Read the full analysis here:

www.hiringlab.org/2025/05/09/e...

www.hiringlab.org/2025/05/09/e...

The Surprising Relationships Between Economic Trends and Time to Hire - Indeed Hiring Lab

The average time it took to hire a candidate fell notably – and perhaps counterintuitively – from 2020 to 2022, but has been climbing ever since.

www.hiringlab.org

May 9, 2025 at 2:39 PM

Read the full analysis here:

www.hiringlab.org/2025/05/09/e...

www.hiringlab.org/2025/05/09/e...

However, there are some signs of underlying weakness in the household survey side of today's job report.

The share of workers who were long-term unemployed (out of work for 27 weeks or more) continues to creep up and jumped to 23.5% in April, the highest share in three years.

#numbersday

The share of workers who were long-term unemployed (out of work for 27 weeks or more) continues to creep up and jumped to 23.5% in April, the highest share in three years.

#numbersday

May 2, 2025 at 1:27 PM

However, there are some signs of underlying weakness in the household survey side of today's job report.

The share of workers who were long-term unemployed (out of work for 27 weeks or more) continues to creep up and jumped to 23.5% in April, the highest share in three years.

#numbersday

The share of workers who were long-term unemployed (out of work for 27 weeks or more) continues to creep up and jumped to 23.5% in April, the highest share in three years.

#numbersday

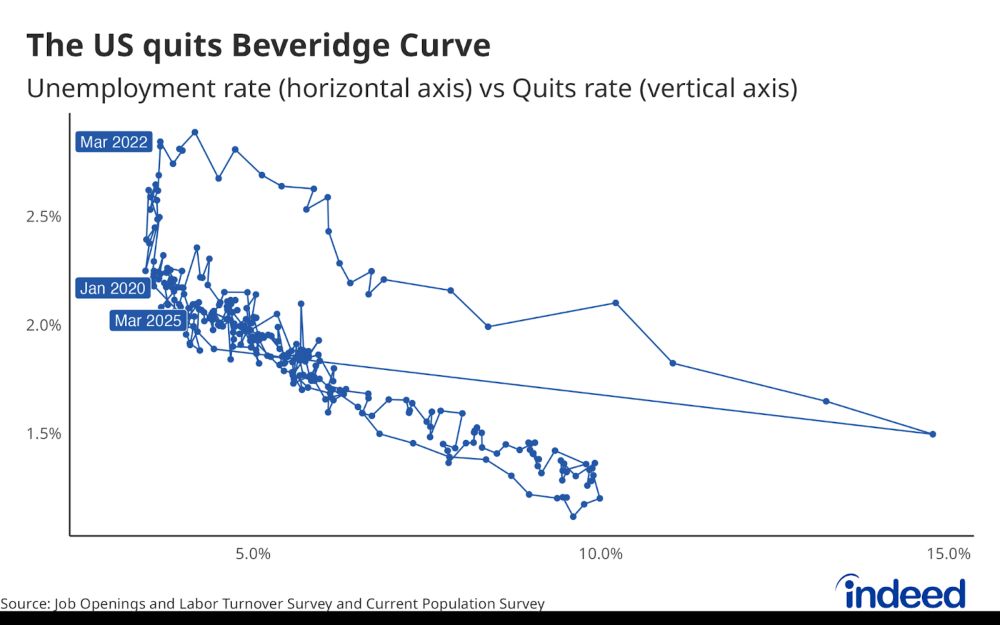

You can't drive a car backwards (very well at least).

A lot has happened since March and the view forward through the windshield is marred by growing concerns around US trade policy and tariffs.

Read my full JOLTS statement here:

www.hiringlab.org/2025/04/29/m...

A lot has happened since March and the view forward through the windshield is marred by growing concerns around US trade policy and tariffs.

Read my full JOLTS statement here:

www.hiringlab.org/2025/04/29/m...

March 2025 JOLTS Report: A Lot Has Happened Since March… - Indeed Hiring Lab

Backward-looking data continued to show a largely steady labor market in March, but a lot has happened since then.

www.hiringlab.org

April 29, 2025 at 3:21 PM

You can't drive a car backwards (very well at least).

A lot has happened since March and the view forward through the windshield is marred by growing concerns around US trade policy and tariffs.

Read my full JOLTS statement here:

www.hiringlab.org/2025/04/29/m...

A lot has happened since March and the view forward through the windshield is marred by growing concerns around US trade policy and tariffs.

