobs

January 31, 2025 at 2:33 PM

More evidence of Chair Powell's statement that “the labor market is not a source of significant inflationary pressures” in today's ECI data.

- YoY private-sector wage growth down to 3.6% in Q4 (compared to 4.3% the year before)

- Clear quarterly and annual slowing for among ex-incentive paid jobs

- YoY private-sector wage growth down to 3.6% in Q4 (compared to 4.3% the year before)

- Clear quarterly and annual slowing for among ex-incentive paid jobs

Reposted by Cory Stahle

Big revisions to the monthly jobs report are coming next month.

This is not government "cooking the books". These revisions show why you should trust US official statistics.

This is not government "cooking the books". These revisions show why you should trust US official statistics.

January 14, 2025 at 1:09 PM

Big revisions to the monthly jobs report are coming next month.

This is not government "cooking the books". These revisions show why you should trust US official statistics.

This is not government "cooking the books". These revisions show why you should trust US official statistics.

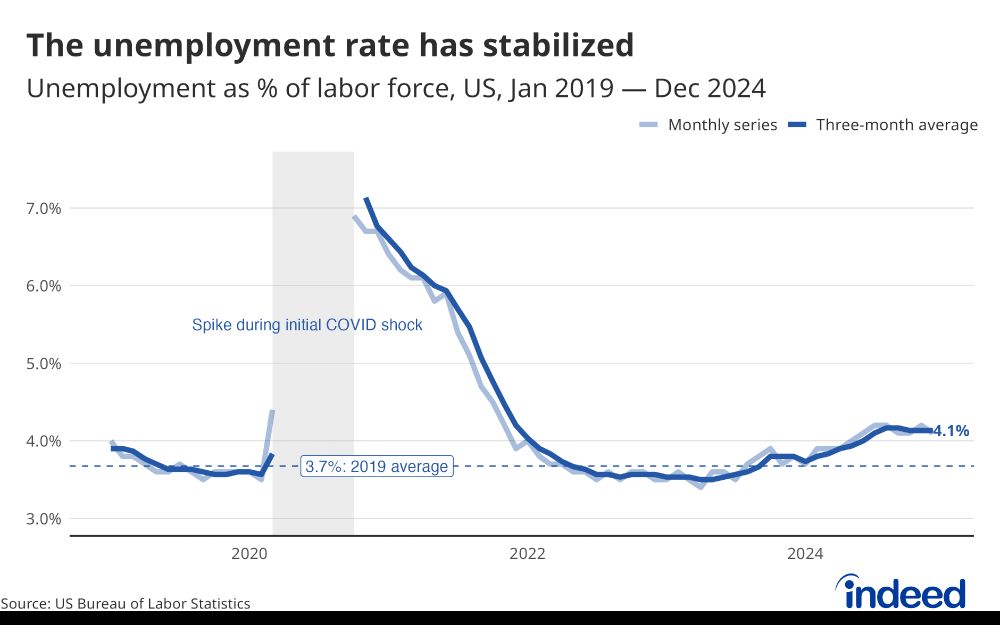

Final jobs report of 2024 was a good one!

- Job gains beat expectations, up +256,000

- Unemployment is down to 4.1%, but more importantly, it seems to be stable over the last 6 months.

- Prime-age EPOP still concerning and looking dangerously close to reversing its multi-year increasing trend.

- Job gains beat expectations, up +256,000

- Unemployment is down to 4.1%, but more importantly, it seems to be stable over the last 6 months.

- Prime-age EPOP still concerning and looking dangerously close to reversing its multi-year increasing trend.

January 10, 2025 at 2:19 PM

Final jobs report of 2024 was a good one!

- Job gains beat expectations, up +256,000

- Unemployment is down to 4.1%, but more importantly, it seems to be stable over the last 6 months.

- Prime-age EPOP still concerning and looking dangerously close to reversing its multi-year increasing trend.

- Job gains beat expectations, up +256,000

- Unemployment is down to 4.1%, but more importantly, it seems to be stable over the last 6 months.

