https://almostsuremath.com

Also on YouTube: https://www.youtube.com/@almostsure

I won the knowbell prize!

I won the knowbell prize!

analogue tape

analogue clock

real life

Then, we invented electric guitars. Oh no.

Which meant saying ‘guitar’ wasn’t clear enough.

So 'guitars' became 'acoustic guitars.'

‘Acoustic guitar’ is an example of a ‘retronym.’

🧵⬇️

analogue tape

analogue clock

real life

Explains why applying FT twice gives reflection (rotation by 180°).

Explains why applying FT twice gives reflection (rotation by 180°).

So the other night a fox came up to me with a tennis ball in its mouth. Quite unusual so tried taking a picture, but fumbled trying to select camera app and it was already walking away by the time I was ready.

But why can you see through it?

So the other night a fox came up to me with a tennis ball in its mouth. Quite unusual so tried taking a picture, but fumbled trying to select camera app and it was already walking away by the time I was ready.

But why can you see through it?

I tried Claude, but due to autocorrect (Manim->mania…) it used JavaScript, and produced nice results.

But when I asked to do in Manim, was full of bugs, did not do the correct thing when these were fixed, and eventually it gave up

I tried Claude, but due to autocorrect (Manim->mania…) it used JavaScript, and produced nice results.

But when I asked to do in Manim, was full of bugs, did not do the correct thing when these were fixed, and eventually it gave up

What does Riemann Zeta have to do with Brownian Motion?

youtu.be/YTQKbgxbtiw

What does Riemann Zeta have to do with Brownian Motion?

youtu.be/YTQKbgxbtiw

Will be on connections between Riemann zeta and Brownian motion.

ETA a few days to a week.

Will be on connections between Riemann zeta and Brownian motion.

ETA a few days to a week.

This looks at weird properties of conditional expectations, such as two random variables being bigger than each other 'on average'

youtu.be/4ZwRXVVepj8?...

This looks at weird properties of conditional expectations, such as two random variables being bigger than each other 'on average'

youtu.be/4ZwRXVVepj8?...

If you were so stupid to do that, then 𝙮𝙤𝙪 𝙬𝙤𝙪𝙡𝙙 𝙣𝙤𝙩 𝙚𝙫𝙚𝙣 𝙗𝙚 𝙖𝙗𝙡𝙚 𝙩𝙤 𝙖𝙙𝙙 𝙧𝙖𝙣𝙙𝙤𝙢 𝙫𝙖𝙧𝙞𝙖𝙗𝙡𝙚𝙨 𝙩𝙤𝙜𝙚𝙩𝙝𝙚𝙧.

If you were so stupid to do that, then 𝙮𝙤𝙪 𝙬𝙤𝙪𝙡𝙙 𝙣𝙤𝙩 𝙚𝙫𝙚𝙣 𝙗𝙚 𝙖𝙗𝙡𝙚 𝙩𝙤 𝙖𝙙𝙙 𝙧𝙖𝙣𝙙𝙤𝙢 𝙫𝙖𝙧𝙞𝙖𝙗𝙡𝙚𝙨 𝙩𝙤𝙜𝙚𝙩𝙝𝙚𝙧.

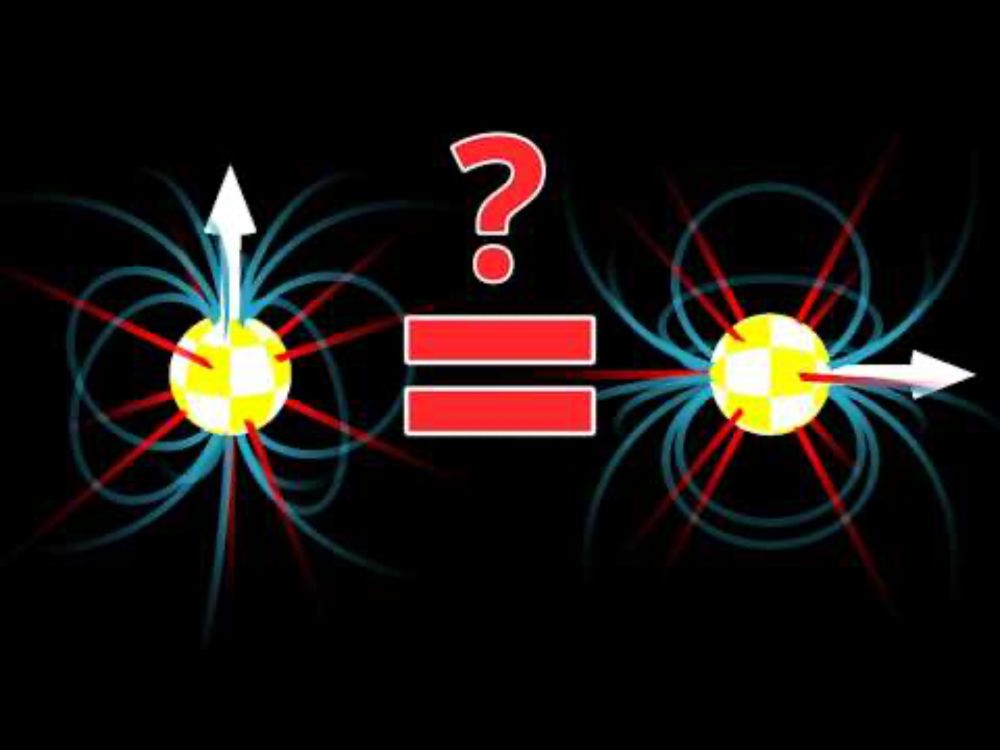

The Algebra of Mixed Quantum States

youtu.be/K6h62Gr0nwg

The Algebra of Mixed Quantum States

youtu.be/K6h62Gr0nwg

This unexpected proof shocked mathematicians!

youtu.be/WJGR1oc6Gxo?...

This unexpected proof shocked mathematicians!

youtu.be/WJGR1oc6Gxo?...

X(mu,t)->1-X(1-mu,t).

It is for individual times, as it matches Dirichlet distribution, but probably not for the entire paths wrt t. Which is disappointing. Maybe it can be modified?

X(μ,t) ~ Beta(μ(1-t)/t, (1-μ)(1-t)/t)

The (1-t)/t scaling is so that on range 0<t<1 we cover entire set of Beta distributions.

For each t, X(μ_{i+1},t)-X(μ_i,t) have Dirichlet distribution.

X(mu,t)->1-X(1-mu,t).

It is for individual times, as it matches Dirichlet distribution, but probably not for the entire paths wrt t. Which is disappointing. Maybe it can be modified?