Read my full JOLTS statement here:

www.hiringlab.org/2025/04/29/m...

Read the full statement here: www.hiringlab.org/2025/03/11/j...

January 2025 JOLTS Report: Frozen is Stable - Indeed Hiring Lab

The JOLTS data lags behind real-time labor market shifts, making it an outdated snapshot that doesn't reflect recent economic and policy changes.

www.hiringlab.org

March 11, 2025 at 3:41 PM

Read the full statement here: www.hiringlab.org/2025/03/11/j...

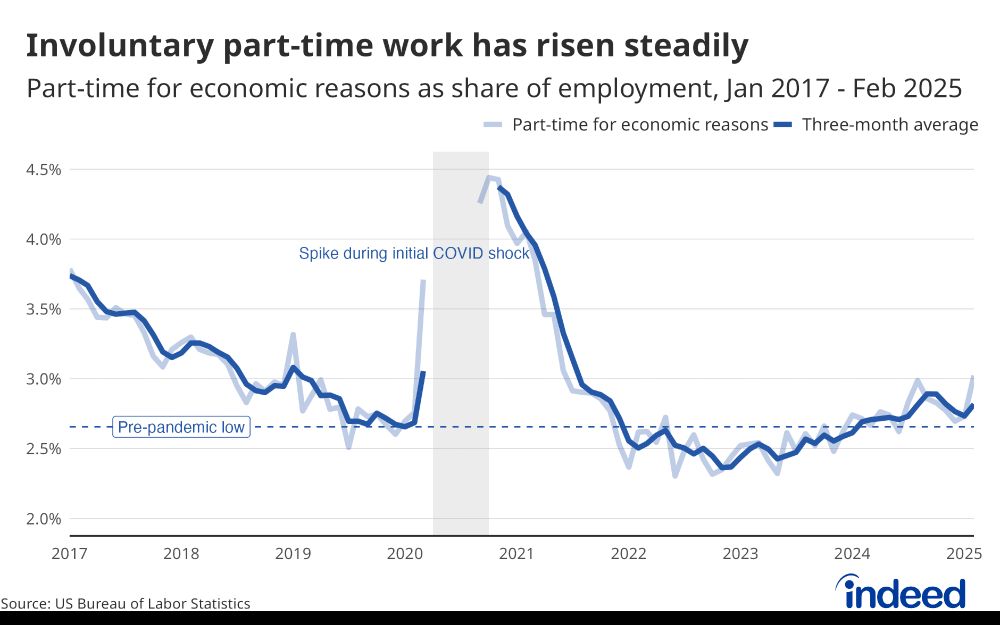

Other CPS concerns: People working part-time due to economic reasons spiked in February. While the number is noisy from month to month, it has shown a clear increase since January 2023.

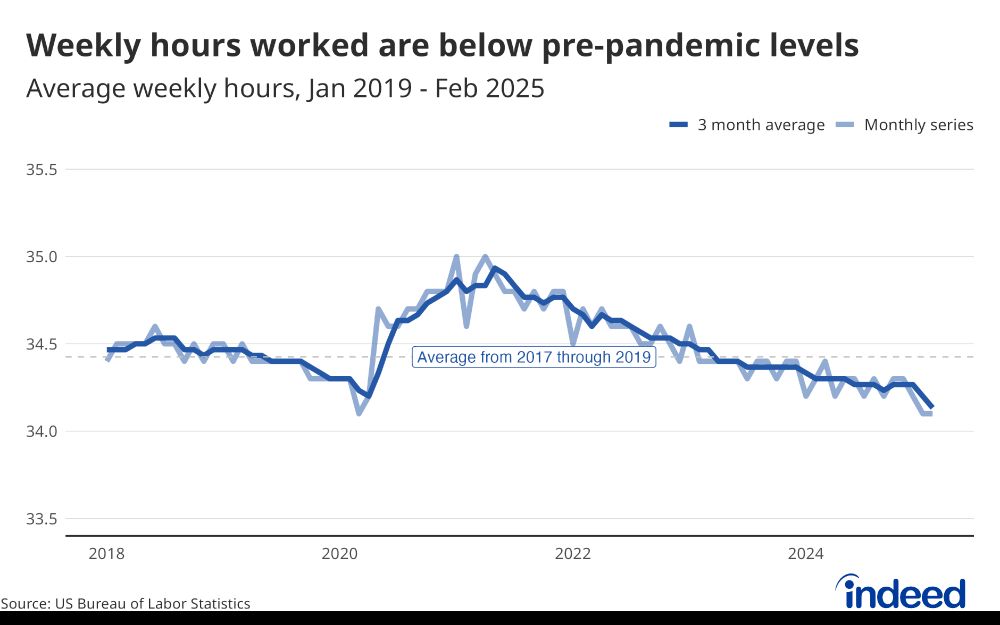

Weekly hours have been in steady decline since late 2021, but have dropped more sharply in recent reports.