- Prime-age EPOP still concerning and looking dangerously close to reversing its multi-year increasing trend.

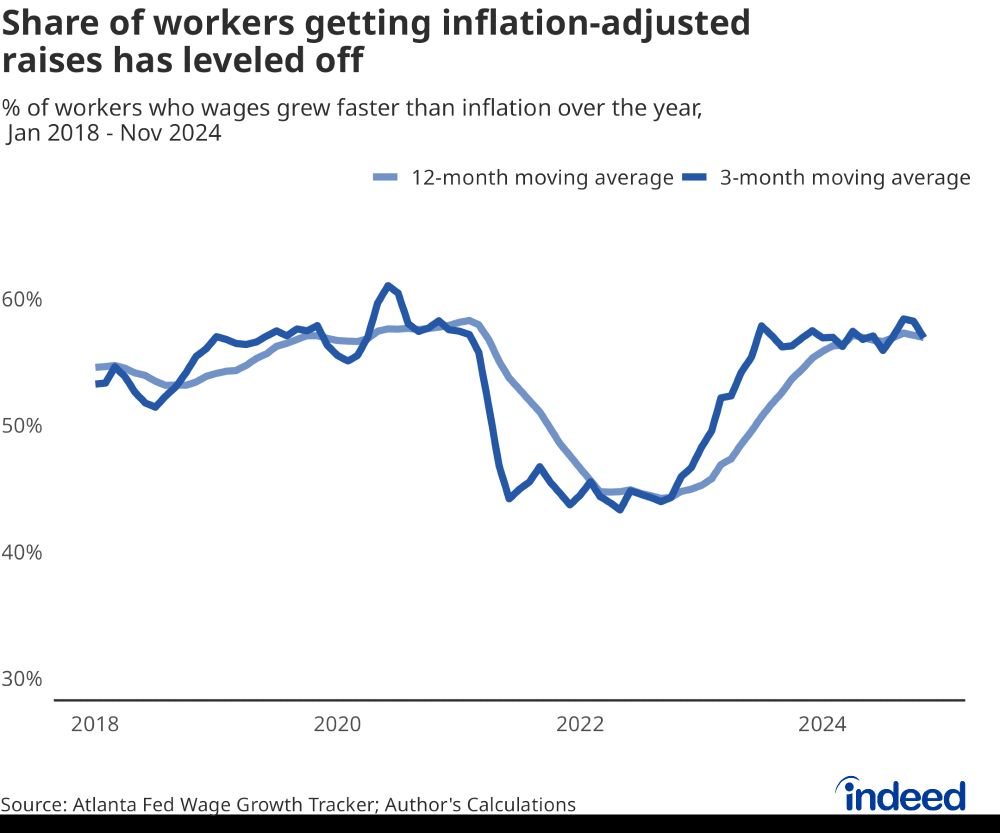

According to November CPI and Atlanta Fed Wage Growth Tracker data, a majority of workers are getting inflation-adjusted raises (57% in Nov).

That is much higher than a 43% low in May 2022. However, the share has leveled off since summer 2023 and now sits around pre-pandemic levels.

That is much higher than a 43% low in May 2022. However, the share has leveled off since summer 2023 and now sits around pre-pandemic levels.

December 12, 2024 at 7:46 PM

According to November CPI and Atlanta Fed Wage Growth Tracker data, a majority of workers are getting inflation-adjusted raises (57% in Nov).

That is much higher than a 43% low in May 2022. However, the share has leveled off since summer 2023 and now sits around pre-pandemic levels.

That is much higher than a 43% low in May 2022. However, the share has leveled off since summer 2023 and now sits around pre-pandemic levels.

Interesting story on Utah's growing tech scene. I drive through this area often and it seems like there is a new tech office building everytime I do.

How Utah's 'Silicon Slopes' tech sector is making a run at Silicon Valley

Technology companies, from giants like Microsoft, Adobe and Oracle to startups are transforming Utah into an economic and jobs rival to Silicon Valley.

www.cnbc.com

December 12, 2024 at 2:48 PM

Interesting story on Utah's growing tech scene. I drive through this area often and it seems like there is a new tech office building everytime I do.

