By @adamrust.bsky.social

By @adamrust.bsky.social

@americanenterprise.bsky.social

Paul Kupiec riffs on the idea of using #AI to write regs and supervise financial institutions. So, soon we could have "regulation-by-bot." What could go wrong?

@americanenterprise.bsky.social

Paul Kupiec riffs on the idea of using #AI to write regs and supervise financial institutions. So, soon we could have "regulation-by-bot." What could go wrong?

@cnbc.com

@cnbc.com

nationalfairhousing.org/judge-reject...

nationalfairhousing.org/judge-reject...

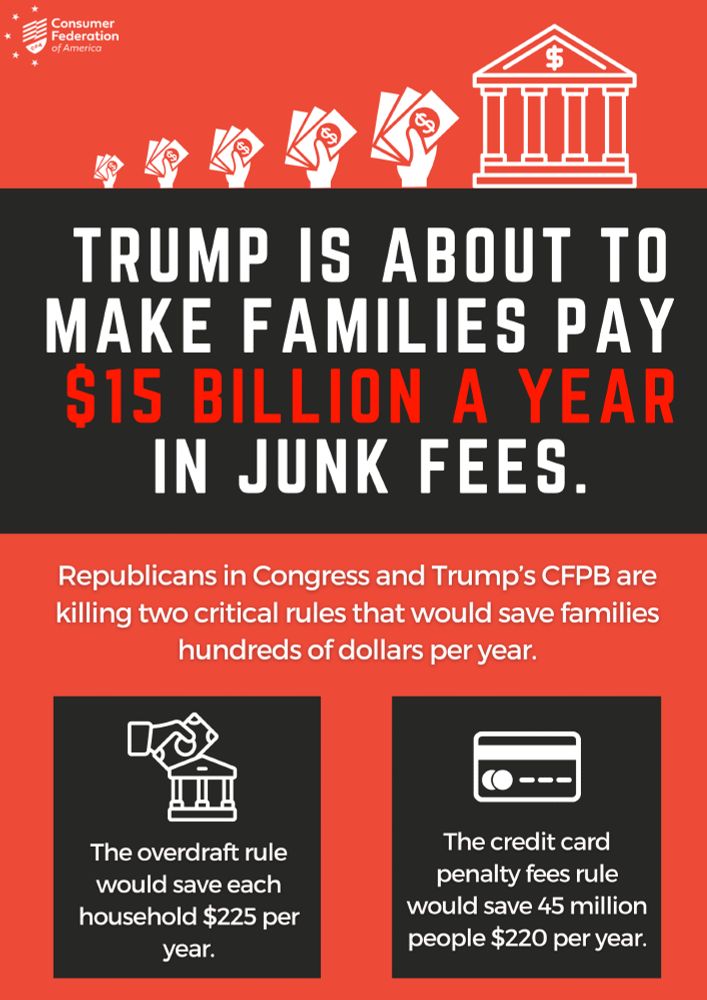

#DefendCFPB #HandsoffCFPB #HandsOff

Meets the "propulsive" standard for #books. It's a mystery with great characters, sense of place, layering. www.penguinrandomhouse.com/books/676637...

Meets the "propulsive" standard for #books. It's a mystery with great characters, sense of place, layering. www.penguinrandomhouse.com/books/676637...