Weekly hours have been in steady decline since late 2021, but have dropped more sharply in recent reports.

March 7, 2025 at 2:45 PM

Other CPS concerns: People working part-time due to economic reasons spiked in February. While the number is noisy from month to month, it has shown a clear increase since January 2023.

Weekly hours have been in steady decline since late 2021, but have dropped more sharply in recent reports.

Weekly hours have been in steady decline since late 2021, but have dropped more sharply in recent reports.

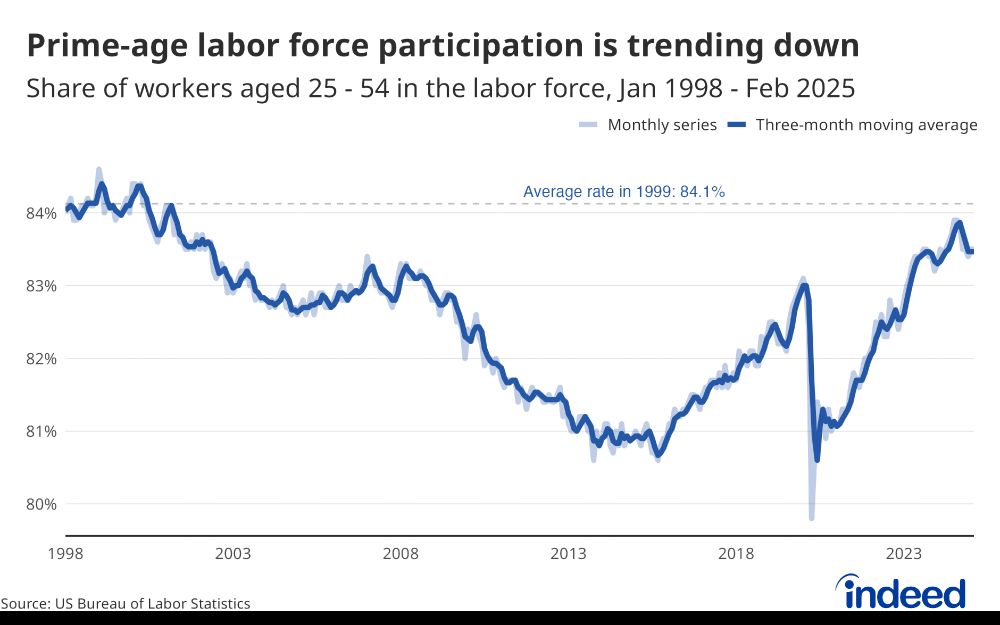

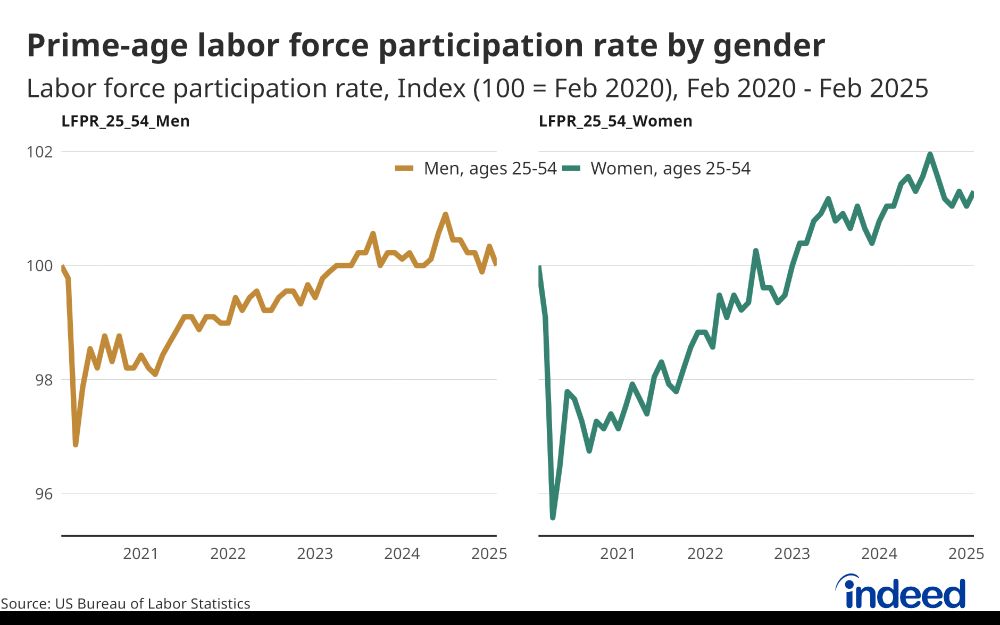

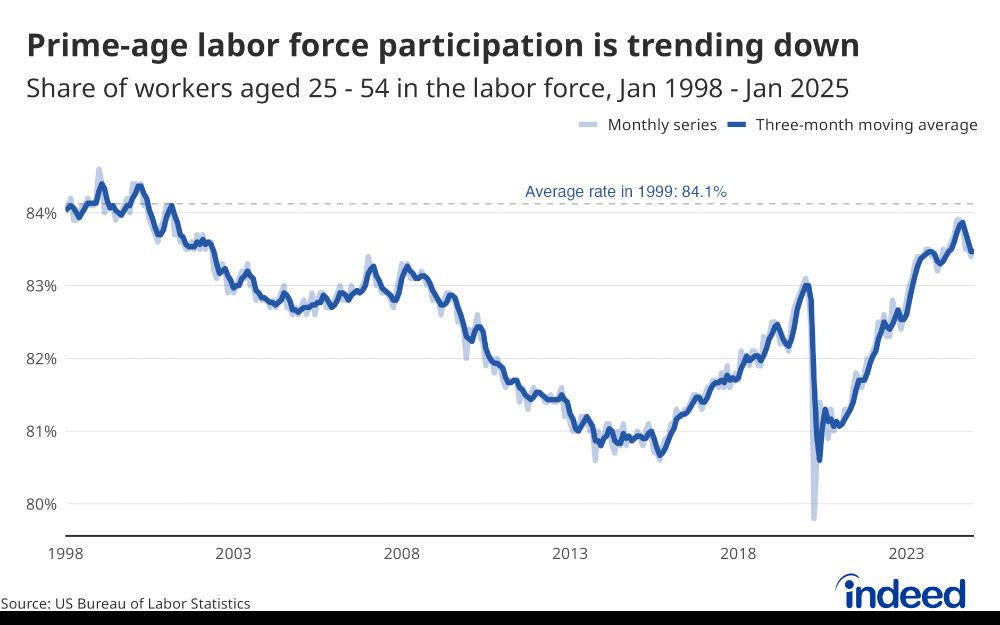

Beyond the concern of federal government job losses, some continuations of not-so-great trends in the household survey.

Prime-age labor force participation is trending down and for men is back to where it was before the pandemic.

Prime-age labor force participation is trending down and for men is back to where it was before the pandemic.

March 7, 2025 at 2:30 PM

Beyond the concern of federal government job losses, some continuations of not-so-great trends in the household survey.

Prime-age labor force participation is trending down and for men is back to where it was before the pandemic.

Prime-age labor force participation is trending down and for men is back to where it was before the pandemic.

Despite the generally sturdy foundation, there are a few small cracks worth monitoring. Hiring and quitting remain near decade lows, and growth in prime-age labor force participation is showing signs of slowing. In the next report, we'll also get a feel for the impact of California wildfires.

February 7, 2025 at 2:38 PM

Despite the generally sturdy foundation, there are a few small cracks worth monitoring. Hiring and quitting remain near decade lows, and growth in prime-age labor force participation is showing signs of slowing. In the next report, we'll also get a feel for the impact of California wildfires.