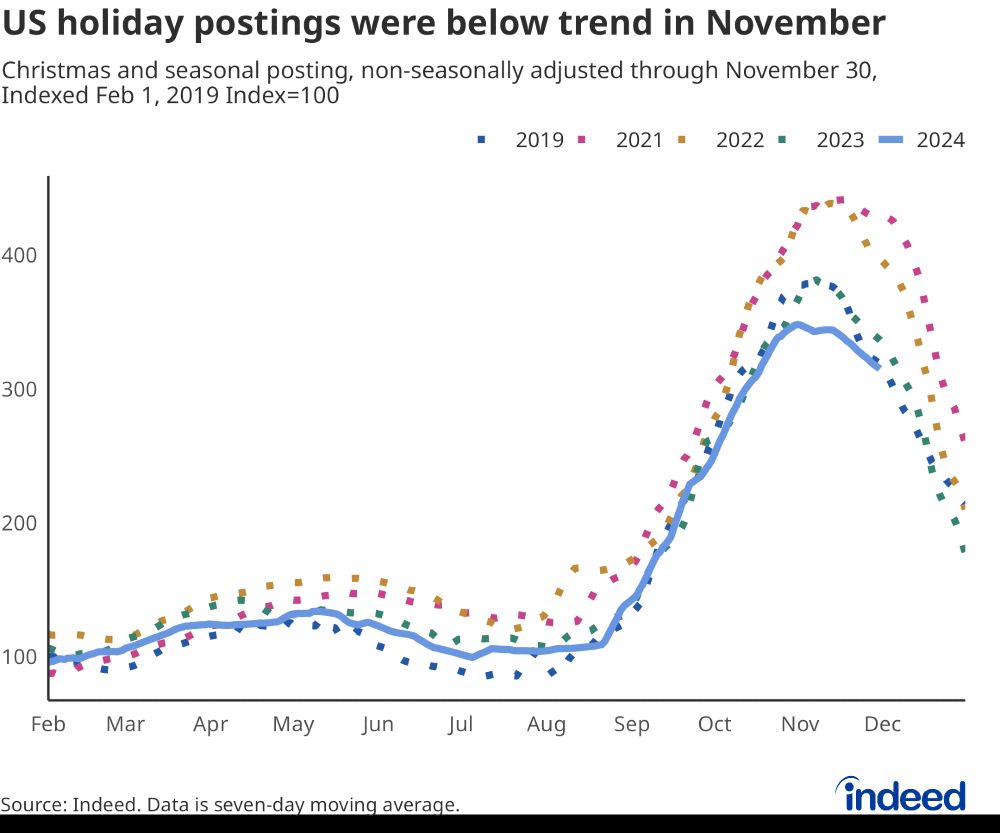

Retail trade shed 28,000 jobs in November.

Indeed data shows a similar story: employer demand for holiday hires fell below the trend in November. Holiday hiring kicked off around the same time in 2024 and rose in line with 2019 levels before flattening in November.

Indeed data shows a similar story: employer demand for holiday hires fell below the trend in November. Holiday hiring kicked off around the same time in 2024 and rose in line with 2019 levels before flattening in November.

December 6, 2024 at 7:29 PM

Retail trade shed 28,000 jobs in November.

Indeed data shows a similar story: employer demand for holiday hires fell below the trend in November. Holiday hiring kicked off around the same time in 2024 and rose in line with 2019 levels before flattening in November.

Indeed data shows a similar story: employer demand for holiday hires fell below the trend in November. Holiday hiring kicked off around the same time in 2024 and rose in line with 2019 levels before flattening in November.

Jobs day takeaways:

Good:

- The (literal) clouds that overshadowed October's report parted, added +227,000 jobs in Nov, Oct revised up to +36,000 (from the initial report of +12,000).

- Average hourly earnings have cooled but remain robust which signals continued demand for workers.

