Center for Global Development note, Mark Plant and I show that the UK can manage its reserves well and recycle SDRs to vulnerable countries, but the IMF can learn from this case to reform the VTA choice mechanism. www.cgdev.org/publication/...

Center for Global Development note, Mark Plant and I show that the UK can manage its reserves well and recycle SDRs to vulnerable countries, but the IMF can learn from this case to reform the VTA choice mechanism. www.cgdev.org/publication/...

- Representatives from the IMF noted that in the Staff's view, the hybrid capital proposal meets the Reserve Asset Status!

- Representatives from the IMF noted that in the Staff's view, the hybrid capital proposal meets the Reserve Asset Status!

Short thread

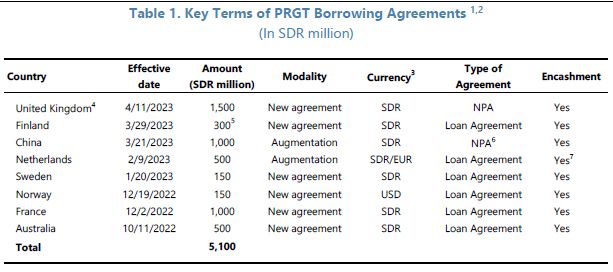

1) Surcharges only apply to borrowing from the GRA, lending under the PRGT comes without surcharges (although yes, eliminate surcharges for GRA)

www.businessghana.com/site/news/Bu...

Short thread

1) Surcharges only apply to borrowing from the GRA, lending under the PRGT comes without surcharges (although yes, eliminate surcharges for GRA)

www.businessghana.com/site/news/Bu...

1: The global economy has been resilient, with the 2023 growth outlook slightly upgraded since the Spring. However, recovery has been uneven and medium-term global growth projections remain weak.

1: The global economy has been resilient, with the 2023 growth outlook slightly upgraded since the Spring. However, recovery has been uneven and medium-term global growth projections remain weak.

www.imf.org/en/Publicati...

www.imf.org/en/Publicati...

www.imf.org/en/News/Arti...

www.imf.org/en/News/Arti...

1:Periodic general allocations

2:Decoupling SDRs from quotas

3:Revisiting IMF tools and rechanneling mechanisms

www.brettonwoodsproject.org/2023/10/reco...

1:Periodic general allocations

2:Decoupling SDRs from quotas

3:Revisiting IMF tools and rechanneling mechanisms

www.brettonwoodsproject.org/2023/10/reco...