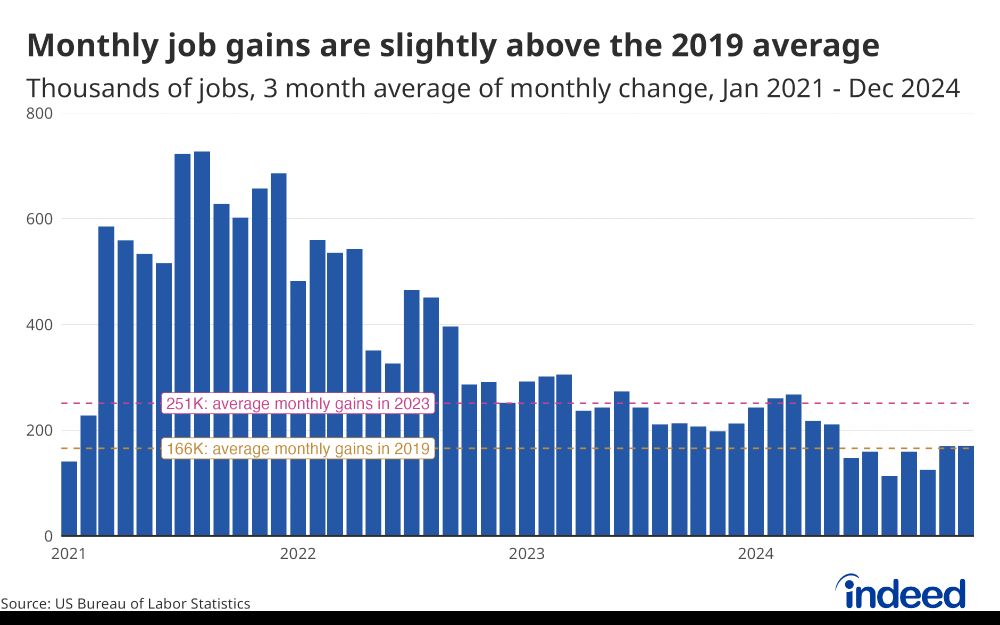

We'll get a clearer picture of 2024's labor market after revisions next month.

For now, I would characterize 2024 as a tale of two halves. Some concerns around rising unemployment, declining hires & quits in the first half of the year. Started seeing signs of stabilizing in the second half though.

For now, I would characterize 2024 as a tale of two halves. Some concerns around rising unemployment, declining hires & quits in the first half of the year. Started seeing signs of stabilizing in the second half though.

January 10, 2025 at 2:24 PM

We'll get a clearer picture of 2024's labor market after revisions next month.

For now, I would characterize 2024 as a tale of two halves. Some concerns around rising unemployment, declining hires & quits in the first half of the year. Started seeing signs of stabilizing in the second half though.

For now, I would characterize 2024 as a tale of two halves. Some concerns around rising unemployment, declining hires & quits in the first half of the year. Started seeing signs of stabilizing in the second half though.