Good:

- The (literal) clouds that overshadowed October's report parted, added +227,000 jobs in Nov, Oct revised up to +36,000 (from the initial report of +12,000).

- Average hourly earnings have cooled but remain robust which signals continued demand for workers.

December 6, 2024 at 3:10 PM

Jobs day takeaways:

Good:

- The (literal) clouds that overshadowed October's report parted, added +227,000 jobs in Nov, Oct revised up to +36,000 (from the initial report of +12,000).

- Average hourly earnings have cooled but remain robust which signals continued demand for workers.

Good:

- The (literal) clouds that overshadowed October's report parted, added +227,000 jobs in Nov, Oct revised up to +36,000 (from the initial report of +12,000).

- Average hourly earnings have cooled but remain robust which signals continued demand for workers.

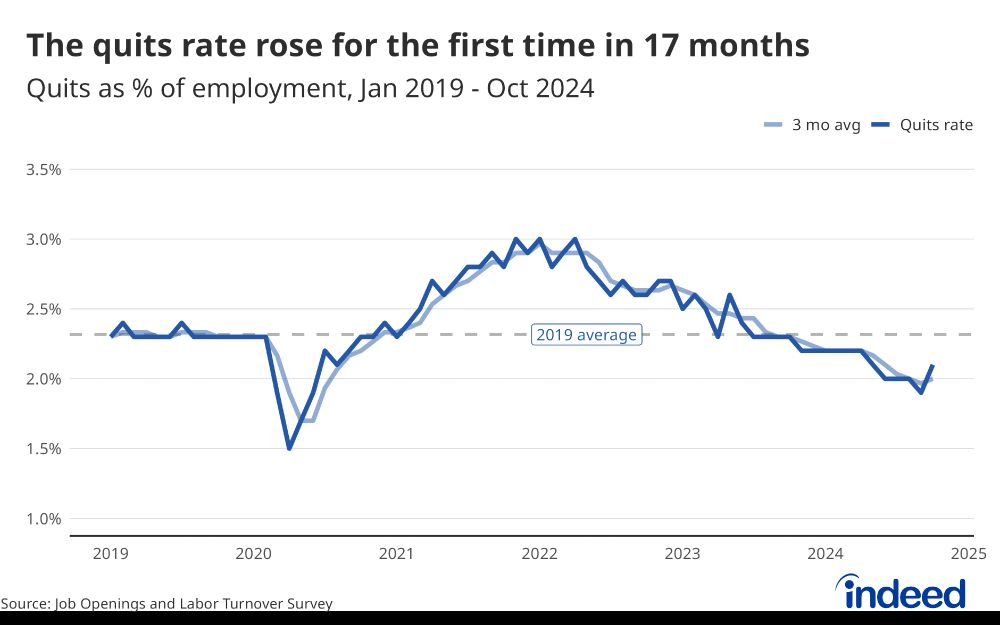

Today’s JOLTS report was reasonably good!

- Job openings ticked up to 7.7 million (from 7.4).

- The quits rate rose for the first time in 17 months.

- Layoff rate = 1.0 -> Below pre-pandemic all-time lows.

Hires rate weak at 3.3%, but could be a blip given slight pickup in recent months.

- Job openings ticked up to 7.7 million (from 7.4).

- The quits rate rose for the first time in 17 months.

- Layoff rate = 1.0 -> Below pre-pandemic all-time lows.

Hires rate weak at 3.3%, but could be a blip given slight pickup in recent months.

December 3, 2024 at 3:40 PM

Today’s JOLTS report was reasonably good!

- Job openings ticked up to 7.7 million (from 7.4).

- The quits rate rose for the first time in 17 months.

- Layoff rate = 1.0 -> Below pre-pandemic all-time lows.

Hires rate weak at 3.3%, but could be a blip given slight pickup in recent months.

- Job openings ticked up to 7.7 million (from 7.4).

- The quits rate rose for the first time in 17 months.

- Layoff rate = 1.0 -> Below pre-pandemic all-time lows.

Hires rate weak at 3.3%, but could be a blip given slight pickup in recent months.