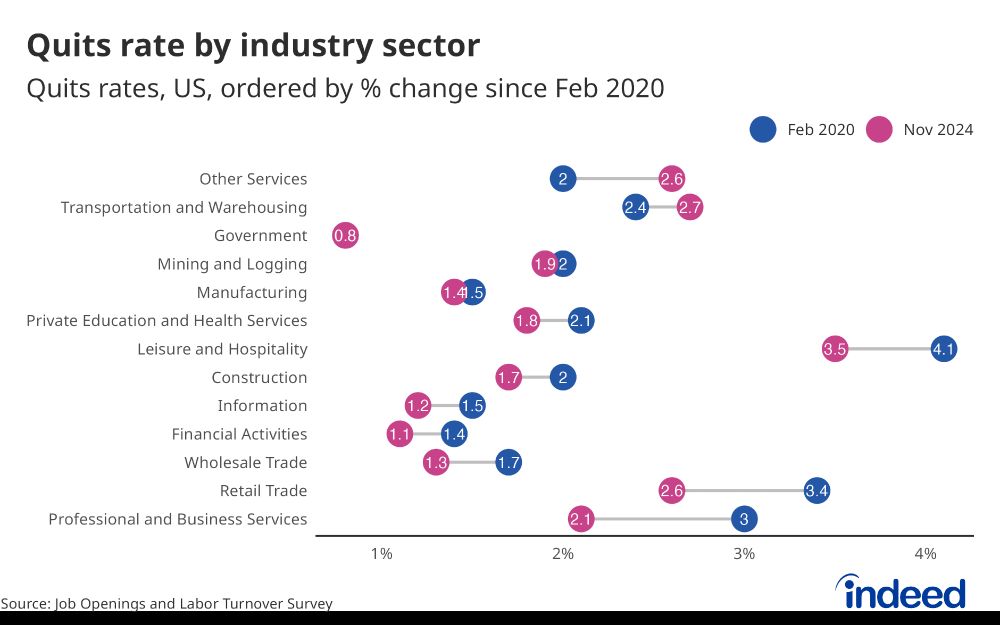

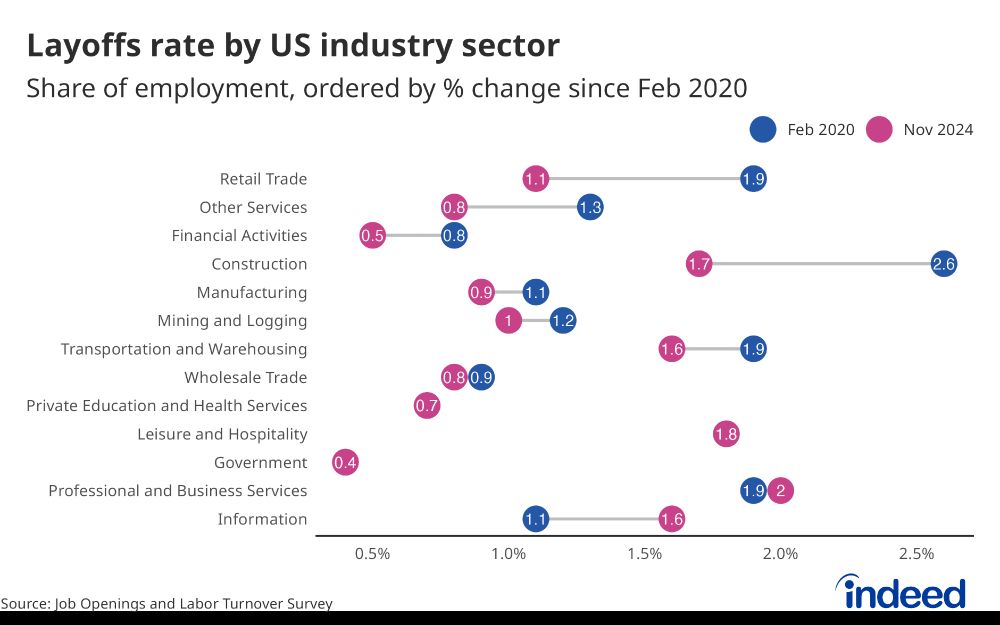

Why are retail hires rates lower now than before the pandemic?

In short, retail workers aren't quitting or getting laid off.

Retail layoffs are much lower now than pre-pandemic (1.1% in Nov 2024 vs. 1.9% in Feb 2020). Quits are also down from 3.4% in 2020 to 2.5% today.

#jolts #bls #econsky

In short, retail workers aren't quitting or getting laid off.

Retail layoffs are much lower now than pre-pandemic (1.1% in Nov 2024 vs. 1.9% in Feb 2020). Quits are also down from 3.4% in 2020 to 2.5% today.

#jolts #bls #econsky

January 7, 2025 at 3:57 PM

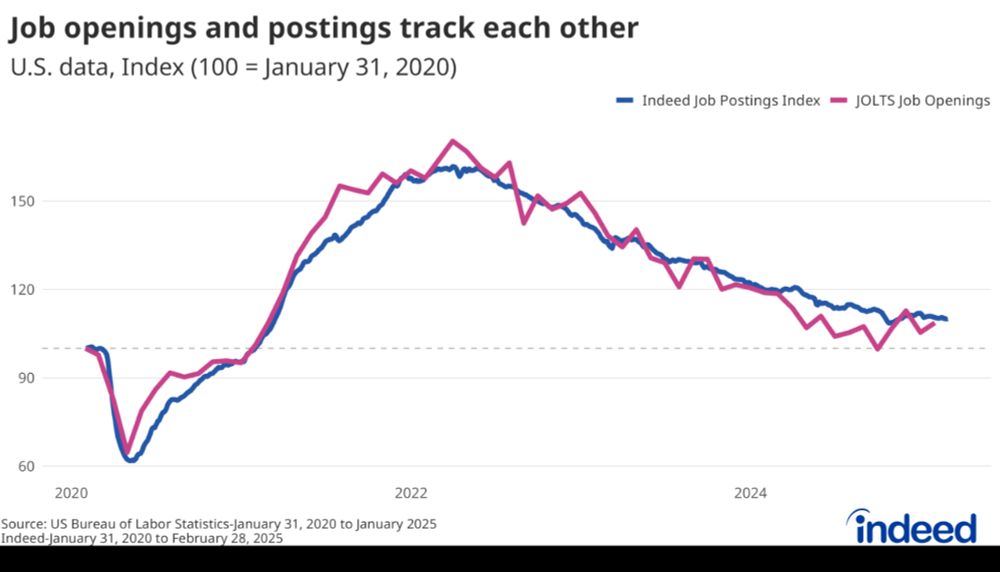

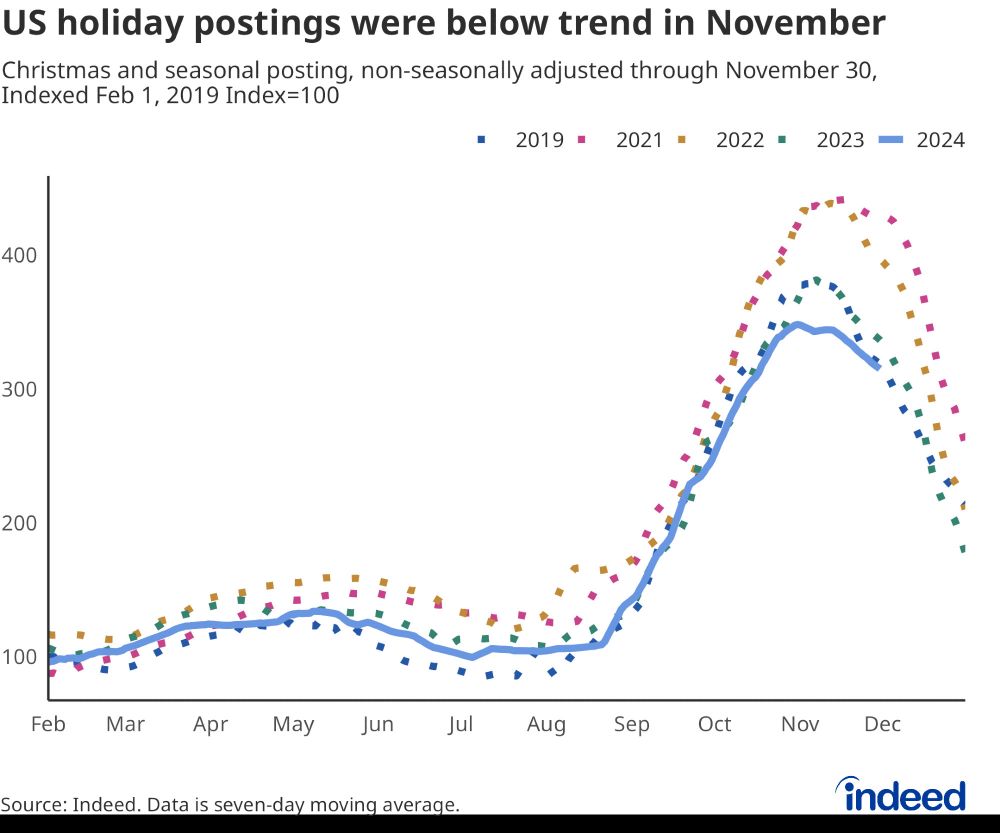

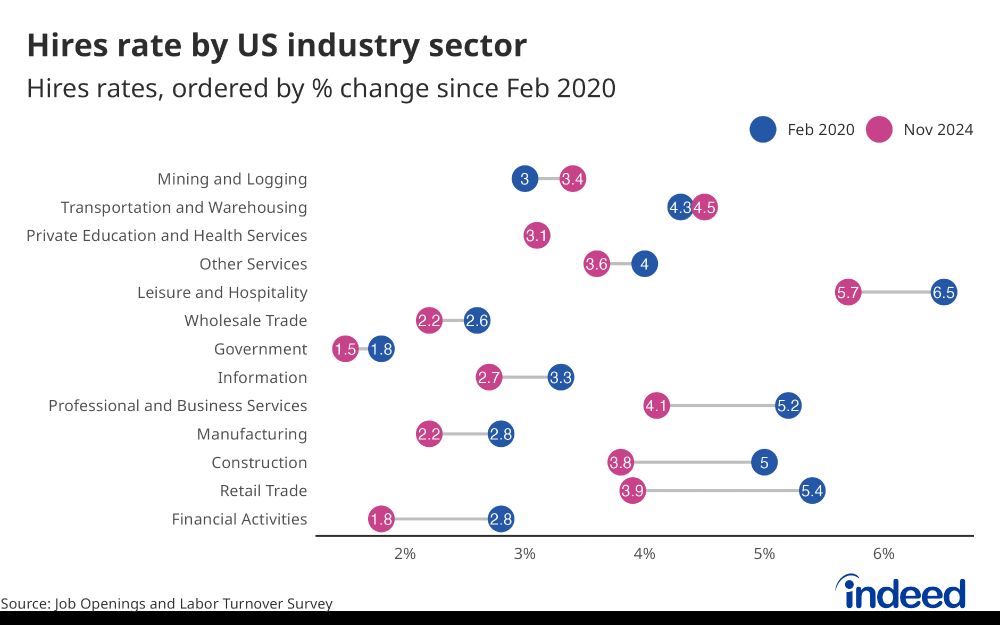

It's hard to talk about November JOLTS data without mentioning the retail industry. Job postings for seasonal/holiday work on Indeed were below trend in November.

The hires rate for retail workers in today's JOLTS report was 3.9%, well below the 5.4% pre-pandemic rate.

The hires rate for retail workers in today's JOLTS report was 3.9%, well below the 5.4% pre-pandemic rate.

January 7, 2025 at 3:49 PM

It's hard to talk about November JOLTS data without mentioning the retail industry. Job postings for seasonal/holiday work on Indeed were below trend in November.

The hires rate for retail workers in today's JOLTS report was 3.9%, well below the 5.4% pre-pandemic rate.

The hires rate for retail workers in today's JOLTS report was 3.9%, well below the 5.4% pre-pandemic rate.

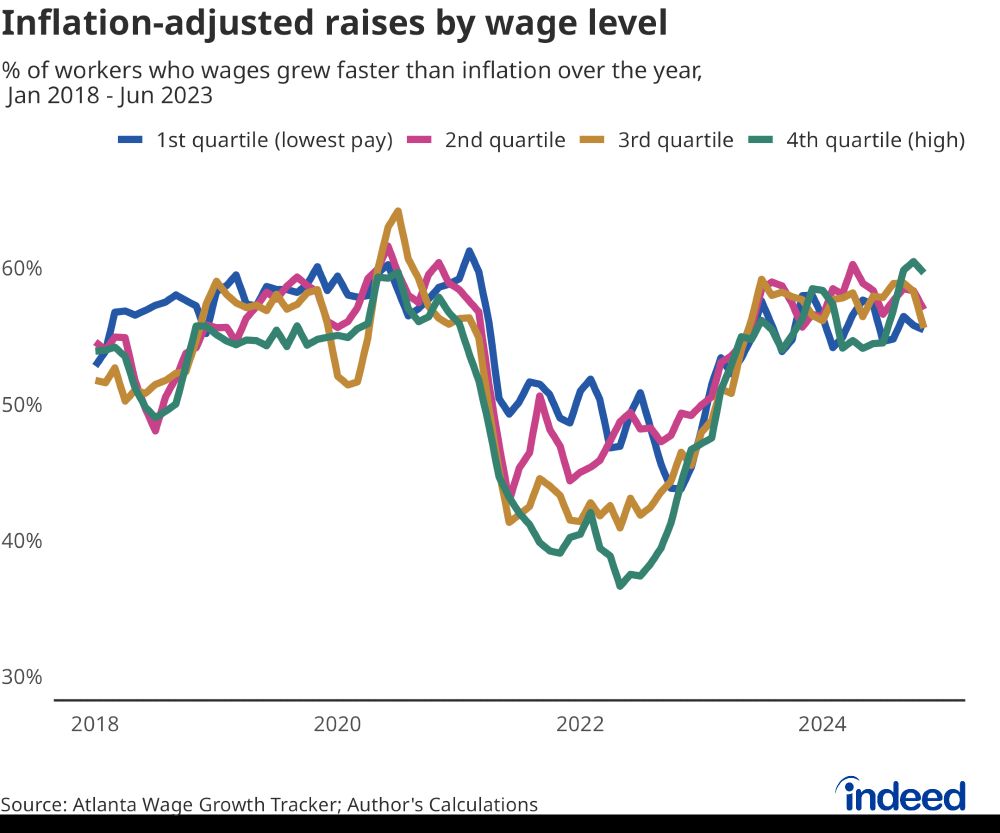

High-earning workers (4th quartile) experienced the greatest drop in real wage growth in 2021 and 2022 but they have recovered since.

December 12, 2024 at 7:59 PM

High-earning workers (4th quartile) experienced the greatest drop in real wage growth in 2021 and 2022 but they have recovered since.